Nothing is priced in

Friday April 19th, 2024 - Issue # 69

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good morning and happy Friday Bitcoin Halving Day!

Over the last 7 or so years I’ve often heard, "Oh, the halving is priced in—it’s literally baked into the system; we’ve known about this for 14 years!!!" or "What’s my edge? What do I know that other people do not know, the market is efficient?" Let's clear this up: You gain an edge not just through exclusive information, but through deep, comprehensive understanding of Bitcoin's fundamentals. This insight ensures you remain firm in your conviction (HODL), even as Bitcoin navigates through its characteristic of high volatility.

An integral part of Bitcoin's fundamentals is the halving mechanism, a core feature designed to curb inflation by reducing the number of bitcoins awarded to miners. Today marks a pivotal moment in Bitcoin's history—the fourth halving event is set to occur at around 7 PM EST. This event adheres to Bitcoin's predefined schedule of halving the mining reward, a critical mechanism intended to control the supply and enhance the asset's scarcity. Consequently, mining rewards will drop from 6.25 BTC to 3.125 BTC per block. Occurring every 210,000 blocks mined, approximately every four years, this reduction ensures a consistent decrease in the rate at which new bitcoins enter circulation, reinforcing Bitcoin's disinflationary nature.

This mechanism is crucial as it programmatically ensures Bitcoin remains a disinflationary asset. Halvings will persist at this regular interval until the total supply of 21 million bitcoins has been reached, projected around the year 2140. The predictability of Bitcoin's supply schedule provides it with a unique economic property, distinguishing it from fiat currencies subject to unpredictable inflationary pressures.

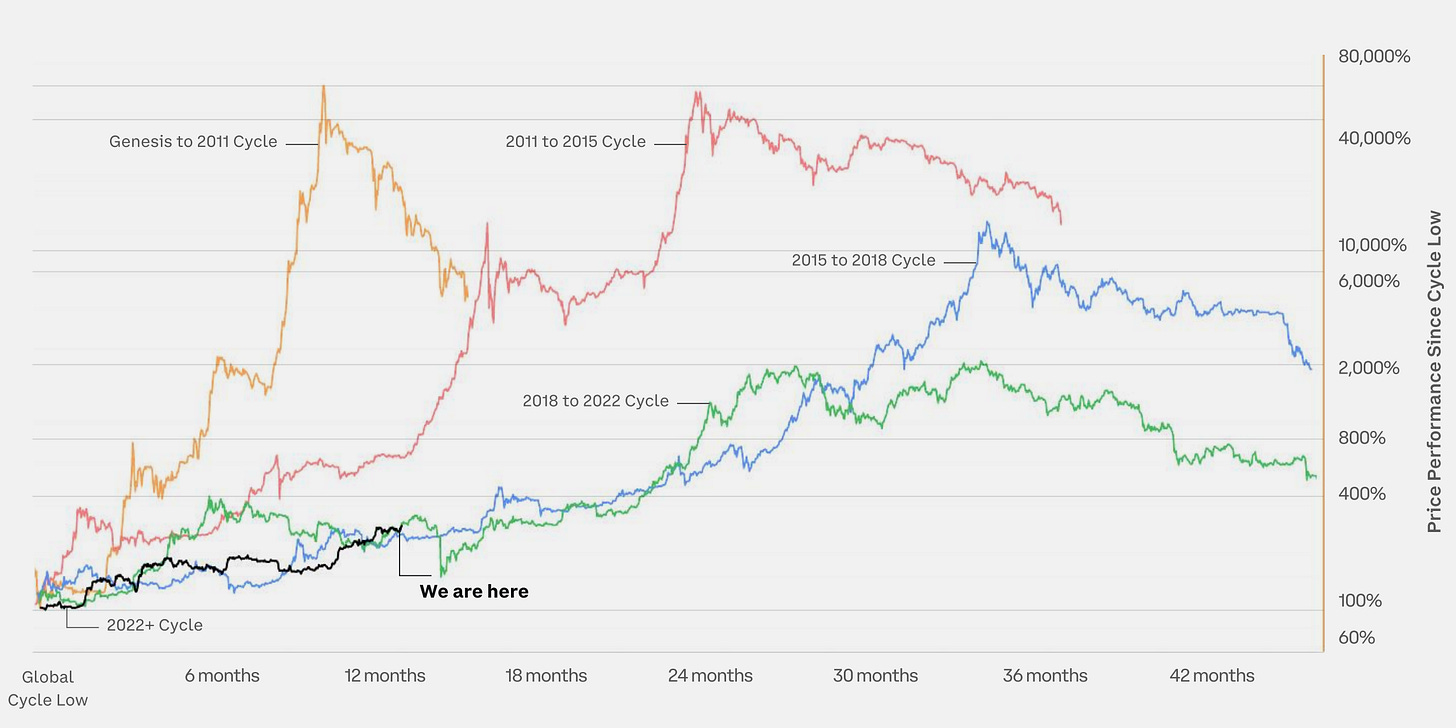

Turning our attention to the chart above, it measures BTC’s total returns for each halving cycle or epoch. The figures are telling: within 12 months following each of the prior three halvings, Bitcoin's price has appreciated significantly. Post the first halving, as represented by the red line, prices soared more than 1,000% in the first year. The second halving, shown in blue, followed suit with a 200% gain. Most recently, the third halving, depicted in green, resulted in a more than 600% increase. This consistent pattern of substantial gains highlights the transformative impact these halvings have on Bitcoin’s market value.

I think it’s also important to consider the available supply of Bitcoin in order to fully appreciate the impact of the halving over the long run. To get a clear picture of Bitcoin's available supply, we subtract the illiquid portion—those coins that are effectively out of circulation, whether locked in lost wallets, held in long-term reserves, or otherwise tied up—from the total circulating supply, which currently amounts to 19.68 million BTC.

The chart reveals a meaningful trend: while the available supply of Bitcoin peaked at 5.3 million BTC in early 2020, it has since declined to about 4.6 million BTC. This reduction, occurring as we approach the fourth Halving, marks a major departure from the previous trend where available supply steadily increased during earlier halvings.

A couple more charts…

The chart above lays out the extraordinary growth in previous cycles: from 2015 to 2017, Bitcoin's price increased by 100x, and in the following cycle, from 2018 to 2021, it increased by 20x. The current bull market, if we’re considering the start in November 2022, has already witnessed Bitcoin prices reaching roughly 4x off the lows.

It’s important to note that historically, the most substantial gains typically come in the back half of a cycle. This pattern underscores the potential for late-cycle accelerations, where previous periods of accumulation and momentum build-up can lead to dramatic escalations in value.

The final chart above shows the trajectory of Bitcoin’s price performance from the lows of each market cycle, encapsulating both bull and bear phases. As previously mentioned, in this current cycle, which kicked off in 2022, Bitcoin has moved 4x in just 17 months since hitting its cycle low.

Interestingly, this pattern mirrors the cycle from 2018 to 2022, where Bitcoin eventually soared by 10x 24 months after its low point.

Acknowledgements: Special thanks to Glassnode and Coinbase for providing the insightful charts used in today’s analysis.

Here’s a thought provoking tweet from Michael Saylor on the implications of the Halving…

Highly recommend watching Andreas Antonopoulos explain the Halving:

Have a nice weekend!