Not All Bitcoin Is Created Equal.

Friday August 15th, 2025 - Issue # 113

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good morning and happy Friday! What a week. Bitcoin hit a new all-time high, briefly flashing $123,456 before ripping past $124k. Ethereum’s been on a tear too, with treasury companies and ETFs gobbling it up like toilet paper at the start of covid. I went to bed pretty optimistic. Then Thursday morning showed up with a cold shower: a hotter-than-expected PPI print and markets sold off across the board.

Quick refresher on PPI and why the market didn’t like the print: PPI tracks wholesale inflation. A hotter-than-expected print signals rising costs, which can spill into CPI, spook markets, and delay Fed rate cuts. Markets are addicted to the hope of easier money. Add any doubt about rate cuts and “traders” go nuts.

The newly annointed king of ETH makes a good point…

You have to ask yourself: do you actually believe Washington is about to become fiscally disciplined because one monthly wholesale inflation number ran hot? Are politicians suddenly going to cancel vote-buying budgets, pause deficit spending, and stop subsidizing everything that moves? Right. Me neither.

You have to remember that the USG has chosen it’s path. They’re redefining the meaning of the phrase "You have to spend money to make money." Another phrase classic phrase that tracks: “A picture is worth a hundred and forty thousand dollar bitcoin” or something like that.

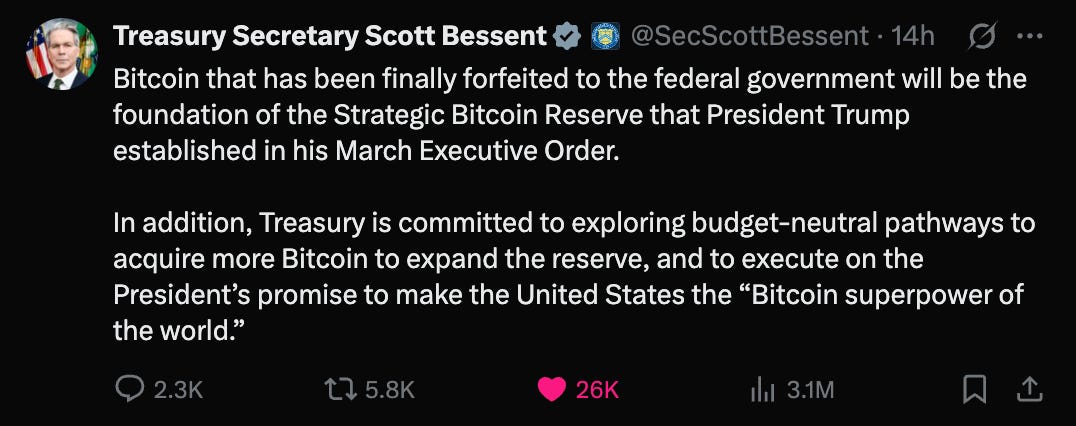

The day’s second plot twist didn’t help but it was pretty quickly walked back. Yesterday, Treasury Secretary Scott Bessent said the U.S. wouldn’t be buying more bitcoin for the Strategic Bitcoin Reserve and instead they would use the already confiscated bitcoin worth $15-20 billion as their reserve. Markets didn’t like this announcement. However, late afternoon, he walked it back.

This flip-flop underscores the U.S. is still figuring out its Bitcoin strategy, but the fact they’re even debating it signals a seismic shift.

