Hike fast and break things.

Thursday March 16, 2023 - Issue # 40

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Woah.

This article was mostly done last Friday morning — I was up at the crack of dawn ready to do my best to explain all the hype around Bitcoin ordinals when I checked Twitter and noticed within seconds that I needed to go in a different direction. The next line I had written was “Well, I guess before we see real green, we have to see red — and you don’t have to look too far then, anywhere, really. The markets are a mess.”

We live in a very bipolar world in more ways than one. On one hand, market sentiment swings 180° on a dime stemming from breaking news virality, on the other, we’re watching a slow decay of US power authority, globally. On this note, last week, China brokered an agreement between Iran and Saudi Arabia to re-establish diplomatic ties, which suggests broader signs of a changing global order.

If China is able to do the same between Russia and Ukraine…watch out US reign of domination.

So, obviously, that next line I had written is no longer relevant as the swing in BTC starting over the weekend and into today has everyone feeling alive again. So what happened? Silicon Valley Bank - which specialized in catering to technology companies - was shut down by US regulators who seized its assets on Friday. This marked the biggest failure of a US bank since the financial crisis. Once customers learned that it had been trying to raise money to plug a loss from the sale of assets affected by higher interest rates, they raced to withdraw funds and instead got a crash course in fractional reserve banking.

At that point, all hell broke loose as thousands of companies found themselves in panic mode due to the fact that they had no way to make payroll without access to their funds. We saw virtually every major tech influence and economic thought leader speak out on the situation and demand that the Federal Reserve, Treasury, and government take action to ensure the public that all depositors would be made whole and that their cash balances would be made available to them on Monday. Otherwise, the confidence would be lost in the US banking system which would lead to a catastrophic run on the banks starting Monday.

So, on Sunday, the Fed issued a Joint Statement by Treasury, Federal Reserve, and FDIC.

“The Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.”

On Sunday, it was also announced that Signature Bank was shut down due to apparent systemic risk. In the course of a week, fiat rails in crypto essentially died. There are theories that this was all part of a concerted effort to squash crypto in the US, but I’ll wait on more information to put something together on this another day.

So, after the Fed announced on Sunday that they would be restoring confidence in the US banking system by backstopping (definitely not bailing out) banks to ensure all depositors are made whole, tech in the US was able to breathe again.

I found this tweet particularly funny ^.

As expected, bank stocks got hit hard on Monday and we wound up with this beautiful picture:

And headlines like this:

Hike fast and break things.

In the 2020-2021 period, the Federal Reserve forecasted low interest rates, which led banks to purchase bonds based on that guidance. However, a sudden and historic rate hike cycle caught them by surprise, resulting in significant losses as banks were squeezed to convert their loans and securities to cash in order to fund customer withdrawals who were pulling cash en masse for higher yielding products (ex., money market funds). Why they didn’t hedge this risk is beyond me but, it could simply be that they believed the cash was stickier than it really was. SVB’s situation, in particular, is interesting in that the bulk of their clientele were VC-backed startups and in a 0% interest rate environment when these companies were raising massive amounts of capital, their deposits grew very quickly. Perhaps they thought their book of business was well diversified, but when the same few VCs advised their portfolio companies to pull their treasuries for higher-yielding accounts as interest rates shot up, the bank wasn’t prepared. It wasn’t a client base of 1000 customers with $10mm in each account, it’s one big conglomerate of accounts with $10bn.

In the US, there were international standards that were meant to address this risk, but they were only implemented for a very small number of the largest internationally active banks. So medium-sized regional banks such as SVB, Signature, etc., were able to resort to an accounting trick by transferring their assets to "hold-to-maturity" (HTM), which allowed them to overlook the loss and show that they were still financially stable. Unfortunately, after Silvergate Bank’s collapse earlier this month, and then Silicon Valley Bank, this strategy proved short-lived, as it only lasted until the threat of broader bank runs occurred.

The Fed’s response to this crisis is a new facility called the Bank Term Funding Program (BTFP) — what the crypto market heard instead was BTFD. This program was put in place to encourage banks to come to them with any of these sorts of problems with their balance sheet where the Fed can step in and provide funding against the face value of any of these bonds rather than the market value. Sounds like a pretty good deal to me.

It is not a good thing that the Fed felt that they had to announce that they would backstop all deposits. I mean, they didn’t have much choice as they needed to stave off a massive bank run, but it is quite scary that they had to do this. It will be interesting to see which banks will take advantage of this new program and if the Fed is prepared for the potential that a lot more come to this window than they might expect. JP Morgan issued a statement saying that the Federal Reserve’s emergency loan support, BTFP, can put in as much as $2 trillion of funds into the US banking system to help the struggling banks and ease the liquidity crunch.

