The International Asset

Friday July 7th, 2023 - Issue # 47

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

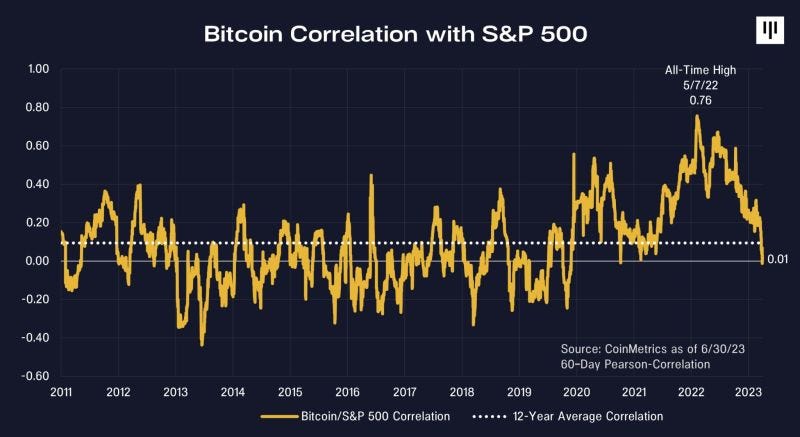

Bitcoin has officially moved from being the big fish in a small pond to competing with gold, private equity, commercial property, et al., in an alternative asset ocean worth ~$100 trillion or more.

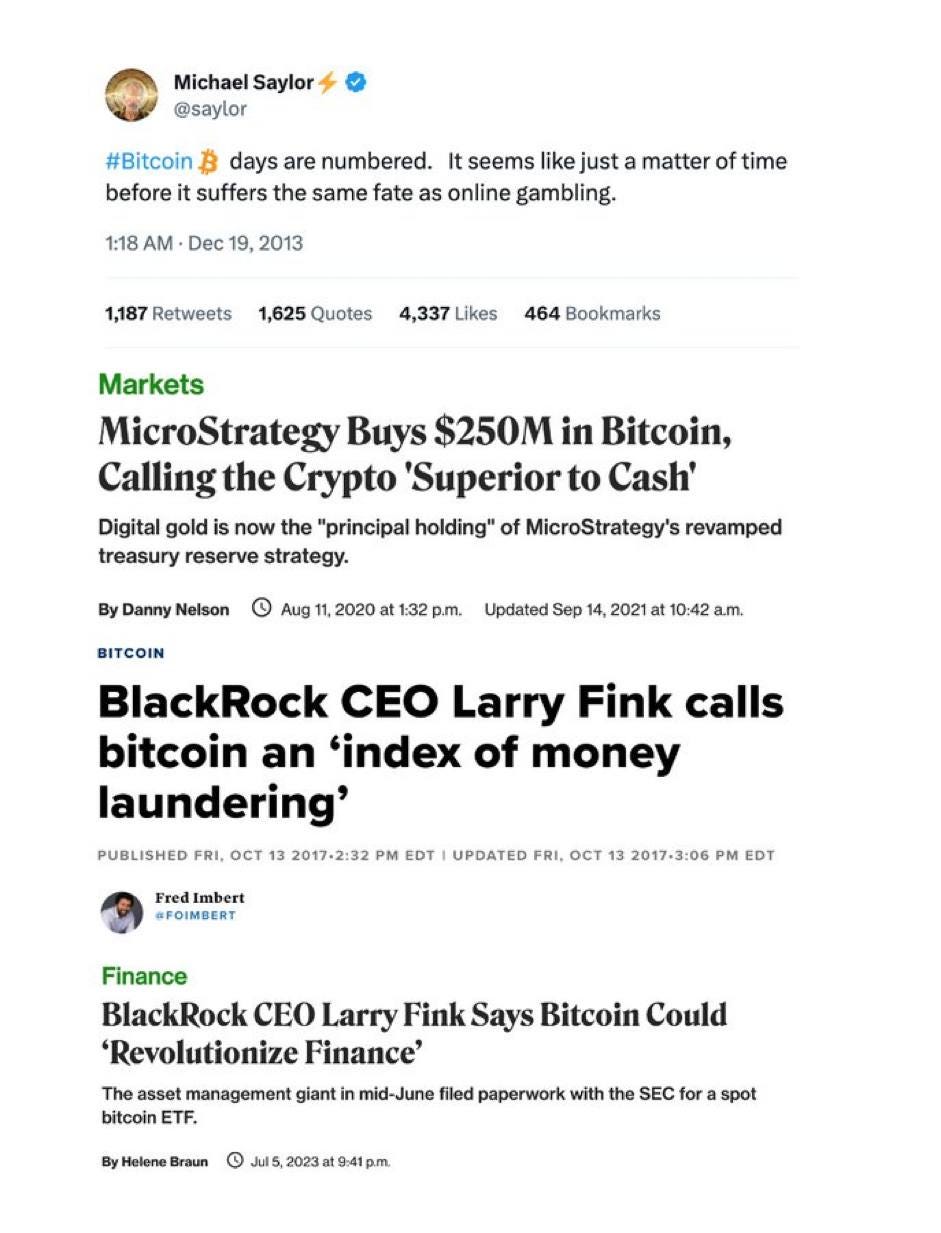

On Wednesday, BlackRock CEO Larry Fink — who is arguably the most powerful and influential person in global finance — gave Bitcoin its stamp of approval (not like we needed it).

“I do believe the role of crypto is...it is digitizing gold in many ways. Instead of investing in gold as a hedge against inflation, a hedge against the onerous problems of any one country or the devaluation of your currency whatever country you’re in. Let’s be clear, Bitcoin is an international asset - it’s not based on any one currency. Bitcoin can represent an asset that people can play as an alternative,”

He did not need to say all that. He could’ve got away with simply saying that BlackRock clients have expressed enough interest in getting exposure to Bitcoin that they could no longer ignore. He could’ve gone on to say that they are in the business of launching innovative ETFs and that they believe they have a good shot of getting this one over the line. Instead, he dug in to why Bitcoin is revolutionary, here to stay, all while breaking the hearts of goldbugs who now have to take BTC a bit. more seriously.

The significance of Fink's pro-Bitcoin remarks cannot be overstated. By openly endorsing Bitcoin as a viable and potentially superior alternative to gold, and an “international asset” he not only gave BlackRock's seal of approval to BTC, but also set the stage for a significant shift in the mindset of the asset management industry. The implications of this endorsement are likely to have a lasting impact on the psychology and decision-making within the finance industry.

Last thoughts on this because I just can’t get over how incredibly bullish this all is…if you’re outside finance, you may not know that Larry Fink produces annual letters to CEO’s and to BlackRock shareholders that are both highly influential within the financial industry, and eagerly anticipated by investors, policymakers, and industry professionals. I think Bitcoin could take the spotlight this year which could have a monumental impact, as his endorsement or positive sentiments towards Bitcoin may boost confidence, attract institutional investment, and validate Bitcoin as a legitimate asset class.

“Higher for longer”

“Massive recession coming”

I really think the market is overlooking the birth of a *new* alternative asset. In my opinion, it is inevitable that we get a Bitcoin ETF and after this week, you better believe that asset managers are doing the work to understand how to size up their allocations for when the time comes.

How they are letting us buy BTC at $30k is beyond me. The risk/reward profile is pretty incredible. To put it in perspective, if BTC triples from here it would still be half the size of Apple…

The window is getting smaller and smaller to get exposure before institutions come in and never leave.

First they ignore you, then they laugh at you…

Then they join you.

Off to Italy for back-to-back weddings. Be back with y’all in a couple weeks!