KISS

Friday November 17th, 2023 - Issue # 55

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Well, we’re officially back to the “too excited to get a full sleep” phase of the market cycle. I’m straying away from the gold bashing this week as I’ve had too many conversations with investors who are still at 0% exposure but are ready to make an allocation “sometime soon.”

Sometime soon: I’m trying to time the market — I think we’re going lower — I’m enjoying 5% in my Money Market Fund — I think there will be a recession — I’m not interested but don’t want to disappoint you, Mike.

Aside from the last point, which is fair enough (but just tell me!), the rest of those thematically specific definitions all run the risk of being too smart by half — as our good friend Greg Foss would say.

At this point, there’s no good excuse to have 0% exposure to Bitcoin. I’ll highlight a few points below and expand on them a bit afterwards. Here’s what the next 12 months looks like:

90% chance that multiple spot Bitcoin ETFs will be approved in the US (I believe this could happen in the next month or two)

Possible rate cuts and easing in the US starting as soon as March

US presidential election

That’s a lot of stuff in not too much time, and even though Bitcoin is the best performing asset this year and up ~120%, we’re still nearly 50% off all time highs.

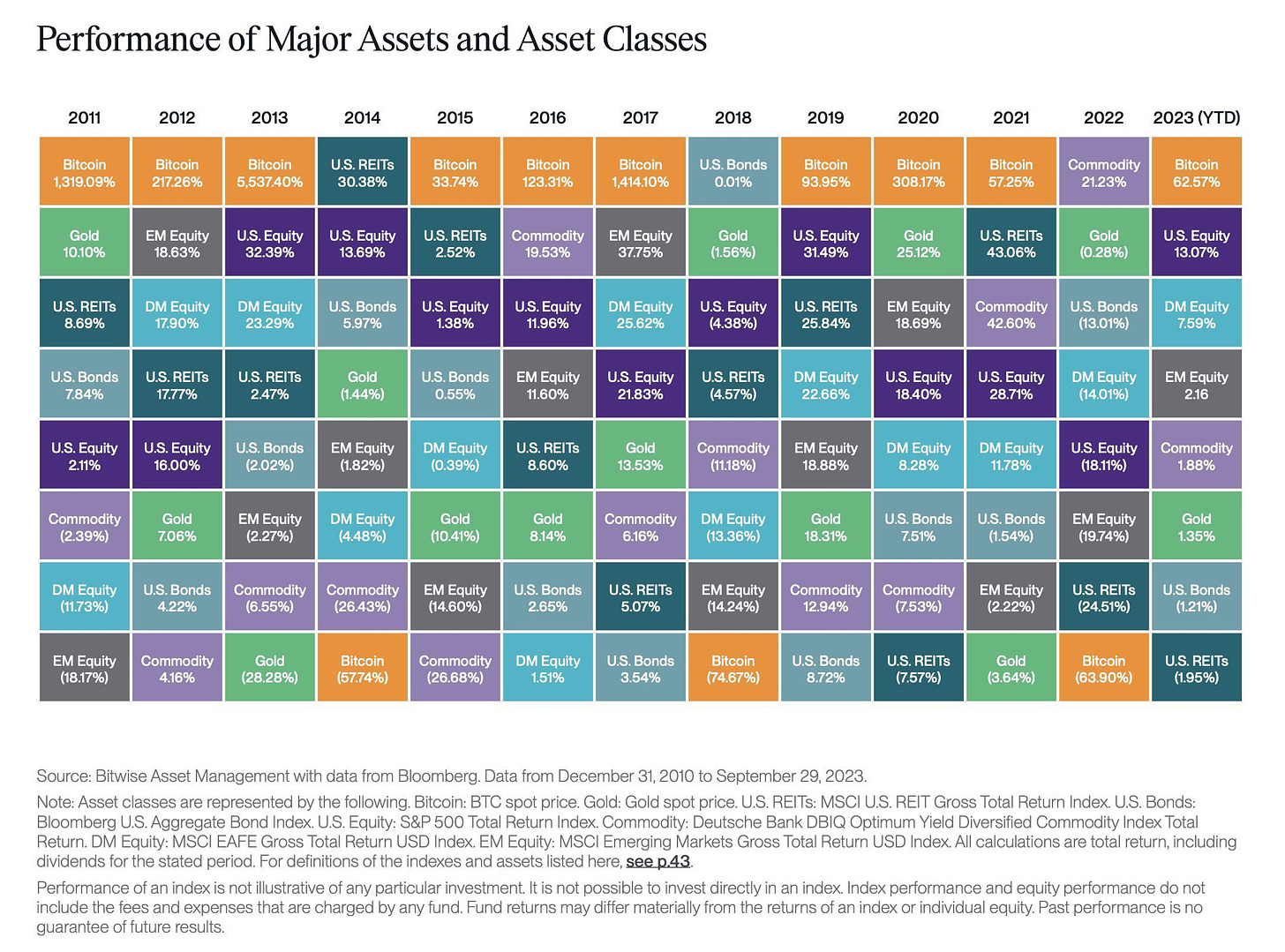

Here’s a visual on why being too picky on entry prices might not make sense.