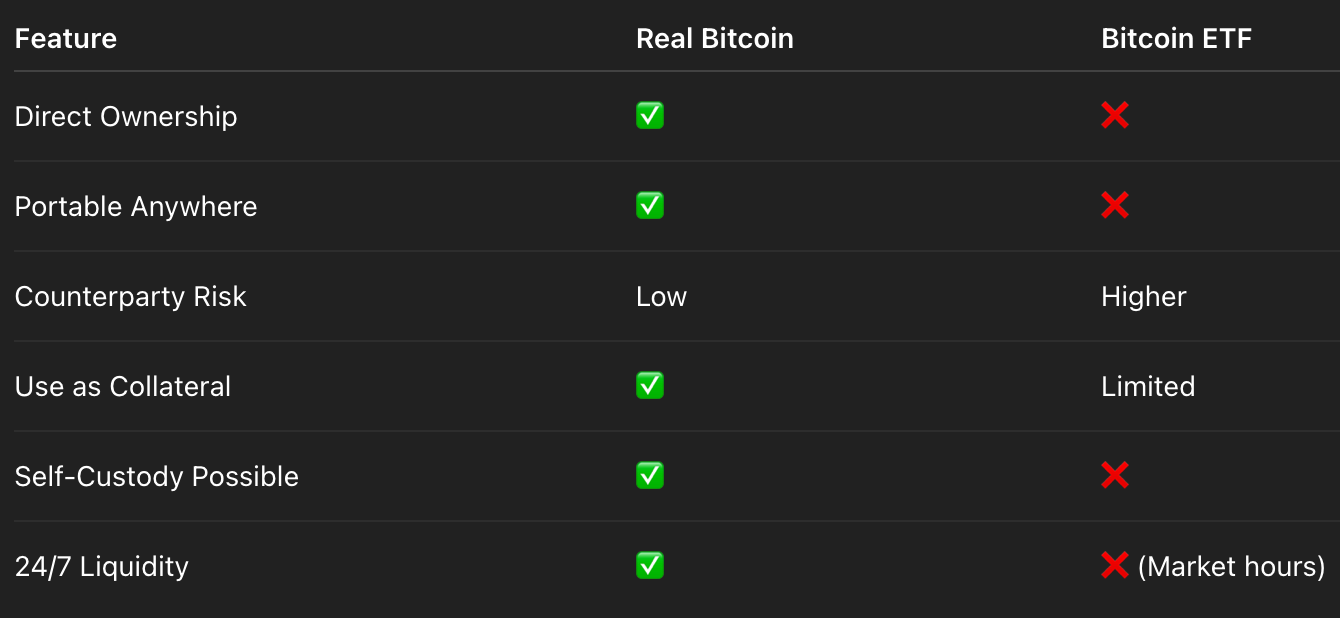

Alright, hopefully you’ve made it this far (probably giving myself too much credit) because the topic I wanted to cover this week is really important: not all Bitcoin exposure is created equal. An ETF gives you price exposure; real Bitcoin gives you property rights. If you want a metaphor you’ll remember: owning a Bitcoin ETF is like having a digital twin of a house you can trade, like owning stock in a property company that tracks the value of your dream home. You’ll benefit if real estate prices rise, but you’ll never get the keys, walk through the front door, or decide what happens to it. With the ETF, you watch from a distance. With real Bitcoin, you live in it. One is a brokerage product. The other is a bearer asset you can move, secure, and use — anytime, anywhere.

A handful of key reasons why I push for the keys:

First, control and portability. Your ETF shares live inside a brokerage account that lives inside a market that runs on a clock. You can’t take an ETF across a border, sign a transaction with it, or settle a payment on a Saturday night. Real BTC settles globally in minutes, 24/7/365. If you need to move value at 2:00 a.m. on a holiday, the chain is open. The exchange is the Bitcoin network.

Second, the counterparty stack. With an ETF you’re relying on the issuer, the custodian, the administrator, the transfer agent, APs/market makers, DTC/clearing, and your broker. Ninety-nine percent of the time that stack works. In stress, frictions appear — halts, spreads blow out, creations/redemptions slow, and you’re gated by market hours. With native BTC, you remove most of that stack. Hold it yourself (properly) or with a qualified custodian like you would with Satstreet. Your settlement finality is cryptographic, not bureaucratic.

Third, fees and drag. ETFs charge a management fee that compounds against you. People wave this away as “only 25 bps,” but compounding is merciless. A simple illustration: on $1,000,000 compounded at 20% for ten years, a 0.25% annual fee leaves you roughly $128,000 lighter than holding the asset directly. That’s before trading commissions and spreads. The higher the return, the bigger the wedge those basis points drive over time.

Fourth, market-hour risk. Bitcoin trades while your broker sleeps. You can wake up to news, want to act, and discover the ETF isn’t tradable for hours — or is halted. In a 24/7 asset, that’s not a feature; it’s a bug. Owning the underlying aligns your liquidity with the thing you’re actually trying to own.

And finally, geopolitical risk. If you’re Canadian, you don’t need me to remind you that this country is not exactly bending over backwards to retain its wealthiest citizens. We’ve already seen creeping tax grabs, retroactive capital gains change proposals, and a growing willingness to target the wealthy for new taxes. And it’s not hypothetical — look back to 2022 and the trucker protest. In a matter of days, bank accounts were frozen without due process. People woke up to find that the “money” they thought they owned was inaccessible because of a political decision. That’s how fast things can change when your assets live inside the system. In times of crisis, governments will reach for whatever levers they can — sometimes including your accounts. Real Bitcoin — properly secured and portable — sidesteps that. An ETF does not.

I’ll be fair as I do have a pretty clear bias in this argument: ETFs serve an important purpose. If you’re constrained by a retirement plan, if your investment committee forbids direct custody, or if you simply won’t take on key management — which can be very risky — an ETF is better than no exposure. It also onboards huge pools of capital — great for price discovery and market depth. But if you can own the asset, the hierarchy is clear: coins > wrapper.

So here’s the practical takeaway if you’re holding ETFs and rethinking things, which thankfully is a growing trend that I hope will continue: start by deciding what portion you truly want as real Bitcoin versus market exposure. If it’s real, convert the wrapper to the thing. Choose your custody path — hardware wallet with a written recovery plan, 2-of-3 multi-sig with a qualified co-signer, or institutional custody like what we offer at Satstreet. Then swap size OTC for low slippage with Satstreet (if you’re reading this and you’re outside of North America, we also have a licensed offshore entity) and take immediate delivery to your address(es) or leave them with us for the time being. There are other very important considerations to make and we specialize in working with you through the whole process — this is what our team has been doing for over 7 years.

So…the message is simple: if you’re going to own it, own it. Get the keys. Because when the locks change overnight, the last thing you want is to realize all you ever had was a claim on the house, not the house itself.