Donald J. Pump pt. 3 - Art of the Pump

Friday July 4th, 2025 - Issue # 108

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy belated Canada Day to my Canadian readers and July 4th to my American friends. I’ve been quiet the last couple of weeks — partly traveling (El Salvador again, amazing again), partly sitting back and watching the setup unfold. And at this point, it’s hard to miss what’s coming next. The game plan is clear: Trump wants lower rates, a weaker dollar, and a stock market that rips into 2026. And it looks like he’s going to get it.

Side note, it is weirdly hard getting back into these newsletters after a couple of weeks off. To be honest, I had one ready to go last week but it just didn’t feel right — it was all about Israel & Iran, bunker busters, BTC’s role as the most liquid asset on the planet, etc., etc.. But sometimes I’m just not really feeling it. Also, I’ve started noticing folks calling out authors for using ChatGPT because they see “—” in their work. Maybe GPT copied me but I’ve been using “—” for years — before it was cool. Anyway, I digress — let’s move on. Trump’s Big Beautiful Bill (BBB) just passed, and it’s not just Big but it’s the largest bill in history. Ray Dalio posted a note this week breaking down the numbers: $7 trillion in annual spending against $5 trillion in revenue, pushing debt to 130% of GDP and interest payments toward $2 trillion a year. That’s not a rounding error — that’s a slow-motion debt explosion. As Dalio puts it, the U.S. either slams on the brakes with “unimaginable tax increases” and spending cuts (political suicide), or it prints, devalues the dollar, and crushes rates to keep the machine running. We all know how this ends. They always print it.

