Fed hikes 25 bps into 7.9% CPI!

Friday March 18, 2022 - Issue # 8

Hopefully you all had a fun night celebrating St. Patty’s day last night! It was a warm one here in Toronto and on my walk back from the office I couldn’t help but feel a bit jealous of crowds of green hopping from bar to bar enjoying pints with their mates. It was the first sign of life I’ve seen in Toronto in quite some time and it was really nice to see. I can’t help but wonder what the discussions of the night were all about. For some, it might’ve been the first time in a long time that they got to see their friends in a more normal environment. Were they sat there talking about the rate hike from yesterday, how damn expensive things are these days, how they got downtown this evening since they left the city to live at their parents house during the pandemic. I wonder if there was “that guy” last night that reminded his mates that things could get worse — “yo, if we were in Weimar Germany back in like 1923 we’d have to like buy all of our beers for the entire night like right away because of hyperinflation, dude.”

Hopefully people just had a great time and forgot about all the bullshit for the evening.

The highlight of the week was definitely the seemingly historic Fed decision at the FOMC meeting this week where they did the expected and raised rates for the first time since 2018 by 0.25%. Yeah, after an inflation print last week of 7.9% and climbing higher, the Fed responded... with a whopping 0.25% increase.

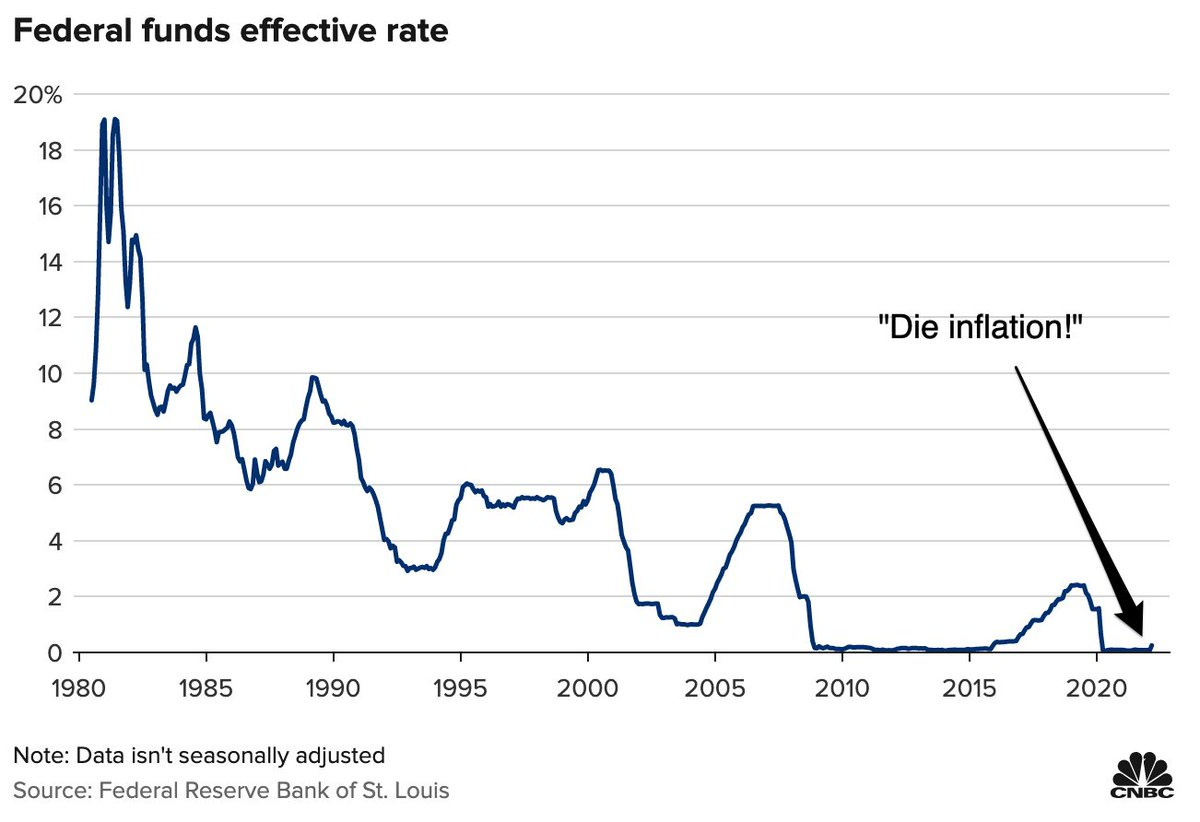

No need to dig into this move too deeply as it was clearly baked in — markets were happy that there were no surprises and moved up higher after the announcement. I guess what stood out to me was Powell informing us that the Fed is expecting to hike rates at all 7 upcoming meetings this year — 7 hikes of 0.25% brings us to only 2% by the end of the year by which time the inflation print will likely be significantly higher. Inflation is clearly a big issue and there are serious tailwinds to keep it climbing for a good amount of time and the Fed is being hounded on to do something. However, it is very apparent that the Fed is out of options for a real, long-term solution.

The chart above does a good job helping us visualize the consistent downtrend that has been periodically disturbed by temporary increases that have been quickly reversed at the first signs of trouble and driven down to near zero. This is because, there is way too much debt in the system to allow for a Paul Volker in the 80s style move to combat inflation effectively.

