Quietest ATH, Ever.

Friday July 11th, 2025 - Issue # 109

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I know, I know. I was right. Thank you, thank you, thank you... Where are my flowers? Oh, that’s right, there are no flowers — I’m just sitting here at my kitchen island at 5am talking to myself like a lunatic. But hey… happy all-time highs, folks.

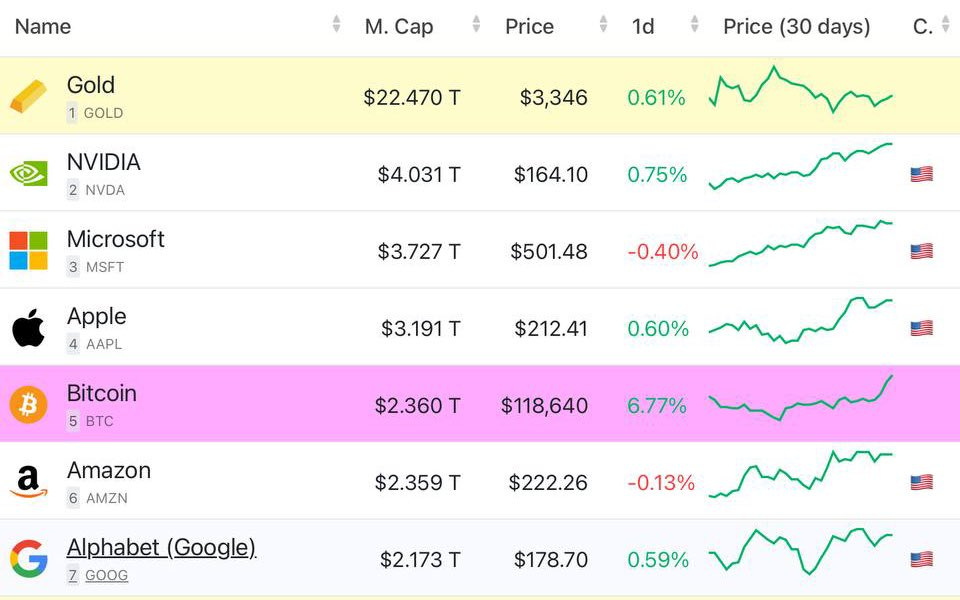

Bitcoin’s officially in price discovery. No resistance. No ceiling. Just air. Every tick higher is uncharted territory. As of this morning: $118,640. And in case you missed it — we just passed Amazon to become the 5th most valuable asset in the world.

Feels good, doesn’t it?

Or... does it still feel like you don’t have enough exposure? That’s normal. Even if you’re “all in” (like me), the FOMO creeps in. It always does. Because the truth is, most people aren’t anywhere near fully allocated. In fact, the vast majority of potential Bitcoin buyers didn’t even notice we ripped through $117K yesterday. As the title suggests — this might be the quietest all-time high I’ve ever seen.

But there are signs the silence won’t last.

While everyone’s eyes are still on the charts, I want to zoom in on something that feels like a big deal but hasn’t made many headlines. Figma, a Silicon Valley unicorn and the design software company basically every modern product team uses — recently disclosed $70 million worth of Bitcoin ETF exposure on their balance sheet, with board approval to buy another $30 million in spot BTC. No big press release, no tweet storm — just a quiet line item buried in a financial disclosure. That’s not nothing. Figma is very well-respected, venture-backed, and extremely well-run. It raises the question: how many other high-quality, cash-generating tech companies are already doing the same thing? Probably more than we think. And if that’s true, it won’t stay under the radar forever. A few more disclosures like this — especially from companies going public — and suddenly it could feel irresponsible not to have some Bitcoin exposure on the balance sheet. We’re not there yet, but the shift may already be underway.

Look what else just hit a new all-time high...

$7.4 trillion is now parked in money market funds.

This isn’t retail “waiting for a dip.” This is institutional cash. Pensions, corporates, high-net-worths. Parked in T-bill purgatory — unsure where to go next.

But that decision point is coming. Fast.

Because when the Fed starts cutting — and they will — that cash isn’t going to earn 5% anymore. It’s going to search for yield. For exposure. For upside. And the smarter money won’t wait for Powell (or someone else…) to ring the bell. They’ll start rotating ahead of the cutting cycle — because that’s how this game works. The market sees forward.

And when Bitcoin and the S&P are both smashing new highs week after week — and the President of the United States is publicly begging the Fed to cut — the risk of being underexposed starts to outweigh the comfort of sitting in cash.

