BTC ETF APPROVED ✅

Wednesday January 10th, 2024 - Issue # 59

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

As we rang in the New Year and celebrated Bitcoin's 15th birthday last Wednesday, a journey that was 30 years in the making, we witnessed another monumental milestone. The much-anticipated Bitcoin ETF, which I, along with many of you, have been eagerly following, has finally been approved. Not without drama of course as the SEC seriously fumbled it Tuesday when their X account was compromised and they sent out a fake approval tweet. To be honest, it kind of took the wind out of the approval yesterday, but I am not complaining — a win is a win and, this is a massive triumph.

2024 isn't just another year; it's shaping up to be historically significant for Bitcoin and the broader crypto market. It's an election year, not just in the US but for more than 50 countries that are home to half the planet’s population are due to hold national elections in 2024 (unfortunately not Canada). The Fed is done with its hiking cycle and the narrative has shifted to rate cuts which could start as soon as March. There's a staggering amount of cash (trillions) sitting on the sidelines in money market funds, poised to flood into risk assets once yields become less attractive. The stock market is already hitting all-time highs, and Bitcoin is still ~30% off all time highs (at the time of writing). Oh, and there are now handfuls of Bitcoin ETFs investors can buy ahead of the freakin’ halving in April, where for the first time, Bitcoin becomes less inflationary than Gold. The strategy for this year? Keep it simple.

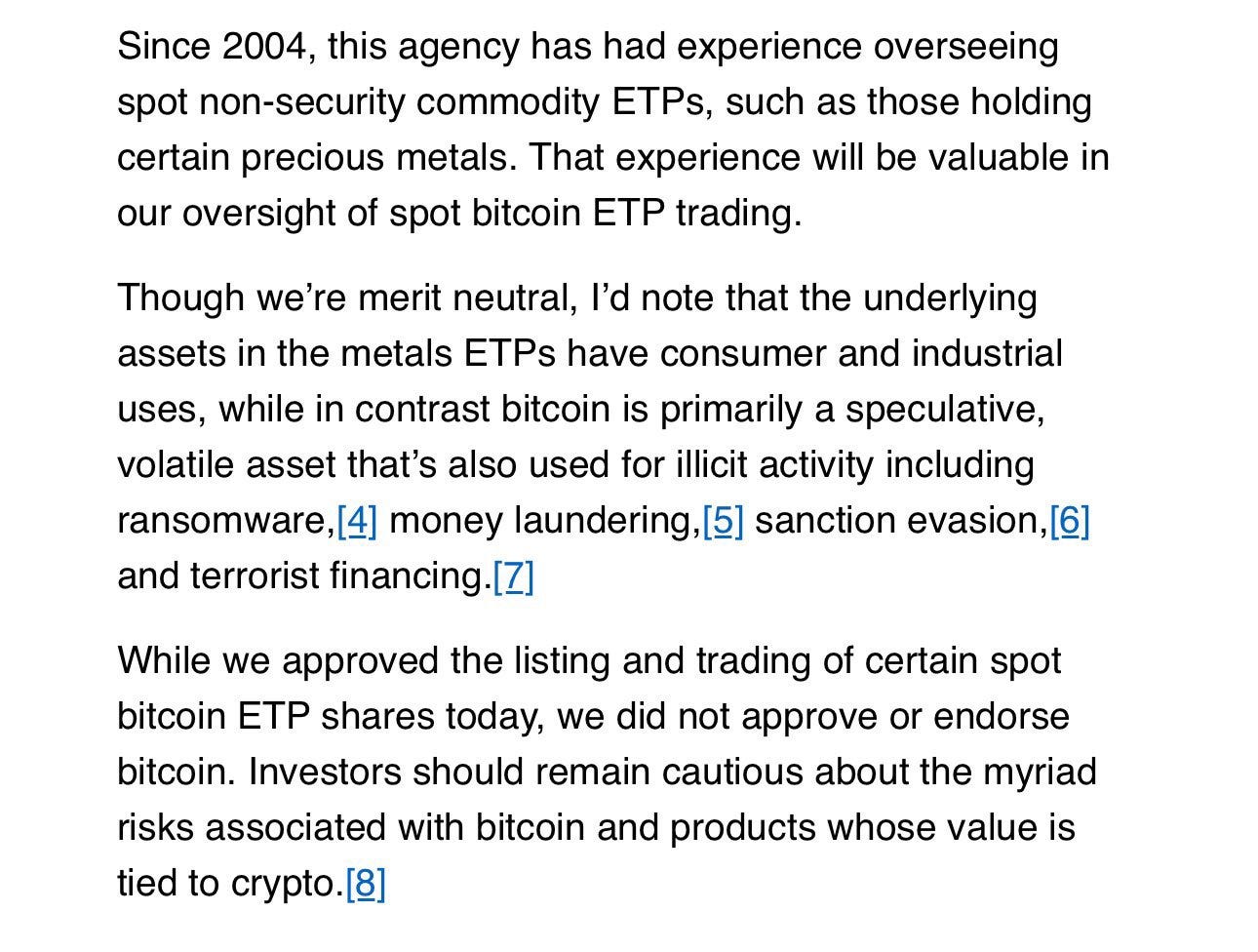

SEC Chair Gary Gensler released a statement on the approval of spot Bitcoin ETF today…

