bank...RUN!

Friday May 5th, 2023 - Issue # 43

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Hey all,

Happy Cinco de Mayo! I’m sorry it’s been a few weeks since my last note — it’s been incredibly busy as we’re plugging away on the regulatory front, and I’ve just got back from Austin where I was in town for Consensus.

I guess I’ll start with a few key takeaways from the conference:

the energy at the actual convention center (where all the booths were) was low

there were a lot of serious builders in attendance which was great to see

I had a few in-depth conversations with software engineers for some of the newer L1s and my key takeaway was pretty disconcerting — essentially the only reason why they left the Facebook’s of the world for web3 is not that they believe the project is going to change the world, just that it’s “new”

when I asked questions like: why did you choose [insert new L1] vs building on Ethereum, for example…I got nothing of substance. I guess what I was hoping to hear was why this particular [insert new L1] was so important that they’ve dedicated themselves to building toward a better future. I got none of that.

I would just expect that a very strong software engineer who is leaving a comfy blue-chip job to join a startup would have a revolutionary vision that what they are working on is incredibly important.

Everyone I met has either left North America or has a plan in place

Remember when Balaji threw up the #BitSignal mid-March and called for $1M BTC in 90 days? He’s been silent since his Twitter rampage and podcast tour which lasted until early April. He broke his silence this week:

He couldn’t have picked a better time to enter back into the frame as the banking crisis has escalated with more banks teetering on the line of receivership.

