Table Talk

Friday November 29th, 2024 - Issue # 90

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I’m not sure how many of you are American, but I know for a fact that plenty of readers here have left Canada for the U.S. in recent years. Whether Thanksgiving is an old tradition for you or a new one, I hope you’re surrounded by good food, good company, and some unnecessarily intense chatter at the dinner table. Happy Thanksgiving! For all of my Canadian readers, we have more time to prep ourselves before Christmas.

Assuming you’re the “bitcoiner” or “crypto person” in your family, I bet you’ve been fielding questions over the holidays. “Is it too late to buy Bitcoin?” “What about Ethereum or Solana?” “How high can it really go?” Sound familiar? Don’t worry—you’re not alone. However, you might need to worry a bit if your guy won the election, it could be a little too soon to take a victory lap.

Last night, and over the weekend, the same Bitcoin you passionately talked about at $17k (TG 2020), $57k (TG 2021), $16k (TG 2022), and $37k (TG 2023) is now just ~5% shy of $100k. It’s lighting up headlines, sparking dinner table debates, and drawing in a fresh wave of interest. Hopefully, they took your advice back then—or at least didn’t get shaken out during the chaos along the way. And now, if they’re finally ready to hear you out without rolling their eyes, you can confidently tell them: it’s not too late.

Uncle Doug: “But there seems to be an incredible amount of resistance at $100k! We sold off like 10% just a few days ago?!”

You: “Look, we had a huge run up to $99k. It was always going to take a pause at $100k. It’s called the big round number effect. You asked about any good Black Friday deals, well, here you go!”

Cousin Mark: “Dad, I think we missed the boat on this. I was actually pretty early I bought some BTC, Doge, and Solana earlier this year and I’m up a couple of thousand bucks! Not too shabby eh. I actually sold at the top and I’m waiting for a crash.

Uncle Doug: “Do you think it’s going to crash? That would be great, then I’d back up the truck.”

You: “If I knew that then I probably wouldn’t be here right now. I’m kidding, but seriously, have you not listened to me after all these years? You’re not too late!”

If you need some back up, here’s some very fresh ammo that you can use alongside all the headlines I highlighted in last week’s note.

It’s not just Saylor…

Since the election, flows have averaged over $560 million per day into Bitcoin ETFs. BlackRock alone increased its Bitcoin ETF holdings from 88,000 shares to over 2.1 million shares between June and September. If you were wondering who was buying Bitcoin in the summer doldrums, now you know. Saylor is no longer the sole driver; this is institutional money, and it’s flowing at scale.Who else has been buying?

I’ve talked about this in past articles. In 2022, Fidelity Canada was the first major investment firm to add exposure to Bitcoin in their Balanced and Growth Funds. These Funds have crushed it. Getting that extra juice from the best performing asset known to man without risking performance to the downside is absolutely brilliant. I wish I thought of this point in advance so I could get my buddies who still work there to draw me up a comparison against their peers but I’m sure they’re way ahead.In a portfolio filing this week with the SEC, BlackRock disclosed owning 2,140,095 shares of IBIT in its Strategic Income Opportunities Portfolio as of September 30, valued at $77.3 million. That's an increase from 88,000 shares previously reported as of June 30. These funds are passively buying millions worth of Bitcoin through their own ETFs. These are not paperhand investors, the only selling these funds will do is to rebalance because the BTC exposure became too large. And if uncle Doug or cousin Eddie say “oh, well that’s just the bitcoin ETF,” you can confidently tell them that every dollar into these BTC ETFs purchases the underlying asset during market hours. This category of bitcoin buyers is only going to get bigger, much bigger. This should quiet anyone questioning whether institutions are taking this asset seriously.

