Fed says no more BTFP. I say BTFD.

Friday February 2nd, 2024 - Issue # 61

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

It was just over a year ago that Satstreet crossed $1 billion in trading volume. I knew that even though we were in a pretty nasty, post-FTX hangover style bear market, that the next billion would come quicker, but even I couldn’t imagine that we’d be here already. Yet here we are, coming off a record quarter and back-to-back record months to kick off 2024, which in my opinion, has the potential to be the most historic year for bitcoin and the broader crypto market. I wanted to start off today’s note by thanking all of our clients for your trust and continued support!

We’re not actually back yet…are we?!?!

We're in a fascinating phase in the markets where cautious optimism seems prudent, yet the macroeconomic indicators are signalling something potentially more significant. While there's a general sense that we might not be fully back, current prices look juicy to me. This is all made even more compelling by the swift movement we're seeing towards 'risk on' assets. Major indices like the NASDAQ and DOW are reaching record highs, and this trend seems well-founded given the broader market dynamics.

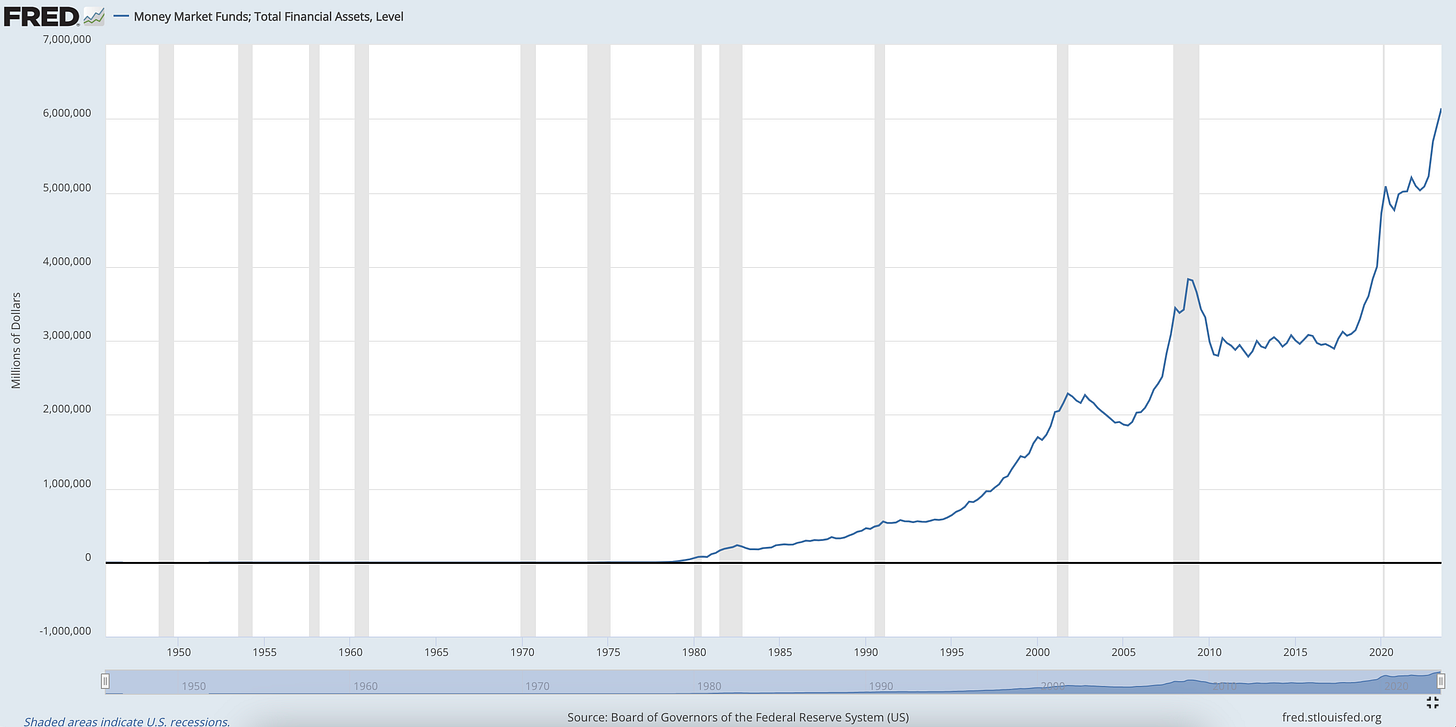

There is a staggering amount of capital, approximately $6 trillion (and compounding), sitting in money markets. All the wealth in the world was very happy to be earning the risk free rate of return after the Fed’s hiking spree. It’s been an easy couple of years for the rich as that juicy free yield combined with ultra-low fixed borrow rates allowed for a comfy life of luxury after the mask wearing days of the two years prior.

