Free Everything (and the Bill Comes Later)

Friday November 7th, 2025 - Issue # 120

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I’m still recovering from the Jays losing the World Series. Absolutely devastating. It’s one of those reminders of what it means to be Canadian these days: full of hope, riding high on potential, and somehow still ending up disappointed.

And just as the sting started to fade, Ottawa rolled out a new budget that felt like déjà vu. Big promises, massive spending, and zero accountability. A record-breaking stimulus package dressed up as “investing in Canadians,” but let’s be honest, most of it will get wasted.

We’re not building; we’re buying time. And the result is obvious: a much weaker Canadian dollar.

Now, if you think that’s just a Canadian problem, look south.

Self-proclaimed socialist Zohran Mamdani just became the new mayor of New York City by running on one simple message: everything should be free. Free housing, free healthcare, free transit, free childcare. A modern socialist platform that apparently sells better than ever.

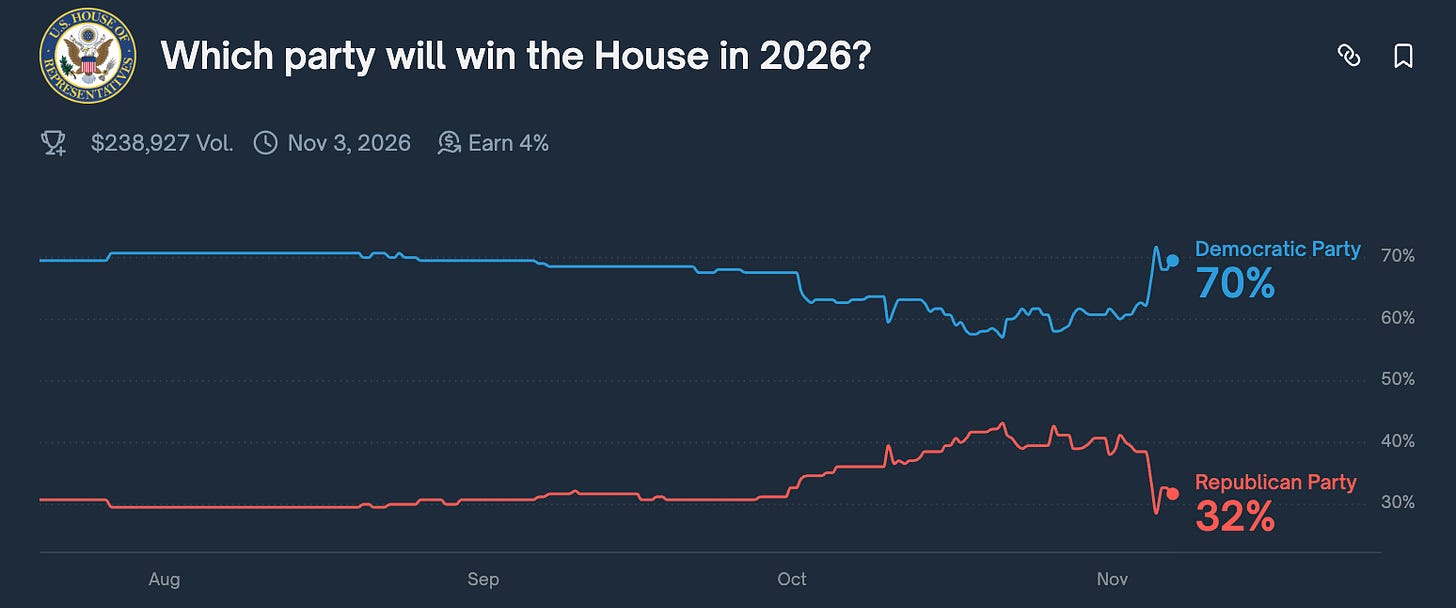

The reaction in D.C. was immediate. Every Democratic strategist saw the same thing: this plays. Polymarket already has the Dems favoured to win the 2026 midterms. Momentum is shifting, and fast.

That means Republicans have a choice: either pull out all the stops, or lose. And in this era, “pulling out all the stops” doesn’t mean cutting spending; it means outspending the other guy. Promise more, spend more, print more.

Fiscal discipline doesn’t win elections anymore. Free stuff does.

But nothing’s actually free. Someone always pays. And it will be the same people who were cheering for the handouts. They’ll get their “free” stuff, and pay for it later through inflation and a currency that buys less every year. They’ll own nothing and be “happy.”