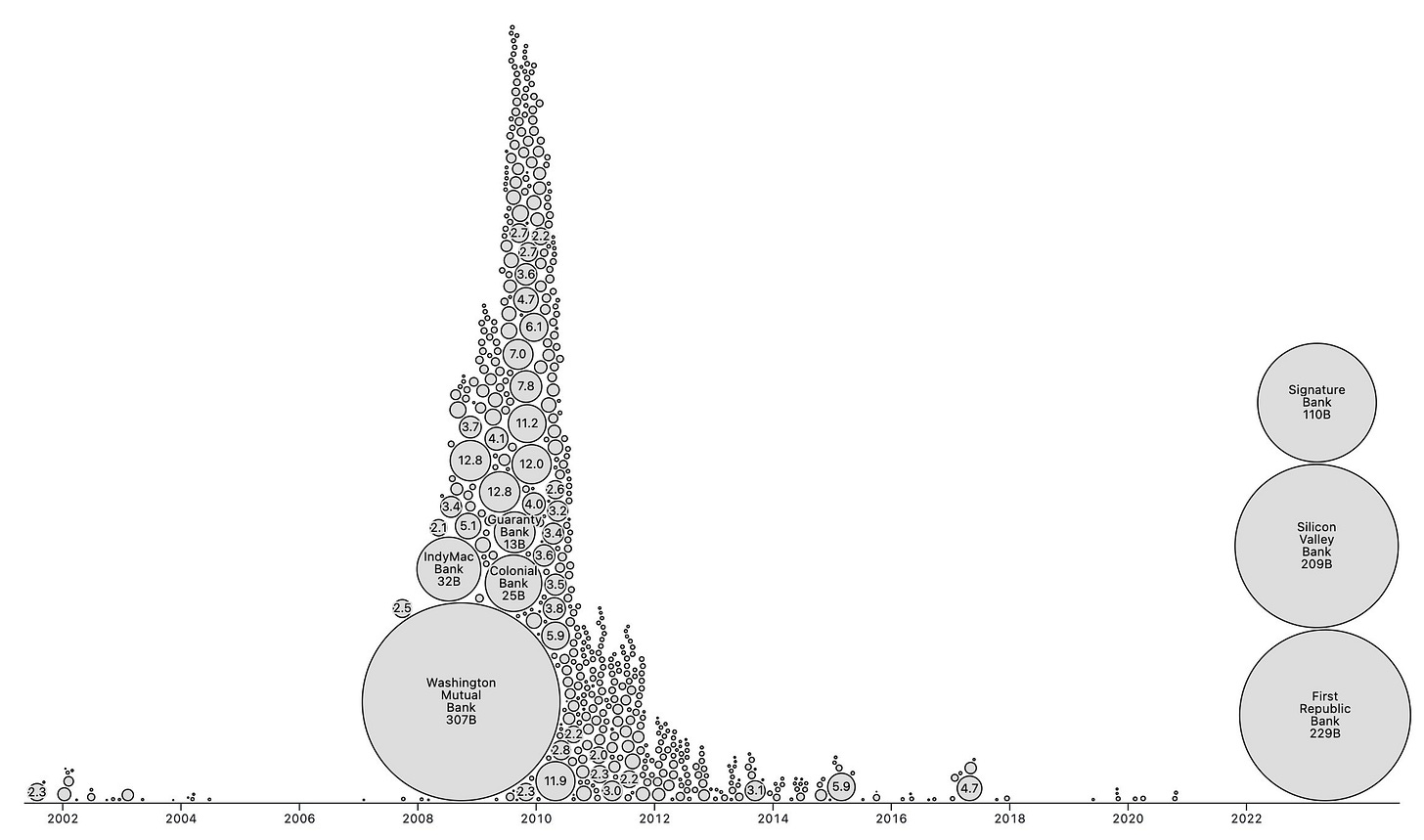

The chart above will soon reflect the addition of a significant bubble as PacWest Bancorp is forced into receivership and subsequently acquired by a larger bank. With assets totaling $41B, this will be the fifth-largest bank failure in US history and the fourth of 2023. This event occurs within a week of the second largest bank failure in US history - First Republic Bank.

Are we bitcoiners, etherians, crypto enthusiasts et al, gold bugs, and macro folks the only ones that are noticing that the sky is falling? I am not old enough to have been affected by the GFC — in fact, I don’t even remember it at all — but how does someone believe, even on the margins, that the US banking system is sound? I mean, I didn’t expect anything different but when Jay Pow stepped up to the mic, looked America in the face and uttered, "the banking system is sound and resilient" I was still surprised. It was at that point — his first 7 words — that I really clued into how bad things really are.

As Powell did his best to reassure the country that the banking system was stable, regional bank stocks across the board were a sea of red. Watching it happen in real time, it felt like the iconic scene from The Big Short:

“Boom”

Two hours after Powell said the banking sector conditions have "broadly improved", PacWest Bank plummeted over 50% after hours and reported that they are considering a sale. It wasn’t much better for Western Alliance which also got demolished and reported that they are also exploring strategic options including a potential sale of all or part of its business.

So, we’ve gone from “it’s a couple bad apples” — Silvergate, Signature, SVB (blaming crypto exposure) — to, it’s just a few and “banks remain strong.” Now they’re talking about evil short sellers — could they ban shorts? Could they go as far as to put restrictions on deposit withdrawals? One thing that they cannot do, is let the financial system collapse, so all options are to be on the table.

As I’ve mentioned before, in my opinion, this is all a posturing game for the Fed. They have taken it way, way too far though. What’s happening is very simple and it can only be solved by chopping rates back down to near 0 because that is the only way this system works.

***Full transparency, right before this historic tightening cycle, I decided to take a variable mortgage rate vs. a 3.3% fixed rate. I knew the BOC was going to raise rates but I obviously didn’t expect them to go as far and as quickly as they did. My rationale was that rates would be near 0 % (or even below 0%) at some point in the future. It’s been a pretty painful year and I’ve regretted my decision for most of the time, but I still have conviction that I will be in the black over the course of the next few years. So please, take everything I say with a grain of salt because I’m clearly biased :)

What’s happening to the regional banking system in the US is very simple to explain, and if Jay Pow doesn’t admit that he screwed up, the situation is going to go from really bad, to horribly worse. Even with the Treasury announcing that all deposits are federally insured, it doesn’t solve the fundamental problem that there is capital flight from bank accounts seeking yield.

Sure, maybe initially people were moving their money out of regional banks to the JP Morgan’s of the world because they were worried about deposit security after the abrupt failure of SVB, but I don’t give much credence to this narrative. The reason why there is a historic capital flight from banks is that they’re offering you 0.1% on your savings while the Fed is giving you 5%. So, with a click of a button, folks are moving their hard earned dough to their new Apple Savings account at 4.15% or to a money market fund offering a similar yield.

Without a mechanism in place to stem this virtual “run on the banks” the entire financial system is in big trouble. Why?

You’ve probably heard the term held-to-maturity (HTM). Back when we were in a low-rate environment, the Treasury had a load of treasuries to sell and allowed the banks to hold these securities to maturity without having to mark-to-market. This was very appetizing to banks who were flushed with deposits from a decade of easy money, and for good reason — they viewed it as risk-free. However, when you get a deposit flight, suddenly banks are no longer able to hold the security to maturity and they have to sell — no matter how underwater they are after the Fed jacked rates on them. The mark-to-market losses are greater than the equity in the banks. They’re insolvent.

Powell knows this and he still took the rates up an additional 25 bps. They are so focused on saving face and stemming panic that they are just too far gone. The Fed is not going to volunteer a rate cut — they need to see more things break until they can be comfortable doing a 180. We don’t really have to break anything new — the bigger break can be simply that the deposit flight is so extreme that draconian measures are implemented to gate the outflows from the US banking sector.

If you’ve noticed, every time a bank has failed or bank stocks have been pummeled, BTC has done the opposite. If there is potentially a lot more of this to come, I like my long BTC position. I mean, Bitcoin was born out of, and meant for times like these. Schmuck insurance, whether it’s US credit default swaps, or BTC, is getting more expensive…

Suggested read: Exit Liquidity by Arthur Hayes