Bitcoin Has Crossed the Chasm

Friday May 17th, 2024 - Issue # 71

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy Friday!

Before I dive into why Bitcoin is over $66k, I want to quickly highlight some major Satstreet updates. In case you missed it, we recently sent out a press release highlighting the following Q1 milestones:

Successful Completion of Third-Party Financial Audit ✅

Over $380 million CAD in transaction volume (58% increase QoQ) ✅

Over $3 million CAD in revenue (83% increase QoQ) ✅

Well over $2 billion in all-time transactions ✅

As always, thank you a million times to all of our clients and supporters.

Early in Q1, after the ETFs launched mid-January, ETF flows were all the rage, sending BTC to new all-time highs in short order. Oh, what a glorious run. Not only did it send our bags to the moon, but it also led to a record quarter as the roars of “up only” rang through crypto Twitter. Then, things started to slow down a bit. Funnily enough, and maybe it’s just a twisted coincidence, but everything feels right in the world when Bitcoin is rising. But when it turns, it feels like World War III is on the table, literally.

I was thinking about it the other day…maybe Bitcoin is somewhat of a macro crystal ball — it certainly feels like it. In fact, many traditional finance talking heads now bring up Bitcoin whenever they discuss where the market is headed, using it as a leading indicator of fiscal and monetary policy. There’s really no point in picking out a specific CNBC interview; it comes up all the time. Anyway, I digress.