History shows us how this story usually ends. When nations drown themselves in debt to buy social peace, the result is always the same: a self-reinforcing cycle where the empire eats itself.

The government can no longer borrow enough to service its debts.

It prints more money to fill the gap, debasing the currency and driving inflation.

Living standards fall, feeding resentment and political extremism.

Economic instability crushes productivity, and society fractures over how to divide what’s left.

Populists rise promising order, but usually deliver more chaos.

That’s the playbook. We’ve seen it before in Rome, in Weimar, in the late stages of every overextended empire. Each time, the same thing happens: the middle class gets hollowed out, the currency dies slowly, and those holding scarce assets rise from the ashes even richer.

That’s the irony. In trying to buy equality, governments end up engineering the exact opposite. When everything becomes a promise, the only things of value are what can’t be printed: hard assets, property, bitcoin, and freedom itself.

Meanwhile, the Fed looks completely trapped. Powell can talk tough, but the data’s screaming slowdown.

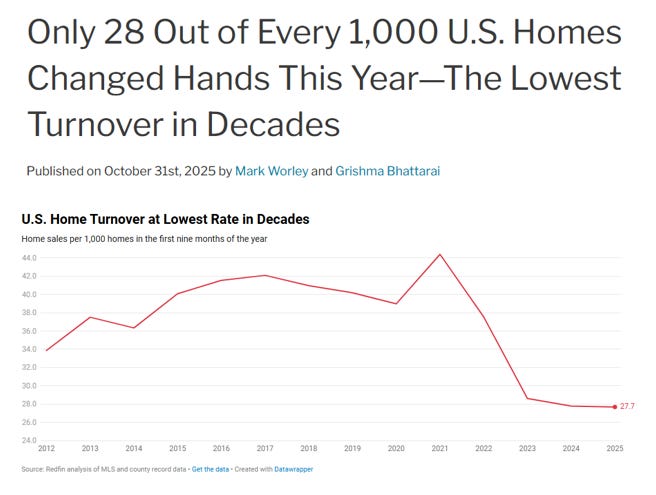

US home sales are on track for their worst year since the mid-1990s. Only 28 out of every 1,000 homes changed hands this year, according to Redfin. It’s the lowest turnover in decades. That’s not a “soft landing.” That’s frozen credit and a middle class stuck in place.

Powell might try to hold rates high a little longer, maybe even to make Trump’s job harder, but unemployment is ticking up, housing is dead, and liquidity is drying up fast. The government is shut down, the economy is slowing, and he’s out of time.

Whether Powell decides to cut in December or not, his term as Fed Chair is coming to an end, and Trump will almost certainly replace him with an ultra-dove. That means rate cuts, QE (or whatever they want to call it this time), and the full embrace of fiscal dominance.

So, zooming out, we’re heading straight into a perfect storm:

Fiscal policy goes full socialist.

Monetary policy goes full dove.

Inflation comes roaring back, not in essentials, but in assets and lifestyle.

That’s the new world order: “free everything” for the masses, and massive upside for the few holding scarce assets. If the middle class was on life support, we just pulled the plug.

But here’s where it gets more interesting.

We’re moving toward a world that looks more like Ready Player One than real life. AI and automation are eating everything. Delivery bots, self-driving cars and trucks, virtual teachers, AI therapists; everything commoditized, everything instant, everything cheap. The average person won’t “work” in the old sense. They’ll receive digital credits, swipe stablecoins, and have cheap fast food delivered to their door by a robot.

And on the surface, it’ll feel like abundance. But it’s not real abundance. It’s dependence — soft totalitarianism wrapped in convenience.

The only true escape will be owning something outside the system. A savings vehicle that doesn’t rely on government permission, corporate servers, or inflationary money.

That’s Bitcoin’s role in the next chapter.

In a world where your income is algorithmic, your “assets” live in the cloud, and your wallet is programmable by policy, Bitcoin becomes the anchor. It will be the way people preserve autonomy, dignity, and optionality. It’s not just the asset of the wealthy anymore. It’s the savings account for those that want to be free.

So yes, governments will keep promising handouts. But those promises come with a cost. And when the bill arrives, the only people insulated will be the ones holding what can’t be printed.

I’ll be at the Economic Club of Canada event with Pierre this afternoon. I’ll report back next week if there’s anything worth noting from his remarks.

Until then, remember: in a world built on free, the scarcest thing left will be freedom itself.

Great letter. The "Brrr" seems inevitable at this stage