Intra-Week Note: Saylor’s STRC Flywheel?

Monday October 6th, 2025 - Issue # 117

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

A few notables on X are screaming about this thing called STRC 0.00%↑ which apparently, it’s the reason bitcoin is about to “go to the moon, bro.” STRC is a new product from Michael Saylor’s company Strategy (formerly MicroStrategy). You might’ve seen the tweets: “when STRC hits $100, Bitcoin goes brrr.” It was kind of the meme of the week for those in the corners of X, but underneath the hype, there’s something worth understanding.

I thought it would be helpful to put together a quick note for you all to share my learnings after going down the rabbit hole in between Jays games this past weekend.

Stretch (STRC) is a variable-rate preferred stock (basically a hybrid between debt and equity — that pays a floating monthly dividend). Think of it as investors lending money to the company in exchange for steady yield and priority over common shareholders — they get paid first, but don’t get voting rights or the upside if the stock rips. It trades around $100 and currently offers an effective yield of about 10.3%. The dividend adjusts depending on short-term market rates to keep the price near par. It’s Saylor’s way of creating yield-backed Bitcoin exposure without touching the banking system. Is this a stroke of genius or something that will end badly…let’s keep going.

Saylor’s goal here is simple: keep buying Bitcoin without having to sell MSTR shares or issue more convertible debt. STRC lets him raise capital directly from yield-hungry investors and redeploy it into Bitcoin. He’s basically building his own BTC-backed credit system inside his company. He even called STRC their “iPhone moment.”

To really understand how this fits into Saylor’s structure, here’s where STRC sits in Strategy’s capital stack.

Click pic below to hear Saylor explain STRC.

The reason for all of the noise last week was because Robinhood just listed STRC, making it available to millions of retail accounts and giving birth to what CT is calling the “flywheel.” Preferred shares have historically been an institutional product. Now anyone can earn ~10% on something that’s indirectly tied to Bitcoin’s balance sheet — and that got Crypto Twitter’s imagination running wild.

