The Future Is Expensive

Friday June 6th, 2025 - Issue # 106

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Well, so much for all of the ideas leading into this week’s newsletter. I was finally prepared — had all the bullet points, the throughline, the angle. Then Trump and Elon decided to nuke each other on X, and now I’m back to square one.

Or maybe square one is the perfect place to be — because it feels like the old system just got reset.

Yikes. Totally my own thoughts on this but the Dems had the Epstein files for years…if there was serious dirt on DJT wouldn’t they have used it during his campaign to keep him away from the Presidency? Anyways, thanks for allowing me to buy BTC at a discount boys 🫡

The Big Beautiful Bill was supposed to be Trump’s economic crown jewel. Make the tax cuts permanent. Toss in some goodies on tips and overtime. Reinvigorate border defense spending. And, in case you missed it, blow another $3–5 trillion hole in the national debt.

But something happened that no one expected: Elon broke rank. His tweet wasn’t subtle. It read like a breakup letter. “Disgusting abomination,” he called it. “Shame on those who voted for it.”

When Elon is calling out Trump and the Republicans for spending too much, you know the floor just shifted.

Even Brian Armstrong jumped in — calling out Congress for ballooning deficits and reminding the world that Bitcoin will take over as the reserve currency if this continues. Spoiler alert: it’s going to continue.

While I was 6 hours ahead of the market in Italy, I went pretty deep down the rabbit hole on AI — again, by the pool, and maybe a Peroni off to the side. Eh, it was the expression “it’s 5 o’clock somewhere” in real time 🤌

I started by reading this paper: SITUATIONAL AWARENESS The Decade Ahead

TLDR: There is an arms race between US & China to get to Artificial General Intelligence (AGI). The paper predicts that AGI will lead to superintelligence — AI far surpassing human intellect shortly after reaching AGI, triggering an “intelligence explosion” that could reshape the world faster than any previous technological revolution.

It’s a meaty report and look, I’m no computer scientist, but I’ve found myself in the camp, with high conviction, that the market is greatly underestimating and therefore greatly underpricing AI.

Don’t worry, I think I’ll be able to bring this around full circle but first here’s former CEO of Google, Eric Schmidt’s TED Talk on the subject — IMO it’s a must watch:

Here’s the thing. You can’t have a recession during an AGI arms race. You just can’t.

Not when the new war is compute. Not when it requires:

A nuclear energy buildout

Full-stack chip sovereignty

24/7 AI inference farms

Data centers that rival small cities

I think the race to AGI is the most important thing we will witness in our lifetimes — and the stakes are global economic dominance. The U.S. won’t stop spending. Not for inflation. Not for bond vigilantes. Not even for Elon.

My idea is that we’re entering a new phase: permanent stimulus.

The financial system wasn’t built for this.

“Too much debt. Too much leverage. The superstructure creaks under its own weight. Treasury yields scream what headlines dare not say: something deeper is breaking.” - Hugh Hendry, the acid capitalist.

Wise words from a very eccentric former global macro hedge fund manager.

