A walk in the park

Friday April 5th, 2024 - Issue # 67

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy Friday! Apologies for missing last week — I was in Mexico on a family vacation, got back Sunday, and haven’t seen the sun since. Nice.

Topic of the week-year: will inflation rear its ugly head and force the Fed to continue its restrictive policy?

To kick off 2024, the Fed has shown itself to be dovish, highlighting that they feel policy is sufficiently restrictive, and have underscored the end to the tightening cycle so long as inflation is tame. To start the year, Fed watchers were expecting 5-6 cuts, which then moved to 3 (current base case) and now you have some folks calling for 2, or 1, or possibly no cuts by the end of the year.

If you’re reading this, you’re likely in a position where you have assets that would benefit from easier economic conditions and are rooting for rate cuts. I’ll also go out on a limb to say that 90+ % of you own BTC, which as the most reflexive asset in human history, would stand to benefit substantially by looser monetary conditions. In order not to miss the forest for the trees, we have to ask ourselves an important question: does any of this noise really matter?

I think not.

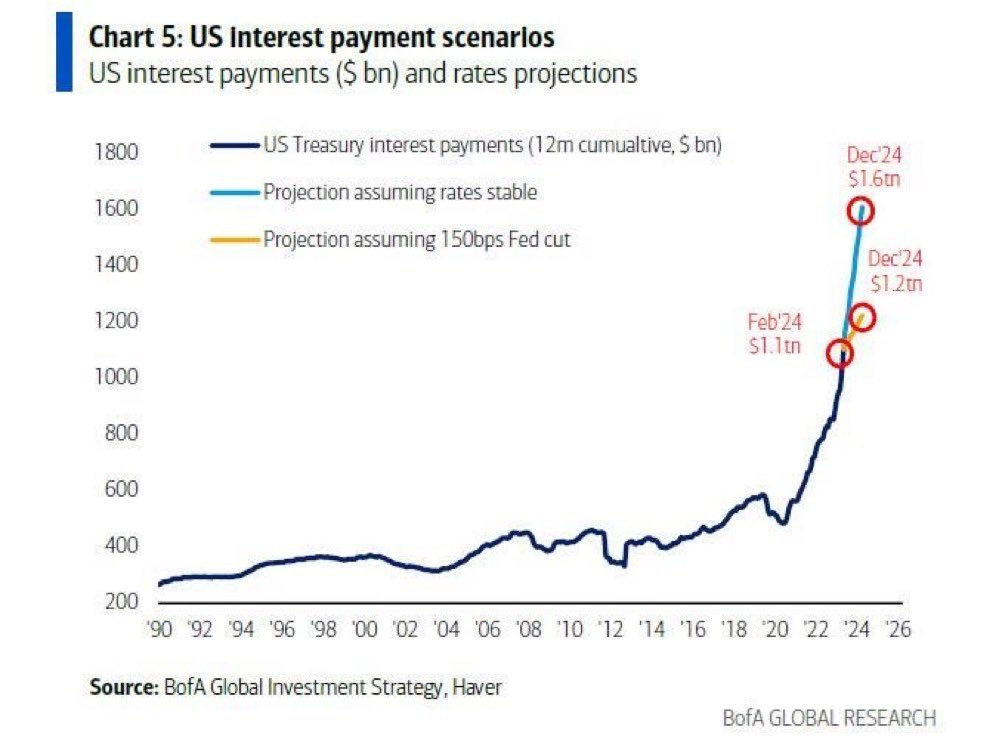

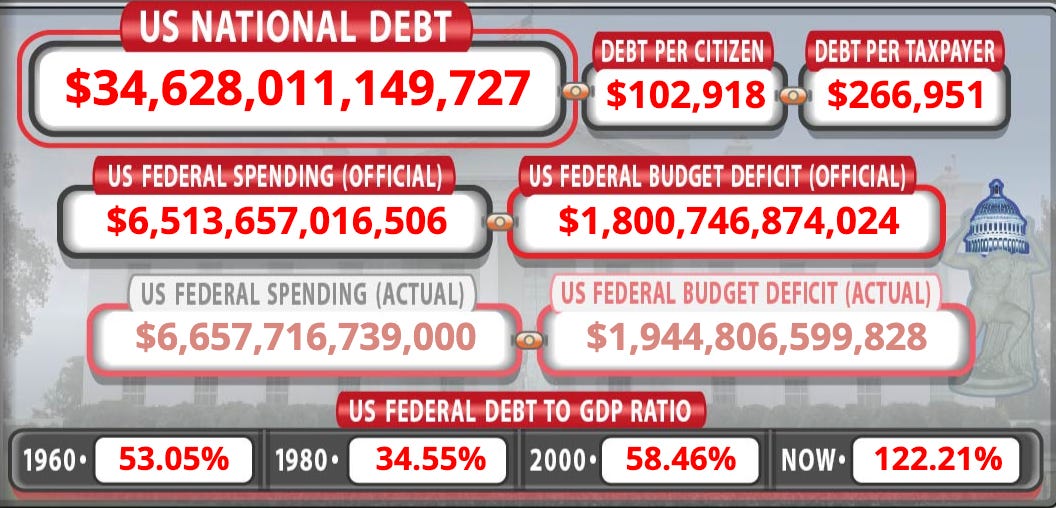