The Fed is in an undesirable position to say the least. There are a few primary reasons from my base level knowledge of financial markets that would inhibit the Fed from being successful in driving inflation down to their 2% target:

If they raise rates too quickly they will push the US into a potentially devastating recession.

Funnily enough, this is probably the medicine they should be taking. Short-term pain, long-term gain.

Powell has made it abundantly clear that instead of acting swiftly (i.e. Paul Volker circa early 80s) their taking their sweet time raising insignificantly, posturing to the masses that they’re doing something about it. Short-term gain, long-term pain.

If they push rates above a certain level the US will struggle to service the interest payments on all the debt its accrued.

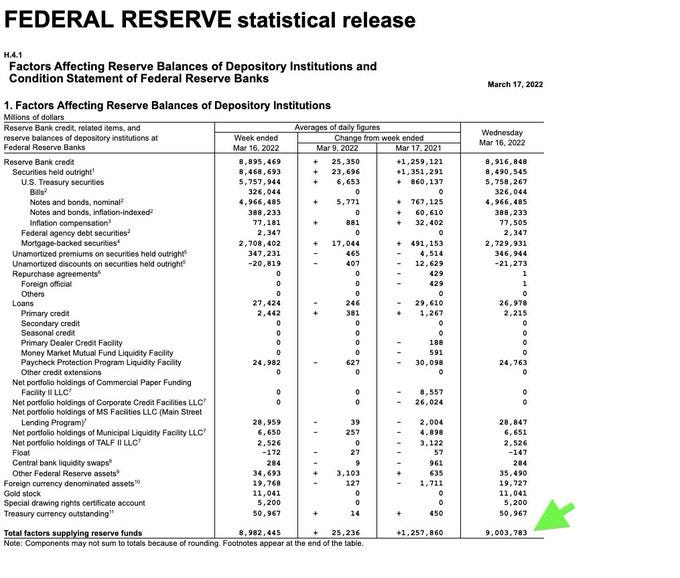

It is hard to imagine that the US economy can grow at a pace that could keep up with payments on $9tr of debt at an interest rate that is high enough to curb inflation.

At just 2%, interest payments on $9tr (assuming that they start tapering any time soon) are $180bn.

On a human level, no one wants to be the bad guy!

Past Fed Chair, Paul Volker got absolutely slaughtered to save the nation and stood fast in the face of oppression.

When I look at J Powell I don’t see that kind of guy. I see him more as a friend of the President who is happy to keep him happy. Typically, Presidents don’t like to throw their country into hard times.

As those St. Patty’s Day beers become more expensive, you’ll likely be looking for somewhere to park those hard earned dollars so you can at least keep pace with inflation. Unfortunately, you’re not going to find it at your local bank as a high interest account might get you a measly 1.5%-2% by the time Powell’s “tough measures” kick-in. I mean, otherwise, your money is literally shrivelling away…and no one wants to shrivel!

I’m on the side that the Fed does not have any tools left to meaningly control inflation and I think more people are starting to come to the same realization. Historically, hard assets like gold thrive in these types of environments. This time around, I think Bitcoin is in a position to steal a lot of gold’s shine.