Playing outside...the system

Friday April 7th, 2023 - Issue # 42

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good morning and happy Friday!

While we’re all back to checking crypto prices like maniacs again, I think it’s important to take a step back and remind ourselves why we’re so invested. I’ve had so many calls over the last few weeks that have gone a little something like “Mike, are you bullish?

While I am checking prices a little more than usual, I feel like I’m starting to break through the high time-preference mentality and care more about how many units of BTC I own vs. the dollar value. Trust in the current system is progressively deteriorating. It seems as though our leadership has lost control, and their priorities are extremely out of whack. It’s not just us who are noticing. We’ve seen other countries make serious moves that would be unimaginable even just a few years back, to rid their dependance on the US and the Dollar.

Today, we'll explore the concept of "inside vs outside money" and the roles of Bitcoin and gold as important instruments to hedge the systemic risks of living within the current system.

Inside money refers to money that is created by the banking system, such as bank deposits and central bank reserves. It is backed by the full faith and credit of the issuing institution and is subject to regulation by government authorities. Inside money is widely used in everyday transactions and is the backbone of the modern financial system. Stocks, bonds, funds, etc., would be considered inside money. Ex. if you own a bitcoin or ethereum ETF, sure you have exposure to the performance of the asset, however.

Outside money, on the other hand, refers to assets that are not tied to any particular government or central authority. These assets can potentially serve as a hedge against inflation, economic instability, and other geopolitical risks. Bitcoin and gold are two popular examples of "outside money."

A common theme we’re seeing at the desk is family offices, and other sophisticated investors, selling their bitcoin ETF positions (inside money) to buy the underlying asset directly (outside money). If you’re going to buy bitcoin as a kind of insurance, you better make sure you’re getting all of the important characteristics of the asset in case you ever need it.

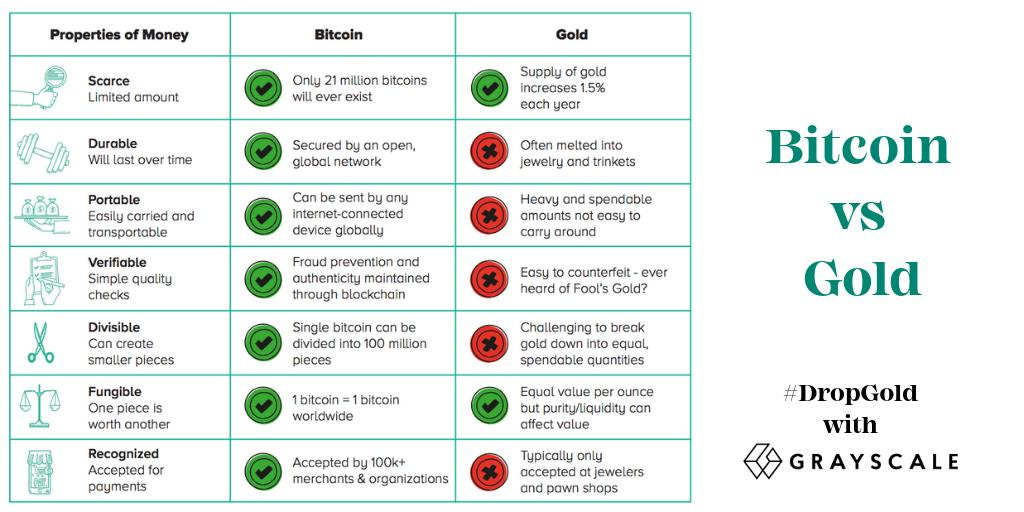

One of Bitcoin's key features as "outside money" is its scarcity. Its fixed supply means that it cannot be manipulated by central banks, unlike fiat currencies which can be printed at will. This makes Bitcoin an attractive option for those seeking a potential hedge against inflation and geopolitical risk. Bitcoin's portability is also a major advantage. As a digital asset, it can be easily transported anywhere in the world with an internet connection. Bitcoin's security is also noteworthy, as it uses complex cryptographic algorithms to secure the network.

