Don't Fight The Fed pt.2

Friday October 31st, 2025 - Issue # 119

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy Halloween and World Series Weekend!

Writer’s block is no joke, folks. I’ve been working on three separate docs for weeks now and haven’t been able to string together anything I thought was worth your valuable time. The Jays haven’t made it any easier — the games this week… wow. As a true fan, I’m at a loss for words and don’t think I even fully appreciate how incredible it is that we’re back at home with two chances to win the World Series. The city needs this. Canada needs this. It’s about to be one expensive weekend.

For the sake of starting fresh I’m going to leave everything that happened over the last few weeks in the past. Speaking of a reset, the only thing worth highlighting was what happened on 10/10/2025 — no, not my last newsletter — the largest crypto flash crash in history that followed it. That Friday afternoon, after a surprise Trump tweet about China tariffs, $20 billion in leverage was wiped out. The liquidation cascade was roughly 10x bigger than the FTX collapse and nearly 20x bigger than the covid crash. BTC fell from $117k to ~$105k in short order, and alts got decimated. Millions of traders lost everything, liquid funds were wrecked, market makers blew up…it was bad.

It was a very dark day for crypto and showed just how much leverage was still in the system. But if you weren’t on leverage, and you held assets you have real conviction in, you were largely unaffected — and if you had the stomach to buy that dip, you were greatly rewarded.

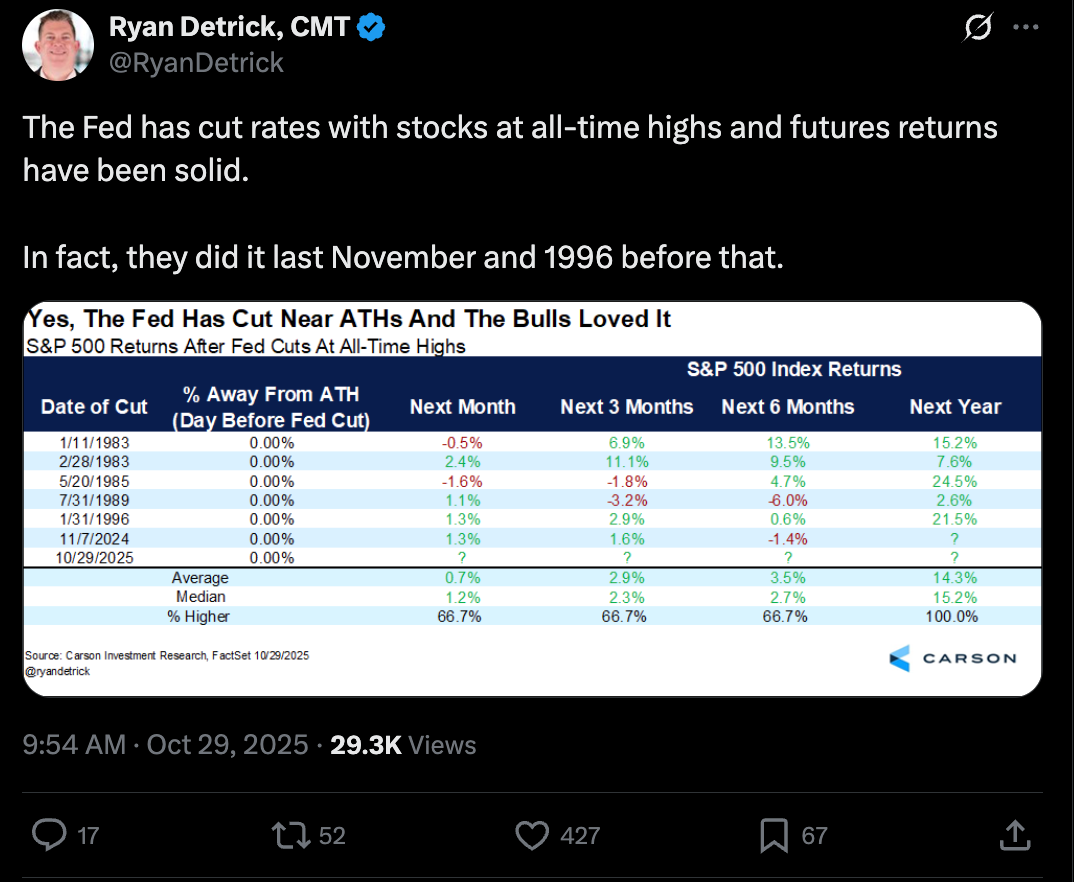

The main story this week was the Fed announcing a 25bps rate cut (as expected) on Wednesday. The BOC went first, but the press conference that followed was so bleak I don’t even want to go there.