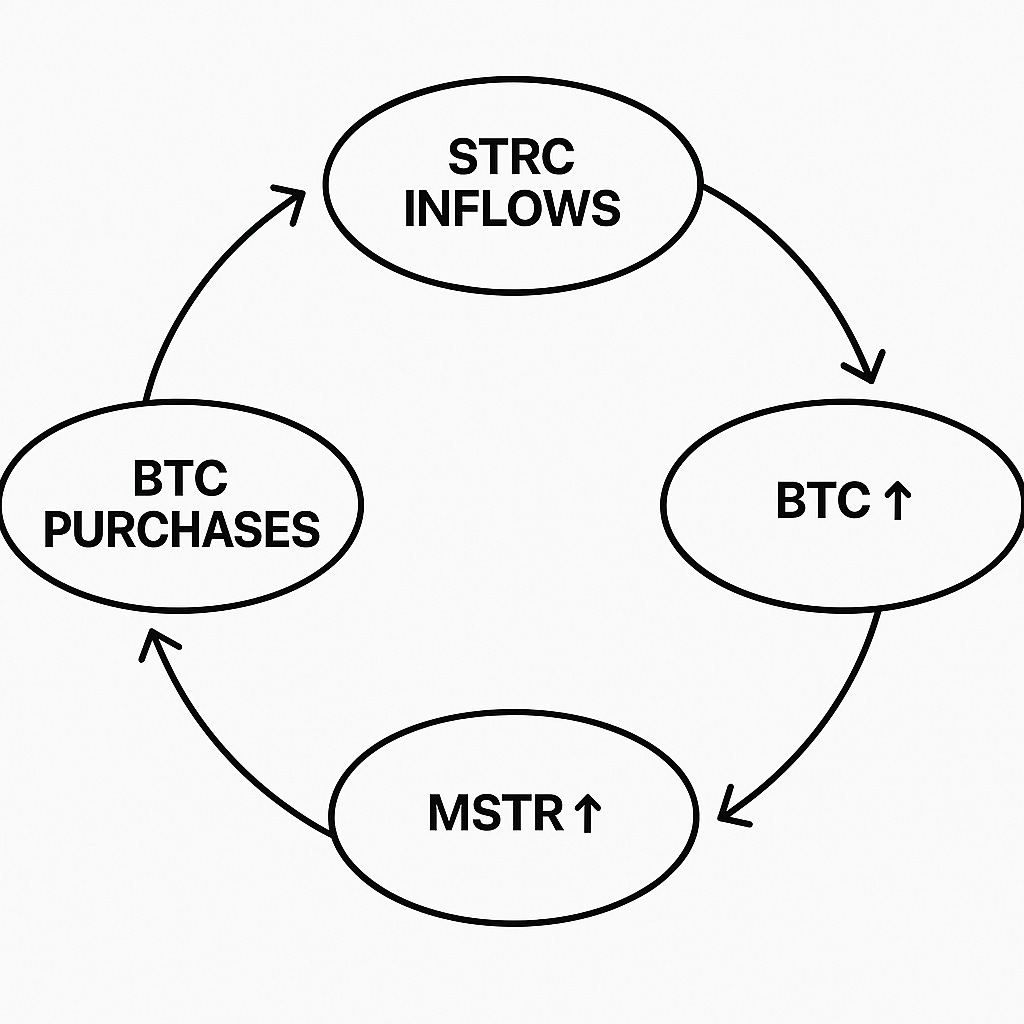

The “flywheel” narrative that’s spreading across X goes something like this: people buy STRC → Strategy raises new capital → Saylor uses it to buy more Bitcoin → Bitcoin’s price goes up → everyone feels richer and buys more STRC → repeat.

It’s a self-reinforcing loop that, *if it scales*, creates real new demand for BTC. If Strategy raised $1 billion through STRC, that’s equivalent to roughly 22 days of new BTC supply at $100K/BTC. That’s not game-changing by itself, but when you’re dealing with an asset that only adds 450 coins a day, every marginal buyer matters.

As someone who’s been in crypto for 8 years (next Friday) I think it’s important to be very skeptical. STRC isn’t treasuries, it’s not a money market fund, and it’s definitely not risk-free. Holders are lending money to Strategy, a company whose balance sheet is almost entirely bitcoin. If BTC has a blow off top style correction like we’ve seen in every previous cycle (say, 70%+), the Strategy’s credit profile would shift dramatically. And that “near-par” design around $100 that Michael Saylor spoke so eloquently about in the clip above? It’s totally engineered and definitely not guaranteed.

But even with that risk, the yield gap versus traditional assets is striking.

The reality is, STRC sits somewhere between a corporate bond and a crypto-backed yield product. It’s innovative, yes, but it’s still a bet on Saylor’s ability to manage a levered bitcoin balance sheet.

And while all of these new structures — from ETFs to Saylor’s preferreds — are clever ways of deepening bitcoin’s integration into traditional finance, they also add layers of complexity and counterparty risk. The whole point of bitcoin is that you can hold it directly, move it instantly, and access liquidity without permission. Every time a new wrapper is created, you gain convenience but lose some sovereignty. Owning BTC outright is still the purest form of protection against volatility, dilution, and someone else’s balance sheet.

So, objectively speaking: STRC is a smart piece of financial engineering, not a magic button that sends Bitcoin to the moon. It’s another step in the evolution of “bitcoin finance,” the blending of corporate balance sheets, traditional yield instruments, and decentralized assets.

Whether this becomes a lasting innovation or just another speculative moment, it’s undeniably creative…and it captures where we are in the cycle: yield hunger meeting bitcoin.

A quick note before I wrap this up:

I don’t own any STRC, don’t plan to, and this isn’t investment advice. I just spent the weekend digging into it and figured it’d be useful to share my notes — partly for my own understanding, partly because it feels like one of those subtle inflection points where TradFi meets bitcoin in a new (and maybe dangerous) way.

It’s Saylor doing what Saylor does best — using the system to buy more BTC — and the market proving once again that if you give people yield, they’ll find a way to show up.