Foundations (2025 in Review)

Tuesday December 30th, 2025 - Issue # 123

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good morning!

Hope you had a wonderful Christmas if you were celebrating — and if not, I hope you still managed to unplug a bit and spend some time with family and friends. I’ve somehow managed to dodge most of the winter weather here in Toronto, and I plan to keep that streak alive when I head back to El Salvador next week for a handful of events that should be pretty special.

Speaking of El Salvador, our MD of Satstreet SV, George McBride, and the legend Max Keiser recently hopped on a helicopter straight from the golf course to Max’s restaurant and recorded an interview along the way. It’s exactly as unfiltered as it sounds and I think it’s worth a watch if you’re interested in what we’re doing down there.

I wasn’t originally planning a final note before year-end, but as 2025 draws to a close it feels like a moment worth pausing on — not for a victory lap, but for context.

Because a lot of what happened this year wasn’t random. It was the predictable outcome of incentives and policy choices that have been compounding for a long time. Most people only noticed once the effects hit price charts.

Let’s get the obvious out of the way: Bitcoin did not reach $200K in 2025. I never explicitly predicted it, but I thought it was within reach. I was genuinely surprised we topped out around $126K and didn’t at least test $150K.

Price, though, is only part of the story.

What I did feel confident about at the start of the year was that 2025 would bring constructive policy progress, especially regulatory clarity in the US, and that capital would flow toward the assets best positioned to benefit from it.

That’s why I stayed almost exclusively in BTC. I remain very comfortable with that choice.

Even though Bitcoin made new highs this year, 2025 didn’t feel like a bull market. In many ways, it felt closer to 2018 or 2019 than it did to 2017 or 2021. Yes, it was a record year for Satstreet and our related entities, but the character of the flows was entirely different.

Almost everything we saw came from corporates and institutions. Very little speculative retail. No frenzy, no mania, no tourists, no panic selling — just steady, deliberate accumulation.

To me, that’s not disappointing. It’s foundational.

We also saw a clear bifurcation: bitcoin pulling away from the rest of crypto. That separation matters enormously for what comes next.