The entire risk curve is getting dragged up by policy. Trump wants to juice the market. He’s not being subtle. He’s calling for lower rates, bragging about how tariffs are pumping stocks and crypto, and practically daring the Fed to chase the rally. This is what it looks like when the mandate quietly shifts from fighting inflation to driving growth. And it feels like we’re early in the cycle.

The tweet from The White House below is absolutely real.

One more thing: next week is “Crypto Week.”

Yes, that’s a real thing now.

In response to Trump’s call to make the U.S. “the crypto capital of the world,” the House will be voting on:

GENIUS Act: stablecoin rules

CLARITY Act: defines SEC/CFTC roles

Anti-CBDC Act: bans a government-run surveillance coin

Regulatory clarity is coming.

And one last thing — for my fellow Canadians:

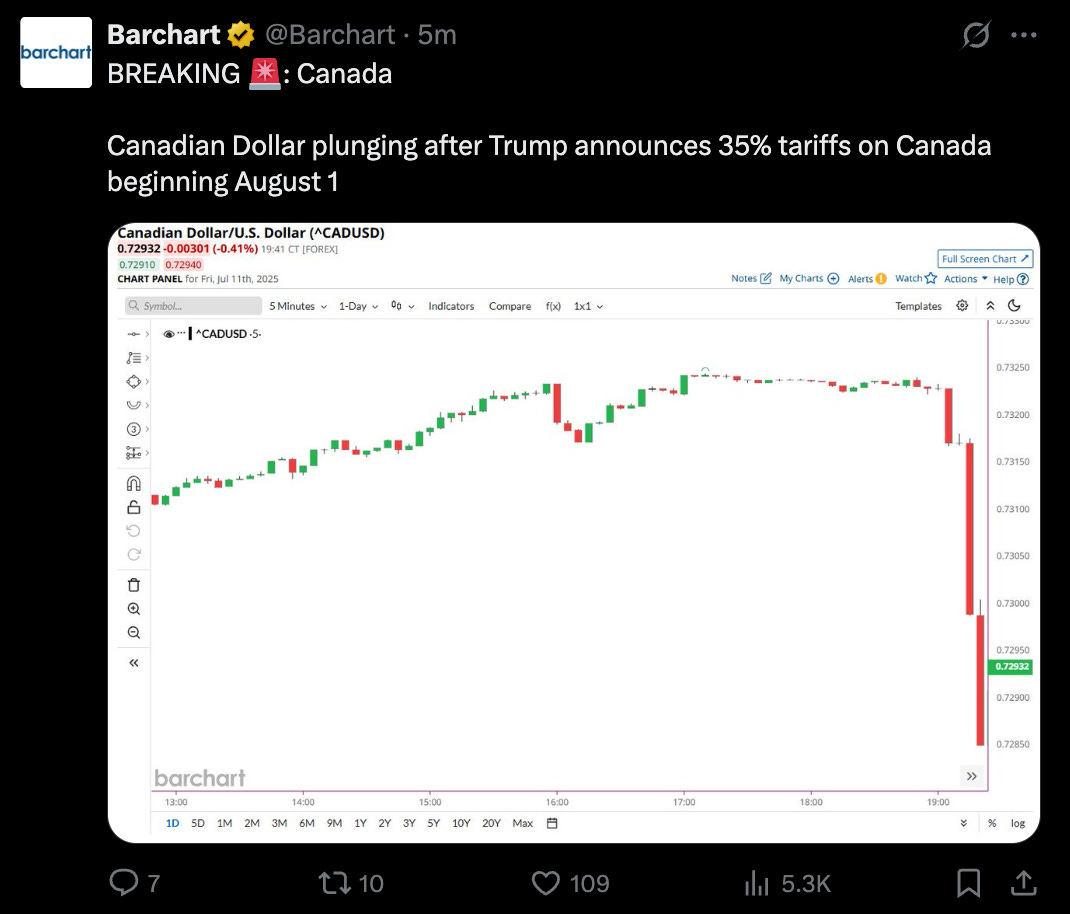

Trump just announced 35% tariffs on Canada starting August 1st. The loonie puked. CAD/USD is in freefall.

If you’re still sitting in Canuck bucks, your purchasing power is melting — and it’s probably not going to get better anytime soon. Ex. My girlfriend and I went to this Persian take out spot for kebabs last night — 2 plates and 2 drinks = $48. Insanity.

So for your own sake…

Call us.

Convert your monopoly money.

Or at least lock in your FX while you still can.

Lol true ^

Stand out podcast of the week:

Happy Weekend!