I Wasn’t Supposed to Stay This Long in El Salvador...

Monday December 1st, 2025 - Issue # 121

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Alright guys, I’m back. Apologies that it has been a few weeks since I’ve put something out — honestly, I didn’t expect to get so many messages asking when I’ll be back or if I’m still alive but here we are and appreciate the concern 🙏. I’ve been in El Salvador for the last while…what was supposed to be a much shorter trip ended up being a much longer trip (thanks to my fiance for being so understanding). No, it’s not because I wanted to leave Toronto when the weather was still in the double digits and miss as much of winter as possible. No, it’s not because the steak here in El Salvador is amazing and it’s 30 degrees and sunny everyday (although both helps). It’s because El Salvador is one of those rare places where you fly in thinking you’ll split your days between meetings and catching up on work, and then you just get dragged into all the momentum.

There’s too much happening here, and the contrast against back home is too sharp to ignore.

So please be assured, I have not been hiding out with bitcoin down massively from the highs. See, everyone in North America feels like they’re waiting for the next shoe to drop — the Fed, tariffs, deficits, midterms, whatever the flavour of uncertainty is this week. But here in El Salvador, in a country that the world spent decades writing off, it feels like you’ve stepped into a different macro environment altogether. The energy is the opposite of everywhere else. It’s not cautious. It’s not anxious. It’s not confused. It’s building, expanding, and moving forward while the rest of the world feels stuck in a loop of political and economic noise.

When I wrote “El Salvador: From Dangerous to Dream Destination” earlier this year, I thought I had captured this trajectory fairly well. Looking back, I undershot it. That became even more obvious last week when Satstreet ended up in the largest newspaper in the country. George McBride, our Managing Director of Satstreet El Salvador standing next to our logo, under a headline about the great work we’re doing here. You don’t get that kind of visibility because of hype. You get it because the flows are real. Investors are coming. Deals are happening. Capital is moving into this country at a pace nobody would have believed just a few years ago.

