Chop Sui

Friday October 4th, 2024 - Issue # 84

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy Uptober October! Only kidding, while it has definitely been a tough start to what is normally an incredibly great month for Bitcoin and the broader crypto market, my bullishness on Q4 remains heavily intact. In hindsight, when everyone on crypto Twitter is posting about how great October is going to be and “Uptober” becomes the new spelling of the spookiest month of the year, it only makes sense that the market would punish the hopeful.

This week, I’m going to go a bit deep into the world outside of Bitcoin and global macro because honestly, Bitcoin is Bitcoin and there is no competition, and it ties in so well to macro — in fact, it is the macro asset in my opinion. So into the world of smart contract platforms and the battle between Ethereum and its rising competitors we go.

Ethereum’s been the king of programmable blockchains for years—after all, it’s been around for almost a decade, survived major market cycles, attacks, and established itself as the go-to for institutions. But the cracks are starting to show. The network is slow, expensive, and it’s getting messy with all these Layer 2 solutions trying to patch things up. When you’ve got too many cooks in the kitchen, things tend to get complicated fast.

Solana, on the other hand, has taken a completely different approach. It’s more like a high-speed Silicon Valley tech start up where you have the engineering team under one roof grinding toward a shared mission. This approach has earned it a lot of love from developers and users alike because they’re focused on making the experience beautiful, fast, cheap, and simple.

But there is strong competition. New contenders like SUI, Aptos, and SEI are stepping into the ring, claiming they can do everything Solana does—but even better. They’re each trying to solve the same problem that’s haunted Ethereum: how to handle massive amounts of transactions without slowing down or getting clogged up. They’re using a tech trick called “parallel execution,” which just means they can process transactions at the same time, instead of one-by-one like Ethereum. It’s a lot more efficient, but it’s still early days to see if it’ll hold up under pressure. Here’s a great article a client shared with me this week that goes way deeper if you’re interested: https://x.com/vik0nchain/article/1841871167860130042

So, who’s winning? Right now, Solana’s in the lead. It’s got a loyal community, strong developer support, and it’s quick. But…it might all just come down to a good old-fashioned market cap game. When things heat up, investors chase the “number-go-up” narrative. Ethereum’s sitting on a $286 billion market cap, while Solana’s at $65 billion. Assuming total crypto market cap stays put for argument’s sake, and if Solana starts catching up, that’s a potential 4-5x move from here. But then we have the new players—SUI is at $5 billion and Aptos is at $862 million. If they get some attention, we could be looking at massive gains, like 10x, 20x, or even 60x. I wouldn’t be talking about all this if we haven’t noticed these tokens catching a bid at the desk…their recent performance is indicative that they are indeed getting traction.

Also, these tokens are all listed on major exchanges like Coinbase and Binance. The infrastructure is there, waiting for the next wave of retail participation. When sentiment shifts and we enter the hype phase, it’s not going to be about fundamentals or tech—it’s going to be about narratives and FOMO.

Last weekend, I was at an engagement party filled with friends who work in tradfi and regular folk. I hadn’t seen a lot of them in years and many I had never met. They had very little interest in talking about crypto (thank God). Not a single question about Bitcoin, no curiosity about digital assets, and certainly no excitement about the current state of the market.

Which brings me to another point… well, who knows—maybe the next wave of investors won’t care about fundamentals at all. Maybe they’re not “in it for the tech, bro.” Maybe memecoins continue to drastically outperform, just like they have so far this year. Take a look at WIF, Popcat, and Moodeng. Similar to the NFT craze of the last cycle, which blew up before fizzling out, the interest here is sky-high. But unlike NFTs, memecoins don’t face the same obstacles. NFTs were hampered by insanely high ETH gas fees that could reach $100+ just to buy or sell a picture of a pixelated animal. That barrier to entry killed the fun for the majority of speculators who just wanted to flip digital collectibles without dealing with a clunky, expensive Ethereum ecosystem.

This time, memecoins are popping up by the hundreds (or even thousands) every day, and you can trade them effortlessly with just a fraction of a SOL token sitting in your wallet. Even Ethereum L2s like BASE seeing a ton of action, with memecoins grabbing the lion’s share of attention. The entry barrier is low, the fees are next to nothing, and the speed is light years ahead of what we saw during the NFT craze. Memecoins are a wild mix of prediction markets, gambling, NFTs, hype, trends, and scams—all rolled into one.