In other “not a bailout” news, Credit Suisse, which looked like as of yesterday that they might not make it, was thrown a ~$54bn lifeline by the Swiss central bank.

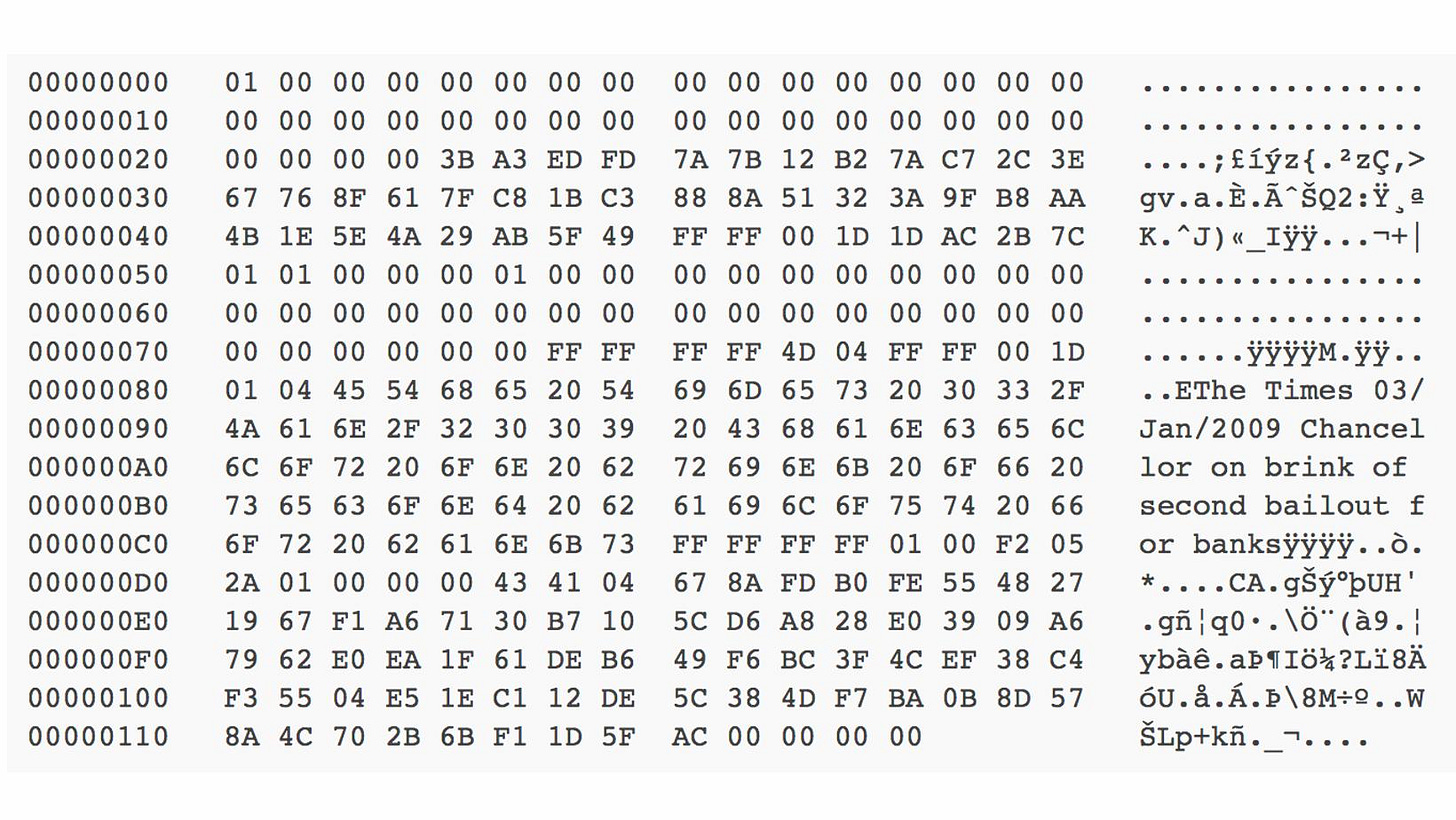

On Jan. 3, 2009, Satoshi left a message in the code of the first bitcoin block. It was a headline from British newspaper The Times:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

The front page of Monday's edition of the The Wall Street Journal:

Bitcoin was made for this.