Bitcoin Was Built for This Sh*t

Friday September 13th, 2024 - Issue # 81

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I mean literally, it was.

As the world descends into chaos—politically, economically, and socially—it’s becoming clearer than ever: Bitcoin was built for this sh*t. And with Friday the 13th upon us, it almost feels fitting to dig into why Bitcoin is more relevant now than ever.

Bitcoin didn’t just randomly appear; it was born out of the wreckage of the last great financial crisis. January 3rd, 2009—Satoshi Nakamoto mined the first-ever Bitcoin block, the Genesis Block, with a line from The Times embedded in its code: “Chancellor on the brink of second bailout for banks.” A statement of intent, whether by design or chance. Imagine Satoshi, sitting at home, sipping his coffee, reading the headlines of the day, and thinking, “this has to go in.” On Day 1, Bitcoin was already calling out the failures of the traditional financial system, which was supposed to be safe and stable. And yet, on Bitcoin’s very first day, banks were already losing to this new digital asset.

Fast forward to today, and not much has changed—except that the problems have only gotten worse. The U.S. national debt is skyrocketing past $35 trillion. Over half of Americans are living paycheck to paycheck, and millions don’t have enough savings to cover a $400 emergency. What did we hear from the recent presidential debate this week? Not a single mention of balancing the budget, reducing the deficit, or even tackling inflation. Instead, we were treated to a theatrical performance, more about scoring internet points than delivering real solutions. Trump took the bait—getting pulled into the muck, defending his past rather than focusing on where he wants to take the country. Kamabla? Well, she delivered a masterclass in saying absolutely nothing with a lot of words. She’s had nearly a full term as the VP, she says she’ll do this and do that…but why hasn’t she done it already? Trump probably could’ve just said “then why haven’t you done it?” over and over again and performed better.

What wasn’t mentioned? The fact that the U.S. is running an annual deficit nearing $2 trillion with no end in sight. The national debt is exploding, and yet, neither candidate bothered to bring up how they plan to tackle this monster that’s looming over every American household. The whole debate felt more like a reality TV episode—complete with drama, personal attacks, and absolutely zero substance. It was as if the moderators, too, were more concerned about creating viral clips than digging into the real issues at hand.

This isn’t just political theater; it’s dangerous. The U.S. is teetering on the edge of fiscal disaster, and we just watched the so-called frontrunners of the country completely ignore the ticking time bomb that is the economy. There were no serious discussions about how to handle inflation, no plan to curb the reckless spending. It felt like we were watching the Congressional Kardashians (can’t remember where I heard that one) rather than a debate about the future of the country.

At least Kamala managed to get through the debate without imploding, which, in and of itself, might save Trump from becoming the target of yet another assassination attempt. But the real tragedy here is that the American people deserve better. They deserve real solutions, not more of this political theatre.

Back to Bitcoin.

True ⬇️

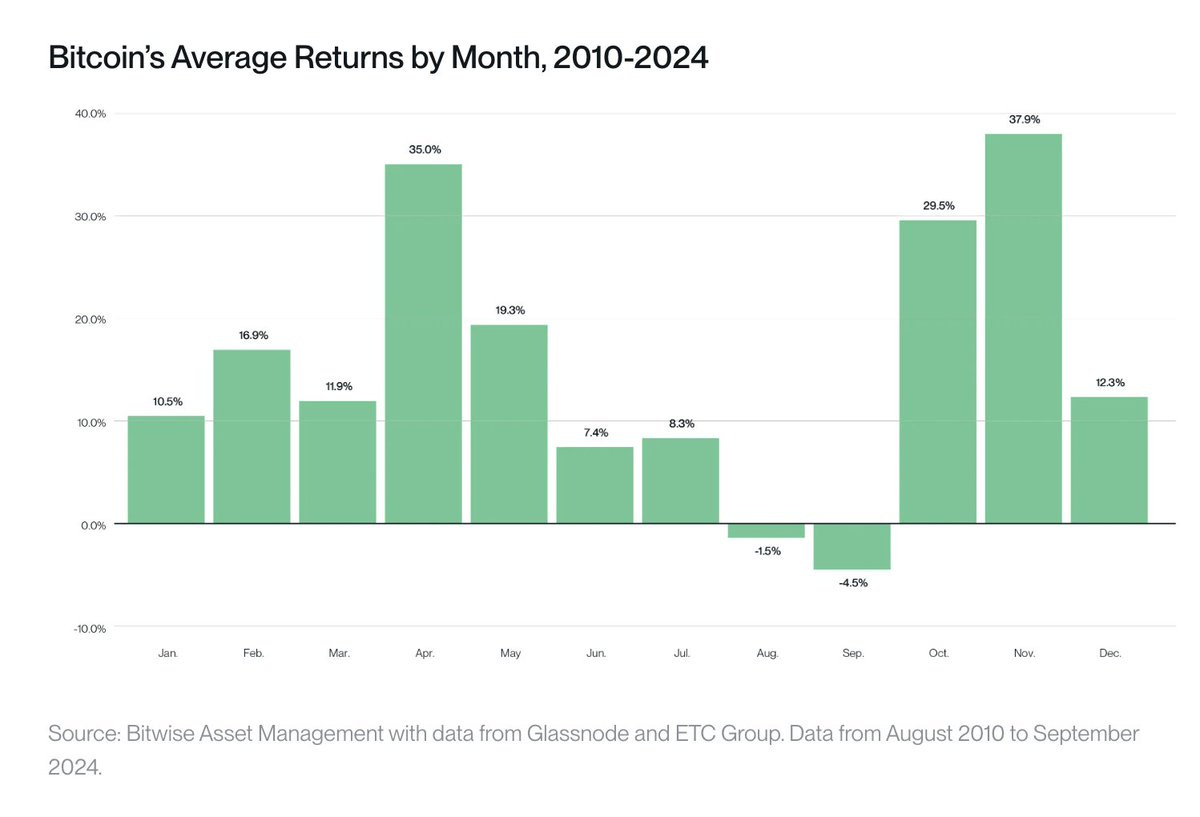

True ⬇️

Reminder:

