King Kong Cut

Friday September 20th, 2024 - Issue # 82

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Argh, I had this whole piece ready to go comparing El Salvador to Singapore and Dubai, but the Fed went Supersize Me on the cut… so that’s parked in drafts for when things simmer down a bit.

Wednesday, the Fed unleashed a massive 50 basis point cut, and if this feels like a déjà vu moment, it’s because it is. It’s eerily similar to the flip side of December 2021 when the market was in denial about the start of the rate hike cycle. Now, instead of bracing for rate hikes, we’re facing the start of what could be a lengthy easing cycle, and risk assets are already ripping.

“The US economy is in a good place and our decision today is designed to keep it there,” said Fed Chair Pay Powell during the press conference.

So a crisis-level 50bps rate-cut at record highs for stocks and home prices, just two months ahead of the election is warranted because the "economy is in a good place." Makes sense. Thankfully the move is definitely not political at all.

Rabobank thinks otherwise. If you have time to read the report, you should, if not here’s the TLDR: Powell had a clear incentive to deliver a 50 bps cut before Election Day, because Trump has already made clear that he would not reappoint him as Fed Chair.... So Powell’s only chance of another term is by pleasing Kamabla Harris and her fellow Democrats.

The lesson here? Don’t fight the Fed. I learned that the hard way last time around, thinking, “They can’t raise rates that much,” while buying my first house on a variable mortgage. It was actually worse than buying a house at the pico top, before the first rate hike in Canada. I actually borrowed money for part of the down payment instead of selling some of my crypto portfolio which was up many multiples because I thought we were going to the moon, bro. So, while I watched my mortgage rates and my portfolio run away from each other, I told myself this would be the last time I duke it out with central banks.

I think this is probably the Goldilocks moment. The Fed just cut 50 bps and hinted at another 50 by year-end. The economy is still resilient, with disinflation taking hold, and we have a government running 6% deficits. There’s $6 trillion in money market cash sitting on the sidelines, earning less and less, and that money is going to need to find a new home.

Fun Fact

In the last 40 years, the Fed has cut rates 12 times when the S&P 500 was within 1% of its all-time highs. Each time, the stock market was higher a year later, with an average return of 15%.

Moving on.

Our new friends over at BlackRock has just released a fresh research report on Bitcoin, and their stance is unmistakably bullish. The report describes Bitcoin as a “scarce, non-sovereign, decentralized asset,” framing it as a unique investment in today’s financial landscape. This characterization plays into the narrative of Bitcoin being a hedge against uncertainty, with BlackRock highlighting how it serves as a “flight to safety in times of fear and uncertainty.”

The report also emphasizes Bitcoin’s trajectory being “driven by the intensity of monetary stability concerns.” In other words, as central banks and governments continue to grapple with economic instability, Bitcoin’s appeal only strengthens. They point out the “inverse relationship” that Bitcoin generally shares with traditional risk assets, suggesting that as market uncertainty rises, Bitcoin has the potential to thrive in environments that challenge conventional financial markets.

Click below for report (reminder, pretty much every graphic in these notes are clickable):

I’m a big fan of this chart found in the report…

It really speaks to me. Every time I look at it, the question that pops into my head is, “How many X’s are we going to get this cycle?” Honestly, I’d be happy with a 2-3x, which would put Bitcoin around $190K. And I’m not claiming to be a chart expert, but from what I’m seeing, there’s potential for it to go much further.

