BTFD & HODL

Friday July 5th, 2024 - Issue # 76

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Woah! I did not expect to wake up this morning and see $53k BTC. I wish I had some extra dough on our platform — this is peak, close your eyes and hit the buy button. This is what you do on days like this. It never feels good, but nothing good ever comes easy.

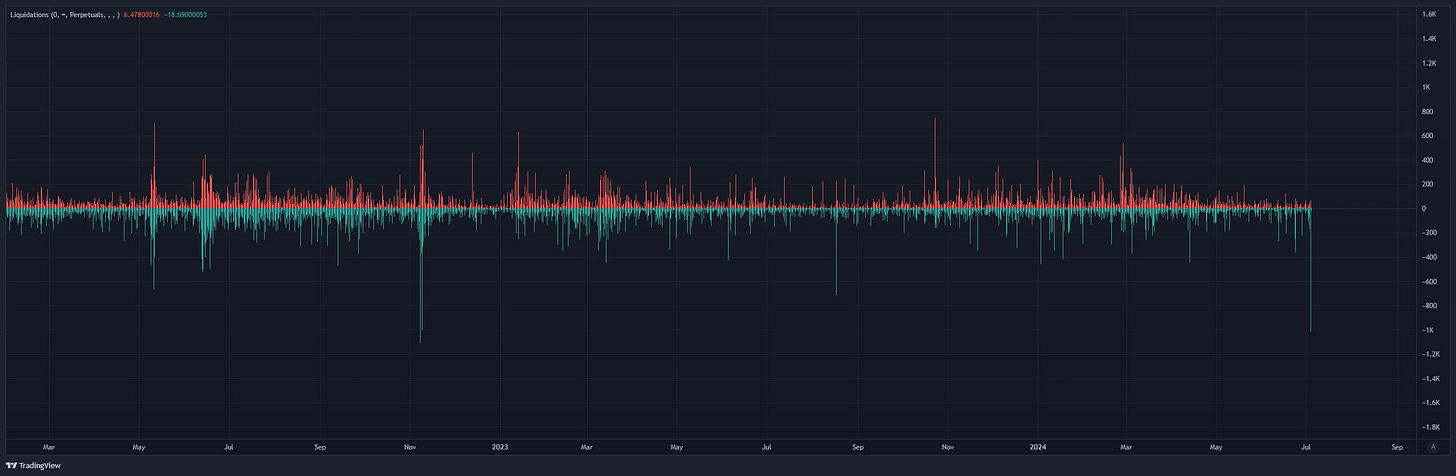

Here’s a reminder to zoom out for a broader perspective. Consider this: previous bull runs weren’t a smooth ride either, featuring half a dozen drawdowns of around 30%. Currently, we're hovering at about a 27% decline. In fact, if you look closely, recent downturns appear to be less severe than what we’ve seen in past cycles. It's easy to forget the normal ebb and flow of a bull market when you're in the thick of it. So don’t panic—historically, these are the moments that savvy investors buy the dip.

This week, we delve into a historic sell-off, one that ranks as the second-largest liquidation event in Bitcoin's history, only shadowed by the cataclysmic collapse of FTX in November 2022.

Have a great weekend!

Kidding.