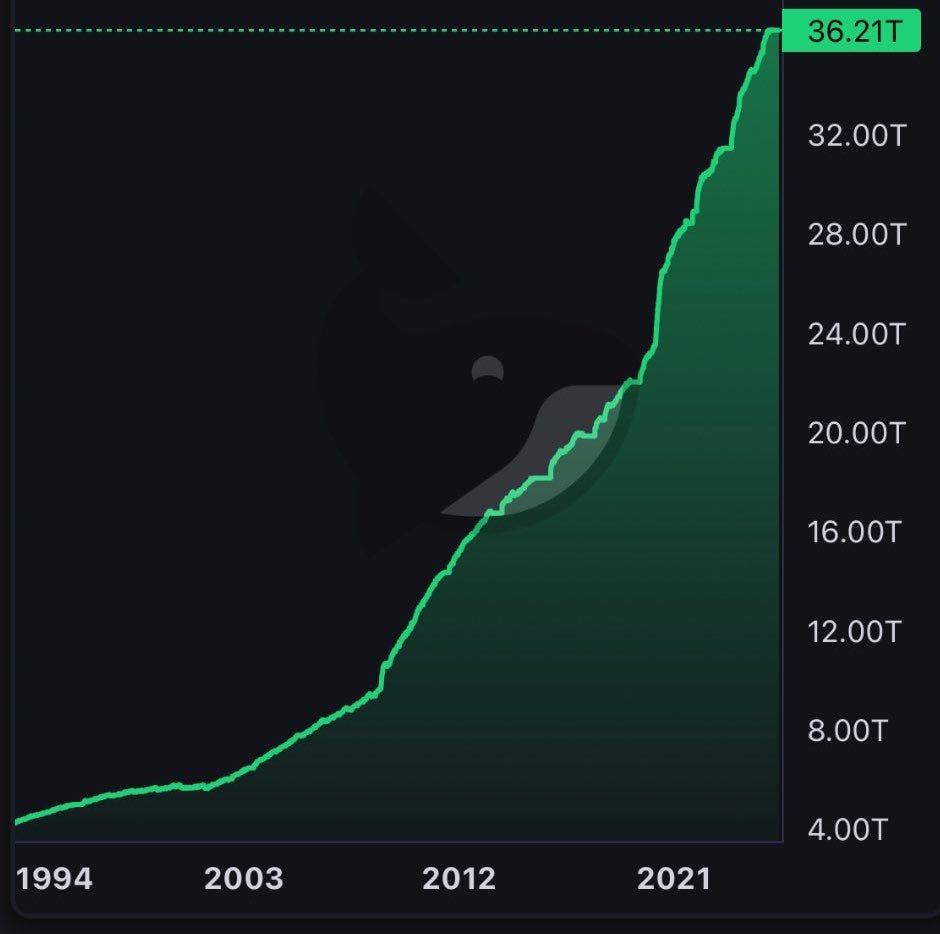

This isn’t Apple, Tesla, or NVIDIA. This is the U.S. national debt chart. And it’s eating the world.

Here’s a letter I wrote nearly 2 years ago to the day:

If you asked me at the time what the US Debt Clock would display in 2 years time, even I could not imagine an additional $5 trillion.

As highlighted in my last letter, austerity is passé.

Elon: “I just can’t stand it anymore. This pork-filled bill is a disgusting abomination.”

Trump: “I agree with Elizabeth Warren. Let’s eliminate the debt ceiling.”

When those are your two poles, the center doesn’t hold. And what’s becoming clearer by the day is this: America is not going to stop spending.

So where does that leave us?

If AGI is now a national imperative — and the spending tap stays wide open — we’re entering a kind of fiscal singularity. One where the government can’t slow down, even if it wants to. The bond market’s already gagging on new issuance. The math doesn’t pencil out. But the mission can’t stop.

What does that mean for markets?

It means the AI arms race isn’t deflationary — it’s inflationary. Not in the CPI sense, but in the sense that capital will flood into everything required to support this new reality: chips, energy, compute, infrastructure… and collateral.

And when everything else is being created, subsidized, printed, or inflated?

Scarcity starts to matter. A lot.

Gold had a millennium-long head start. Bitcoin didn’t need one. Its message is louder now than ever: finite, borderless, unkillable. And this time around, the adoption curve is real.

This is the first cycle where we’re seeing institutional-level accumulation of Bitcoin as a store of value, priced next to gold and sovereign bonds.

There is still a massive delta between gold at $20 trillion and Bitcoin at $2. That gap won’t last forever.

It’s not just about avoiding collapse anymore. It’s about what emerges on the other side.

You can feel it — the coil is tightening. The state won’t cut spending. The debt ceiling is gone. The AGI race can’t be paused. Markets are scrambling to price all of this in, and they’re behind whether they think they are or not.

That’s why this cycle might last longer — and go higher — than most people think is possible.

Because Bitcoin is no longer just a bet on monetary failure. It’s a bet on the world sprinting into a future of infinite abundance…where the only thing that can’t be printed is trust.

The only question I have now is: is my Tesla more or less likely to be key’d than before?

Have a nice weekend.