Ever since the Fed hinted at potential rate hikes a few years back, I've been somewhat skeptical, viewing their stance as more of a strategic "posture" than a concrete plan. Looking back, I'll admit my perspective was partially off-target. Specifically, opting for a variable mortgage rate just before the economic turbulence wasn't my best move—a classic case of hindsight being 20/20. However, my underlying belief might still hold some water. I suspected that maintaining elevated interest rates over an extended period could strain a debt-heavy system that fundamentally relies on low rates to thrive. As we navigate this period, it's clear the impact of high rates on such a system is a complex issue, testing the resilience of our economic structures.

Digging deeper into that thought, the reliance of our economy on low interest rates sheds light on a key feature of how things currently operate. We’re talking about an economy that flourishes when credit is easy and cheap, fueling both consumer spending and business investments. When interest rates go up, however, it’s like throwing sand in the gears—it all starts to slow down. The scenarios we're looking at aren’t just theoretical exercises; they’re glimpses into possible futures, each with its own set of hurdles and possibilities.

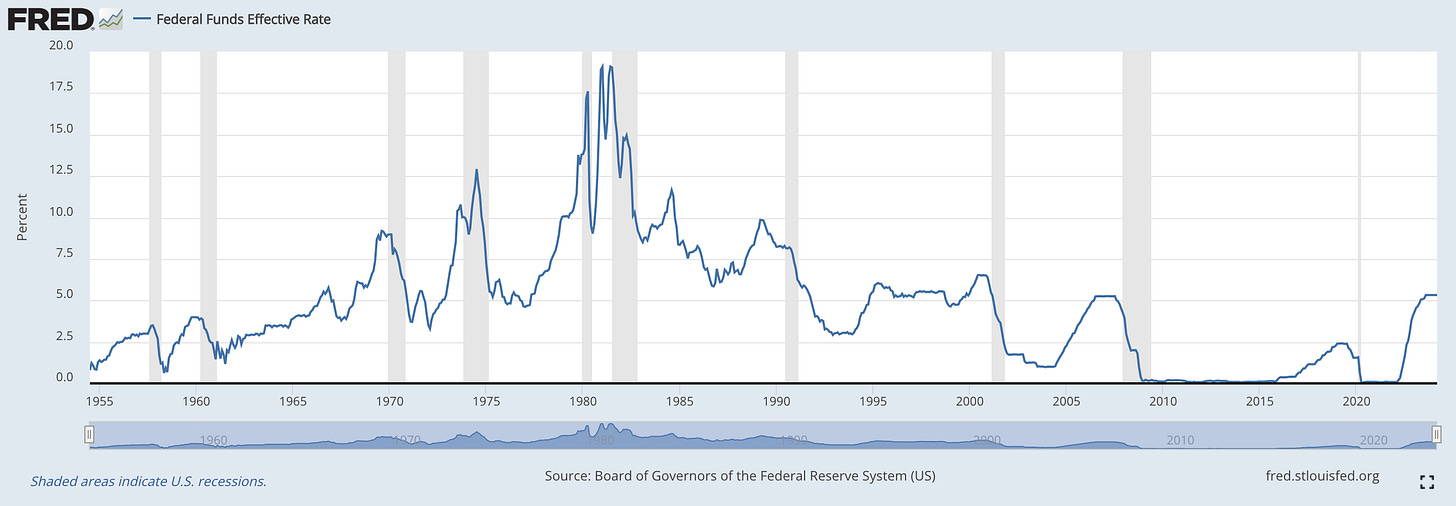

But if we zoom out a bit, we see the ebb and flow of monetary policy and economic conditions over time. Tightening has always eventually given way to loosening as situations change, feeding into expectations for future rate cuts—a cycle of tightening followed by easing that's repeated itself over the years.

