Don’t Fight The Fed pt.3: The $8T Rotation in 2026

Friday December 12th, 2025 - Issue # 122

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I’m getting that feeling again. I could be wrong as I have been many times before, but I feel like 2026 has all the trappings to be a monumentally strong year for bitcoin, the broader crypto market, and risk assets. It feels like we can chop around these depressing levels of $90K (definitely not more depressing than the weather I’ve just come back to) into the end of the year as holidays are typically slow, but I’m very excited for Q1 and 2026.

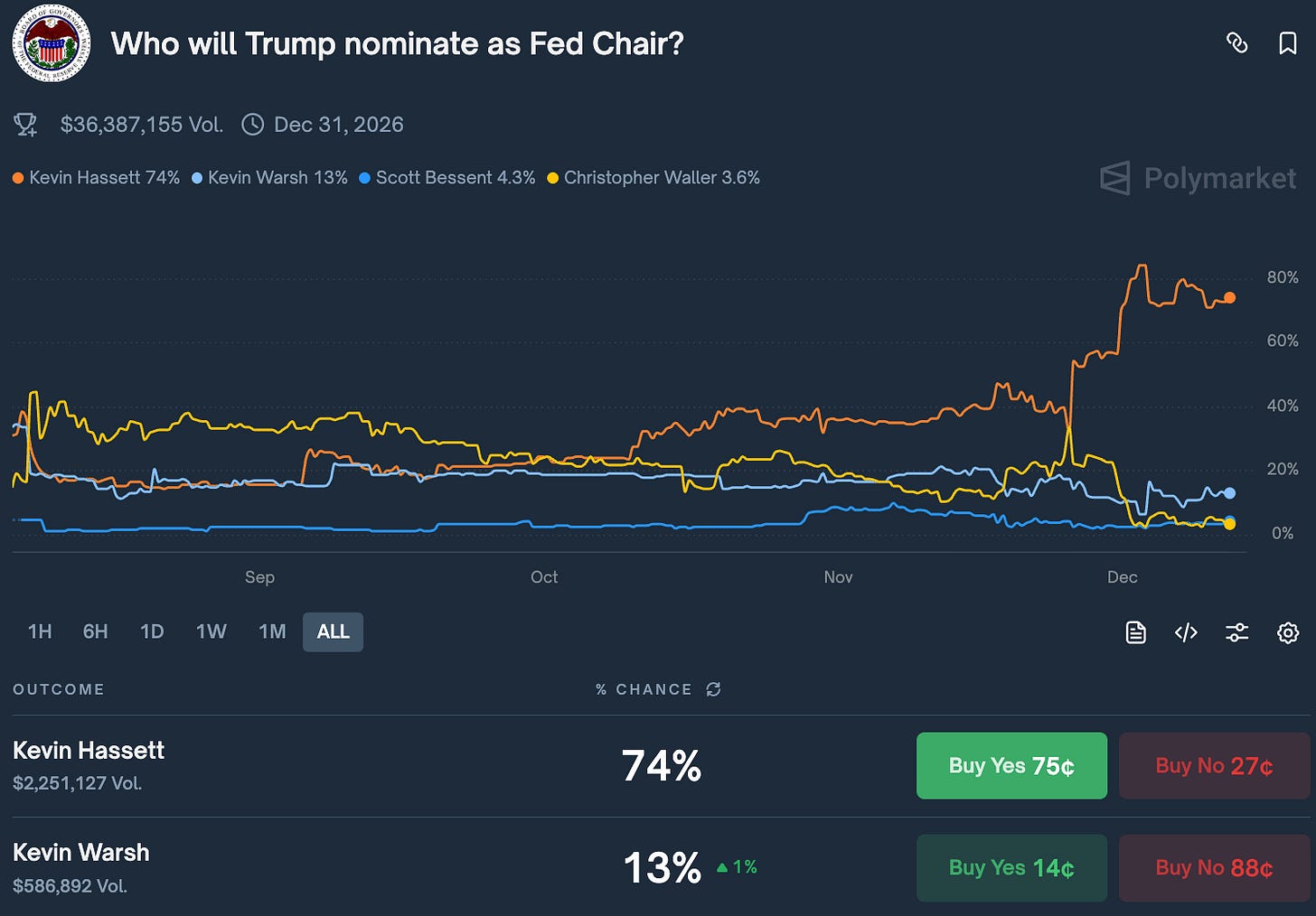

And when I try to put my finger on why next year feels so interesting, a big part of it comes back to policy. There are a few things lining up at once, but monetary policy is the starting point. The next Fed Chair is going to matter more than usual, and Kevin Hassett is now a 74% favourite for the role. If that plays out, the tone at the Fed should shift meaningfully. Hassett is a dove. He’s openly pro-crypto (previously worked as an advisor for Coinbase). And he’s ideological enough that if he thinks the US needs 2% interest rates to “win the future,” my bet is that he’ll take us there fast.

