Bitcoin "quietly" retakes $1 trillion market cap!

Wednesday February 14th, 2024 - Issue # 62

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy Wednesday & Valentine’s Day! Yes, normally these things go out on Fridays but I made the mistake of checking my phone in the wee hours of the morning and saw Bitcoin at $51.5k — just as it was in my dream — there was no going back to bed. There’s really nothing more important to highlight this week besides the staggering amount of BTC ETF inflows over the last handful of days.

Yesterday's ETF inflows was an insane $631 million with BlackRock coming in just shy of half a billion. This is four days in a row of ~half a billion dollars flowing into these ETFs.

What you’re seeing is correct. Blackrock has pulled in over $5B and Fidelity will be over $4B in AUM today, in their first 30 days of trading. There have been over 5500 ETF launches in history, no other ETF product has ever come close to accomplishing these numbers.

As Pomp proclaimed on CNBC yesterday “Bitcoin has become Wall Street’s favourite asset!”

Pomp makes a great point when pressed with the objection that these ETF numbers are small relative to Bitcoin’s current market cap of $1 trillion. It’s true, the current market cap of Bitcoin stands at roughly $1 trillion. However, 80% of all BTC in circulation has not moved in the last 6 months, meaning, only $200B is tradeable with the ETFs absorbing 5% of the total tradeable supply in the last 30 days.

I’m really trying to find the other side to balance out how bullish I am but it’s extremely hard. If you asked me ahead of the US CPI print yesterday, my bearish view would be that if CPI came in hotter than expected, the dollar would strengthen and we would go lower based on “higher (interest rates) for longer”. CPI did come in hotter than expected and the dollar did strengthen against everything but Bitcoin which was down slightly before slicing through $50k to make a fresh high since December 2021. With that surprising CPI print, and the big psychological barrier of $50k, I think Bitcoin would likely have dropped back to the low $40s pre-ETFs. Traders sold their coins or shorted expecting to profit or be able to buy much lower but failed, and now they have to rebuy higher. It seems like it would be foolish of them to try again.

“it’s going up forever, Laura”

I concede, nothing goes up in a straight line forever, but I wouldn’t be doing what I do now, and during the depths of seemingly endless crypto winters, if I didn’t fully believe that Mr. Saylor was directionally correct in the long-run.

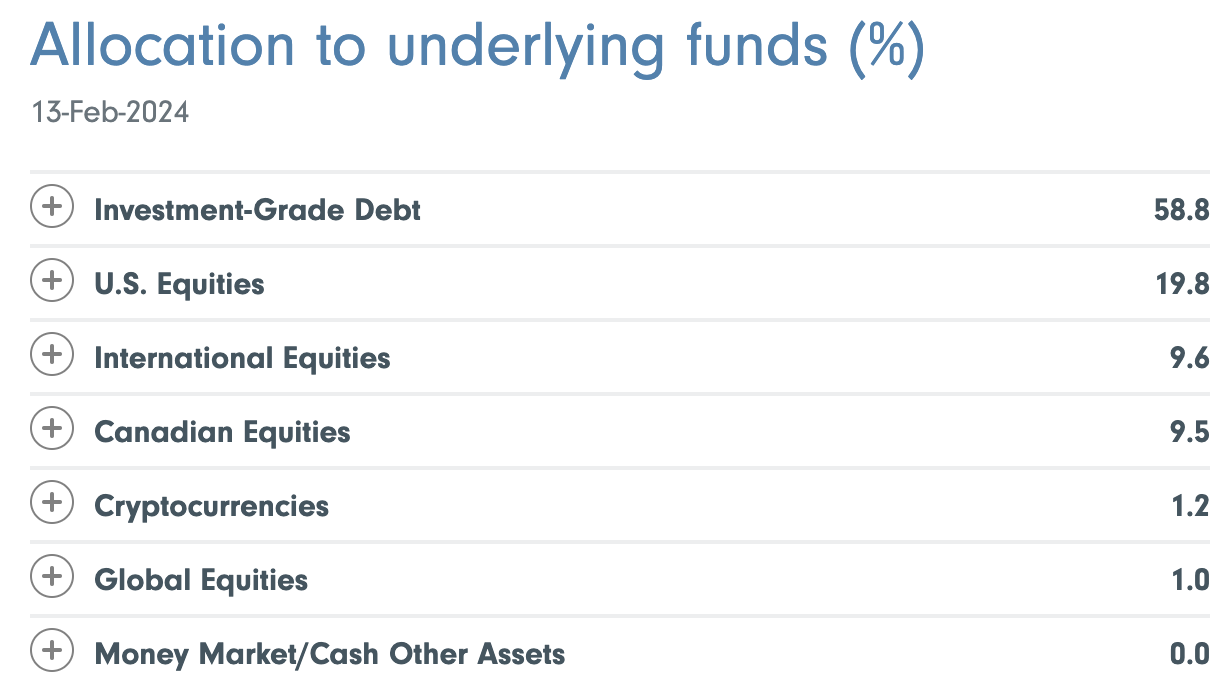

Fidelity Canada's Strategic Move

I’ve mentioned this before in an earlier pre-ETF approval article titled “Well, now we know…” and I’ve been talking to clients about it ever since. Fidelity Canada is tiny compared to their counterparts in the US so this 1.2% allocation to BTC doesn’t really move the needle for the market. However, it does set the stage for what’s to come when this starts to happen in the US. These large asset managers will add their own Bitcoin ETFs to managed funds. It just makes sense from a risk/reward standpoint and it helps build AUM for these behemoth competitors — Blackrock & Fidelity. It’s an obvious move that is not priced in.

So…it appears the ETF launch was not a sell the news event.

That’s better.