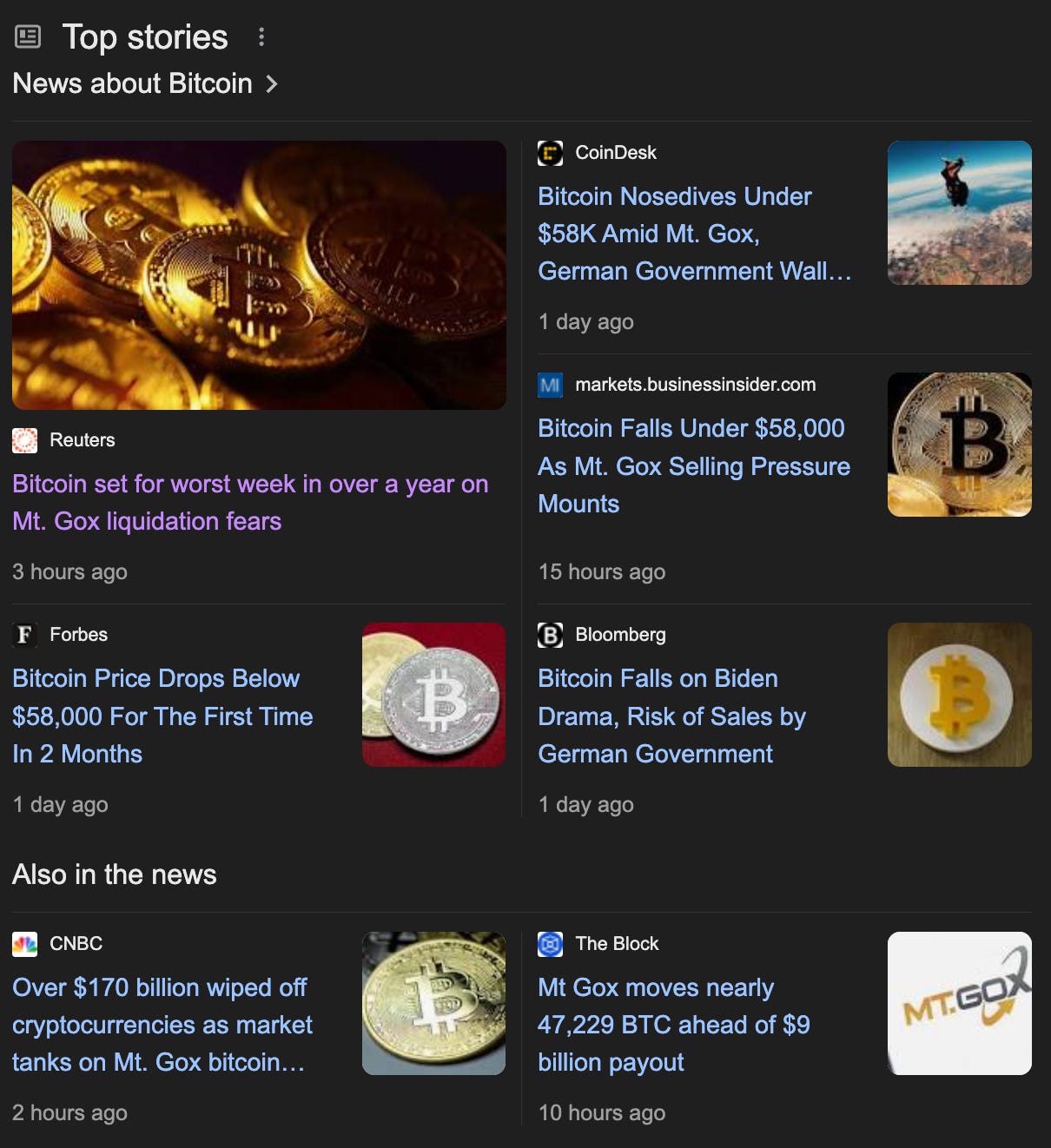

Germany, not a place I’m keen on travelling to any time soon, and a country that has made multiple strategic blunders in the past. There’s the very obvious ones, and then there was the decision to nuke themselves into a long-term energy crisis and recession by shutting down their nuclear power plants, and now dumping the hardest asset in the world for Euros. Euros, those funny pieces of paper and coins that come in all different shapes and sizes.

Their holdings have dropped from 49.86k BTC to 40.36k, and they are likely to continue to sell...this decision to dump a load of that sweet confiscated coin is not entirely popular.

Independent German Member of Parliament, Joana Cotar, has criticized the German government's decision to rapidly sell off its bitcoin holdings, calling the move "not sensible" and "counterproductive." She's been pushing for Germany to adopt bitcoin as a strategic reserve asset, especially after they confiscated 50,000 BTC in January. Cotar argues that holding bitcoin could diversify state assets, serve as an inflation hedge, and boost Germany's technological and financial development. Legend.

