April 2nd

Friday March 28th, 2025 - Issue # 100

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Bitcoin: a global, scarce, non-sovereign, decentralized asset, that exists outside of any one countries economic, political, or monetary system.It’s hard to describe the mood in markets right now. Everyone’s on edge, but no one’s really panicking. It’s more like a deep, collective exhale — the kind you take when something big is coming, but you’re not sure what shape it’ll take. I’ve had more conversations in the last two weeks that end with “what do you think happens next?” than I can count. Clients, friends, family, even some pretty plugged-in people in finance and politics — everyone’s watching the same signals, reading the same headlines, and walking away with completely different interpretations. So I’ve been sitting with it. Listening to the macro guys. Reading between the lines. Watching what’s not being said.

And I keep circling back to one thing:

This whole mess — the debt, the politics, the war, the AI boom, the market chop — it’s the kind of environment Bitcoin was born into. Not built for, not perfectly timed — just a natural extension of the same problems that led to its creation in the first place.

Oh, almost forgot to mention, we’re hosting another market outlook call for Q2 on April 16th. It should be a good one so feel free to register using the button below.

I know a broken clock is right twice a day, but we were pretty bang on with our bull BTC bear ETH call and a number of folks positioned themselves accordingly and were greatly rewarded. Let’s see what we can conjure up this time.

Anywho…

Think about what’s going on. The CBO projects a US federal budget deficit of $1.9 trillion for this year, while some on the Street say that number could quietly drift closer to $3 trillion once all is said and done. We’ve got $9 trillion in maturing debt to refinance — most of it short-term — and the solution being floated is… tariffs. Massive ones. 25% on imported cars. 200% on European wine and spirits. They’re calling it “reciprocal trade.” What it really is: a politically palatable way to raise taxes without calling it that. And it’s all happening in real time, through X posts and interviews, like a live-streamed negotiation with the world.

Markets are rattled. Hedge funds are de-risking. Momentum has flipped. But underneath all of that noise, something else is happening — the administration is trying to rapidly restructure a completely dysfunctional fiscal system without triggering a full-blown crisis. And they’re doing it fast.

Ray Dalio has been writing about this for years — the concept of a “beautiful deleveraging.” A careful rebalancing of inflation, growth, taxes, spending, and money printing. Tariffs to pull in revenue. A push to eliminate income taxes for anyone earning under $150K — that’s 85–90% of American households — to boost consumption and address wealth inequality without punishing capital. Pair that with austerity on the public payroll side, and what you’re left with is a redistribution effort through the back door. Again — bold, messy, maybe impossible to pull off — but that seems to be the goal.

And all of it is colliding with the biggest productivity boom in a generation. We’re in the middle of a full-blown AI arms race. Data centers, robotics, energy infrastructure — the CapEx cycle alone is in the hundreds of billions. There’s no room for a recession in this environment. Not with every country trying to one-up the next in compute and automation. Even the Fed knows this. They’re boxed in. They can’t cut until inflation rolls over, but they also can’t let the economy break. So we sit. We wait. And we try to figure out where this all leads.

But here’s where it gets interesting — and where Bitcoin reenters the frame in a big way.

