No Appetite for Austerity

Friday May 30th, 2025 - Issue # 105

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Well hello again, and happy Friday to you all! And if you are an FTX creditor, it’s an even better day as FTX will start distributing $5B+ in stablecoins today — I suspect a good amount of that dough will find its way back into the market.

Aside from celebrating new all-time highs in the Amalfi Coast, I don’t think we missed all that much that I can’t catch up on this week, so I feel like I picked a good time to get away for a little R&R.

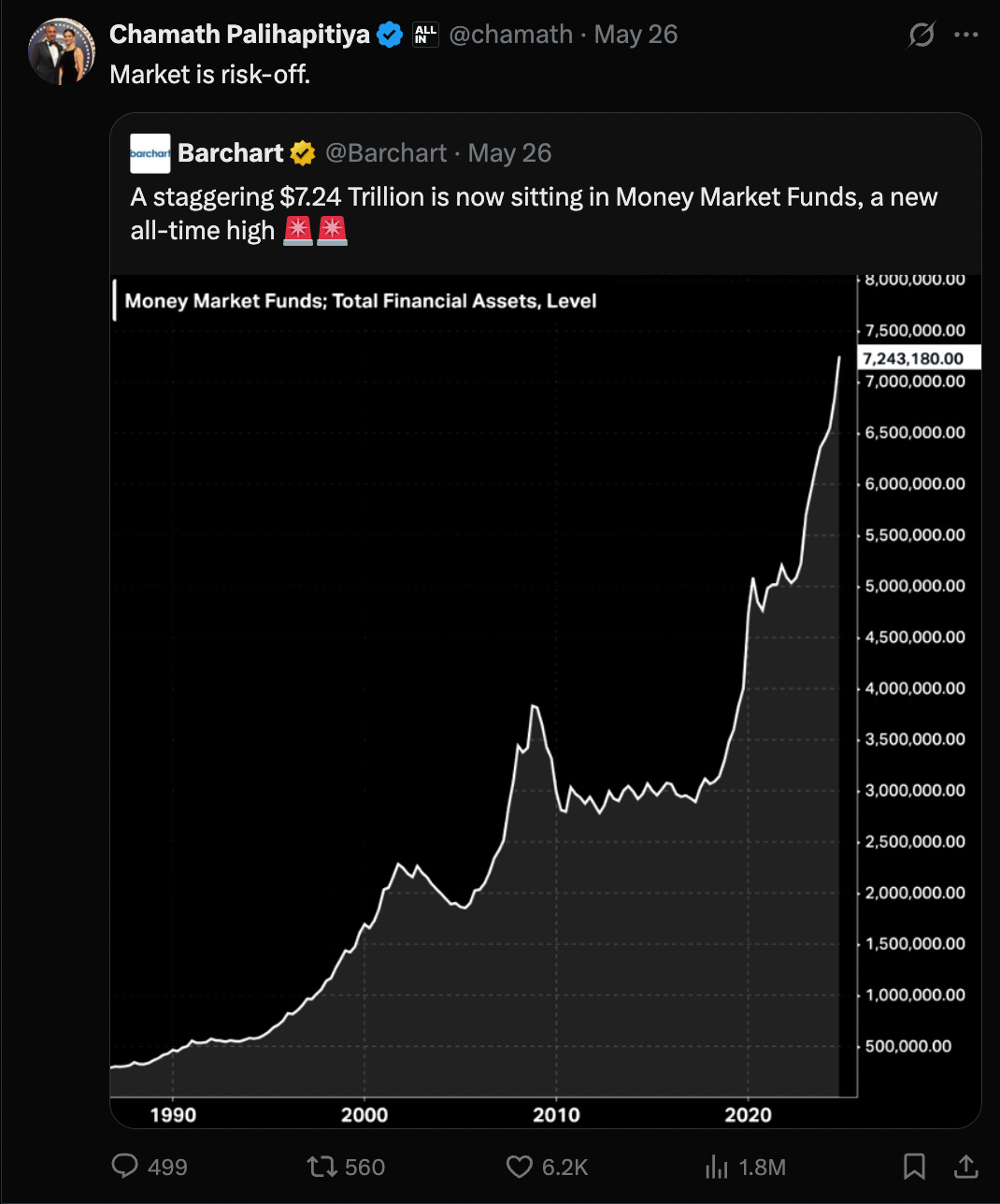

I posted this on LinkedIn while I was enjoying an ice cold Peroni poolside last week because I truly believe that this is the most important chart for Bitcoin. Not because it's technical. Not because it has candle wicks or RSI signals. Because it shows, in plain English, the value of hard assets. This is what I’ll focus on this week, and I think this is what we’ll end up focusing on for the foreseeable future.

