Fiscal Dominance: Now in 4K

Friday July 18th, 2025 - Issue # 110

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

While Crypto Week at the White House started off shaky, it turned around quickly — and just like my birthday next week, we got everything we wished for.

There is simply way too much to write about this week so I’m going to keep focused around a topic that I’ve written about before that seems to be coming to a head: Fiscal dominance. Last April, I wrote a letter called Fiscal Domination Nation - this was post US Bitcoin ETF launch, pre-halving, and of course pre-Trump. No need to go back and read it — it already feels like ancient history.

Inflation was sticky around 3.5%

Gold broke all-time highs — and it’s up another $1,000 since then

BTC was at $60k

Biden’s autopen told the world the Fed would cut before year end

That was novice-level fiscal dominance.

Then came the “totally apolitical” Fed, which slashed 50bps in September and another 50bps by December to juice markets into the election. It had about as much impact as your fifth COVID shot.

We’re now living in a completely different world — for better or for worse depending on which side you’re on. I mean, it’s radically changed. The US has regained its strength — Business is booming, inflation has shocked to the downside, and animal spirits are flying. But it’s still brutal out there for most Americans — especially first-time homebuyers — and the real estate market is feeling it. Rates are too high, and the Fed has a serious case of TDS: Tariff Derangement Syndrome.

Last week I hinted at something that felt a bit too conspiratorial to publish. This week, it’s out in the open: Powell may actually be on his way out.

The reason Powell’s job looks shaky isn’t that complicated: Trump’s team wants lower long-term yields to refinance America’s debt. Cutting the Fed Funds Rate won’t do it alone — the only way to truly bring down the long end is through outright Treasury purchases. Powell isn’t going there without a crisis.

So what’s the play? Merge the Fed and Treasury. Go full Japan-mode: yield curve control, turbo-charged stimulus, and liquidity on tap — I think so. Whether it’s Bessent, Warsh, or Hassett replacing Powell — it doesn’t matter. They’ll all carry out the same plan: inject liquidity, suppress yields, juice growth — and pray that AI is the deflationary miracle it very well could be…or, deal with inflation later

Risk assets love this setup. But so does inflation. That’s why you want to be in the hardest asset on the planet.

Here’s a taste of what we’re going to see from a very likely candidate for the next Fed Chair.

Trump is now openly tying monetary policy to the government’s debt burden, claiming that if Powell “does what’s needed,” the U.S. could save over $1 trillion in financing costs. That’s fiscal dominance — plain and simple. The idea that rate policy should serve the Treasury’s refinancing needs, not the Fed’s inflation mandate, is now being said out loud. And it’s not just Trump. Ted Cruz recently called for abolishing interest on reserves — a long-shot idea, but clearly motivated by pressure to ease the debt load. These aren’t isolated outbursts; they’re signals. The political attacks on the Fed are becoming broader and more coordinated. What we’re seeing is a full-court press to bend monetary policy in service of fiscal survival. All of these things are meant to push policy changes that will ease the debt burden.

This is all from me searching for about 1 minute — this is fiscal dominance rhetoric, there’s no way around it.

Can’t help but feel a bit bad for the guy but politics is a dirty sport. Let’s see what happens, but I’d put the odds at around 70% that Powell resigns before his term is up. If that happens, brace yourself — markets might wobble at first, but once the dust settles, I think they rip. Bitcoin will be the biggest winner — and I believe it’ll be repriced instantly.

Rails founder & Round13 DAF’s CIO, Satraj Bambra, recently made what might be the most grounded bullish Bitcoin prediction I’ve seen so far (click for full article):

This letter is already too long but there’s so much more to talk about. Let’s quickly review how “Crypto Week” is going.

