Gold has always been the target

Friday November 15th, 2024 - Issue # 88

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Ah, currently posted up on my hotel balcony watching the sun come up over the stunning Bahamian ocean. I’ll admit, I was planning to skip this week’s newsletter—vacation mode, you know? But how could I, when Bitcoin is smashing through all-time highs? Intraday, we’ve even cracked $93,000 USD (or about 130k Canadian mooseknuckles). Sitting here with a mediocre hotel room coffee in hand, I can’t help but think: we’re going to win.

This week, I’m keeping it brief.

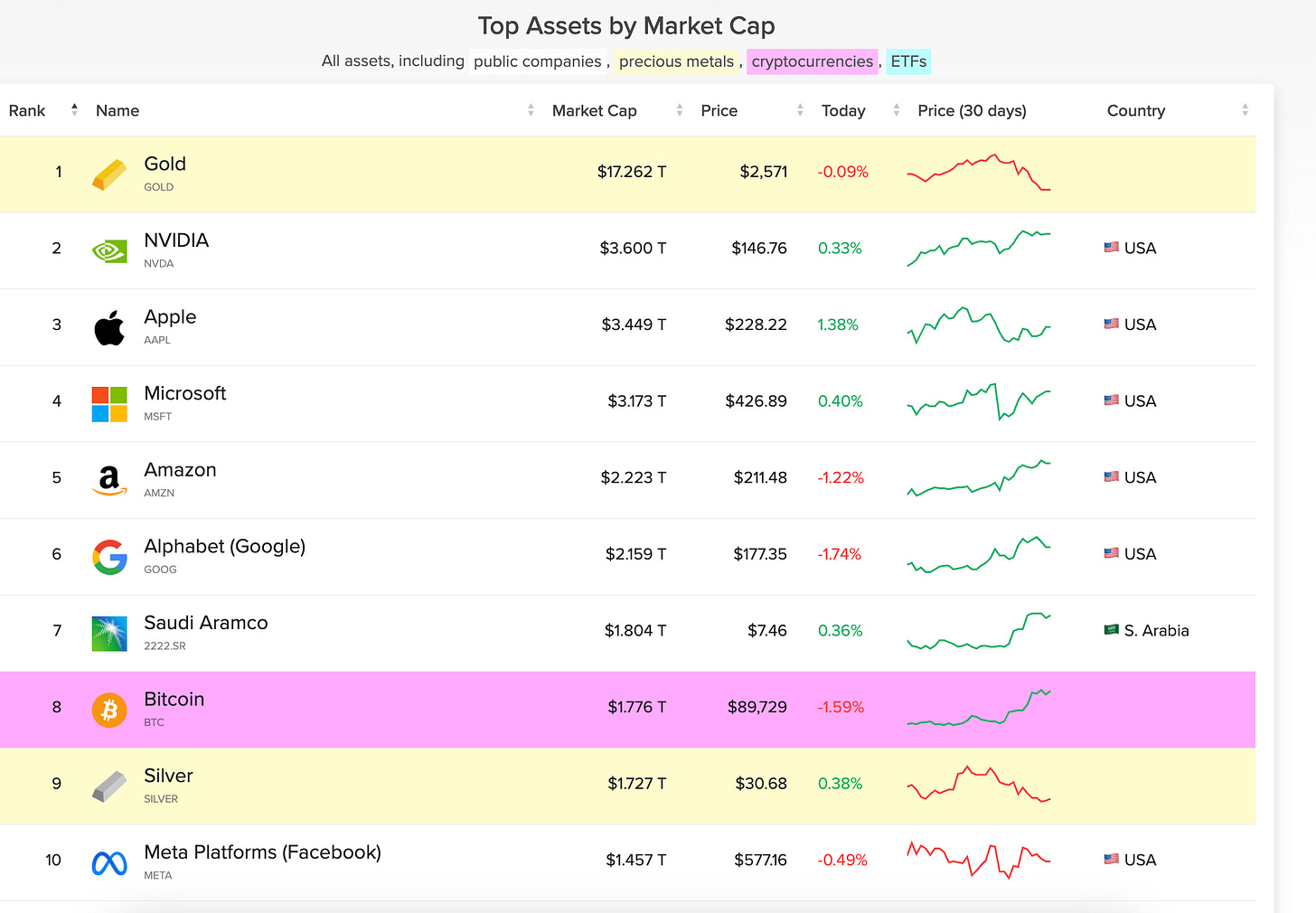

Below is the only chart that matters.

Sorry, goldbugs...I’m baaackk 👀

Gold sits comfortably at number one, with a staggering $17.5 trillion market cap. Nvidia is next at $3.6 trillion, and Bitcoin has just smashed silver to claim 8th place. It’s now within striking distance of overtaking Saudi Aramco to become the 7th most valuable asset in the world.

Let’s take a moment—a historic one, actually: Bitcoin’s market cap has just surpassed that of all the above-ground silver—the noble metal that has served as money for over 4,000 years.

or all the reasons I’ve discussed in past newsletters, Bitcoin will eventually reach gold’s market cap. If you’re new here, the very traits that make gold the most valuable asset on Earth, by multiples—scarcity, trust, and its role as a store of value—are things Bitcoin simply does better. Bitcoin is digital gold, but portable, divisible, censorship-resistant, and with a finite supply immune to manipulation.

Here are my two notes from late last year, much to Peter Schiff’s dismay, where I laid out why Bitcoin is 1000x better than gold in every way.

Let’s do the math. If Bitcoin were to reach gold’s market cap of $17.5 trillion, each Bitcoin would be worth approximately $897,436 USD or $1,260,346 CAD. Funnily enough, in bear markets, I tend to toggle to CAD to make my portfolio feel a bit less grim. But now, for the first time in a bull market, I find myself switching to CAD because the numbers are starting to look pretty wild.

That’s the path to Bitcoin-gold parity. And as I sip my coffee, watching the waves roll in, it’s hard not to believe this is where we’re headed. The climb from here may not be linear, but the destination feels inevitable.

Cheers to the journey. See you at $897k.