And if the US goes to something like 2%? That’s when the real fireworks start.

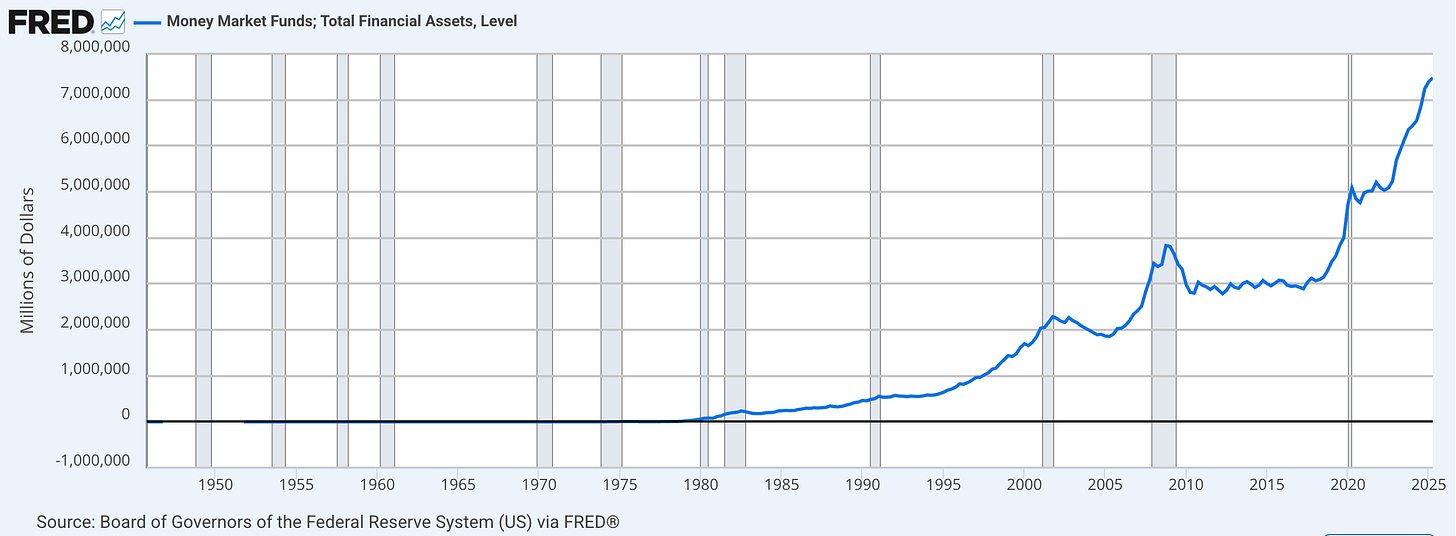

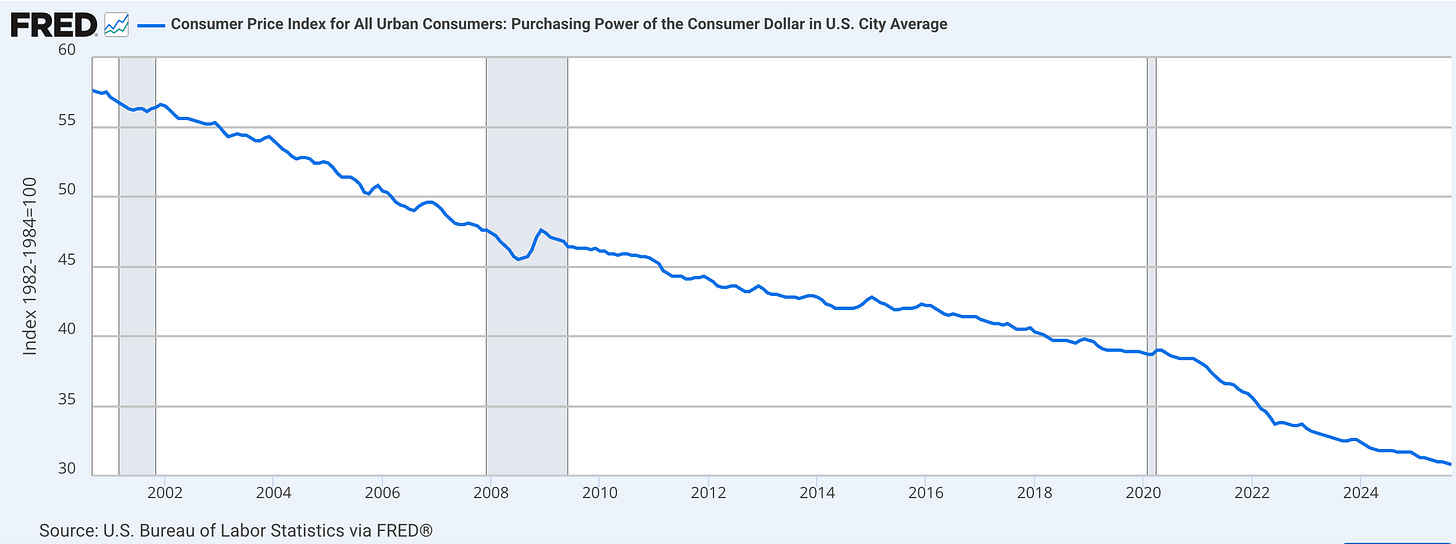

There’s roughly $8 trillion sitting in money-market funds right now (and growing), and here’s where things get interesting. If Hassett walks in and signals that he will be taking rates down toward 2% and starts hinting that 3% inflation is the new target, that entire pile of cash becomes uninvestable overnight. Real yields go negative. It’s brutal math. And when that happens, capital doesn’t slowly “rebalance,” it scrambles for anything that won’t lose to inflation.

We’ve seen this movie before. After 2008, when the Fed signaled they were comfortable running things hot, over a trillion dollars rotated out of cash in 18 months. Same setup here, except the numbers are much bigger. And it’s not like this is some fringe idea, Reuters literally said back in September that the recent cuts were “a signal that 3% is the new 2%.” Inflation is sitting at ~2.8% PCE anyway, so Hassett doesn’t even need some giant framework overhaul. He can just normalize it.

Markets are already pricing terminal rates basically at 3%. So the second money-market yields roll over? That $8T becomes vulnerable and starts getting FOMO. I’m not saying that all of it has to go but we have to assume that a good chunk of it has to go somewhere. And historically, in environments where inflation expectations drift higher and rates drift lower, liquidity piles into anything with real scarcity, growth optionality, or political tailwinds. Bitcoin usually moves early because it’s the cleanest liquidity barometer in the world — but this isn’t just about bitcoin. This is about a full-market rotation.

The point is simple: pair 2% rates with a soft 3% inflation target and cash becomes toxic. Nobody wants to sit in an asset that’s guaranteed to lose purchasing power. And once the outflows start, they don’t stop.