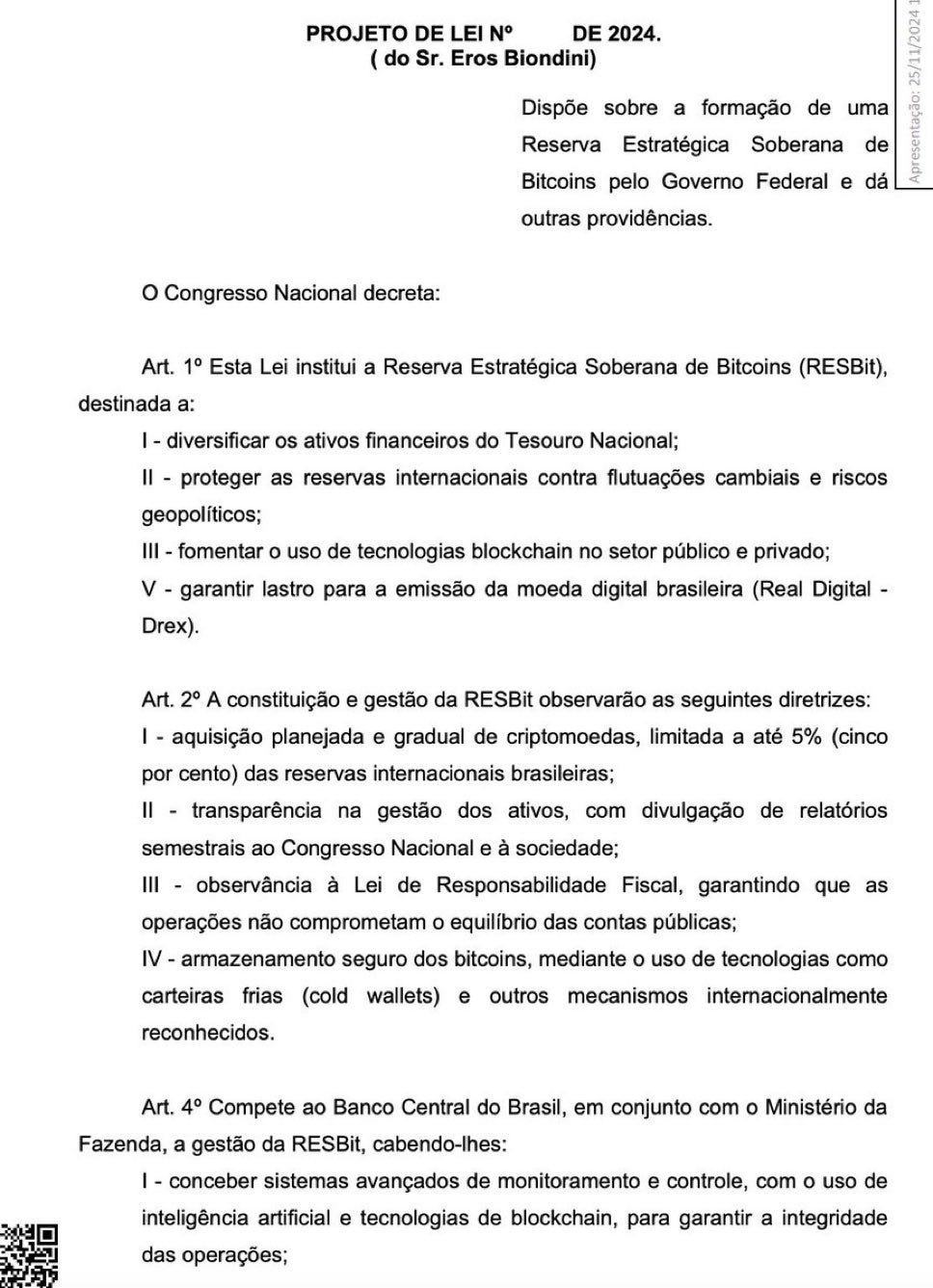

Strategic Bitcoin Reserves

This week, Brazil introduced a bill to create a Strategic Bitcoin Reserve marking another turning point. If any country formally establishes such a reserve, we’ll see a cascade of others follow. As of today, 57 central banks hold gold, while zero hold Bitcoin. The first domino (well, I guess second after El Salvador 🇸🇻) is always the hardest to tip. Click picture below for a good overview.The Treasury and dollar dynamics

I love when things come around full circle…

In January, Janet Yellen is out as Treasury Secretary and Trump has tapped Scott Bessent. Who is Mr. Bessent? He’s the Founder of Key Square Capital Management, he was the CIO of Soros Fund Management (2011-15) and he’s a big fan of crypto.

His support for a Strategic Bitcoin Reserve is public knowledge, and his stance aligns with broader financial conditions that favor Bitcoin as an asset class (a weaker dollar to drive growth). This isn’t just about Bitcoin adoption; it’s about the reconfiguration of global financial priorities.

Okay, so now that you’ve got their attention and you’re now at the table with skeptics-turned-crypto-curious or full-blown Bitcoin bullievers, here’s some advice—not financial advice, of course, but a guide on how to navigate the discussion without creating future headaches for yourself.

Set Expectations: Make it clear—you’re not a wizard, and every action is their responsibility.

Cycle Context: We’re relatively deep into a bull market. BTC is up 6x, ETH 4x, and SOL 30x from the lows. They need to accept they're not buying at peak opportunity.

K.I.S.S.: Recommend blue chips like BTC, ETH, and SOL in something like a 50/25/25 split for newbies. Or, just recommend Bitcoin. Limit speculative plays to less than 10% of their portfolio.

Take Profits Wisely: Encourage disciplined profit-taking—sell half after a 2x, and secure the initial cost at a 3x. This helps them avoid getting wiped out by bear market volatility.

Don’t Chase FOMO: Warn against reinvesting profits out of fear of missing out. They could end up losing more to taxes and market collapses than they gain.

Tax Awareness: You’re not a tax expert and neither am I, but unless they’re in Cayman or another tax haven, every trade is likely a taxable event, even crypto-to-crypto. Profits should go into a safe, principal-protected account for 12-18 months before reallocation.

Avoid Supercycle Myths: Despite current optimism, past cycles suggest the potential for massive crashes (80-90%). “This time is

differentrarely different.”Teach from Experience: If you’re like me and have been through multiple cycles, use your hard-learned lessons to guide them through the mania of a bull market and prepare them for what’s likely to follow.

Think of it as giving them just enough optimism to stay intrigued, but not so much that they start remortgaging the house before dessert.

Not Bitcoin related, but Apple ditched ‘woke’ and released the best Christmas ad I’ve seen in awhile…I’m not cryin’ you’re cryin’.