Gold, on the other hand, is a physical asset that has been used as a store of value for thousands of years. Its limited supply and difficulty in extraction make it a scarce commodity, which has been historically used as a hedge against inflation and geopolitical risk. Gold's physical nature also makes it somewhat difficult to counterfeit, making it a secure store of value. However, its physicality makes it more difficult to transport and store securely than Bitcoin.

Bitcoin and gold share many of the same characteristics, however, there are key unique differentiators that must be taken into consideration when weighing which is better.

*SPOILER ALERT* bitcoin is better.

Despite Grayscale’s damaged reputation, they sure know how to make a chart!

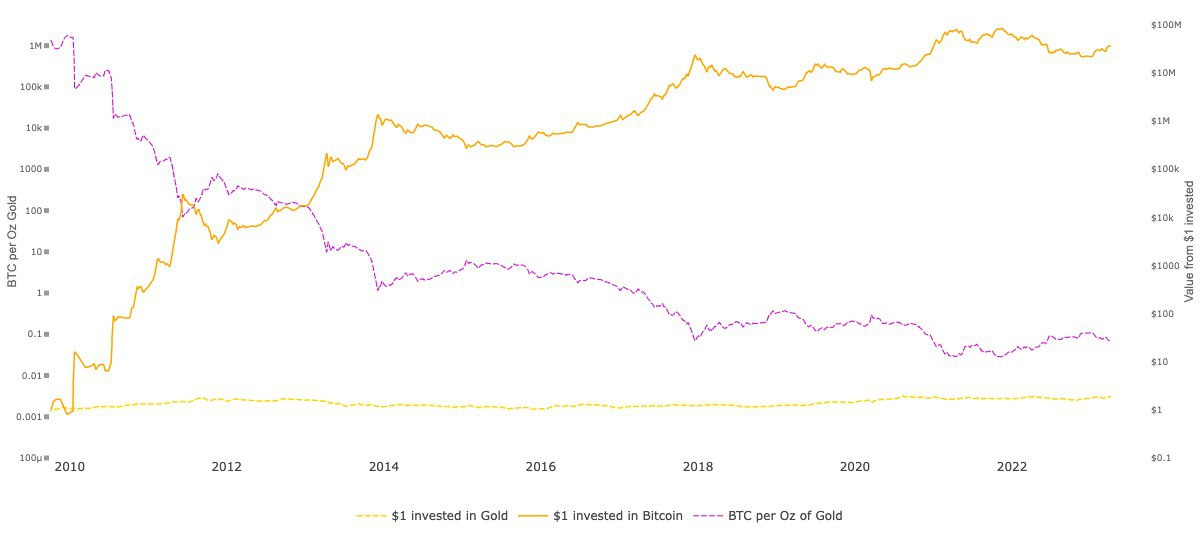

Here’s another chart, in case you’re more of a quantitative thinker.

Really tough one.

In conclusion, both Bitcoin and gold can serve as "outside money" and potential hedges against economic instability and geopolitical risk. As with any investment, it's important to carefully consider the risks and potential rewards before making a decision.

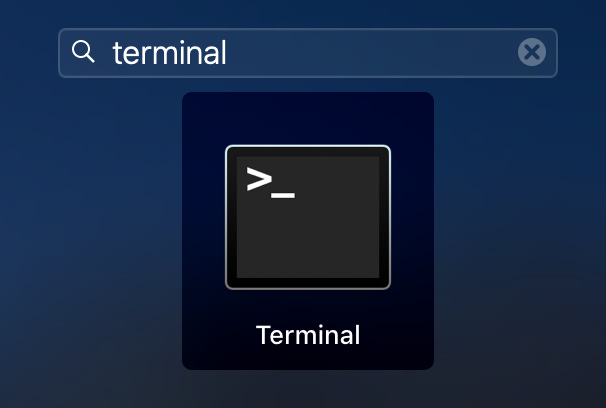

Try this if you use a Mac

In the spirit of the Holidays, here’s a little Easter hunt for you 🙂

Step 1: Click on the Launchpad icon (grey circle with rocket ship)

Step 2: Search “terminal”

Step 3: Copy and paste the following…

open /System/Library/Image\ Capture/Devices/VirtualScanner.app/Contents/Resources/simpledoc.pdf

Step 4: Press enter or “return”

Pretty cool, eh?

Have a nice long-weekend!