Tariff Tantrum

Friday April 4th, 2025 - Issue # 101

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

From my WGMI (we’re gonna make it) group chat. While it’s true that I’m on the 68th hour of my water fast and dRiftInG iN anD oUt of coNscioUsne…

Only kidding, it wasn’t so bad at all. On top of the fact I knew it was going to be a slower week at the desk as investors were waiting to see what Liberation Day really meant, I was also pretty sick and didn’t have much of an appetite so I figured this would be the optimal time to do my first 72 hour fast.

As with most historically important press conferences (there are too many for my liking), I was glued to the TV with the price of BTC open on my laptop. It was a very strong start as Trump came out with the niceties and BTC was ripping, touching ~$88K from sub $85K before it started. Then the charts came out. What looked harmless at first glance — an old man holding up physical charts and making funny noises about different countries — was eventually taken extremely seriously and the market puked on the realization that shi* was about to get real.

TLDR: Trump’s new tariff plan introduces a default 10% import tax (starting April 5th), with country-specific rates rising as high as 50% or more (starting April 9th), aiming to create a “reciprocal” system to protect American jobs and reduce trade deficits.

The TLDR TLDR: the announcement was much worse than expected.

Trump’s tariff bombshell sparked a brutal stock market sell-off yesterday, with the S&P 500 plunging 4.84% — its worst day since June 2020 — erasing $2.4 trillion in value. Fear gripped Wall Street as the “as bad as it gets” plan defied expectations, pushing markets into correction territory and igniting trade war panic.

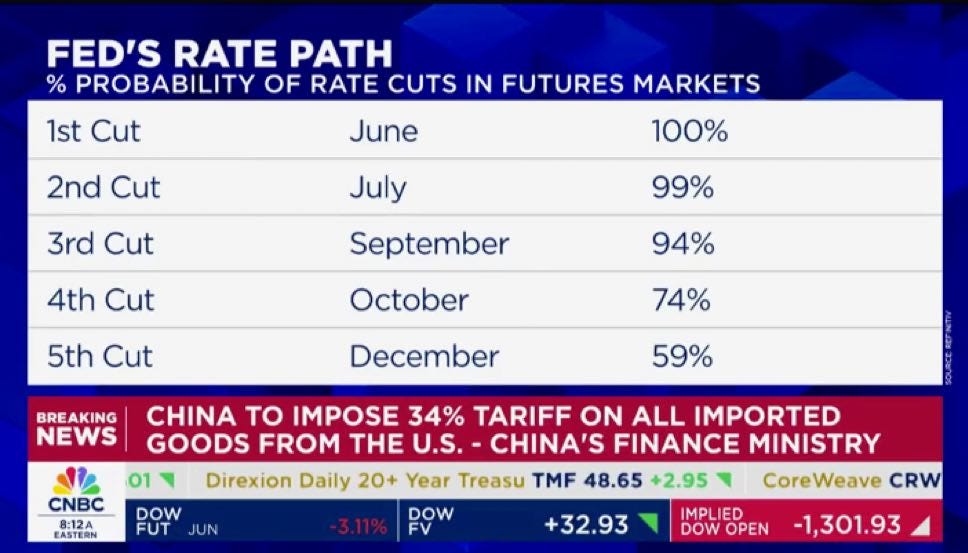

This just in (6:20AM): China hits back with a 34% tariff on U.S. goods.

The trade war is on.

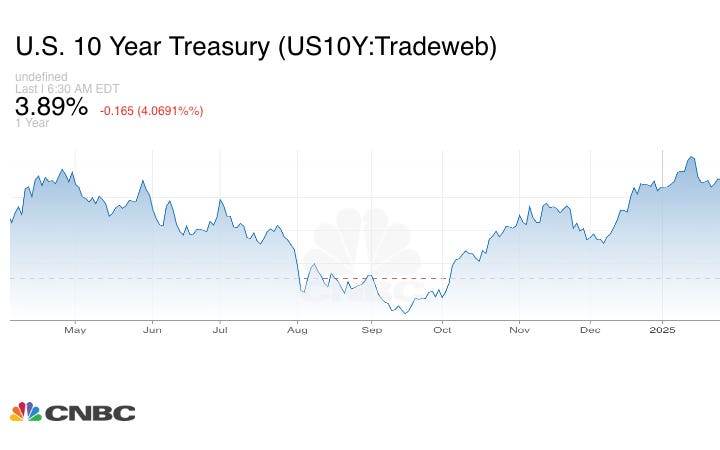

And looky what we have here:

Mr. Treasury Secretary just got a 3 handle on the 10 year.

So who is this beauty and why is he on cloud 9 right now?

That’s Scott Bessent — Trump’s Treasury Secretary and the guy who’s been quietly orchestrating one of the most aggressive financial resets we’ve ever seen.

The market’s melting down, the 10-year is tanking, and Bessent is grinning like it’s Christmas morning. Because this? This is exactly what he wants.

Here’s why: the U.S. has over $9 trillion in debt maturing this year. Most of it short-term. At the same time, we’re running a deficit that could hit $3 trillion. That’s a monstrous refinancing problem. Every extra percentage point in interest costs the Treasury hundreds of billions.

So what’s the move?

You manufacture fear. Not a recession — just enough volatility to shake out leverage and send money flooding into Treasuries. Yields fall, refinancing gets cheaper, and you start plugging the hole without ever using the word “bailout.”

That’s what this whole tariff circus is really about.

Call it reciprocal trade, call it economic nationalism, de-globalization — whatever the label, the result is the same: stock market gets smoked in the short-term, bond demand spikes, and the government rolls its debt at ~3% instead of ~5%.

Bessent’s dream scenario.