TLDR (click below to watch Tiff Macklem use his hands to explain how f’d we are if we can’t make a hard pivot soon):

We’ll see what the highly anticipated 2025 budget looks like next week, but I don’t have high hopes. Actually, I do have some hope that if the Liberals can’t get enough support for their budget, we’ll be back to the voting booths within 12 months. I give that a pretty good chance.

Okay, back to the economy in the driver’s seat. Powell tried to sound tough Wednesday, but you could feel the political undercurrent in every word. The December verbiage about whether they might cut again could’ve been viewed as a warning shot — a subtle “reopen the government or no rate cut” message to the administration. From my vantage point, Powell seemed to be protecting himself politically — making sure that if things go wrong later, he can say he warned everyone or wasn’t at fault. The market didn’t love it at first; it’s rare for Powell to comment on market pricing so directly, and when he does, it’s usually because something’s breaking behind the scenes.

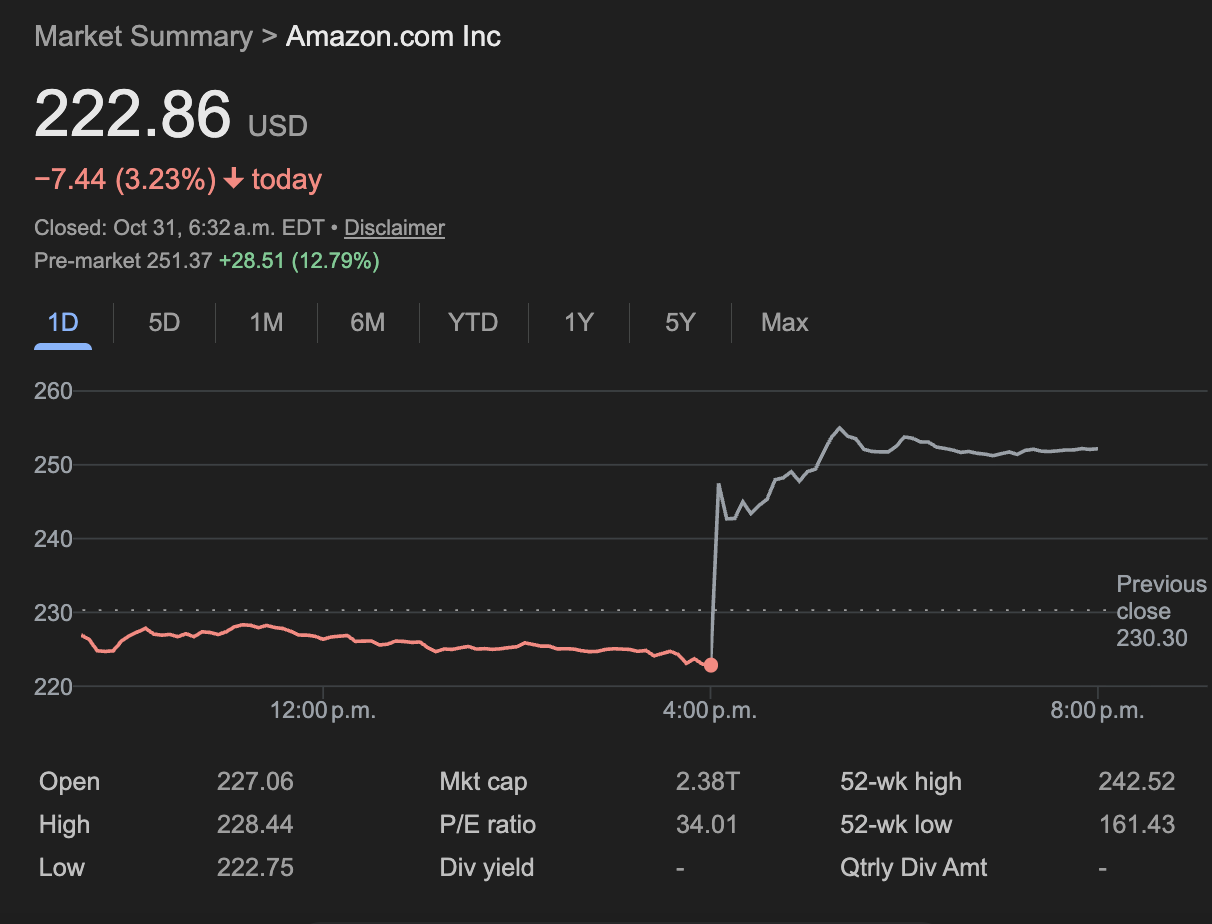

Every day, we’re seeing more headlines about layoffs. Finance, tech, consulting, the sectors that carried the recovery are slashing headcount. The interesting part is that the industries shedding these jobs en masse are crushing it.

