HODLers Of Last Resort

Friday December 8th, 2023 - Issue # 57

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good afternoon!

It’s been a very interesting last few weeks. It has been a blast watching Bitcoin take off to levels not seen since March 2022 when we were bleeding down from all time highs in November 2021. I’m not sure that’s actually the right way to look at it, or at least, it’s not the most positive view, in hindsight. Really, we should be considering the last time, in a bull market, that we were at these levels and that was early February 2021 — a few months shy of 3 years ago. Here’s what I was writing about back then:

Bitcoin Closes In On $50K After Tesla Announces $1.5B Purchase!

BTC Cracks $50K; Supply Crisis!

Aw, I was so excited. I vividly remember waking up in LA to check my phone (first thing anyone has to do in a bull market) and seeing the news that Elon Musk purchased Bitcoin. I think I actually cheered, like out loud…by myself.

The point I’m trying to make is that this time is very different. Satstreet has around 1000 clients (HNWIs & corporate accounts), which has been built up since we started in the summer of 2020. We have an experienced sales team that takes a proactive approach to business development. In bull markets, more time is spent delivering unparalleled support to current clients and to new accounts (inbound), and less time is spent going out there and bringing on new accounts (outbound). In bear markets, it is the complete opposite — we focus on making sure our current clients are happy and well serviced, and we spend the majority of the time educating affluent individuals and corporations on Bitcoin in hopes that we’re top of mind for when they’re ready to get off of 0% exposure.

I’ve been doing this for just over 6 years, meaning I saw the 2017 bull run and the two-year bear market that followed, and then the bull run in 2021 followed by another two-year bear market. You’re all lucky that you have a life outside of crypto — bear markets are really tough to grind through. Apologies, I’ll get to the point.

The point is that net new retail (at least our version of retail — accredited investors) have not showed much interest in crypto at all this year. We’ve been speaking to folks every day for the past two years who are all bullish on Bitcoin “long-term” but are “waiting to see what happens.” The sentiment has slowly started to rollover, and we’re getting more calls answered, calls back, and getting replies from emails sent months ago. Luckily for these folks, they’ve got their new “crypto guys” keeping them informed, and they’re noticing that we might be onto something.

Google search trends is a common tool used to gauge the level of interest (fomo) — Bitcoin is up over 150% this year and trading $43.5k and this is what google search trends for Bitcoin look like today.

The average person is not paying attention. We have gone almost 3x from the November 2022 bottom and the trend shows no signs of euphoria. I’ve been thinking about this for a while now, and I have a lot of conviction that retail doesn’t start paying attention until we break the previous all-time high.

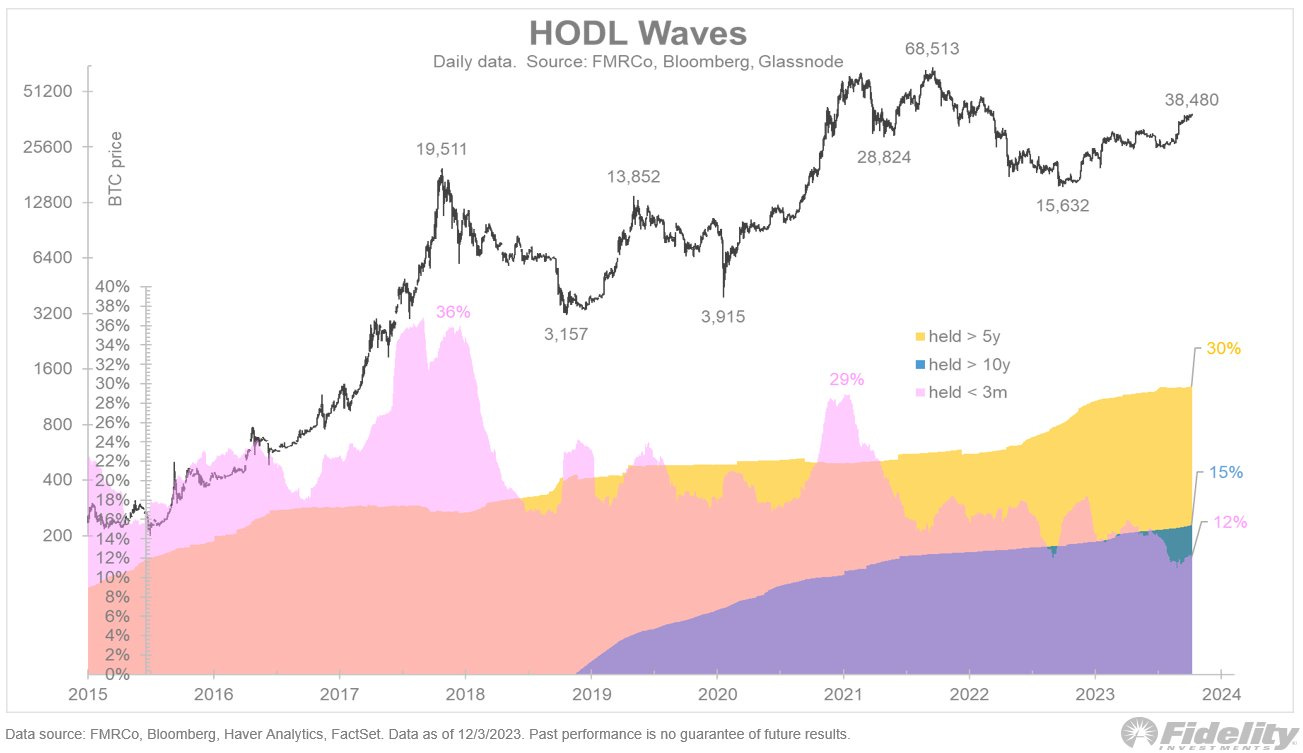

I could go on and talk about what happens from there — media picks up, coinciding with ETF approvals, halving, Bitcoin commercials from all the major asset managers that now have a product to sell, etc, etc, — but as the title suggests, I want to briefly touch on a notable chart:

The percentage of Bitcoin held for at least five or even ten years continues to grow. These are the true believers, and my guess is that they aren’t looking to sell any time soon. In fact, when I speak to investors who are so caught up in price action, I always ask would you sell at $100k? The answer is almost always “no.” When I ask what price they would be willing to sell their coins, the answer is usually “never.”

This wave of Bitcoin holders, let’s call them, the HODLers of last resort, have been steadfast in retaining their Bitcoin since late 2020, resisting the urge to sell despite the 2023 bull run. Supply is more tightly held than ever before. Accumulation is ongoing; supply distribution from HODLers (selling) is unlikely to occur until the price discovery phase, as is tradition.

HODLers form parabolic distributions, as evidenced by the data. Meanwhile, the accumulation of assets and resulting supply constriction persist.

There’s just not that much Bitcoin out there and I think that will become very evident as the ETFs launch.

If you can’t tell, I’m pretty excited.

Have a great weekend.