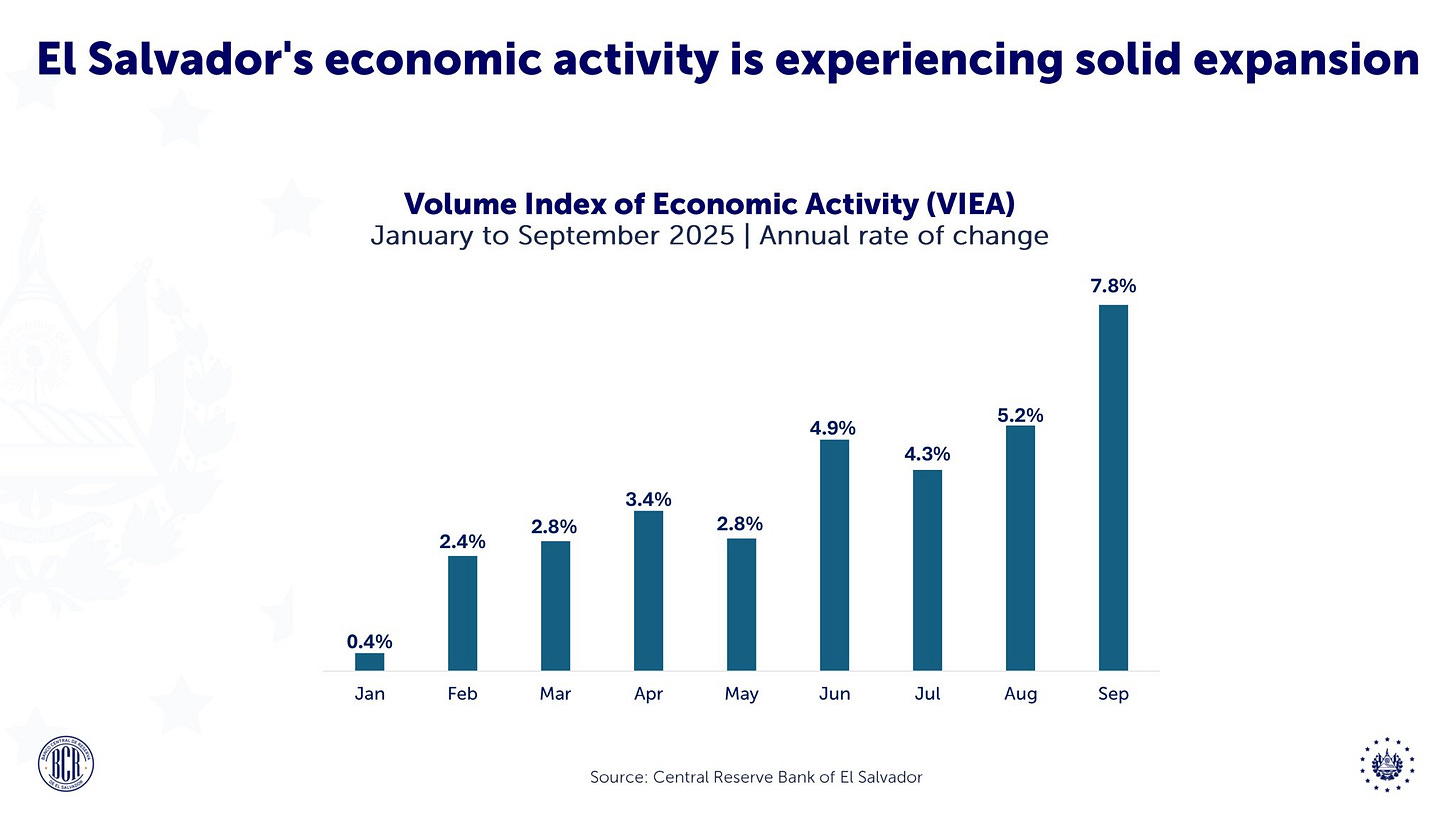

And the numbers back it up in a truly impressive way. In 2019, El Salvador had 2.9 million international visitors. In 2024, it hit 3.9 million. Tourism revenue has nearly doubled in five years, from $1.76 billion to $3.41 billion. The average daily spend per tourist jumped from $107 to $153. For a country of 6.4 million people, that’s transformative. Almost one tourist for every resident. And for the first time ever, El Salvador is attracting more international arrivals than Costa Rica — a country that has had a multi-decade head start in tourism branding. This isn’t luck. It’s strategy. It’s security. It’s execution.

This was a picture taken from the San Miguel Carnival on Saturday where there was a record ~2 million people in attendance enjoying the celebration, in peace.

Surf City alone has become a case study in how to rebuild a country’s international image. Hosting global surf competitions, positioning itself as a Pacific surf capital… it’s brilliant. But what’s more impressive is that 80% of visitors are now staying overnight, which means people aren’t just passing through, they’re engaging with the country. They feel safe. They see the opportunity. They come back. And the government is already projecting another record year in 2025 (4m+ visitors).

But what has stood out the most on this trip has been the seriousness of the entrepreneurs and investors who are now building here. I’ve been in meetings with founders working on real-world asset (RWA) tokenization, infrastructure financing, bitcoin-native credit structures, and business models that simply wouldn’t get off the ground in Canada or the US. The conversations aren’t hypothetical — they’re funded, they’re being executed, and it’s all happening now.

What’s making this possible is the regulatory clarity the country has put in place. The National Commission of Digital Assets (CNAD) deserves credit here. They’ve built a framework that gives builders an actual path to issue digital assets backed by real cash flows or real infrastructure. It’s clean, it’s understandable, and it’s attracting the right kind of projects — the kind that would get bogged down for years elsewhere. You can feel the impact on the ground. The pipeline forming here is real, and it’s drawing in people who want to build substantial, long-term businesses rather than chase trends.

And if you want to understand this shift firsthand — the builders, the capital, the momentum — the perfect moment to come down is in April for the Digital Asset Summit (DAS). It’s shaping up to be one of the most important events in the global crypto calendar, and it’s exactly the kind of forum where you can see the country’s strategy up close, meet the people driving it, and understand why so much serious capital is paying attention.