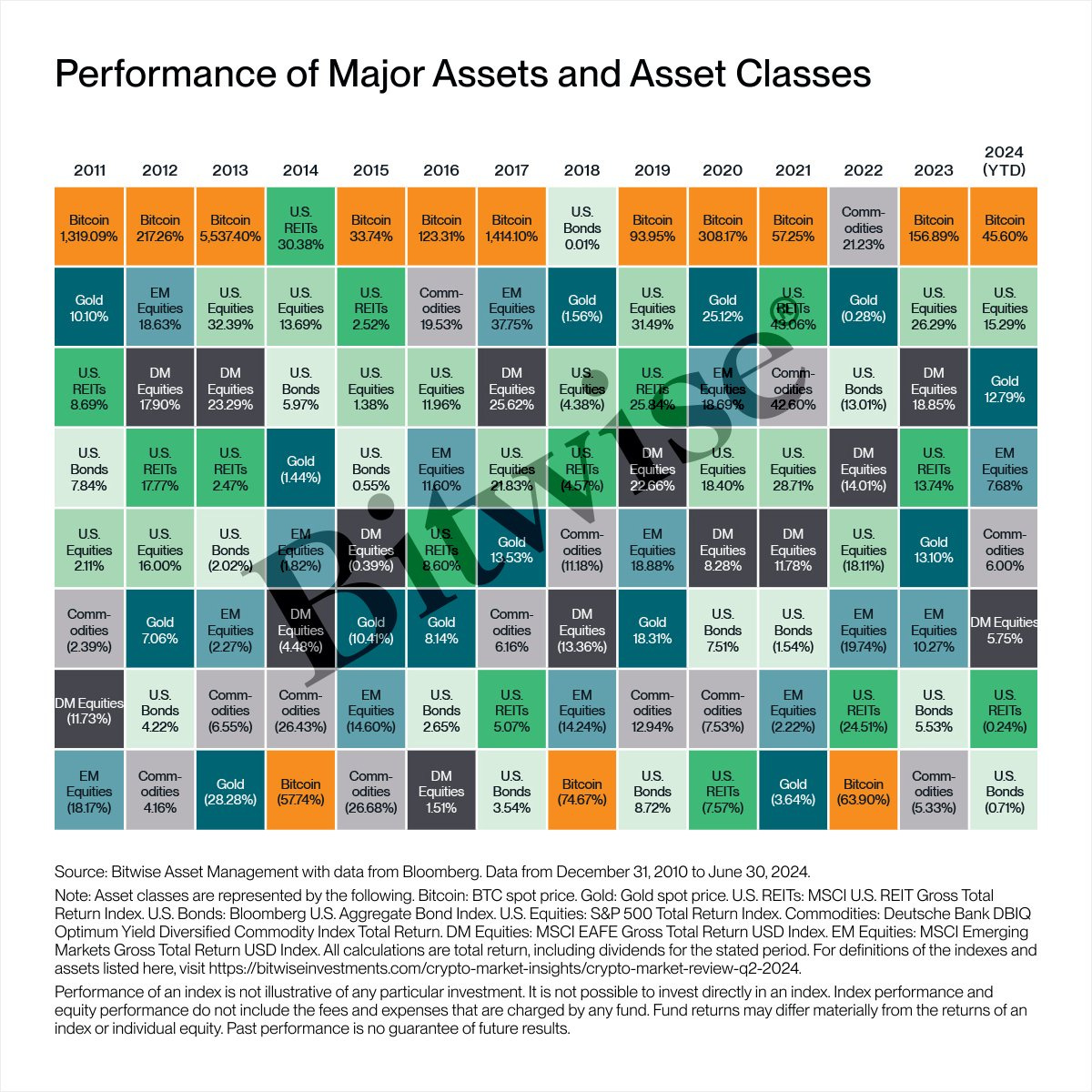

I’ll take a 2013 please:

I’ll end with this, in a world where governments are spending like there’s no tomorrow, Bitcoin shines. Sure, it’s volatile, and yeah, the ride isn’t for the faint of heart. But that’s why those who hold on during these times get to enjoy the upside. Bitcoin thrives in chaos—it was designed precisely for this environment. While the Fed gears up for its cutting cycle and FTX creditors prepare to inject $16 billion back into the market, Bitcoin stands tall as the alternative to the broken systems we’re watching unravel. It’s not just an investment; it’s a hedge against a world gone mad.

This is why, more than ever, Bitcoin makes sense. It was built for the deficits, the uncertainty, and the reckless spending. So as we head into Q4 with more geo-political and economic instability on the horizon, remember that Bitcoin wasn’t created for the smooth times—it was created for this.