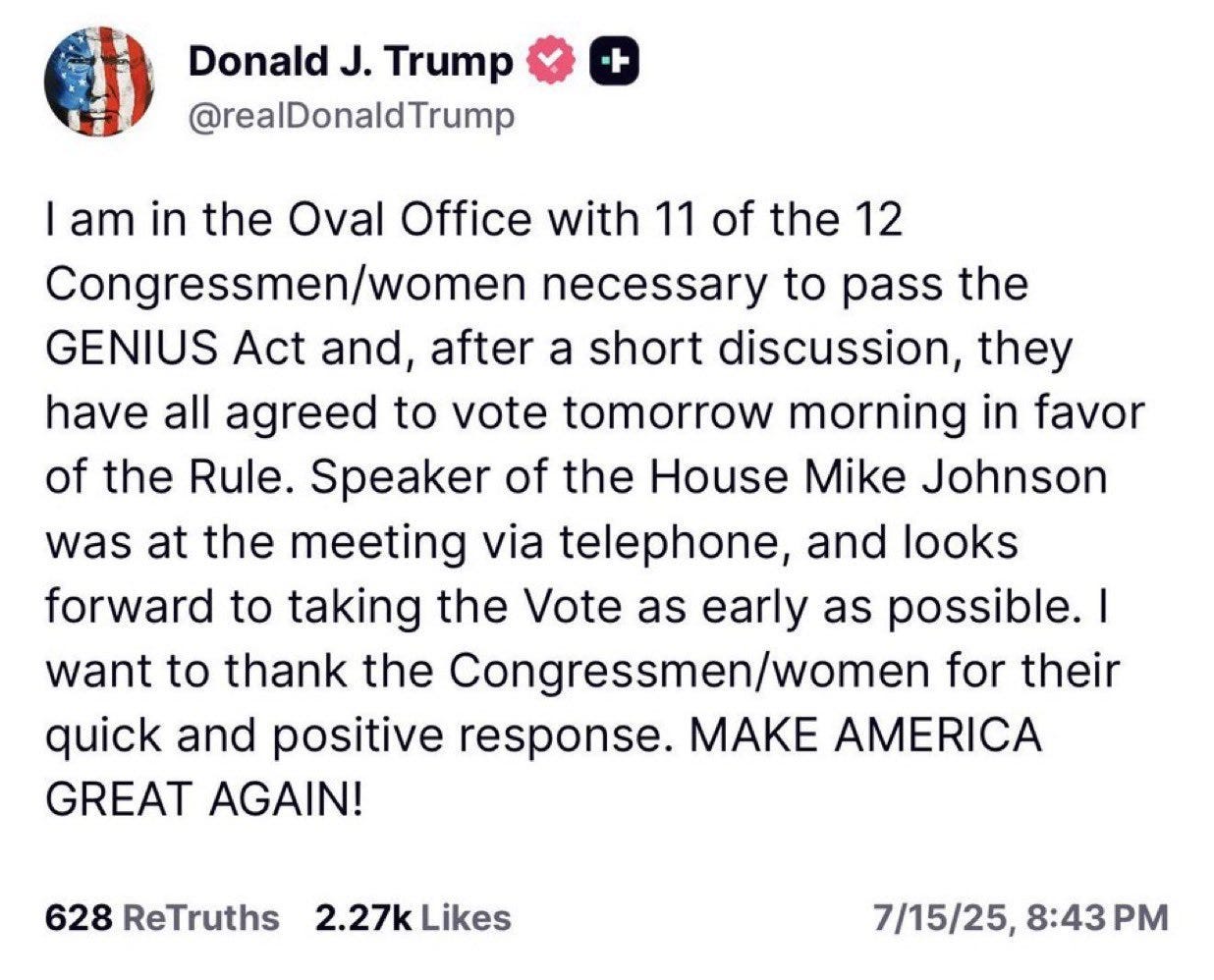

This week was Crypto Week on Capitol Hill, and it delivered fireworks. At first, it looked like a disaster: the GENIUS Act, meant to create the first stablecoin regulatory framework in U.S. history, failed to pass in a stunning House vote (along with the other two bills). Panic set in. But then Trump personally stepped in, lobbying Republicans behind the scenes, flipping votes, and resurrecting the bill in real time.

The second vote? It passed 308–122 — a total reversal. The process dragged on so long it became possibly the longest House vote in U.S. history, with members literally held hostage on the floor until Trump’s allies twisted enough arms.

The result? A sweeping victory for crypto:

– The GENIUS Act is now headed to Trump’s desk

– The CLARITY Act passed, limiting SEC overreach

– The Anti-CBDC Act also sent to the Senate, banning a U.S. surveillance coin

Markets cheered. Bitcoin ripped past $120K, ETH ripped through $3K. And for the first time in years, it feels like the U.S. government isn’t trying to suffocate the industry — it’s now leading the charge. Say what you will about Trump, but this week he didn’t just back crypto…he delivered.

There’s just too much winning going on this week. Yesterday it was reported that Trump is preparing to open the $9 trillion US retirement market to Bitcoin & crypto investments. Tired of winning yet?

I’ll stop here — but let’s just say I won’t have to think too hard about what I’m writing next week.

Have a nice weekend!

Great article again thanks for taking the time to share this newsletter

Great article again thanks for taking the time to share this newsletter