Banana Republic, Banana Zone

Friday May 31st, 2024 - Issue # 73

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good morning and happy Friday!

Not too much has changed since last week except…everything. Kidding.

No, but it has been a pretty quiet week after last week’s fireworks stemming from the SEC’s ETF approvals and two big wins in congress for crypto. Many thought leaders in our space have beaten the drum that one day, crypto would be a focal point of a contentious US election, and it appears that this is the year.

A great example is Messari founder and CEO, Ryan Selkis who is someone I’ve been paying close attention to for years now and who I hold in high regard. Also, as a bit of a writer myself, his annual report is a work of art and I highly recommend that you add it to your must-reads.

If you think it’s just political pandering from the right, click below and take a look at President Trump’s website…lol pretty sick.

Selkis and others have been bashing Biden Boden so much this year that I’m thinking…maybe we should think about our position and give them a chance to catch up…heat of the moment bipartisan support for our industry seems to me to be way too good to mess with.

Let’s milk this thing right?

…

I wrote all of the above yesterday morning. It’s par for the course that everything has kind of changed from a political standpoint in the US over the past 24 hours. I really only care to talk about politics as it relates to macro, but as Florida Governor Ron DeSantis put it quite plainly in a tweet last night: Trump’s conviction yesterday shows how a leftist prosecutor, a partisan judge, and a liberal jury bent the legal process to “get” Trump. This case, involving alleged misdemeanour business records violations from nearly a decade ago, highlights the political debasement of the justice system. If it weren't Trump, this case wouldn't have even been brought.

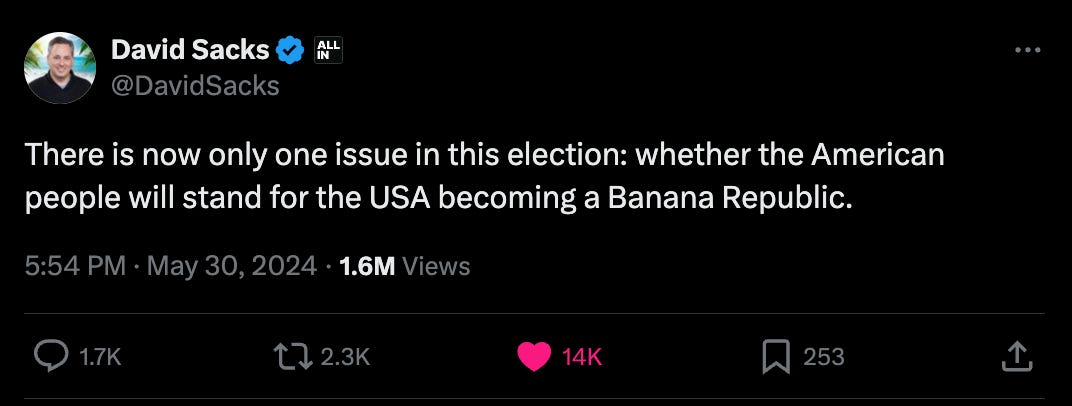

Honestly, nothing really surprises me these days but there’s always some shock value when things like this happen. The bottom line is that I think pretty much nothing is legitimate anymore — not the media, elections, or the courts. I can’t imagine a world without X. Imagine all of the bat sh** crazy stuff that’s happened over the past 5 years without a “townsquare” of hundreds of millions of people made up of leaders, politicians, subject matter experts, visionaries, and the layman sharing their raw and unfiltered views real time? It’s pretty much one of the only things that gives me real hope that we can win.