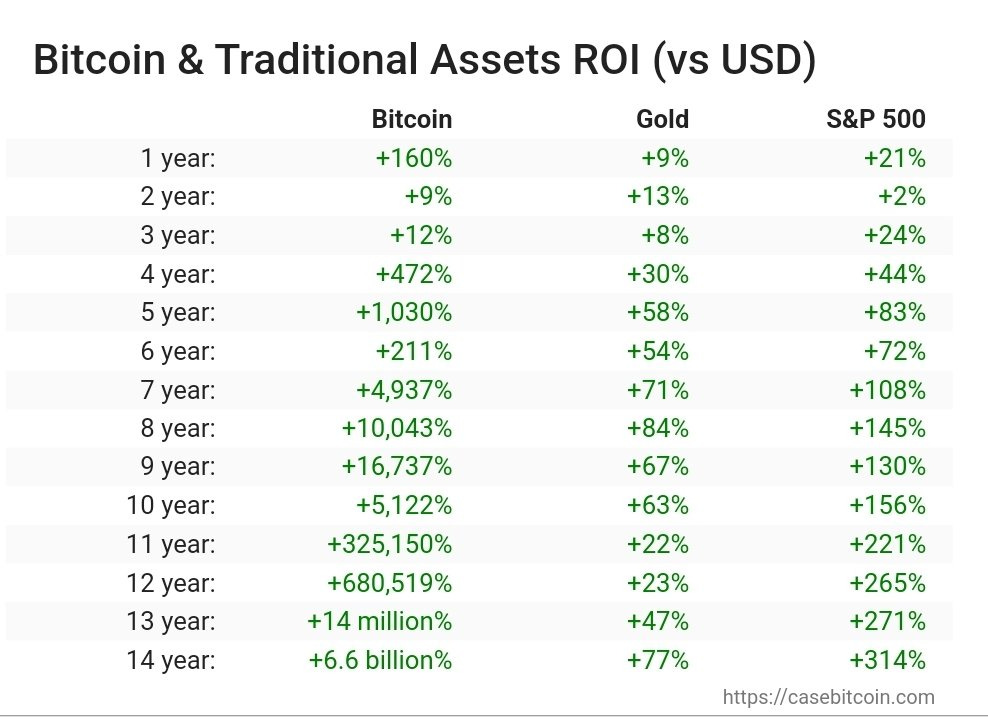

Up until now, Bitcoin and the broader crypto market has been predominantly retail-driven. For the first time ever, the little guy has been able to beat institutional investors to the punch and have benefited greatly while their overlords were on the sidelines grinding out percentages in the tradfi markets.

Crypto is very cyclical — the “boom” period is followed by a “bust” where retail-type investors get their insane returns wiped out after some sort of traumatic event(s). Each time, retail was left licking its wounds until it turned its attention elsewhere for a while until crypto found its way back into favour. Cycle after cycle, retail has had the chance to drastically outperform the sharpest investors on the Street with little competition. We’ve had the best asset class ever all to ourselves for well over a decade. I think that’s about to change.

With the now-approved Bitcoin ETF in the US, Bitcoin has solidified its status as an investable asset class. This means Wall Street giants like BlackRock, Fidelity, Franklin Templeton, and Invesco are no longer on the sidelines. They're gearing up for a fierce competition to attract the most assets. Remember, in the world of ETFs, the one with the largest asset pool often dominates.

Imagine being the go to Fund for the best performing asset ever…even the 2yr number is green again!

At first, I thought that the ETFs would start off with a bang, driven by retail investors. I thought, strong retail flow, then a slow but steady trickle in from institutional investors who were “sold” the product from well-groomed Wall Street salespeople. Then I heard the rumour that BlackRock has $2bn lined up for the first week of trading and I thought to myself, of course they do! They’re not going to risk losing the battle to be numero uno after the all powerful Larry Fink put his neck out on the line last year crystalizing Bitcoin as a flight to quality, an international asset that is here to stay!

All these financial powerhouses likely secured substantial commitments from their top clients, ensuring a strong start. This isn't just about waiting for retail participation; it's about leading the trend, where a significant move up is anticipated as liquidity begets liquidity.

In this electrifying context, 2024 is poised to be a banner year for Bitcoin and the crypto market. The stage is set, the players are in position, and the market dynamics are more favourable than ever. This is the year to keep an eye on the prize and ride the wave of historic opportunities.

Oh…you thought you’d stop hearing the letters E-T-F? The new deadline to obsess over just dropped — May 23rd is the final deadline for decision on VanEck’s spot ETH ETF!

Happy New Year!!!