The trade of a lifetime: buying the Feb 2020 market collapse, or even just HODLing through it, watching your assets climb dramatically as the Fed took on drastic measures to stimulate the economy, locking in your mortgage as the Fed slashed rates down to nothing, and then selling off your risk assets to move into treasuries as the Fed went to war on inflation. Simple.

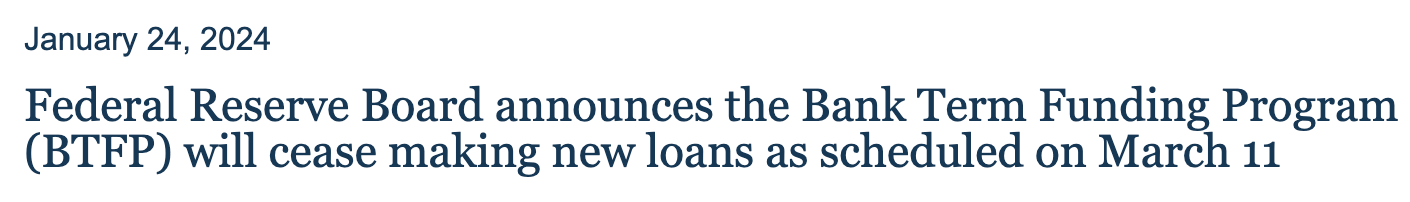

Imagine being on the sidelines raking it in as the banks who took the other side of your ultra-low, fixed mortgage were crumbling. Then witnessing Powell and Yellen bail out the regional banking system with not QE, QE with the Bank Term Funding Program (lol that name still makes me laugh). Why would anyone be rushing to get back into the market? Well, that part wasn’t so simple. The ones who were able to piece it together and think 2-steps ahead, understood that the economy doesn’t work under restrictive monetary policy. Just like inflation was transitory (it was), so is this high rate environment. Smart money started rotating back into risk-on mode and we saw the most reflexive asset in the world do 155% in 2023. As we got closer to the end of 2023, the Fed’s tone changed. They felt that they were “sufficiently restrictive” and rate cuts were now on the table. Right on schedule.

The real big money is still relishing in the warmth of “higher for longer” but that will change soon.