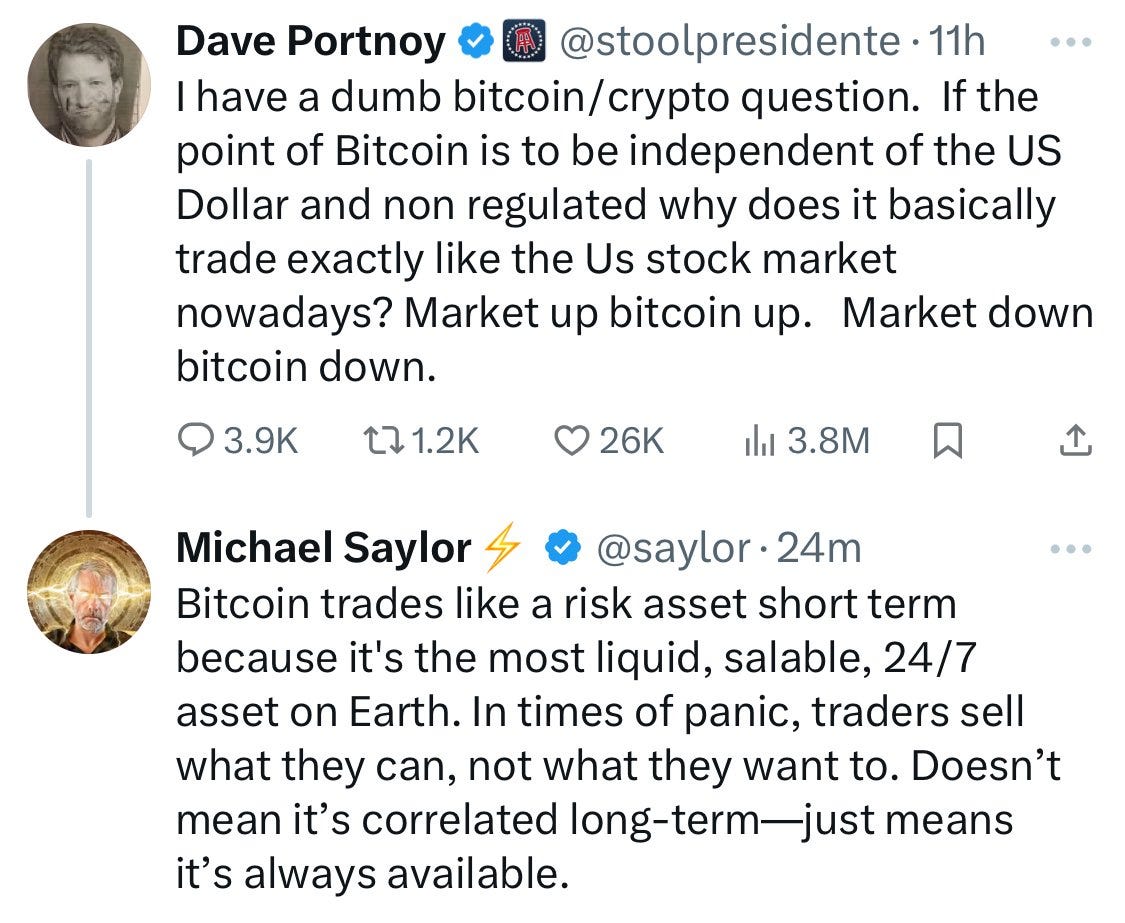

So Bitcoin must be getting crushed as well right? Nah, BTC is holding up like a digital champ.

On a day when the S&P had its worst sell-off since the pandemic, Bitcoin barely flinched. As crazy as it sounds, this might actually be the environment where it starts to break away from its old NASDAQ correlation for good. 2025 might just be the year Bitcoin starts acting like Bitcoin again.

I’m starting to see it.

If you’ve been paying attention, this has all been telegraphed. Bessent’s gone on record saying he’s targeting “3% GDP, 3% inflation, and 3% 10-year yields.” He doesn’t care about stocks. In fact, he openly mocked the sell-off in tech the other day as a “MAG7 problem, not a MAGA problem.”

As mentioned above, this has all been incredibly mapped out. Spook the market. Trigger a rotation to safety. Crash yields, not jobs. That’s the plan. And so far? It’s working.

But here’s the thing — you zoom out on a 10-year yield chart, and the setup gets a lot more ominous. We’ve had multiple attempts to force yields lower since 2021. Each time, it works… until it doesn’t. If the Fed caves and cuts too soon — my base case — or if inflation re-accelerates, we could be staring at 6–7% yields later this year. At that point, the whole “beautiful deleveraging” dream breaks down — and we’re back in between a rock and a hard place: default or debasement.

Oh?

I’ve always leaned toward money printer go brrr but who knows, maybe some kind of controlled default or economic restructuring can work — it’s an idea that’s at least a lot less far-fetched than before.

One thing we know for sure, Trump just f’d up global markets throwing countries into guaranteed recessions with just a few strong words. It’s pretty much like buh-bye emerging markets — for now anyways.

So while Powell might not be doing this yet…

Other countries will have to. Global distortions will be forced back into balance, and whatever pain that causes will be numbed with liquidity, which is good for BTC.

Bitcoin’s (short-term, periodic) correlation to NASDAQ could be coming to an end soon.

Thanks, Mikey.

That’s what makes Bitcoin so fascinating right now. It doesn’t need perfect conditions to shine. It just needs a system that keeps limping along, with bad options and even worse incentives. And that’s exactly what we’ve got.

Bitcoin is entering its 'Digital Gold' era.

Well when you put it that way…

Off to El Sal…see ya next week & good luck out there friends 🫡