The second piece of the story that Powell didn’t even touch on at this weeks FOMC meeting: the impact AI has on jobs. Whether people want to accept it or not, AI is going to hit the labour market harder in 2026 than at any point before. Productivity booms do not translate into broad-based employment booms, at least not right away. That means the government is going to need a pressure valve. Some form of UBI…tariff dividend checks has already been floated as the new name for something the market might deem scary like UBI. Essentially a “cash for calm” program becomes highly likely heading into the midterms. Washington wants people happy, stable, and spending money. And happiness programs all have one thing in common:

It’s actually pretty sad and depressing to think about. The other day I read an article about the realities of coming out of University/College with little to no prospects of getting a job in a field that’s relevant to what you went to school for. Nice, found it:

It’s worth a read you can click the headline.

The truth is, it’s going to get a lot worse and it will move upstream to jobs of all sorts as robotics become more prevalent. Right now you have a better shot at being hired by Mark Zuckerberg to build out his data centers than you do getting hired at Meta as a software engineer. In 2026 it will be a problem too big to ignore and the government will need to find a way to plug the gap.

Jensen does a great job painting a positive future outlook on jobs in his recent appearance on Joe Rogan’s podcast. Click below for the clip but I’ll also post the full podcast in my weekly recommendations below. It’s a must watch/listen!

Then there’s housing which is arguably the most politically combustible issue in America right now. The long end of the curve remains high, which leaves the housing market frozen. Buyers can’t buy, sellers can’t sell, affordability is wrecked, and the demographic that everyone needs — young families — is stuck on the sidelines. That won’t fly in an election year. Expect incentives, subsidies, loan-guarantee schemes…anything that juices demand and gets the housing conveyor belt moving again. Translation: more stimulus.