I guess it’s about that time for a M2 vs. Bitcoin update…

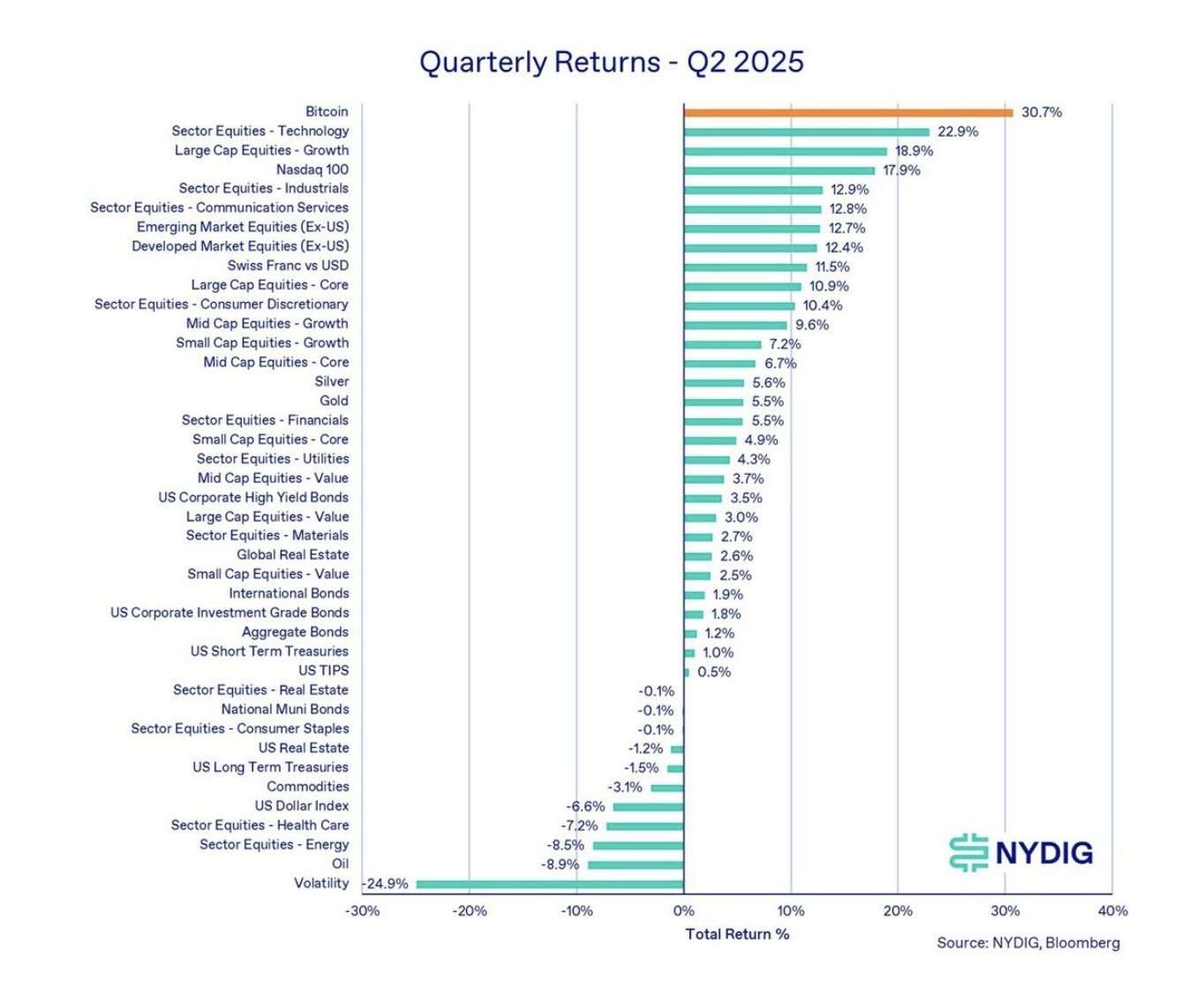

Pretty incredible. Also pretty expected. Bitcoin was the best-performing asset in Q2. Again.

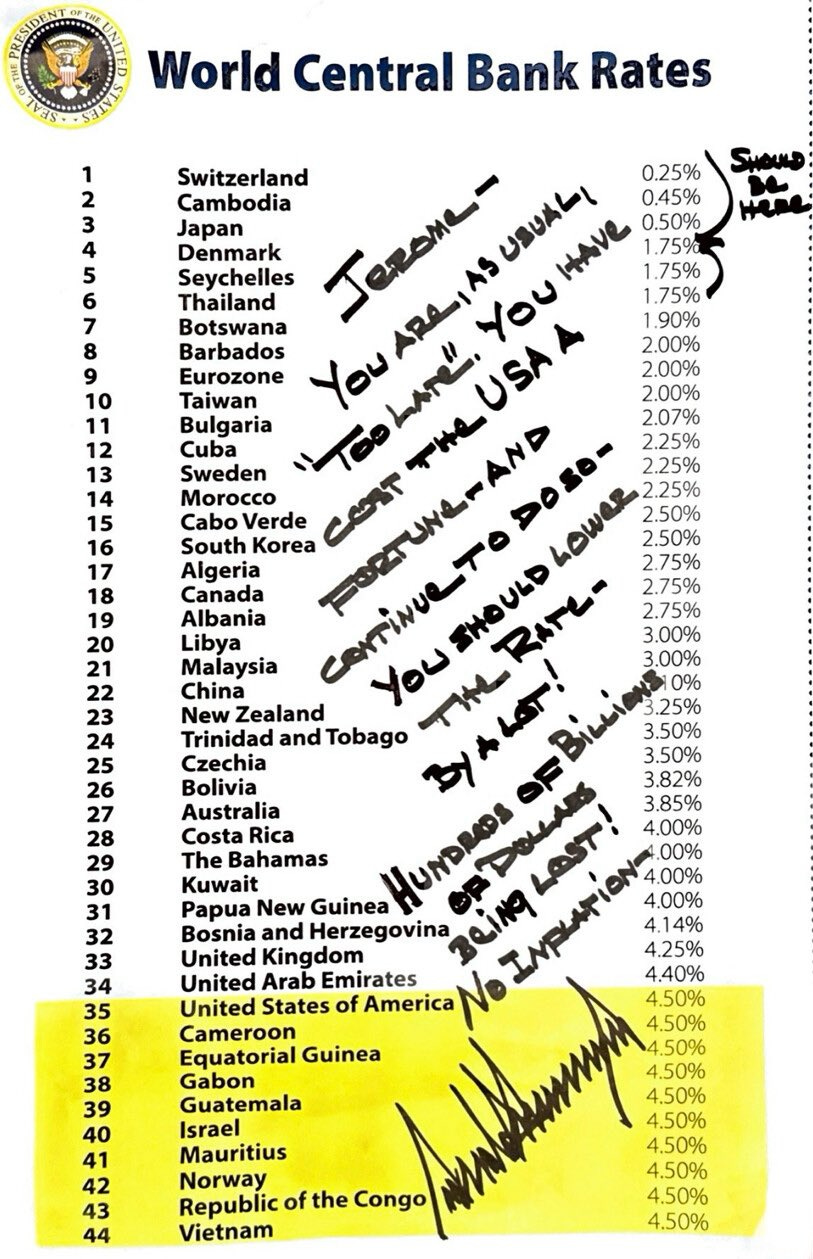

Trump wants more cowbell. He wants rates at 1%. That’s not speculation — he’s saying it outright. And if you’ve followed him over the years, you’ve probably noticed the pattern: when Trump tweets something bold, it usually turns into policy. Shoot for the moon, land on the stars — or however that goes. “Too Late” Powell is under pressure.