Before we get into it, here’s how I’ve been thinking about things. After the Trump win earlier this year, there were two potential curveballs for the Bitcoin thesis: Trump bringing in Elon to run point on spending cuts, and a serious push to tackle America’s debt problem.

Now, I’m not rooting for a debt spiral — but let’s be honest, my portfolio is set up for one. Bitcoin was born from the chaos of the 2008 financial crisis. It exists as an escape valve from exactly this kind of irresponsible governance.

So I thought: if anyone could actually bend the debt curve, it’s Elon. The guy’s disrupted cars, rockets, tunnels, and brain chips — maybe he could disrupt federal spending. Meanwhile, Lutnick and Co. were hyping up tariffs and a U.S. manufacturing boom. Elon saves $1T. Lutnick earns $1T. Deficit goes down. Bitcoin gets…less necessary?

For the first time, I found myself wondering if I might be too overweight Bitcoin.

But just like that, it all got tossed. We were starting to see cracks with Elon stepping back from DOGE. Last week, Trump’s “Big Beautiful Bill” passed the House — a sweeping tax-and-spend package that does the exact opposite of fiscal restraint. It makes the 2017 tax cuts permanent, eliminates taxes on tips and overtime, and ramps up spending on border security and defense. If it clears the Senate with only minor tweaks — and odds are it will — we’re looking at another $3–5 trillion in new debt over the next decade.

The bond market responded instantly. Last Wednesday’s 20-year Treasury auction flopped, demand collapsed, and yields shot up across the curve. The message is clear: this bill is inflationary, the spending is reckless, and investors aren’t buying the narrative.

I pulled this chart from an All In Podcast from last week. According to the CBO’s long-term outlook, if we stay on the current path, U.S. debt-to-GDP will hit 166% by 2054.

But add in some realistic assumptions, and it spirals:

Extend Trump’s tax cuts? → 203%

Add some extra spending? → 241%

Keep rates where they are now (5%)? → 295%

Add just 2% to the CBO’s interest assumptions? → 362% debt-to-GDP

Every 1% increase above baseline adds $350 billion per year in interest expense.

If rates stay just 1.5% higher than assumed, we’re looking at $5 trillion in extra interest over the next decade.

That’s not just unsustainable. That my friends, is a debt spiral: higher deficits force more debt issuance, which pushes yields higher, which increases interest expense, which leads to more borrowing. Around and around we go.

The market isn’t reacting to inflation anymore. It’s reacting to fiscal recklessness.

If you’re still looking at this through a political lens, you’re missing the point. This is math. And like every debt crisis in history, the endgame is the same: currency devaluation, global repricing, and a stampede into hard assets.

Chamath is right, there’s over $7 trillion sitting in money market funds — sidelined capital looking for a signal. Eventually, this capital will flow into assets that can’t be printed.

And when it does, Bitcoin stands alone.

It’s the only truly finite, digitally native store of value. It’s consistently outperformed. And in a world barreling toward more debt and more money printing, it’s the only escape hatch that scales.

You can feel the shift. Some are already starting to position — borrowing while rates are still relatively manageable, exploring Bitcoin treasury strategies, looking for ways to hedge what feels increasingly inevitable. It’s not a stampede yet, but the smart money is starting to move.

And if AI ends up displacing a meaningful chunk of high-income white-collar jobs — and rates stay elevated — we could see defaults ripple through the professional class. What happens then? Same thing as always: they print to plug the gap and suppress yields. Only this time, it might be on a scale we've never seen.

Arthur Hayes summed this all up and more quite well during his keynote at Bitcoin 2025 this week. Pardon his french.

Have a nice weekend!