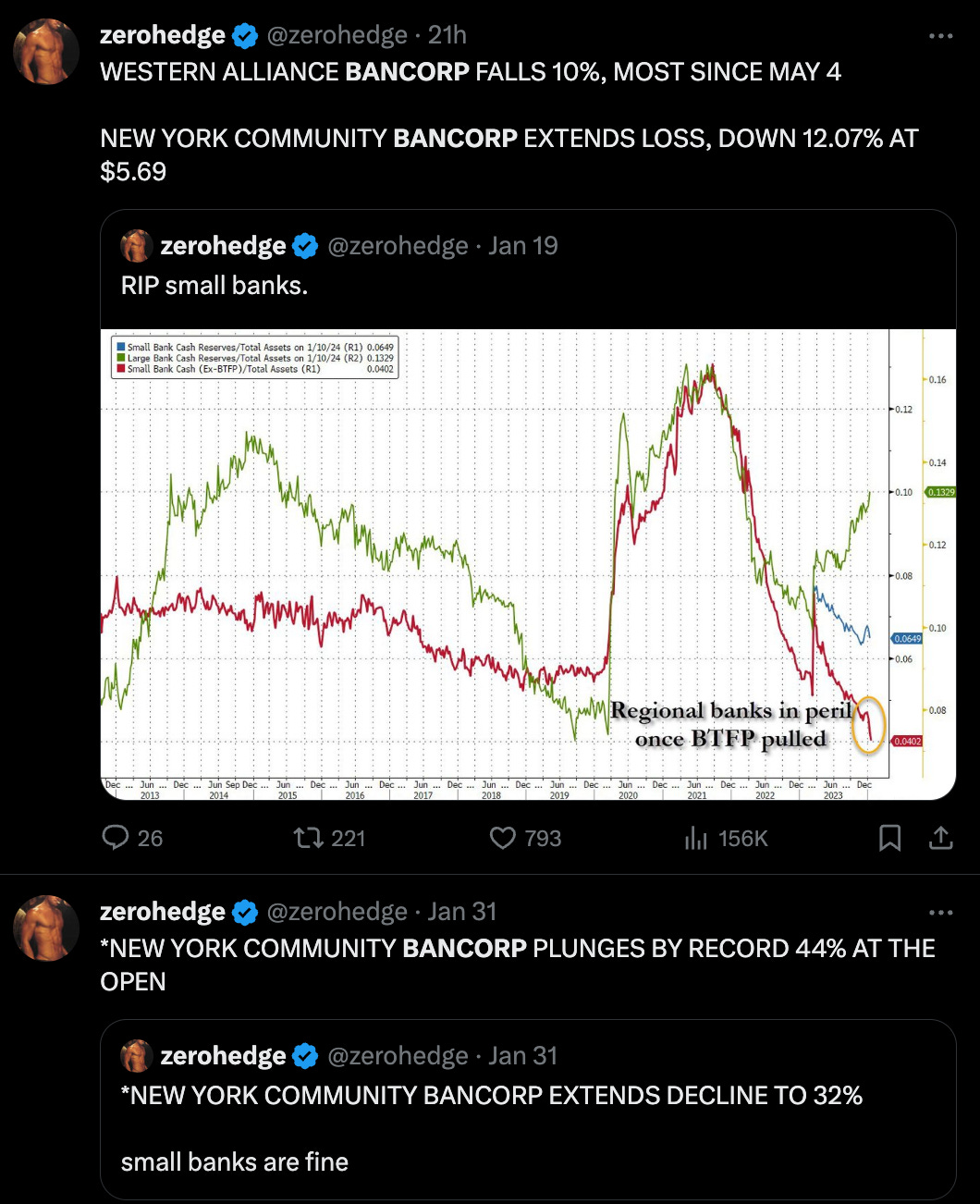

The end of the BTFP (Buy The F****** Dip) program is the “all-in” moment for risk takers.

We know that the US will not let banks fail after last year’s bailout of SVB. If it’s not March rate cuts, then it’s another acronym used to cover up its actual identity — quantitative easing. There’s a good chance that we see serious turmoil in the regional banking system ahead of a solution. When Silicon Valley Bank collapsed last March, Bitcoin fell sharply, and then rebounded dramatically when the FDIC and the Federal Reserve invoked an emergency bailout. This time around, I’m not sure we see the same level of panic because the US has already shown its hand. I expect risk assets to melt up.

Rate cuts are coming this year. And with an election year upon us, these dynamics could further catalyze movement, as the traditionally safer investments become less appealing due to lower interest rates, causing a shift of this capital towards higher-risk assets. This movement is further amplified by the excitement surrounding Bitcoin (and likely Ethereum) ETFs and the upcoming Bitcoin halving. The stage is set.

Hmmm…maybe this is the real reason crypto has four year cycles…

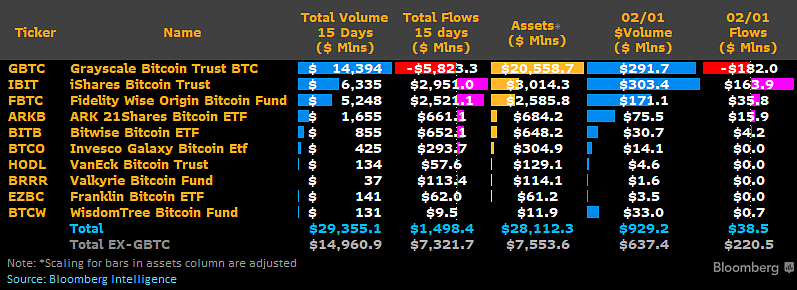

BlackRock just hit $3 billion in asset in 3 weeks. IBIT is now in the top 10% of all ETFs by assets under management. 3 weeks!

Who says evil can’t be good?