Supply Shock

Friday February 23rd, 2024 - Issue # 63

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

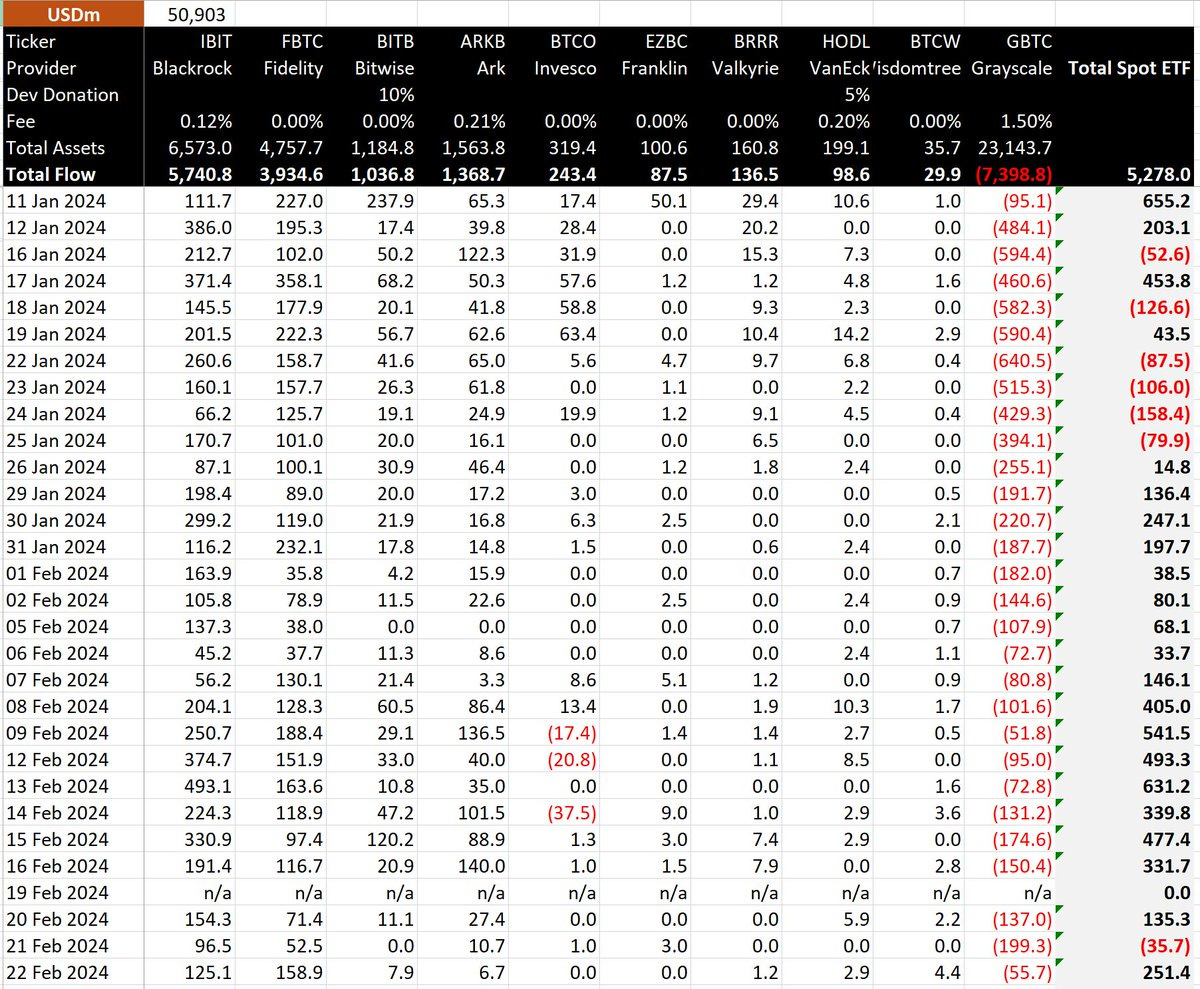

Hello there. It’s been a short downish week for bitcoin — the first since the launch of the ETFs. Wednesday’s soft outflow was likely due to the whole world watching out for NVIDIA earnings — the consensus was that if they didn’t beat earnings, it would take the entire market down. That did not happen, in fact, they absolutely smashed earnings and now the overall trend is intact. We can resume the “up only”. Yesterday, net inflows were $251.4m which isn’t quite half a billion but it’s still incredibly strong.