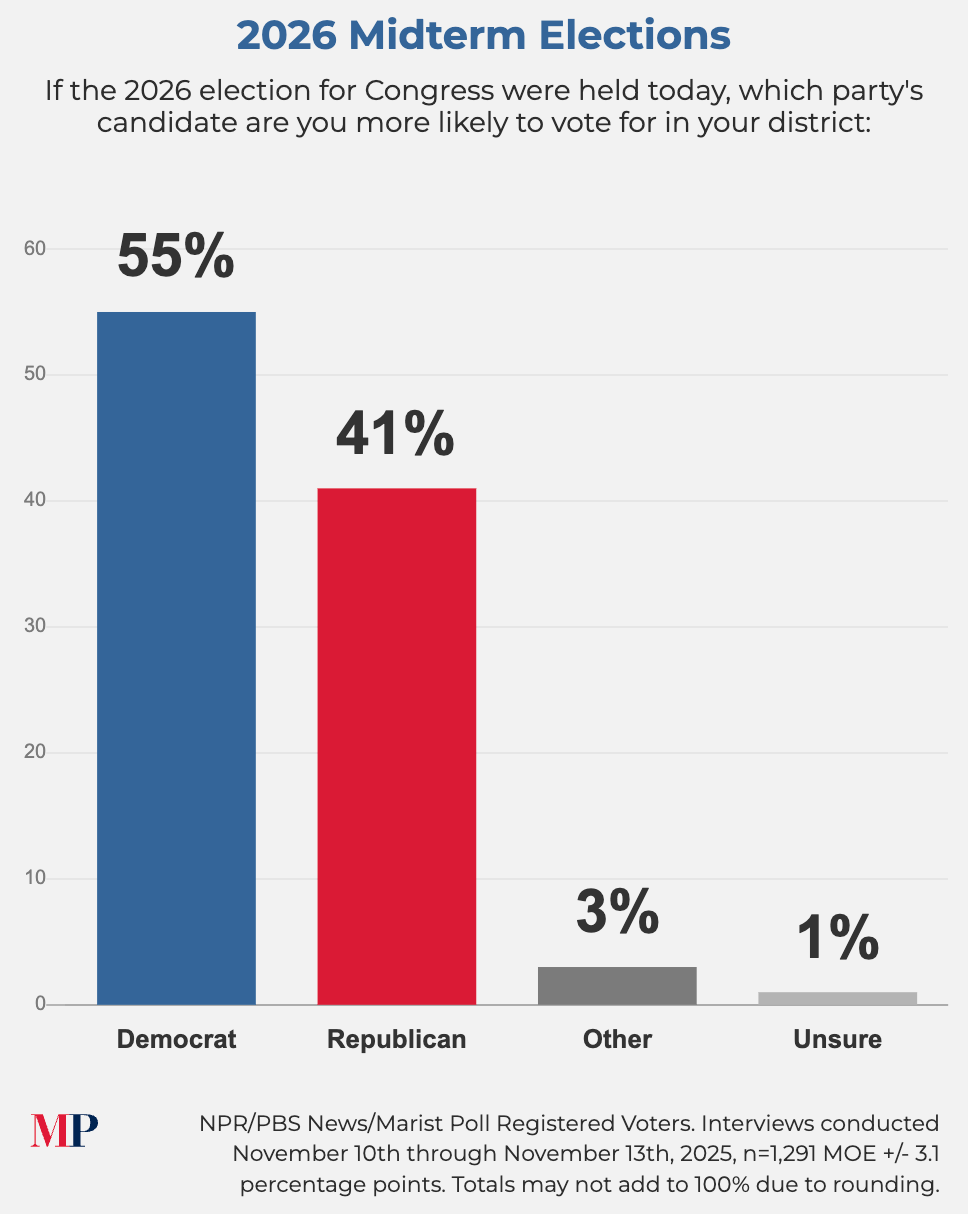

And this is all happening against a political backdrop that’s way more precarious than the headlines suggest.

If the midterms were held today, Republicans would likely lose. Trump would walk into 2026 as a lame-duck president with no ability to pass anything meaningful. And if that happens, 2028 is the Democrats’ to lose — and their policy direction is already clear. Look at Zohran Mamdani’s socialist playbook in NYC: aggressive redistribution, housing intervention, populist messaging. That’s the future of the Democratic Party. And if Republicans don’t course-correct fast, that’s the macro regime we enter and then we all have to move to El Salvador.

So what does this all mean?

It means Republicans have no choice but to go full send. Pull every lever. Stimulate everything. Cut rates. Float trial balloons about new inflation targets. Unlock housing. Keep consumers flush enough to stay happy. Basically: they have to turn the money printer back on, turbo, or they risk losing the country for a decade.

The setup...

If Hassett takes the chair…

If money-market yields collapse…

If $8 trillion needs a new home…

If UBI-lite programs emerge…

If Republicans flood the system with happy pills to avoid disaster…

Then 2026 should be an amazing year for asset holders. Albeit, I’m sure there will be some nauseating bumps along the way as usual…