I think this is right…

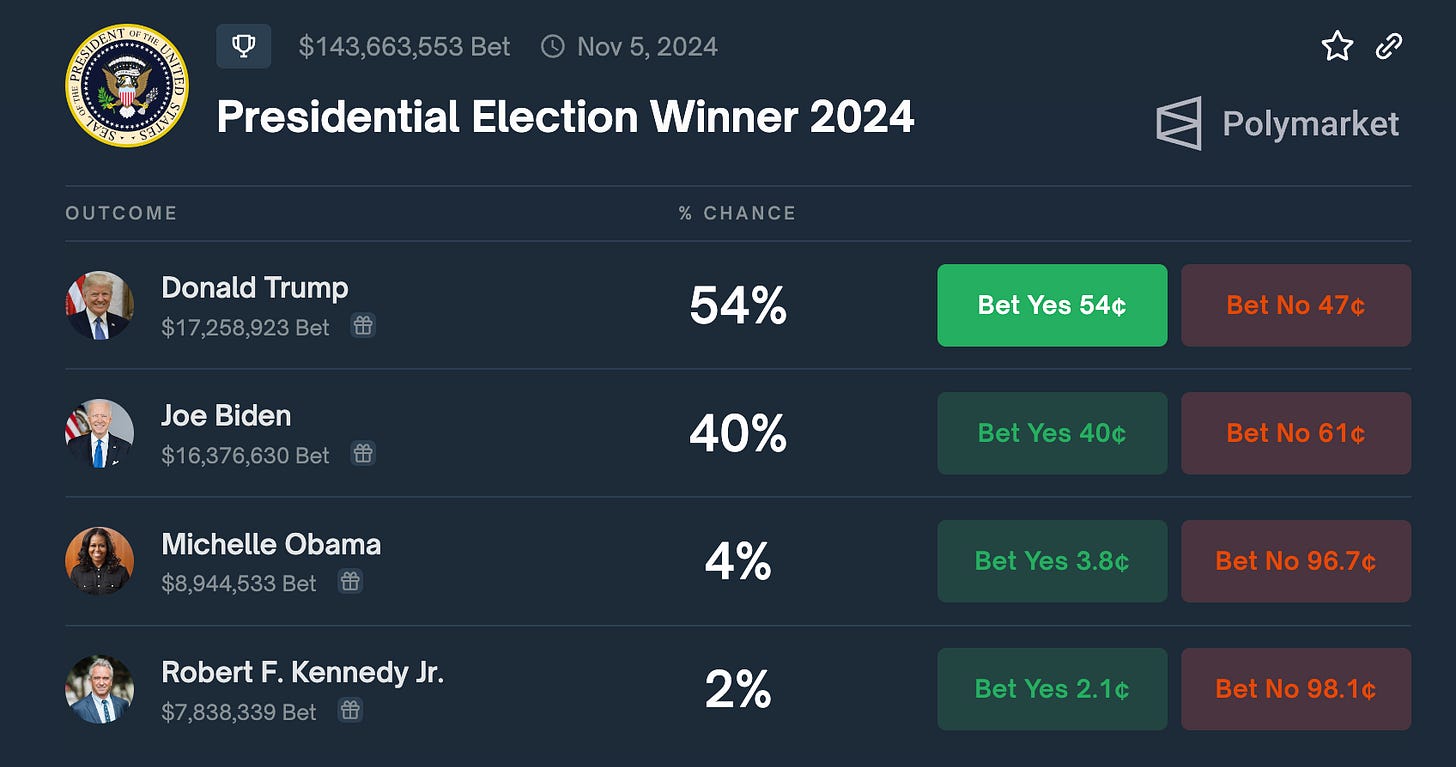

Trump’s donation page was down multiple times yesterday because of all the traffic. Folks that were on the fence and hoping Biden did something leading up to the election to make them feel better about voting for the Dems just put on their MAGA caps. Prediction markets are saying Trump 2024.

There’s truly never a dull moment anymore.

Agh, I just wanted to lightly touch on bipartisan support for crypto and then talk about a couple of new corporate bitcoin treasury announcements. I was even going to talk about multiple possible productivity miracles that, even if one were to hit, could pull the US out of its debt spiral…

I’m going to be away for a couple of weeks so I’ll just leave these here for you in case they become old news by the time I’m back.

Quote from their Chairman:

"Our bitcoin treasury strategy and purchase of bitcoin underscore our belief that bitcoin is a reliable store of value and a compelling investment," said Eric Semler, Semler Scientific's chairman. "Bitcoin is now a major asset class with more than $1 trillion of market value. We believe it has unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid global instability. We also believe its digital, architectural resilience makes it preferable to gold, which has a market value of approximately 10 times that of bitcoin. Given the gap in value between gold and bitcoin, we believe that bitcoin has the potential to generate outsize returns as it gains increasing acceptance as digital gold."

“Scientists from the University of Pittsburgh have discovered a large amount of lithium located in Pennsylvania, saying it could eventually supply more than a third of America’s needs for the mineral.”

Probably more pandering and again we don’t really trust anything they say anyways but any shift toward nuclear energy is progress.

“The US GDP could grow by an extra 1% if 60 million Americans took GLP-1 drugs by 2028, Jan Hatzius, the chief economist at Goldman Sachs, wrote.”

Parting thoughts before I post some podcast reccos below: Imagine we didn’t have Bitcoin.

Weekly podcast recommendations