Early warning signs

Friday August 18, 2023 - Issue # 49

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

“The time to buy is when there's blood in the streets, even if the blood is your own.”

Baron Rothschild

I got up way earlier than I normally do this morning. It’s been a long one with the Toronto Blockchain Futurist Conference taking place this week but how could I not get something out today with the massive move down yesterday? I got up early because out of the few things that I was going to touch on, I couldn’t piece together what effect the China Evergrande situation could have on the US and the global markets. Unfortunately, I still haven’t been able to find much more but I’ll give it a go.

Yesterday, Evergrande Group, one of China’s largest property developers until it collapsed in 2021, filed for bankruptcy protection in New York — Chapter 15 protects the US assets of a foreign company while it works on restructuring its debts. This is kind of old, very serious macro news, which has made its way back into the headlines after being on the backburner for so long because of you know… the war, Hunter Biden’s laptop, aliens, etc, etc..

China's post-zero COVID economy has really done itself in, with growth far below previous years. Exports, investment, factory output, and retail sales have slowed, causing falling prices and weakened consumer spending. China is now experiencing what governments fear the most — deflation.

The property sector, a significant part of the economy, is in crisis due to major developers like Evergrande and Country Garden facing bankruptcy and default. These failures should cause (are likely causing) construction projects to come to a halt, damage to investors who piled into pre-construction opportunities, a decline in home prices and housing market, job losses, financial instability since Evergrande has a large number of creditors including banks, insurance companies, and other financial institutions, that ultimately will cause a slowdown in growth.

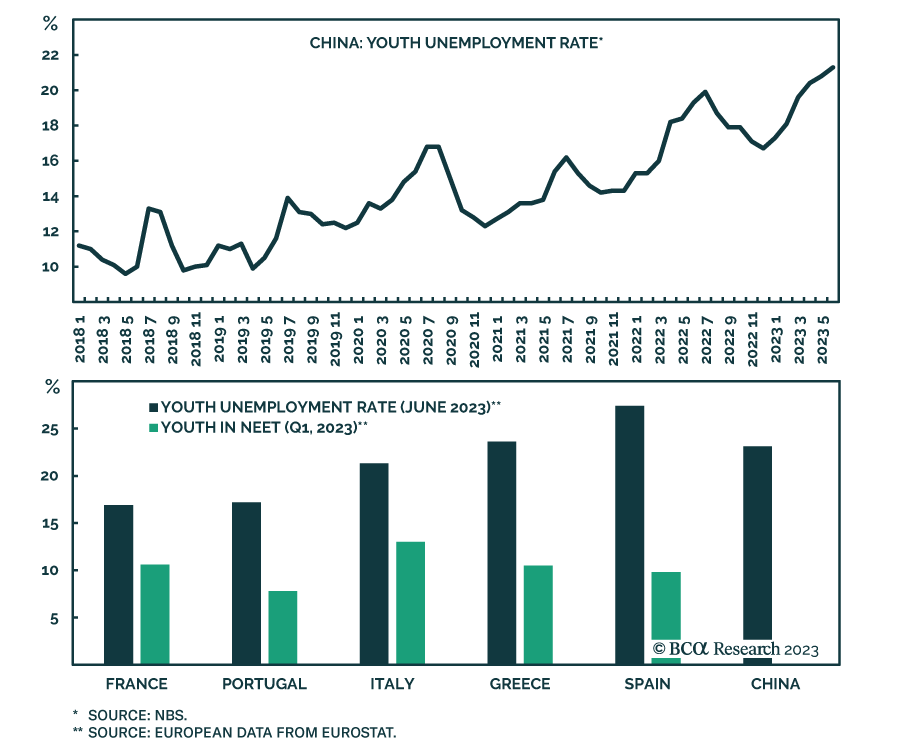

Chinese authorities, despite calls for decisive action, have done little to intervene and this hesitancy to bail the system out has led to declining consumer confidence. The challenge also lies in youth unemployment which is at record highs. Things are so bad in this department that China suspended its reporting of youth jobless data earlier this week.

There are not many Westerners who know China as intimately as legendary investor Ray Dalio. I don’t want to meddle with his views and his eloquent writing so if you click the image below you can enter into the mind of Ray on how China can combat its issues by navigating a massive debt restructuring.

Okay, now onto the easy stuff.

Bitcoin had been chopping around the $29k level for nearly 3 months. It was due for a breakout in either direction, and yesterday confirmed its direction to the downside after some negative news.

Firstly, with the Grayscale ruling supposedly coming today, yesterday looked like a bearish indicator of that decision based on price action. At the same time, SpaceX reported to have written down its bitcoin holdings which the market took as “sold all of its bitcoin.” It is still unclear whether SpaceX is holding BTC on its balance sheet but from my perspective, it appears that they just wrote down the value of their bitcoin holdings, which is common practice for companies to do with balance sheet assets. It doesn’t matter what I think though because this caused a big move down, coupled with the Evergrande news which came around the same time and further exacerbated the narrative sending BTC down even further which led to nearly $1bn liquidated from the crypto market in short order.

Then, a few minutes after the crash we got another headline: "SEC set to greenlight ETH futures ETF." This does not mean that it is approved, it means that it is very likely that they will not block the approval. Ethereum quickly rebounded on the news and saw a near full recovery.

What a day. At least we can stop saying how low bitcoin volatility is.

Have a nice weekend!