Cold (STORAGE) War

Friday March 04, 2022 - Issue # 6

To say that over the years people have been skeptical about Bitcoin and the rest of the crypto universe would be an epic understatement. This magic internet money was nothing more than a tool for drug dealers, betting sites, or a speculative investment akin to tulips. Clearly, the narrative has changed over the last decade, especially over the last few years.

Okay, so there’s been some recent validation by big, smart money that have switched their tone, started taking it a little more seriously, made a small investment, or gone all in. But still, Bitcoin consumes a grotesque amount of energy, fees are too high to serve its intended purpose as a currency, and the rest of the ecosystem is the Wild West rife with BS.

Like any new technology, there’s folks on both sides of the equation and we’re still at a point where the majority of people have yet to crossover. The epic volatility that’s made headlines across the globe has helped make Bitcoin a household name (for better or for worse), but there’s still a massive education gap that has kept most people on the left of the curve.

Things are changing fast as the world has spiraled over the last couple of years. To refresh your memory, Bitcoin was born out of the financial crisis of 08/09. If you remember, when Bitcoin's first ever block was mined, its creator (or creators), Satoshi Nakamoto, posted a message referencing a 2009 story by UK newspaper The Times. The message read: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” After decades of trial and error, humans figured out and successfully launched a new financial system which lived outside of the control of any one person, government, or central bank.

Andreas Antonopoulos explaining Bitcoin in 2013 (May 18th) at The Bitcoin Conference in San Jose, to an empty room.

No one cared — except those 4 guys — they’re probably on their yachts right now laughing at us all.

Speaking of yachts…we’ll get there in a second.

Fast forward to the start of the covid crisis that started in late 2019. During the pandemic (I guess up until today), while everyone in the world was WFH wondering when or if things will get back to normal, they started noticing the suspect actions of the folks in charge. Before covid, I’m not so sure that most people ever thought about money and inflation. Now, thanks to the internet allowing us to be connected more than ever during isolation over the past couple years, “money printer goes brrr” is commonplace and we saw the rise of meme stocks and crypto.

People lost trust in the system and that education gap I mentioned earlier got a lot smaller. Eventually, the right side of the curve became more populated and we saw the price of Bitcoin rise substantially.

After over two years of hell, 2022 seemed promising. We rallied behind the Canadian truckers who took to Ottawa in protest to end mask mandates. A lot of us even donated to the cause. It made global news.

Then, the crowdfunding platforms froze the millions of dollars raised in support of the Freedom Convoy and we were all quickly reminded of the pitfalls of centralized systems.

As if things couldn’t get any more hairy, the Federal government invoked the Emergency Act for the first time in history essentially throwing Canada into martial law over a mostly peaceful protest. They took these newfound powers seriously and froze the bank accounts for many Canadians who donated to the truckers. Imagine, after two years of hell you decided to donate $50 to truckers who were protesting for things to get back to normal and now you’re cut off from the financial system. Gross.

A lot more trust was lost (mostly here in Canada but this made headlines across the globe) and the right side of the curve became more populated as Bitcoin became a topic of discussion amongst folks who learned in the hardest way that their money was only theirs until it wasn’t.

Then Russia invaded Ukraine and the thought of WW3 ending in nuclear carnage took over. Can’t catch a break, can we? It’s almost laughable at this point. Like man it’s only March…

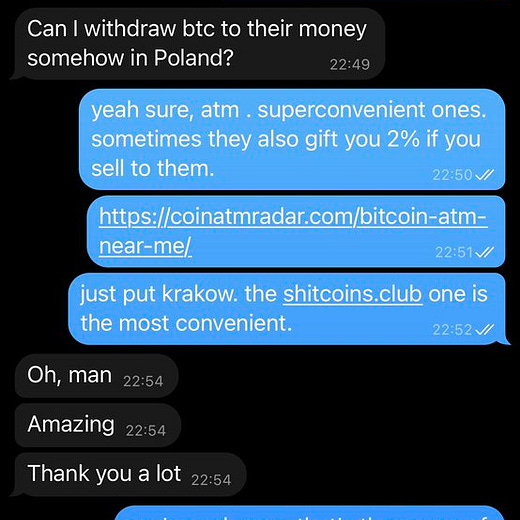

This chart kind of puts it all in perspective.

That hockey stick line in the chart represents a sharp move up in Bitcoin wallet addresses with balances of over 1000 BTC.

Told you I’d get back to yachts…

So is this just Russian oligarchs buying bitcoin to protect their assets from being seized? Maybe, to an extent.

Tens of millions of Russians have been crushed by sanctions that have brought the Ruble crashing down in value alongside the Russian stock market. Millions of Ukrainians are fleeing for their lives with whatever they can take with them while everything around them crumbles.

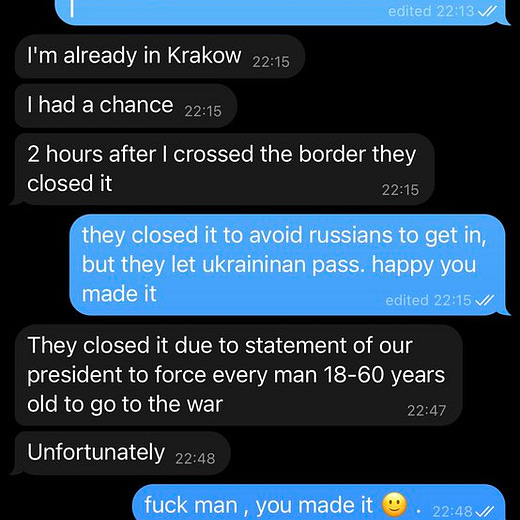

Another shining example that highlights bitcoin as a means to getting money anywhere in the world without having to cross through a centralized system:

If you’re still reading this — thanks for your attention because this piece that I started writing in the wee hours this morning is way too long.

Although we may not be in dire straits like other parts of the world, there is no denying at this point we’re too smart to believe, whether intentional or not, that the powers at be have our best interests in mind.

I guess the point I’m trying to get across here is that Bitcoin is showing the world, time and time again, why it is so important and that we are blessed to have another option.

As the education gap gets smaller and smaller, the right side of that curve is really starting to fill up. Soon everyone will realize the importance of owning at least a little bit of financial sovereignty.

I guess one positive takeaway from this whole mess is that Covid appears to be over.

Thank God for Satoshi.