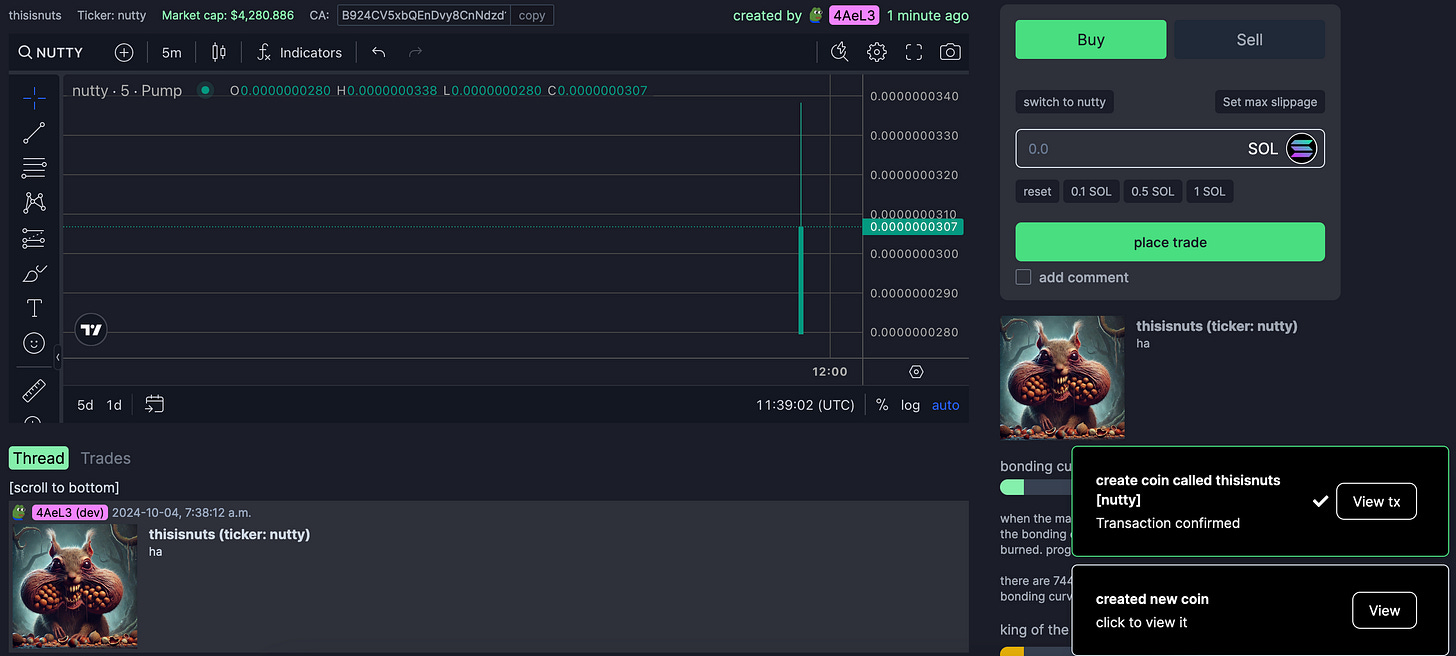

Lol, here’s some screenshots from one of the most popular memecoin venues pump.fun

There, I just created a memecoin. This is what I’m doing at 6am. This is my life.

So, while we may not know who the long-term winner will be — Solana’s the clear frontrunner, but the smaller caps like SUI, Aptos, and SEI are sitting on the sidelines, waiting for their moment to shine. And don’t count out the memecoins—if the next wave of investors comes in looking for quick gains rather than fundamentals, they could take center stage, just like NFTs did before.

Here’s where I stand: My portfolio is heavily weighted toward Bitcoin, with a relatively large position in SOL. I also own some of its competitors like SUI, APT, and SEI, along with, let’s just say, a hilariously large memecoin bag (don’t tell my girlfriend). One of my buddies tossed me a few suggestions that worked out really well (and a few others that REALLY didn’t).

I am way too busy with Satstreet to be focused on my PA so I keep things simple and rarely make moves. That’s why my core position is still focused on Bitcoin. My conviction in BTC ties in so tightly with macro that it’s almost impossible to ignore. And right now, the macro is so chaotic that it’s been tough to focus on anything else. This newsletter is more about sharing what I’m seeing “in the arena” rather than how I’m allocating capital. To be honest, it was almost impossible to think about what to write about this week with so much happening in the broader market.

Never a dull moment.

Weekly podcast recommendations

*I actually didn’t listen to any podcasts this week but I read a full book that I really enjoyed called Private Equity: A Memoir by Carrie Sun.*

Here’s an oldie but a goodie