I’m not much of a chart guy but based on this graph, I would not bet on rates going any higher. Visually, it looks like we might level out for a bit before rates head down rather aggressively. I know, I know — genius level technical analysis.

This rate cycle has huge implications, especially when we think about assets like Bitcoin. Bitcoin has tended to react vividly to monetary policy shifts and changing investor sentiments. Calling Bitcoin a "reflexive asset" is more than catchy; it reflects its sensitivity to the broader economic and policy environment. As the Fed treads through these tricky waters, its decisions send waves across markets, from traditional stocks to cryptocurrencies, shaping values, guiding investor decisions, and influencing the entire economic scene.

Like everyone else, I’ve been listening closely to Powell since he went on his rate hike rampage a couple of years ago and what I’ve learned (and should’ve learned way earlier) is that you really shouldn’t try to fight the Fed. Listening to his recent remarks including his speech at Stanford earlier this week, it appears to me that he’s paving the way for cuts and he’s being very careful as to make it look as non-political as possible as the country is headed into a historically tumultuous election.

“We have held our policy rate at its current level since last July. As shown in the individual projections the FOMC released two weeks ago, my colleagues and I continue to believe that the policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as we expect, most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year.”

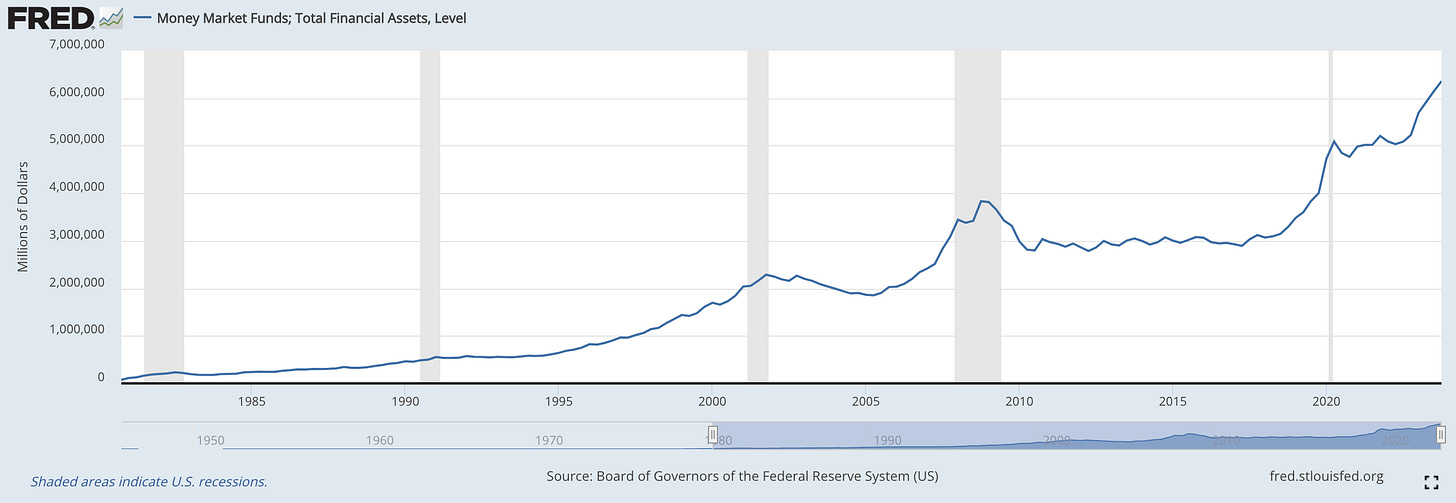

Ouf…I wonder what happens when this capital starts moving into risk assets once rates become less favourable…