Things were looking pretty good for a July cut up until yesterday’s jobs report came in stronger than expected: +147K jobs vs. +111K expected, with unemployment ticking down to 4.1% instead of rising to 4.3%. Not a game-changer, but just enough strength to give Powell cover to hold steady. So maybe July’s off the table — but the broader direction hasn’t changed. The pressure is mounting, the liquidity is building, and the rate path still bends toward 1%. Bessent chimed in on rates yesterday.

And when those yields start to disappear, so does the appeal of cash.

Cash is trash, cash isn’t trash, cash isn’t just trash — it’s a burning pile of sh**.

There’s over $7 trillion parked in money market funds right now, earning 5%. The second those yields disappear, that capital is going to chase return — and fast. Into equities. Into AI. Into Bitcoin. The setup is there, and the money is ready. What’s missing is the trigger — and that’s what Trump is trying to pull.

I’ve been feeling a strange complacency lately. A lot of clients seem comfortable with their current level of exposure. And after nearly eight years of doing this professionally, I’ve seen this movie before. That calm-before-the-FOMO moment when everyone’s nodding along… until the market rips and they’re chasing entry points 30% higher. FOMO is a MOFO.

I think the part that’s a bit sad this time around, is that the crypto market is no longer led by retail, it’s all institutional. As an individual who already owns a good chunk of BTC, it’s tempting to sit back and think, “my bags are packed, I’ll just wait for Q4 money printer go brrr and sell into the euphoria.” I get it. It’s hard to press buy on six-figure Bitcoin when you were stuffing your plate at $30K.

But markets evolve. And when they do, so should your thinking. Bitcoin might actually be more undervalued now than it was when it was half the price — because the world’s waking up to what this asset really is. While you're sitting back, big dogs are buying aggressively. They’re not guessing. They’re reallocating.

Obviously, as always, none of this is financial advice — but I’ll share a personal thought experiment I ran recently. I had a 5% cash (USD) position set aside for some chunky commitments later this year and/or to catch a sharp drawdown. It felt prudent. But this week, I started to question whether it was actually imprudent. Holding USD while the government is actively trying to debase it, lower rates, and inflate its way out of a $35 trillion debt hole — is that really “safe”?

I walked through the usual alternatives. CAD? Euro? No thanks. Bitcoin? That’s my core position already — but I hesitated. Volatility, liquidity, timing. But eventually, it clicked: there is no perfect answer. Just different risk profiles. And sitting in fiat while the world re-rates Bitcoin felt like the wrong kind of risk.

So I trimmed that cash position to 2% and moved the rest into BTC. I know that’s not conventional — but in a world where everything is being inflated away, I’d rather be early, overexposed, and right than sitting in “safe” cash while the train leaves the station.

If you’re still on the sidelines waiting for sub-$100K Bitcoin so you can “get in properly,” be honest with yourself. You probably won’t pull the trigger. Or you’ll buy so little it won’t move the needle — and then you’ll chase at higher levels anyway.

This was surprising:

Ric Edelman, who runs a very well respected RIA in the US shocked the investor world this week when he came out and explained why he believes that a 10-40% allocation to crypto is appropriate. Click below to hear what he has to say.

Edelman isn’t just another financial advisor. He is the founder of Edelman Financial Engines, which manages $287 billion for 1.3 million clients. He’s Mr. RIA.

Here’s a link to his whitepaper: The Death of 60/40 – and Why Your Crypto Allocation Should Be 10% to 40%

Remember above when I said that institutional investors are leading the charge?

This entire interview is a really good watch, but if you click the link below, I’ve got it starting about 8 minutes in — where the Laffont brothers start talking about Bitcoin.

For context, Coatue is one of the most respected tech investment firms on the planet. Over $70 billion in AUM. Absolute killers.

From 8:00 to 16:00 you’ll hear the brothers, and Brad and Bill — four of the most respected investors in the world — pontificate on Bitcoin as a legitimate asset class. You can feel it in their voices: they’re not dismissive anymore. They’re curious. Interested. Trying to figure out how to own it.

What you don’t hear them say (at least not out loud) is the obvious part: that they’re late. That of course they wish they bought “institutionally” five years ago. But now they’re stuck asking the question every mega fund manager eventually asks: “How do we buy it... and how do we hold it?”

(P.S. — I can help.)

We cannot let these guys in under $150K. We’re still so early.

Have a great weekend.