It would’ve been nice for her to say — look, if you’re going to do it, at least do it through Satstreet so we can minimize price impact instead of transferring it to retail exchanges only to get front-run, eat up order books, and ultimately come away with less Euros. :)

Haha wow, I guess not all press is good press after all. I really wish I had some dry powder.

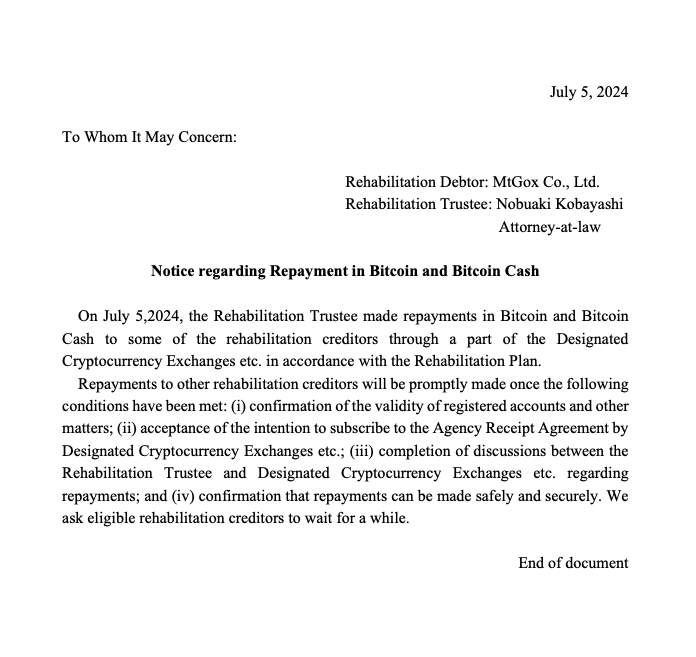

Mt. Gox — the ghost of Christmas past

Mark Karpelès, the former CEO of Mt. Gox, steered what was once the biggest Bitcoin exchanges to a notorious collapse, losing 850,000 BTC and shaking the Bitcoin world to its core.

Every cycle, Mt. Gox comes up and serves as a very bearish overhang. It’s typically a rumour of a payout to creditors, or the wallet making a move that sends the price down because the market worries that after 10 years of waiting, creditors are ready to follow Germany and sell it all since the settlement is in-kind (unlike FTX where creditors are likely to be paid out in USD which is a bullish development as those funds are likely to come back into the market).

I’ve spoken to a handful of Mt. Gox creditors this year, a small sample set no doubt, but it’s worth noting that many of them are unlikely to sell all of their BTC. You have to keep in mind the majority of folks that were buying BTC on Mt. Gox over a decade ago was actually in it for the tech. While I’m sure many of them were using their bitcoin to purchase “stuff” on the Silk Road (free Ross!), a lot of them were cypherpunks and early adopters who saw Bitcoin as a technology revolution. These people were buying BTC from <$100 to <$500 before the exchange collapsed. Imagine these hardcore believers watching the network grow over the past 10+ years while presumably buying more and getting generationally wealthy along the way? These folks are unlikely to sell.

However, that does not stop the headlines and the movement of billions of dollars worth of BTC from adding to sell pressure which contributed to the second-largest liquidation event in Bitcoin's history.

Looking ahead, I’m being honest when I say that I’m as bullish as ever. The launch and monumental success of the Bitcoin ETFs earlier this year, paired with the highly anticipated arrival of the Ethereum ETF, are setting the stage for an exciting era in crypto. Alongside this, the upcoming U.S. election could catalyze significant shifts in political and regulatory landscapes concerning crypto, just as global trends lean towards looser monetary policies. Plus, with the expected $16 billion FTX payout poised to reenter the crypto ecosystem, we're gearing up for a historic run.

P.S. A little trick I've picked up over the years—when the market looks grim, try toggling your portfolio denomination from USD to CAD. Somehow, it just seems to do the trick!

Weekly podcast recommendations

steady lads