Amazon laying off thousands of workers and then beating earnings so hard that the stock gained hundreds of billions in value tells you everything you need to know about what AI is going to do to society. Even when it’s not AI literally taking people’s jobs, it’s the cover that lets companies cut waste and boost efficiencies. It’s why corporate profits are up while payrolls are shrinking, and why the Fed’s playbook for managing employment cycles feels completely outdated.

That’s why rate cuts aren’t just appropriate — they’re necessary. The more hawkish the Fed stays, the worse it gets for the parts of the economy that actually build things. Rates need to come down meaningfully so companies can hire, expand, and fund projects — homebuilding, infrastructure, manufacturing. Cutting rates works in the short term because it gives these industries breathing room to produce.

The big risk is that we wake up in a year or two with a “strong” economy, low inflation, and 5–6% unemployment. Where do those come from? Not from keeping money expensive. You can’t sustain an economy where only capital owners win while the middle is hollowed out.

They’re going to cut in December. And the bigger story isn’t the cuts themselves, it’s what Powell said about the balance sheet. A few weeks ago, no one expected QT to end this soon. Now he’s openly talking about the next phase being balance sheet growth. That’s liquidity positive, period. Even if the purchases are short-term bills, the Treasury’s still skewing issuance toward the front end, which has the same effect as QE — removing duration from the market.

Even if they don’t cut in December, Powell’s gone in May, and everyone knows it. His replacement will be picked to play ball with the administration, not fight it. Between the politics, the liquidity tailwinds, and a Fed terrified of breaking the labor market, it’s hard to make a bear case for BTC right now.

But even with all of that, I’d say this is the worst level of investor sentiment I’ve seen in crypto since the FTX collapse. We’re only down 15% from the all-time highs we hit in August, and yet the timeline reads like it’s 2022 all over again. I don’t know these people IRL, but man — they’ve got to chill out.

Can we please just take a second and appreciate what Bitcoin is? It’s not the loonie, it’s not the US dollar, and it’s definitely not any other fiat currency that can be printed at will. Gold? Sure, in spirit, but comparing gold to Bitcoin is like comparing leaves to Charmin toilet paper after food poisoning abroad. They both get the job done, but one is way better than the other.

It’s time to take a step back and really appreciate what Bitcoin does — and why the world needs it now more than ever.

At its core, bitcoin isn’t just pristine collateral — it’s the apex asset in a world built on liabilities. It doesn’t need a balance sheet, a bank, or a border. You either have it or you don’t. Bitcoin is everywhere and nowhere at once — owned by no one, accessible to everyone. When the global economy runs on promises, bitcoin is the only thing that is what it says it is.

That’s what makes this such a rare moment. While governments are openly choosing to debase, most investors are still playing defense, sitting in cash, chasing yield, and hoping to outpace inflation. Others are scrambling for the next hot trade in AI, quantum, or rare earths, while some are just straight-up gambling. It’s financial nihilism. Meanwhile, the best-performing asset of all time, the only one that lets you park your capital and get back to living your life, is sitting right in front of them, fifteen percent off its highs, patiently waiting to be accumulated.

Bitcoin will ultimately supersede gold’s $30 trillion store-of-value market because it does what gold never could: it’s digital, censorship-resistant, seizure-resistant, and absolutely scarce. It’s programmable, portable wealth — a bearer instrument for the digital age. As the dollar weakens and liquidity comes roaring back, the smartest move anyone can make is quietly stacking the one asset governments can’t print.

It kind of reminds me of this Jays run. Baseball is a long season — 162 games. You don’t get here by luck or by chasing short-term streaks. The Jays have home field advantage because they showed up every day, played through the noise, and didn’t get rattled when things went cold. They earned it.

Bitcoin’s story isn’t all that different. It’s had its slumps and its critics, but over the long season, no one even comes close. Through every crash, every cycle, and every headline calling it dead, it just keeps performing. It’s the most consistent asset on earth — the best-performing of all time.

The lesson in both is simple: consistency beats hype. Show up, stay patient, and the scoreboard takes care of itself.