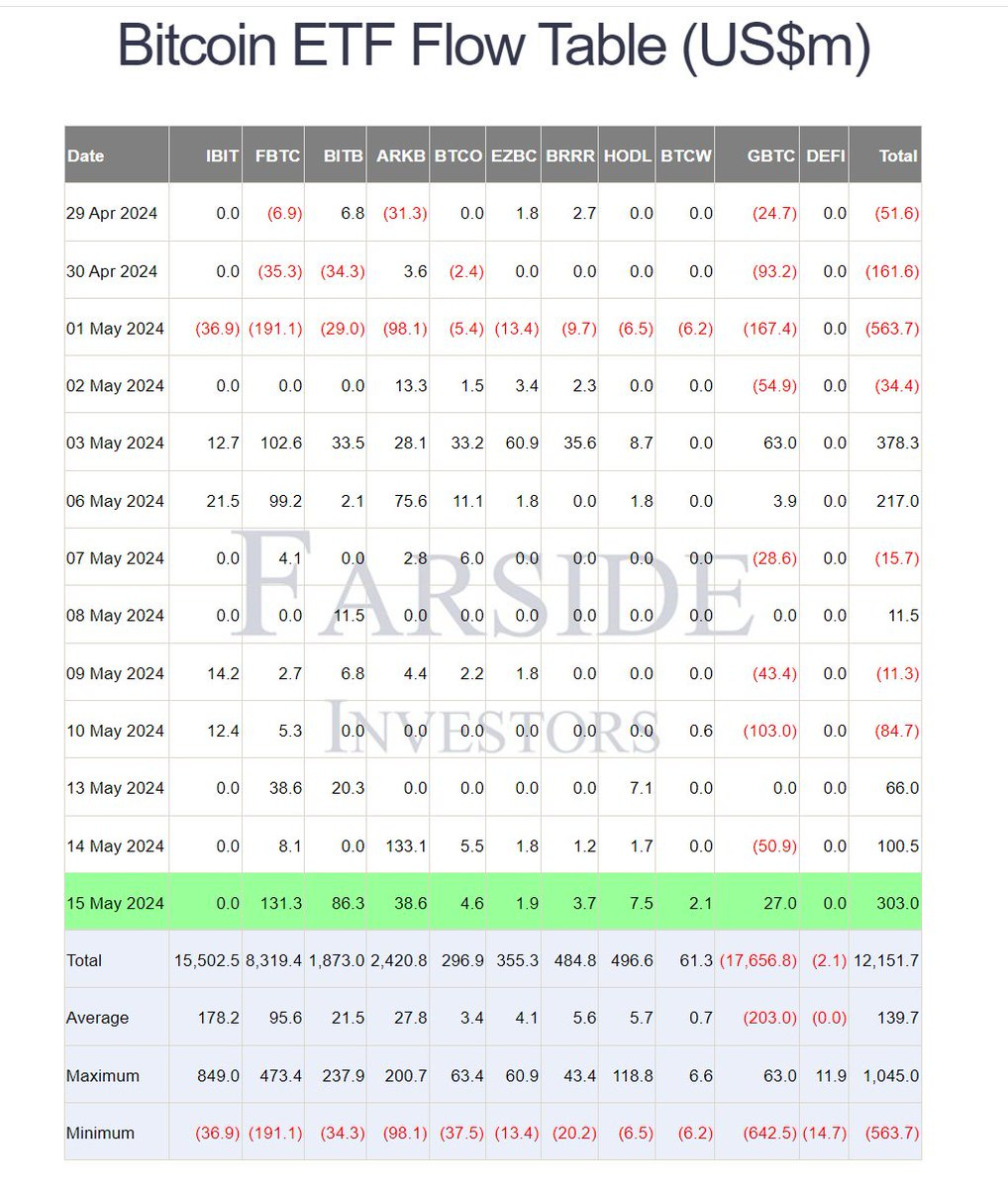

Things started to slow down a bit when we saw that ETF flows were not always going to be positive, but boy, what a run we had. As the momentum stalled and reversed sharply from time to time (with scary geopolitical/macro headlines), ETF outflows were prominent. As you can see from the chart below, May 1st was just one of those days.

But if you look to the 15th, the flows rebounded aggressively. Was it the softer-than-expected CPI numbers that came out on Wednesday? Yeah. However, we have to talk about these 13F disclosures, which we kind of expected but had to see with our own eyes.