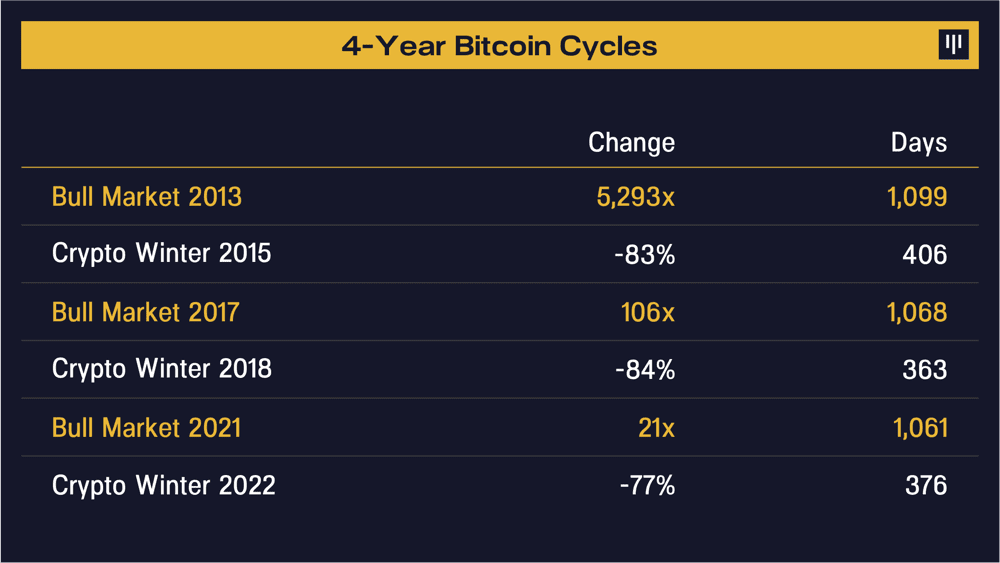

Here’s another that double-clicks on Bitcoin.

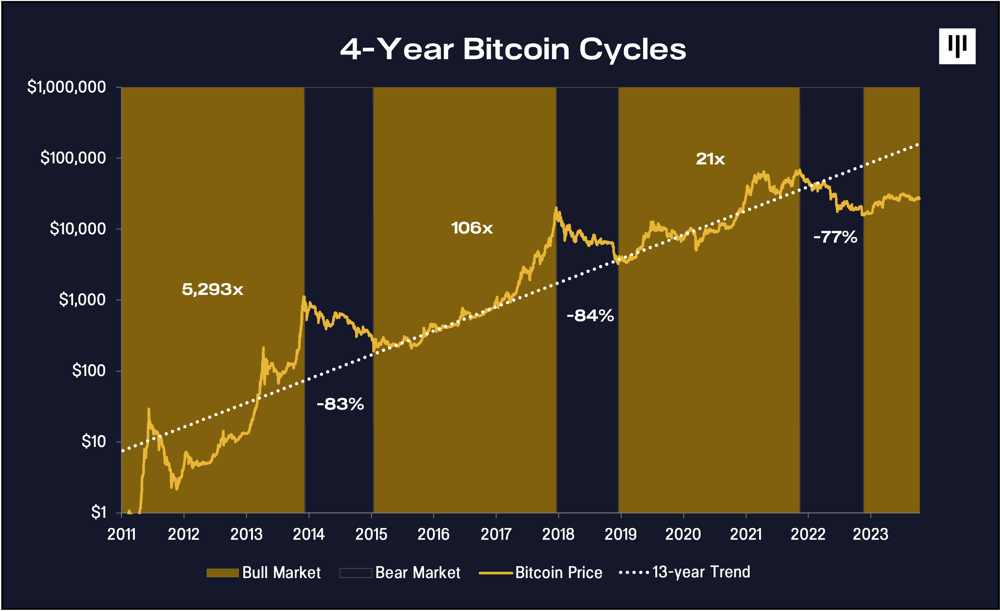

Here’s one for folks that like lines.

Whether they have a position or not, everyone seems bullish on Bitcoin long-term. I speak to sophisticated investors all the time that have $100k++ price targets looking out 12-24 months. Is there really that much of a difference between buying at $36k versus waiting on a big pullback that may never come to $30k, $25k? I don’t really get it. I would be tripping out right about now if I wasn’t comfortable with my allocation.

A spot Bitcoin ETF approval would add a whole other layer that I’m personally very interested in seeing play out.

Up to this point, retail has been the primary driver of capital flow into bitcoin and the broader crypto market. Retail is a tiny market when you think about it, with Bitcoin already sitting at roughly half of its $1.4 trillion market cap. I think that is going to change in a big big way.

“Retail” is a relatively insignificant fraction of the vast majority of wealth that is managed by financial advisors and institutions in the US. A Bitcoin ETF unlocks 10’s of trillions of dollars held by these institutions and gives money managers something in the fiat world that they are comfortable with. When BlackRock, Fidelity, and others start advertising their Bitcoin ETFs alongside new cycle price appreciation instigating the next wave of FOMO, financial advisors will be getting the same calls they’ve been getting for years, but this time, they will have a solution — a solution they can get paid on to boot.

This is all well and nice, and should bring in 10s of billions, but there’s something much bigger to consider... managed portfolios are MASSIVE. They’re the products that branch financial advisors sell to you based on a questionnaire about your risk tolerance. The 60/40 portfolio is well-known, and depending on risk tolerance, can be more weighted to equities vs fixed-income, and vice versa. These funds can be called “Balanced Funds”, “Growth Funds” and they have many other names. They’re essentially the easy button of products for financial advisors to sell to their clients. Anyway, there is a massive amount of capital tied up in those funds and I don’t hear enough chatter about the probability of them adding exposure to bitcoin in the form of their own ETFs.

Fidelity Investment’s Canadian arm (tiny compared to US business) is already doing this in Canada.

Once the ETF gets added into model portfolios at 1% + people are going to realize there’s just not enough liquidity out there for the amount of money that will gradually come into these ETFs. The market is going to be dealing with a lot of money that’s going to be trying to go through a very tiny door — and that door are these Bitcoin ETFs.

Don’t overthink it.

Keep It Simple, Stupid.