I also want to highlight the work happening at the Bitcoin Office under Stacy Herbert. You really feel its impact when you’re here. The country is attracting a very high caliber of people across critical industries like AI and healthcare…founders, engineers, operators, and investors who aren’t here to “check things out,” but to genuinely explore building in a place that’s aligned with them.

Bitcoin Histórico, the event the Bitcoin Office organized, was actually the reason I came down on this trip. It was a curated, and extremely high-quality gathering — the kind of room where you don’t have to sift through noise because everyone there is already serious. Events like that compound over time. They create gravitational pull. And you can see it happening here: El Salvador is starting to function like a real hub, not because of marketing or hype, but because the right people are choosing to show up.

Here’s the view, pre- “conference” at the Presidential Palace. Looked way cooler at night.

But the real story isn’t just the Bitcoin bet or the surfing beaches. It’s geopolitical.

For the first time in decades, Washington is looking south again, and it’s moving fast. In October 2025 the US Treasury quietly bought $20 billion in Argentine pesos to keep a key ally afloat. Military exercises involving 25 countries just wrapped up in the Pacific. New trade frameworks are being inked from Ecuador to Guatemala. Latin America suddenly matters again — for energy, for manufacturing, for the simple fact that most migrants crossing into the United States start their journey somewhere on this continent. And sitting right in the middle of the new chessboard is El Salvador.

A country of 6.4 million people has somehow become one of Washington’s most reliable partners in the hemisphere. Nayib Bukele gets invited to the White House, signs nuclear cooperation deals, and, in what might be the most unprecedented migration agreement in modern history, agrees to take not just Salvadoran deportees but anyone the US wants to send, housing them in the infamous CECOT mega-prison for a modest fee. In a region full of chaos, El Salvador has become the rare “anti-chaos” jurisdiction: stable, aligned, unmistakably pro-American.

Yet walk through San Salvador’s boulevards and you’ll spot the other player too. Chinese restaurants keep popping up. New BYD dealerships gleam under the tropical sun. Construction sites for a national stadium, a pier at La Libertad, a giant water park in Surf City, all stamped with the quiet red logo of Beijing-backed firms. Trade tells the same story: in the first five months of 2025 alone, El Salvador imported more than $800 million in Chinese machinery, textiles, and electronics. The old diplomatic switch from Taiwan to Beijing in 2018 is still paying dividends in infrastructure, in soft-power scholarships, in visas that make it easy for Chinese managers and technicians to set up shop.

Two superpowers, one tiny country. Most nations in this position get squeezed. El Salvador is getting courted.

When both Washington and Beijing decide you’re worth their time, the tailwinds are ferocious. Capital flows in. Concessions get offered. A leader who plays the game well can extract things like debt relief, investment packages, and diplomatic cover that bigger countries can only dream of. That’s the quiet privilege El Salvador enjoys right now. A front-row seat to the new Great Game, with the best surf in Central America as a bonus. I, for one, am glad to be here watching it unfold.

And all of this is happening at the same time that North America feels more chaotic than ever. Canada continues to punish capital with tax policies that push out the exact people it needs to keep. The US can’t afford a recession in the middle of an AI arms race, so it’s leaning deeper into deficit spending. Everyone is improvising. Everyone is reacting. Everyone is trying to keep a system from wobbling off its axis.

El Salvador is one of the only countries playing offense. Not just with bitcoin, but with policy clarity, tourism, security, investment strategy, and long-term nation building.

De acuerdo.

It’s funny, because people think El Salvador is selling Bitcoin. But what they’re really selling is certainty. And in a world where economic certainty is disappearing, that becomes incredibly valuable. You can feel it in the investors flying in. You can see it in the cranes going up along the coast. You can measure it in the tourism numbers. You can track it in the tokenized capital inflows coming next.

Most people won’t understand how big this moment is until years from now. By then, it’ll be obvious. By then, every country will be trying to replicate this playbook. But right now, this very moment, is the inflection point.

I wanted to get this out before I fly to the Bahamas in a couple of days (I know, I know). The world is getting noisier. El Salvador is getting clearer. And for the investors paying attention, the next decade will be defined not by what you invest in, but by where you invest from.

Más por venir.

Hasta la próxima.