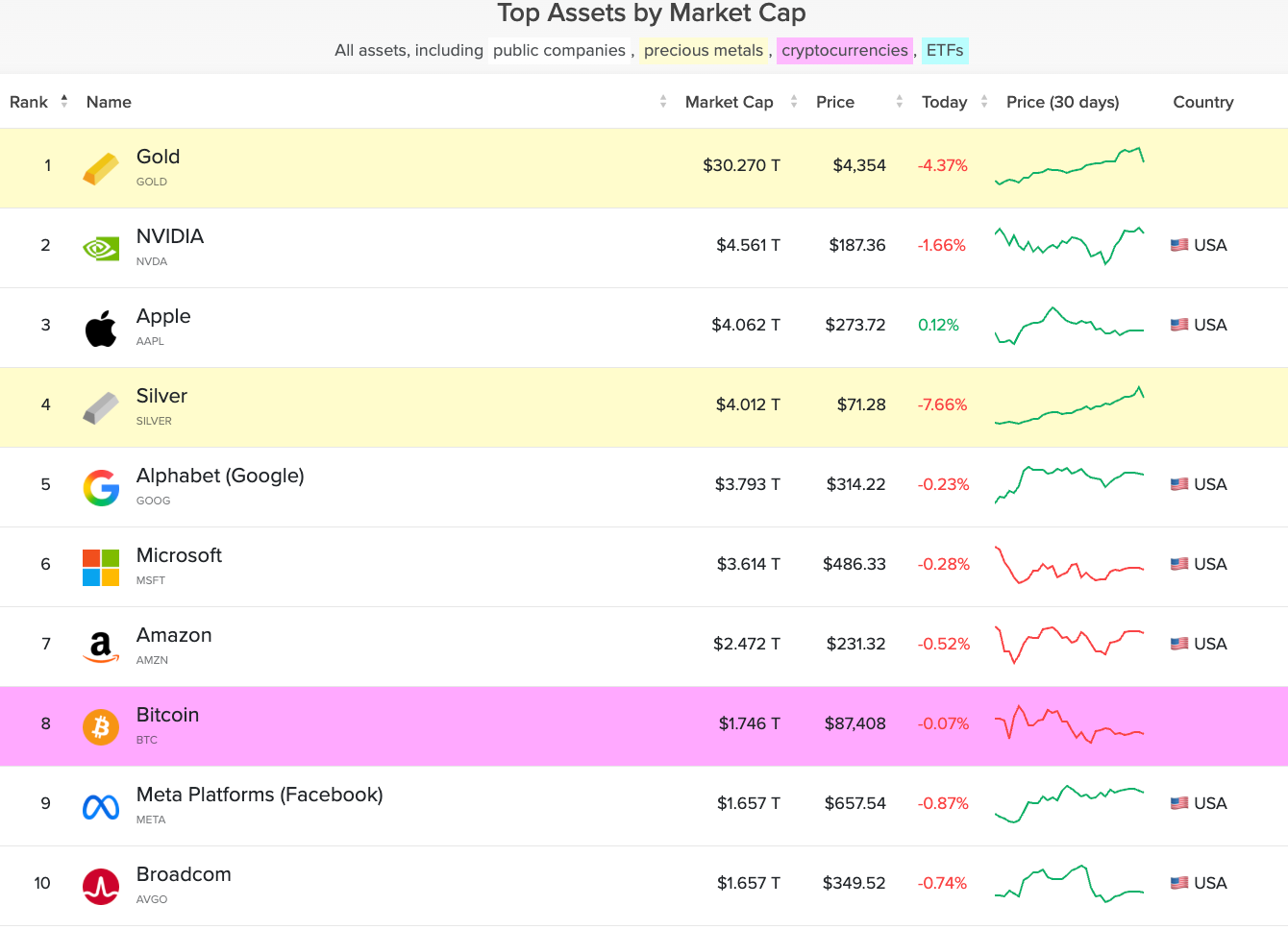

One thing I got plainly wrong: I repeatedly said I expected bitcoin to outperform gold this year. It didn’t. Gold led the “debasement trade” convincingly. That’s on me.

But the why is more interesting than the scorecard.

Gold moving first isn’t a rejection of bitcoin, it’s exactly how conservative capital behaves when trust begins to erode. It reaches for the familiar before it reaches for the new. Gold is the early warning. Bitcoin tends to follow once the realization hardens that the underlying problems aren’t being solved, only managed.

In other words, I may have been early, but the sequence is textbook for an environment of falling rates, ballooning deficits, creeping policy risk, and midterm elections coming soon.

At the start of the year, the real question wasn’t whether inflation would magically disappear or whether growth would suddenly reaccelerate. It was whether policymakers had any appetite for restraint. Whether there was a willingness to accept short-term pain in exchange for long-term stability. And once again, the answer was no. Not even with Elon at the helm.

There was no appetite for austerity, no tolerance for recession, and no political will to let markets clear on their own. The moment things wobbled, the playbook was familiar: support growth, protect asset prices, and push the consequences further down the road.

Rates didn’t come down because the system was suddenly healthy. They came down because staying tight became untenable. Debt servicing costs were rising too quickly. Growth was too fragile. And deficits quietly drifted into territory that would have been unthinkable a decade ago, let alone debated seriously.

We’re no longer in a traditional growth cycle. We’re in a debt-management cycle. Once you view markets through that lens, much of the “confusion” disappears.

You can feel the next phase beginning to emerge — not just in markets, but in politics.

Recent chatter out of California about the billionaire wealth tax is one small but telling example. When a sitting member of Congress floats redefining private property as provisional, it’s less about whether that specific bill passes and more about the direction of travel. To be honest, it’s what worries me most about Canada also…

Amazing dunk by David Friedberg…worth the read 🏀

Whether any specific proposal passes is almost beside the point. Again, it’s the direction of travel is what matters.

When debt burdens become uncomfortable and growth can’t carry the load, governments don’t suddenly discover discipline. They look for new definitions. New categories. New justifications for accessing capital that already exists. History is very clear on this.

This is precisely the environment bitcoin was built for — not because it’s “anti-government,” but because it’s neutral and outside the reach of discretionary rule changes.

The surge in precious metals this year underscores the same trend. Gold and silver don’t rip higher in a vacuum, especially on the way down in rates. It signals capital seeking scarcity and credibility as Treasuries quietly lose appeal.

That move isn’t bearish for bitcoin. It’s deeply bullish. As the chart shows, BTC still has enormous ground to cover as capital continues migrating toward hard, credible assets.

Gold can absorb hundreds of billions with barely a shrug. Bitcoin absorbing even a fraction of that flow reprices dramatically. The asymmetry is profound.

It’s also why bitcoin isn’t merely “digital gold.” Gold preserves wealth. Bitcoin can re-price it entirely…

Gold is heavy, slow, hard to verify at scale, and increasingly political in a world of borders and capital controls. Bitcoin is weightless, infinitely divisible, instantly verifiable, and native to the global digital economy.

Gold shines when people are scared. Bitcoin shines when people conclude the system won’t be fixed.

Equities today aren’t expensive because earnings are extraordinary. They’re expensive because expectations have been pulled forward and discounted into a future that feels increasingly uncertain. As rates fall and Treasuries stop compensating for inflation risk, capital doesn’t want more duration — it wants scarcity.

Bitcoin has a habit of sniffing out stress before it shows up on the front page. Every cycle has a moment where something breaks, liquidity tightens briefly, and then policy responds aggressively. Bitcoin often struggles into that moment, and then becomes the strongest performer coming out of it.

If that pattern holds, the setup for 2026 is quietly forming right now.

I don’t expect straight lines next year, and I certainly don’t expect sudden fiscal discipline. What I do expect is growing resolution: that debt won’t be paid down, that 3% inflation is the new “low,” that rates aren’t returning to some higher normal, and that scarce hard assets aren’t a temporary trade — they are the trade.

If 2025 was the year of quiet positioning and patience, 2026 feels like the year bitcoin finally sheds the last of its speculative baggage and starts behaving like the core macro asset it has been becoming.

And historically, when that shift happens, bitcoin doesn’t just outperform. It leads.

See you in the new year.