Bitcoin’s Initial Public Offering

Friday March 1st, 2024 - Issue # 64

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy Friday!

It has been a crazy week in the markets — I hope you’re all enjoying the volatility as much as we are over here at the desk! I’m finding it hard to pinpoint a time where I remember price action like this. Wednesday brought especially wild fluctuations with traders being stopped out in both directions as price shot up to $64k before selling off dramatically slightly below $60k. Yesterday, the price tapered off slightly across the board, however was quickly lifted back up without any signs of hesitation. Where does Bitcoin and the broader crypto market go from here? That is the real question we should be asking…

In my view, the trajectory for Bitcoin is set for a significant upward movement from here, despite the inevitable, painful corrections that are part and parcel of its journey. The stirring ascent of Bitcoin is fueling a whirlwind of speculation and excitement among investors, leading to rampant questions about its potential to surpass previous milestones – be it previous all-time highs of $69k, reaching the $100k mark, or going north of $250k.

I keep coming back to the ETFs…I hope it’s not so boring for you as readers but every day I see record inflows — Wednesday for example was a record, with $673.4m of net inflow — I think about how we’re only just getting started.

There’s no question that the investment landscape for Bitcoin has undergone a seismic shift. No matter which way you slice it, we are venturing into a new era of price discovery for Bitcoin. Historically, the Bitcoin price was predominantly driven by self-directed retail investors and technology aficionados. The introduction of ETFs has dramatically expanded Bitcoin's accessibility to a global investor base, including financial advisors, family offices, institutional investors, endowments, and more. As Matt Hougan, CIO at Bitwise put it recently: It’s like we went from 10 normal people bidding on a house to 100 very wealthy people bidding on a house, overnight. Not surprisingly, the price is going higher.

The implications of this shift are profound. With asset and wealth managers globally managing $100+ trillion in capital, a sector that had minimal exposure to Bitcoin now has the potential to allocate significantly towards it. If just 1% of this capital were to flow into Bitcoin, it would represent more than $1 trillion of buying pressure, surpassing Bitcoin's current market capitalization. This influx of capital is akin to Bitcoin experiencing its IPO (initial public offering) allowing the market to discover its true value.

See chart below from Ark’s Big Ideas 2024:

So yes, there’s tremendous opportunity for big money to flow into bitcoin via these new TradFi vessels but with all this current inflow, it’s important to dig in to where it’s coming from and what’s on the horizon. Here’s Bitwise CIO Matt Hougan explain what they’re seeing:

Staying on the topic of the Bitcoin ETFs, it was just reported that BlackRock’s IBIT just reached $10 billion in AUM.

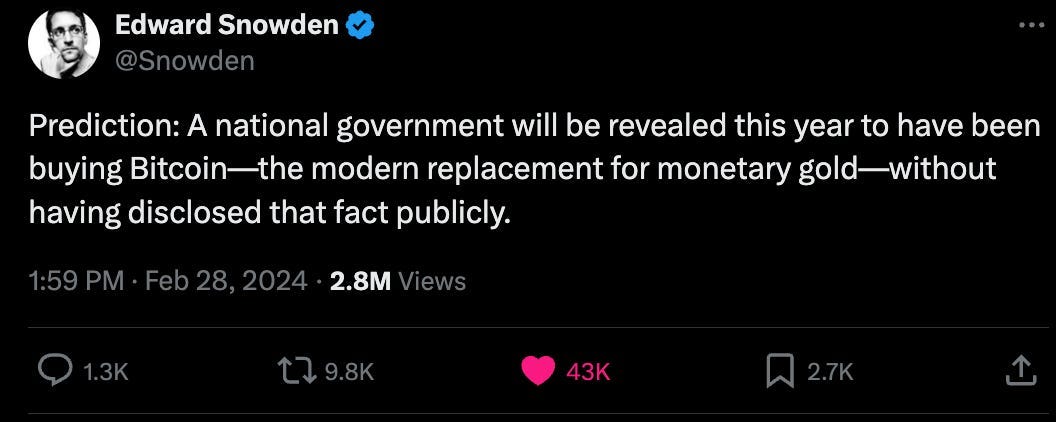

I agree, Mr. Snowden. Stay tuned for more on this next week.

After a very long week, I’m very excited to eat well and relax this weekend. Hope you all get to do the same!