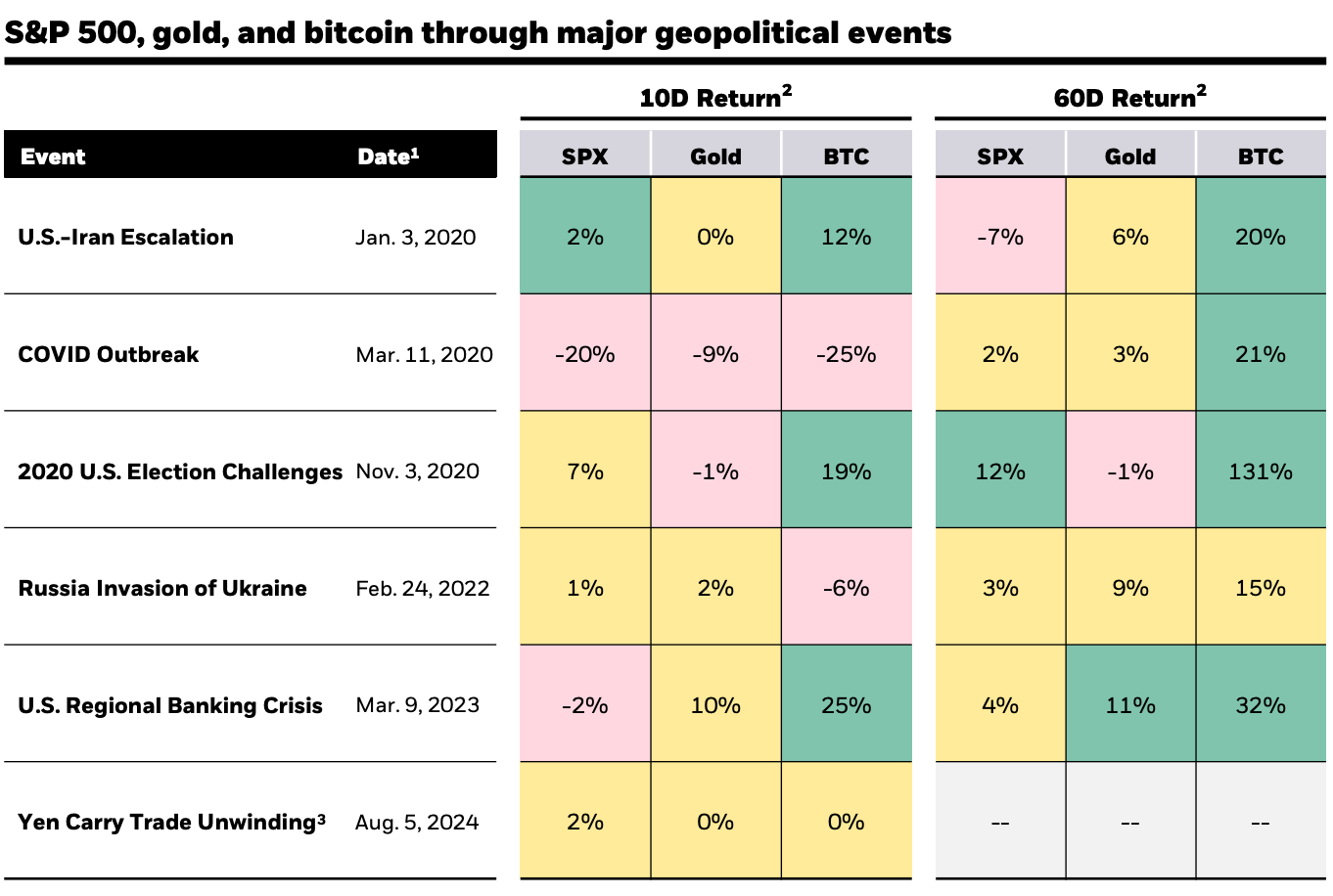

I also like this one:

"As the global investment community grapples with rising geopolitical tensions, concerns over the state of U.S. debt and deficits, and increased political instability around the world, bitcoin may be seen as an increasingly unique diversifier against some of these fiscal, monetary and geopolitical risk factors investors may face elsewhere in their portfolios."

In summary, with risk assets primed to rip and an unprecedented amount of liquidity about to re-enter the market, it’s simple: don’t overcomplicate this one. We’ve seen this play out before. Stocks and Bitcoin are both ready to take off. And let’s not forget, FTX will be redistributing billions to creditors in Q4—most of which is likely to flow back into crypto. This is going to be a liquidity-fueled run, and it’s only just starting.

Here’s Trump handing out burgers he bought with BTC at a bar in NYC this week.

Have a great weekend!

Weekly podcast recommendations

Must watch ⬇️