And the best performer in 2023 goes to...

Friday January 27, 2023 - Issue # 37

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy Friday!

I don’t know about you but I’ve been feeling pretty excited over the last couple of weeks. I’m not sure if it has to do with some of the exciting stuff that we’re working on at Satstreet or if it has something to do with the fact that, more often than not, when I check the price of BTC, it tends to be up. It is probably a good mix of both. Generally, when I start to get excited again — especially about my work — the market tends to react positively. I start noticing tokens ripping 100%+ over the course of a week, and I start to feel some fomo, but I have to remind myself that I’m not a trader and my focus on building the business is far more important — think long-term, think long-term.

The reality is we’re still in a rocky bad macro environment. It seems that every week we brace ourselves for new data points that may affect the investment landscape. When everything revolves around the Fed, positive numbers are negative. Whether we like it or not, everything does revolve around the Fed, and subsequently, their interest rate decisions. This week, for example, the US economy showed strong growth in the fourth quarter, with a 2.9% increase in GDP, which was higher than the expected 2.6%. The markets are trying to understand the implications of this data for future interest rate hikes and when the current hikes will start to cause systemic issues.

In my opinion, the Fed can only go so far and would be wise to back off asap. Yesterday, Billionaire investor and Starwood Capital CEO, Barry Sternlicht, weighed in on the proverbial rock and hard place the Fed is in.

As our good friend Greg Foss would say “it’s just math!”

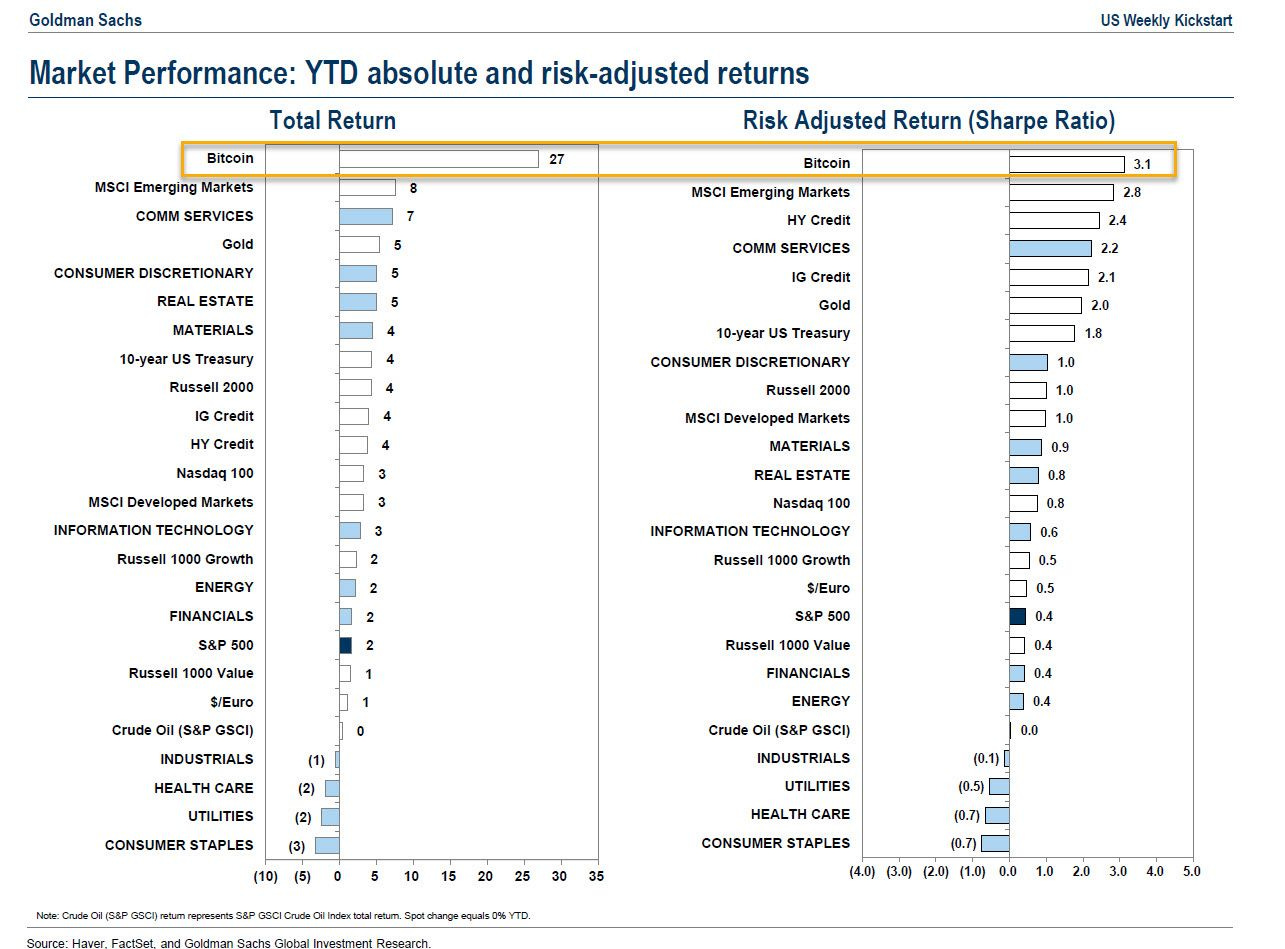

In terms of price action, Bitcoin has had its strongest start to the year since 2013, increasing by 40% in January This week, Goldman Sachs reported that Bitcoin has had the highest returns among all assets so far this year, surpassing gold, real estate, 10-year US Treasury, energy, Nasdaq 100, and other investment options.

What’s the saying? Oh yeah…probably nothing.

When clients ask if now is a good time to allocate, we must first, of course, remind them that we cannot give financial advice, but more importantly we remind them that when dealing with a verifiably scarce asset it is critical to weigh the opportunity cost of sitting on the sidelines. Especially considering that Bitcoin is now viewed as an investable asset by major institutions, and in some cases, even countries. It can take something as simple as a tweet to push the first domino over that starts the chain of events that leads into the next bull cycle. I firmly believe with an asset like bitcoin, as long as you’re in it for the long run, it’s more risky to have no exposure than to have some skin in the game. Food for thought.

Have a great weekend!