Blackrock (~$6.5bn) and Fidelity (~$4.7bn) have really pulled away from the rest and have soaked up over $11bn in combined AUM.

Here’s a cool side-by-side (not cool if you still like gold): 1 week Bitcoin-related funds inflows ($777mm) vs Gold-related funds outflows (-$608mm).

Since the ETFs launched, I’ve spent a lot of time talking about the demand side of the equation. Today, I want to dive into the other side to give a better overarching view on why Bitcoin is going to — as the kids would say — “the moon”.

Everyone knows that there will only ever be 21 million bitcoin…duh. Most people don’t know that there are ~19.6 million BTC that have already been mined (~93.5%) leaving less than 1.4 million BTC left to be mined which will be released much slower than ever before after the halving in a couple of months. If you don’t know, currently 6.25 BTC are mined every ~10 minutes, or 900 BTC are mined per day. After the halving, 3.125 BTC will be mined every ~10 minutes and the daily supply will be slashed to only 450 BTC per day. It’s pretty obvious what comes in April 2028 but the number is worth displaying since it appears quite dramatic. After the next halving, the numbers look like 1.5625 BTC/block and 225 BTC/day. Here’s where you can get a real time Bitcoin-focused dashboard where I pull a lot of information from: https://bitbo.io/

Have you ever lost your Bitcoin? I hope not, but if you have, you’re not alone. It’s estimated that as much as 3-4 million BTC has been lost/unrecoverable (some estimates are as high as 6 million coins or ~28.6% of all supply.

These Bitcoins are considered lost for various reasons, such as:

Lost Private Keys: Users who have lost access to their Bitcoin wallets due to misplaced or forgotten private keys.

Old, Unused Wallets: Bitcoins that have remained in wallets without any transactions for an extended period, which might indicate lost access or forgotten holdings.

Deaths of Bitcoin Holders: Bitcoins held by individuals who have passed away without transferring their holdings or providing a way for heirs to access them.

Failed Hard Drives: Bitcoins stored on hard drives that have been damaged, lost, or thrown away.

Scams and Frauds: Bitcoins stolen or defrauded from users, which are then lost if the fraudsters lose access to them.

It's important to note that since the Bitcoin blockchain is a public ledger, these coins are not technically removed from the total supply; they remain on the blockchain but are simply inaccessible and thus effectively out of circulation. The estimation of lost Bitcoins is speculative and based on analyzing patterns of wallet activity and other indicators.

Click above to read about some pretty big Ls.

So, aside from the estimates that at least 14% and as much as 28% of Bitcoin’s supply is effectively out of circulation, we also have to consider another large percentage of supply that would have to be pried out of [one's] cold dead hands.

I’m talking about the HODLers. The real OGs and the new believers who are quietly, or very publicly — ex. Saylor — sitting on a tremendous amount of coins.

What's more intriguing is the pattern of accumulation among these HODLers. During market dips, when short-term traders often exit the market, these long-term holders have historically increased their holdings. A report from Glassnode highlighted that in the last quarter of 2023, despite market volatility, the amount of Bitcoin held by long-term investors grew by 2.7%. This behavior not only underscores their resilience, but also stabilizes the market to a certain extent, providing a form of cushion against extreme price volatility.

Furthermore, the commitment of these HODLers is reflected in the 'Bitcoin Days Destroyed' metric, which remains relatively low despite increasing market capitalization. This indicates that the majority of Bitcoin transactions involve recently moved Bitcoins, while those held by long-term investors remain untouched. Their role in the ecosystem is thus not just of passive holders; they are the backbone of the Bitcoin market, holding a vast amount of its value in their steadfast hands.

This metric emphasizes coins that have remained stationary for extended periods, recognizing that long-term Bitcoin investors, often considered 'smarter money' due to their deeper understanding of Bitcoin, make its tracking particularly valuable for observing significant shifts in coin days destroyed over time.

The supply problem is real and only going to get more acute. Depending on which side of the coin you’re on, this is a good problem to have.

It is a beautiful day in Toronto! Go get some sun.

Wen moon?