1/ Fool’s Gold

Friday November 3rd, 2023 - Issue # 53

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

“In my view, Bitcoin is a commodity currency that aspires to be a store of value and a hedge against monetary debasement. I think of it as exponential gold.” - Jurrien Timmer, Director of Global Macro at Fidelity Investments

The other day, I found myself thinking about why after years of always having exposure to gold in my portfolio, I currently have none. The actual answer is quite simple: compared to Bitcoin, it sucks. How I got to this revelation is also pretty simple, but it’s worth mapping it out. There’s a chart that does a great job of highlighting why Bitcoin is 1000x better than gold in nearly every category…

Over the course of the next few weeks, I’m going to dive into most of the above valuable traits separately as I’m not sure I’ve seen a thorough inspection before, and I feel it’s critical to understand these basics. If gold is a “safe haven” asset, a store-of-value (SOV), an inflation hedge that has attracted a market cap of ~$13 trillion, then Bitcoin, which dominates gold in nearly every category, is heavily undervalued at ~$600 billion market cap. I expect most of gold’s investible value to find its way into Bitcoin — that’s a ~21x opportunity.

I have to say, I know many of my readers really like gold and some, really, really like gold. I’m with you in that I’d rather hold gold than fiat currencies, bonds, and I might want to hold gold over the broader stock market right now, but I’d much rather hold bitcoin over gold — and I’ll tell you why...