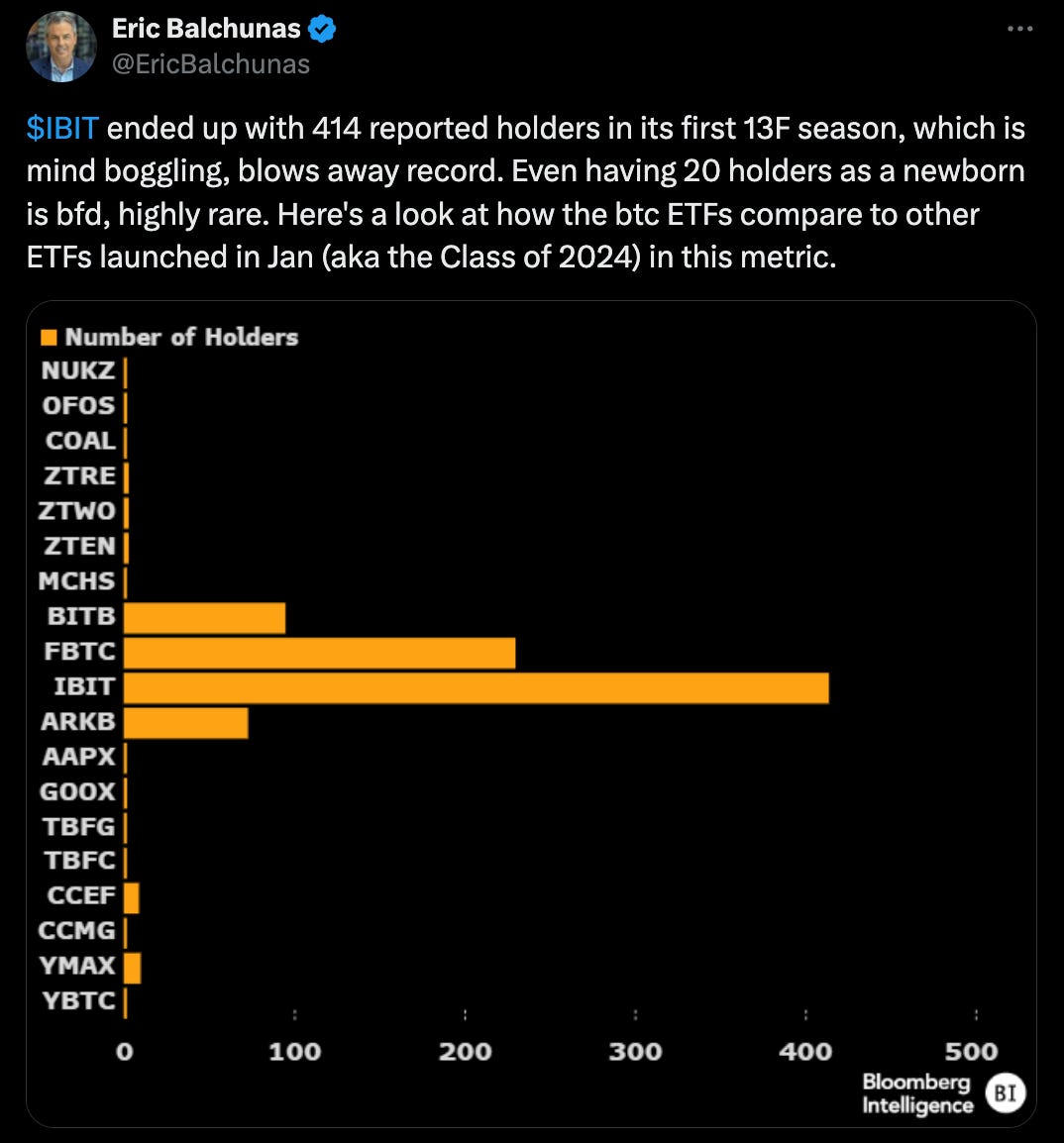

Here’s a tweet that caught my attention…followed by more than a handful of others:

The chart highlights that the BlackRock IBIT BTC ETF, with 414 institutional holders, has become the most successful ETF launch ever, significantly surpassing expectations.

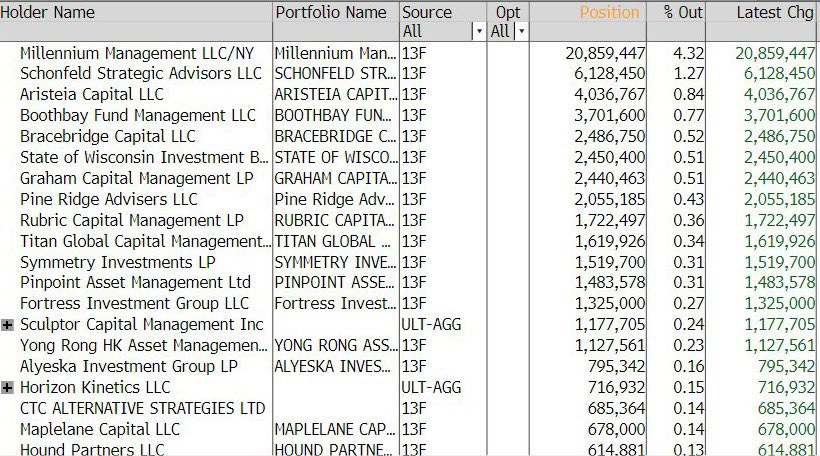

Hedge Funds have joined the party:

This week Millennium Management disclosed a ~$2b Bitcoin ETF holding as of Q1, 3% of their $64b fund. Wild.

The next thing we’ll be looking for are the mutual funds, then the sovereign wealth and pension funds. Looks like it’s already started…(all my links are clickable)

The state of Wisconsin has purchased about $163 million worth of bitcoin, according to 13F filings.The state of Wisconsin Investment Board purchased bitcoin ETFs from BlackRock and Grayscale in the first quarter.The Wisconsin Investment Board manages state's pension which is worth more than $150 billion.

Click this tweet below for a pretty good tweet thread summary of institutional participation by Bitwise — the more bitcoin-native ETF issuer:

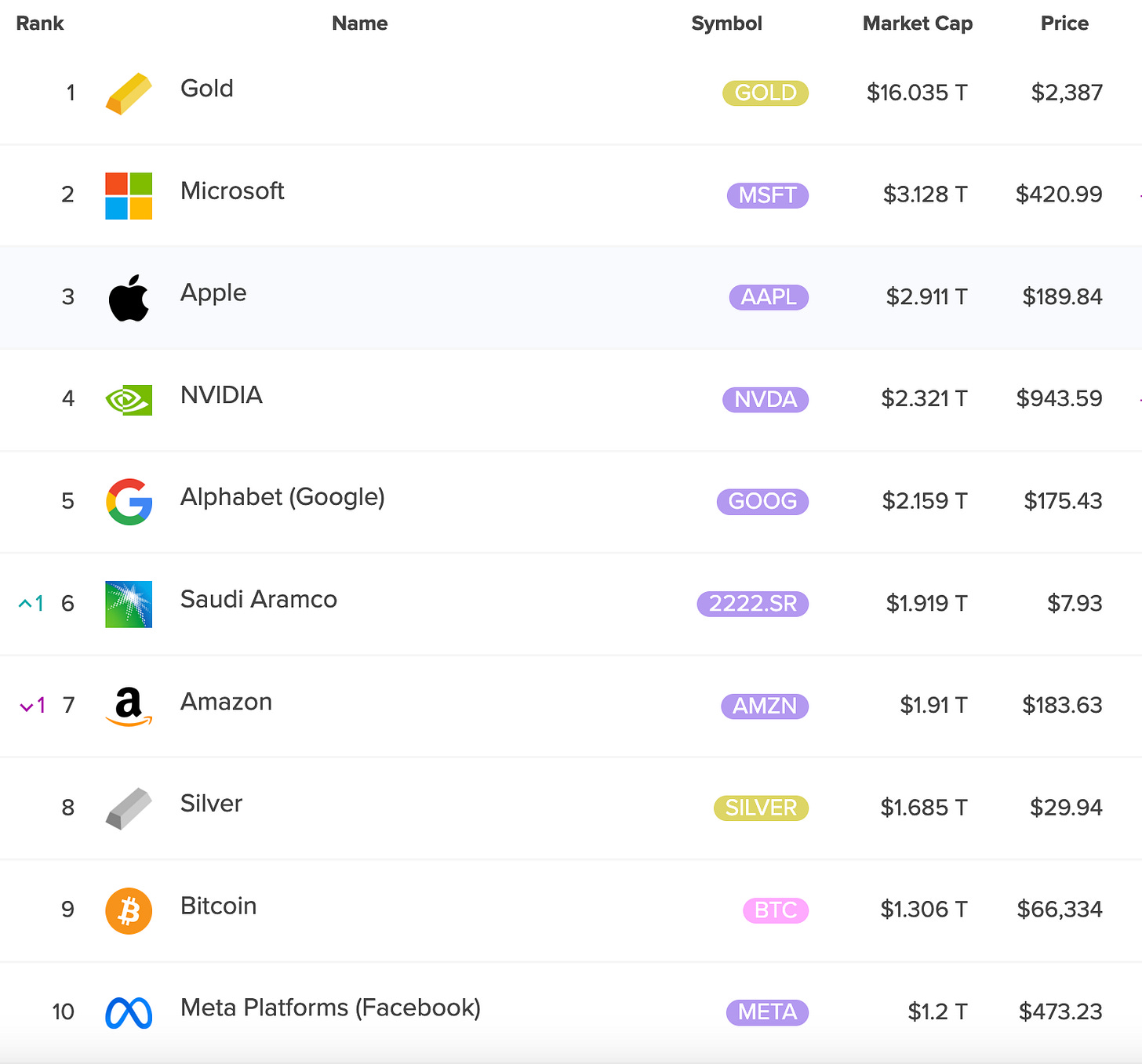

I haven’t looked at this chart in a while…

We’ve come a long way — to be ranked in the top 10 out of all assets is a tremendous feat. What’s your key takeaway? Mine’s actually not just the way gold absolutely dominates everything else by 5x+. When I look at this chart, I see commodities (and proxies — Saudi Aramco) and tech companies. The gap is so incredibly wide that it appears to be a fact that the only way an asset can hit $10 trillion is if it is some sort of scarce commodity. To take it a step further, gold’s market cap is largely due to its role as an investment vehicle or store of value. So, I think an asset needs to be some sort of scarce commodity that is also held by investors as a store of value. I’ve bashed gold in the past, but I can argue all day why I believe Bitcoin is better than gold at being an investment vehicle, store of value, payments technology, wealth preservation tool, etc. My bet is that Bitcoin will continue to creep up on gold and slowly steal market share. For those that have modest Bitcoin price targets, you’re not thinking big enough. Bitcoin will continue to climb up this list until it’s neck-and-neck with gold, and I think it will happen in short order.

I’m going to start something new this week. I listen to a lot of podcasts…more than the average bull. Usually, when I’m talking shop with clients, I’ll reference what I heard on certain podcasts, and I’m excited to share certain episodes that I think they’ll enjoy. So, moving forward, please allow me to take on all the future hearing damage and only present to you the top podcasts I listened to this week.

Weekly bullish-bias podcast recommendations