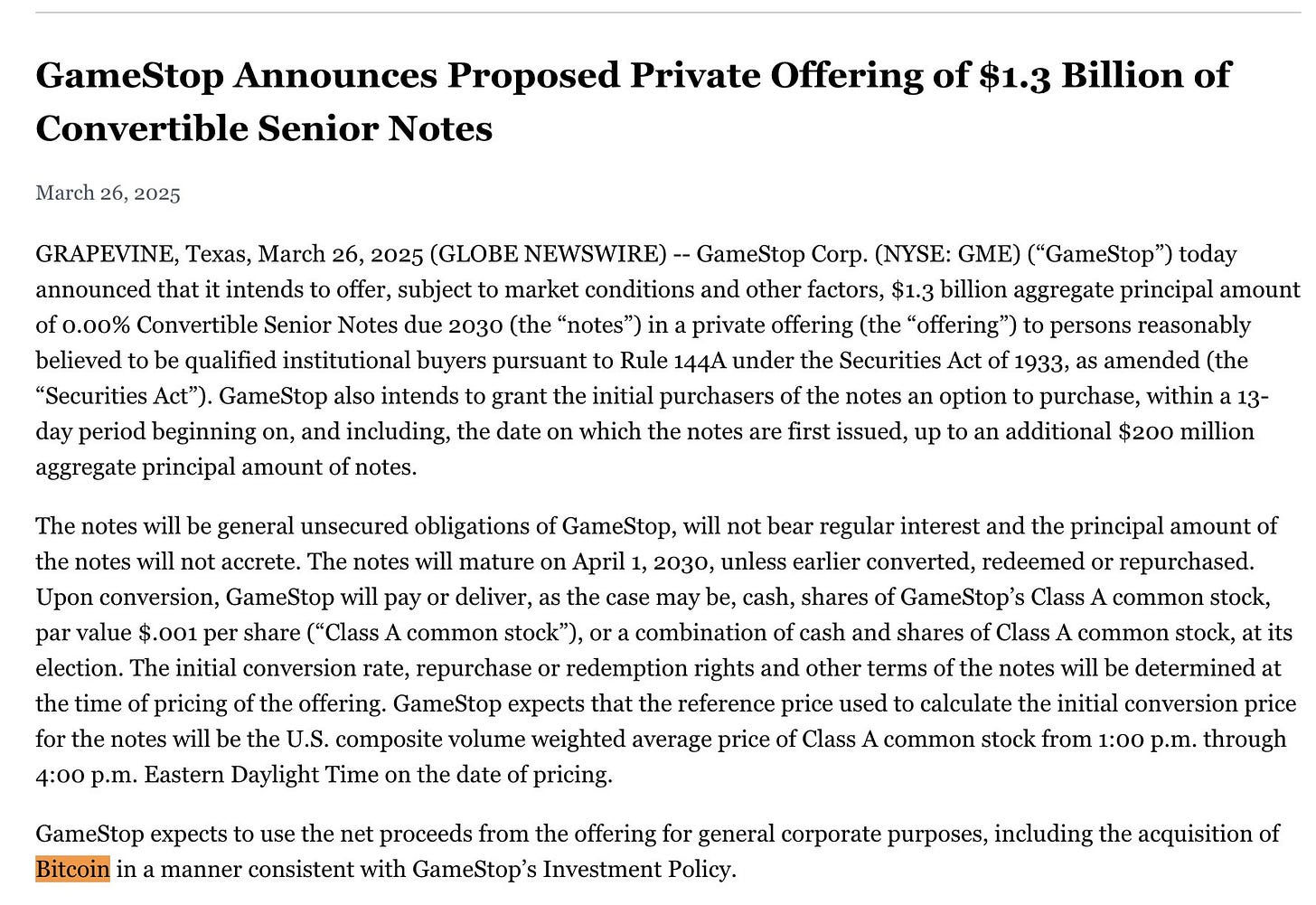

GameStop ($GME), just announced a $1.3 billion raise to buy Bitcoin. Not stock buybacks. Not debt repayment. BTC. The biggest retail army in history just joined the hardest money in history. A signal, not just a headline.

Meanwhile, Congressman Begich publicly suggested that the U.S. should be acquiring 1 million Bitcoin. I’m taking that one with a grain of salt — but still, the fact that people in Congress are even floating these ideas is wild. There are serious conversations happening behind the scenes about budget-neutral ways to acquire Bitcoin — including selling some of the country’s gold reserves to fund the purchase. That sounds insane… until it doesn’t.

Bo Hines, now Executive Director of the Presidential Council of Advisers for Digital Assets, is pushing hard for Bitcoin to be treated as digital gold — a national strategic asset. Say what you want about politics, but when people at this level start saying the quiet part out loud, it’s usually not by accident.

Also, it’s important to weigh the reality that these signals are not falling on deaf ears. Other countries who are not as bureaucratic — Russia, China, countries in the Middle East (Qatar, UAE, Saudi) — have to be looking at these signals and are making moves to front-run the US on their Bitcoin acquisition strategy, if they haven’t already. The fact that I’m even typing this right now is crazy. We went from insignificant magic internet money to arguably one of the most geopolitically important assets since I started less than 8 years ago. F’ing wild.

Zoom out for a second. Gold is at all-time highs. Central banks are buying. Sovereign trust is eroding. Fiat is being weaponized geopolitically. And Bitcoin is just… sitting there. Quiet. Dormant. Oversold. This divergence won’t last. Bitcoin doesn’t move gradually — it moves all at once. And if you believe the endgame is more money printing, more financial repression, and more instability — then you already know where this is going.

There’s still so much to unpack, especially as we approach April 2nd — D-Day for tariff watchers. But from where I’m sitting, Bitcoin is staring down one of the most asymmetric macro environments it’s ever seen. A global debt spiral, geopolitical friction, the early innings of an AI supercycle, and the slow death of trust in public institutions. That’s not bearish. That’s the reason Bitcoin exists in the first place.

I’ve felt this energy before. Late 2020 had a similar rhythm. You could feel the system buckling… and something better starting to emerge. We’re close again. Maybe even closer this time.

Let’s see how it plays out.

These two podcasts offer a front-row seat into the mindset driving Trump’s economic strategy.