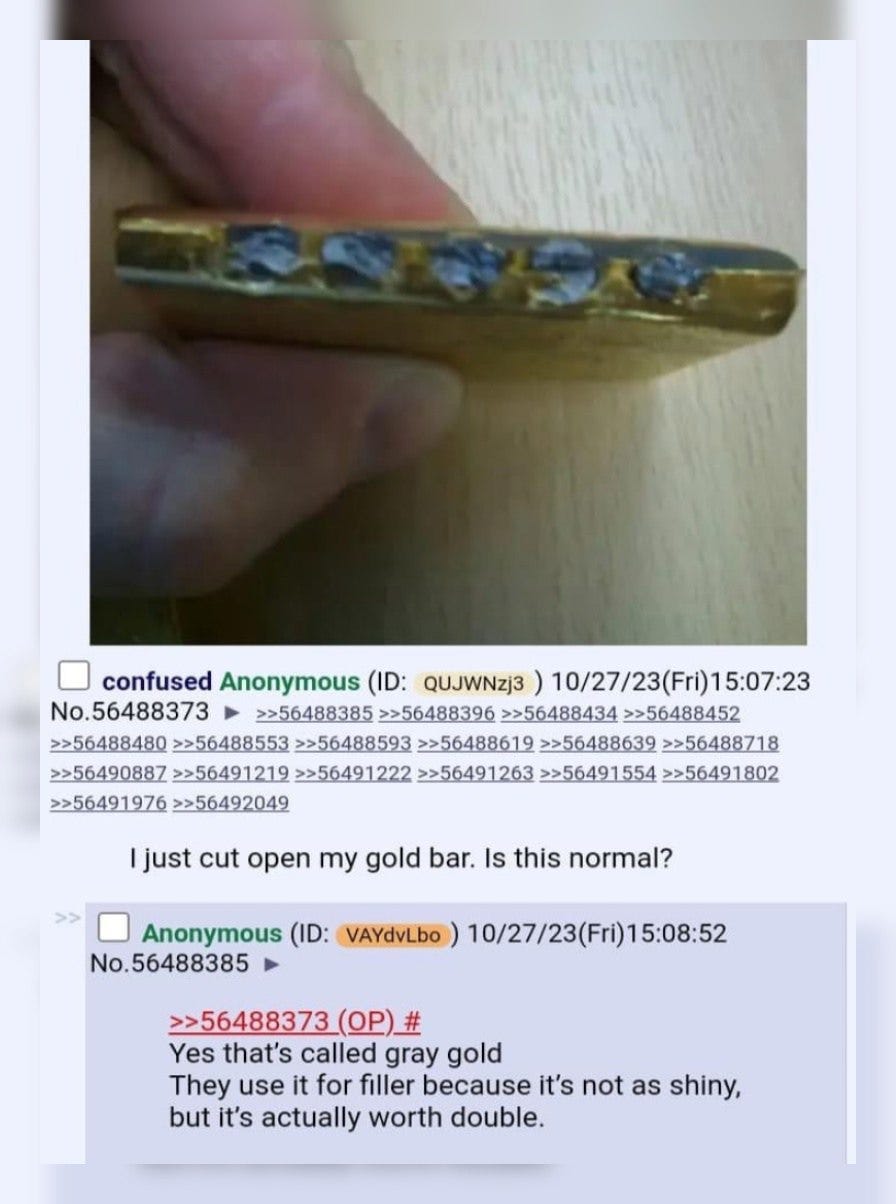

One massive problem with gold is its verifiability. In other words, how can you be so sure what you’re buying or accepting as payment is real gold? And with gold it’s not just asking whether or not it is real, but also real to what degree (purity)? If gold plays a bigger part in investors’ portfolios, leading it to become much more valuable and popular, then you would have to believe that there will be a premium to physical gold since the paper market is understood to be massively juiced up. If the physical gold trade finds its legs, it is without a doubt that bad actors will attempt to “step on” their product. Gold bars or coins should be 99.5% pure, or better. It’s not hard to imagine a world where dealers dilute the gold to make more money — which, in one form or another has been well documented throughout history. So, what should in a perfect world be 100% pure, may in fact only be 75% when you consider the following. These bad actors could mix heavy metals like tungsten into the gold they are selling to deceive buyers who do not possess the instruments or technical capability to test the chemical structure of the gold they are purchasing.

If you’re an institution managing billions of dollars, being 99% sure that what you bought is real, is just not good enough.

By the way, Bitcoiners have long flagged the tungsten trick—scammers filling gold bars with the metal because it shares gold’s density. This sleight of metal can't happen with Bitcoin's digital nature, a fact we Bitcoiners don't let the world forget. Google “fake gold” and you will see many stories of massive counterfeit gold scandals.

I was listening to a podcast featuring Lyn Alden last week where she mentioned that when China buys gold they usually get it from Switzerland where it is in the form of 400oz bars. Before they take possession, the Swiss melt down the bars and shape them into 1kg pieces so that the entire batch down to the core is verified before it's sent to China. Having to melt and recreate a bar is not an easy verification process. As ridiculous as gold seems to me, this process seemed ludicrous and after looking into it myself, I think Lyn got a little bit ahead of herself.

Central banks, when acquiring gold, do have stringent verification processes to ensure the authenticity and purity of the gold they're receiving. They don't typically melt down entire bars for testing, as this would be impractical and could diminish the value of the gold. However, there are several methods central banks and other entities use to verify the authenticity of gold:

Assaying: This involves taking a small sample from the gold bar and analyzing it to determine its purity. In some cases, a small drill is used to extract a sample from deep within the bar to ensure it hasn't been tampered with (e.g., filled with another material like tungsten). The drilled sample can then be melted down and assayed.

Ultrasound: Ultrasound machines can send sound waves through the gold bars, and based on the reflections of these waves, experts can determine if the bar is solid gold or if it has been filled with another material.

Density Test: Since gold has a unique density, it's possible to check the authenticity of a bar by measuring its dimensions, weighing it, and then calculating its density.

X-ray Fluorescence (XRF) Spectrometers: These devices can scan the surface of gold bars and determine the composition of the metal. However, they only test the surface layer, so other tests might be needed to verify the core.

Magnetic Tests: Genuine gold is not magnetic. Any magnetic response from a gold bar would be an indication that it's not pure.

Visual Inspection: Expert evaluators can sometimes spot inconsistencies or irregularities in gold bars that might suggest tampering or counterfeiting.

Generally, a combination of the tests above is used on every gold bar purchased. So while it’s not as drastic as melting a bar down, it is still a very exhaustive and kind of hilarious process to go through.

Bitcoin, on the other hand, offers an unparalleled level of transparency and verification through its decentralized ledger, the blockchain. Every transaction, every movement, every single satoshi is accounted for and can be verified by anyone with an internet connection. You don’t need to trust; you can verify. In the world of investments, Bitcoin has set a gold standard – pun intended – that gold itself can't even live up to.

Stay with me in this series as I delve deeper into why, when stacked against Bitcoin, gold has lost its luster.