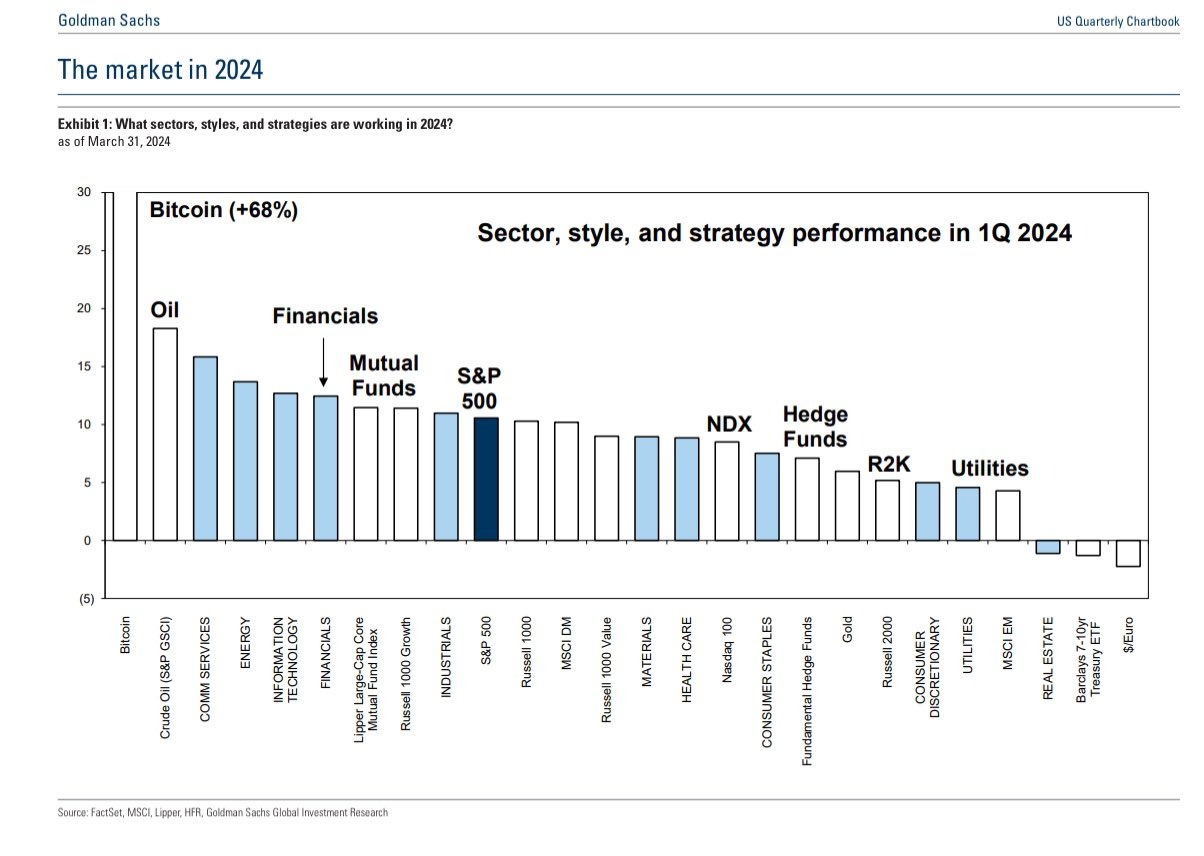

Enough about rates, check out this chart by Goldman Sachs that puts various asset classes side by side to compare their performance so far this year. At the top of this chart? Bitcoin. That’s right, in the race of year-to-date performance, Bitcoin is leading the pack. This isn’t just a one-off. The fact that giants like Goldman Sachs are regularly covering Bitcoin, CNBC is keeping the conversation going, and industry heavyweights like BlackRock are getting involved, all point to one thing: digital assets have firmly made their mark. This chart isn’t just a set of numbers; it’s a signal that the world of finance is evolving, with Bitcoin at the forefront of this transformation, proving that digital assets have secured their spot in the financial ecosystem.

I could go on and talk about a bunch of other stuff, like global currency devaluations and their potential impact on bitcoin or the halving in a couple of weeks, but I’m going to touch some (wet) grass and take my writing partner, Leo, for a walk in the park.

Have a nice weekend!