The new narrative

Sunday February 26, 2023 - Issue # 39

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good morning and happy Sunday!

Can someone tell me how we’re already at the end of February? I don’t know if it’s just me but, this year feels like it’s flying by — I am not mad about a seemingly speedy “crypto winter” and actual winter — but so much to do, and so little time.

I’m going to keep today’s note relatively short since I thought I’d just touch on the current narrative playing out in crypto — Hong Kong reopening its doors as a key crypto hub. But first, I think I should mention that I listen to a lot of podcasts…like, a lot, every day. I’ve tossed a pod into these weekly pieces here and there, but I think moving forward I’ll make it a habit to highlight any podcast that I believe are worth taking in. This week’s dose of hopium came from Luke Broyles on the Bitcoin Fundamentals segment of the We Study Billionaires podcast. During their conversation, Preston Pysh and Luke Broyles discuss the impact of Bitcoin from a historical perspective on monetary systems. Luke is known for producing compelling content on the significance of Bitcoin, emphasizing the beginning of the information era and the crucial need for scarce digital monetary units at this juncture. If you’re on the go, you can listen on Spotify here, but I think the charts in the YouTube video are worth checking out.

Okay, Hong Kong, known as the fourth-largest financial centre in the world, after New York, London, and Singapore, has been all the rage recently as it has reopened its doors to crypto. "Asia is bidding" seems to be the new narrative as folks are feeling blissful off the back of the recent move up and are now searching for hope that we can sustain the momentum.

Hong Kong's recent re-emergence as a crypto hub is expected to have a significant positive impact on the crypto market. The city has once again become a hotspot for crypto enthusiasts and investors due to its strategic location and financial ecosystem. The recent events, including China reopening after Covid-19 and the Hong Kong Securities and Futures Commission's decision to allow retail investors to trade crypto, have further fuelled the hype around Hong Kong's potential to lead us into the next bull cycle.

Reason to be bullish #1: HK is considered the first option for wealthy mainland Chinese to withdraw their capital from the isolated country. Estimates show that, Chinese wealthy move close to $500 billion to HK to gain access to special economic zones and the global financial system.

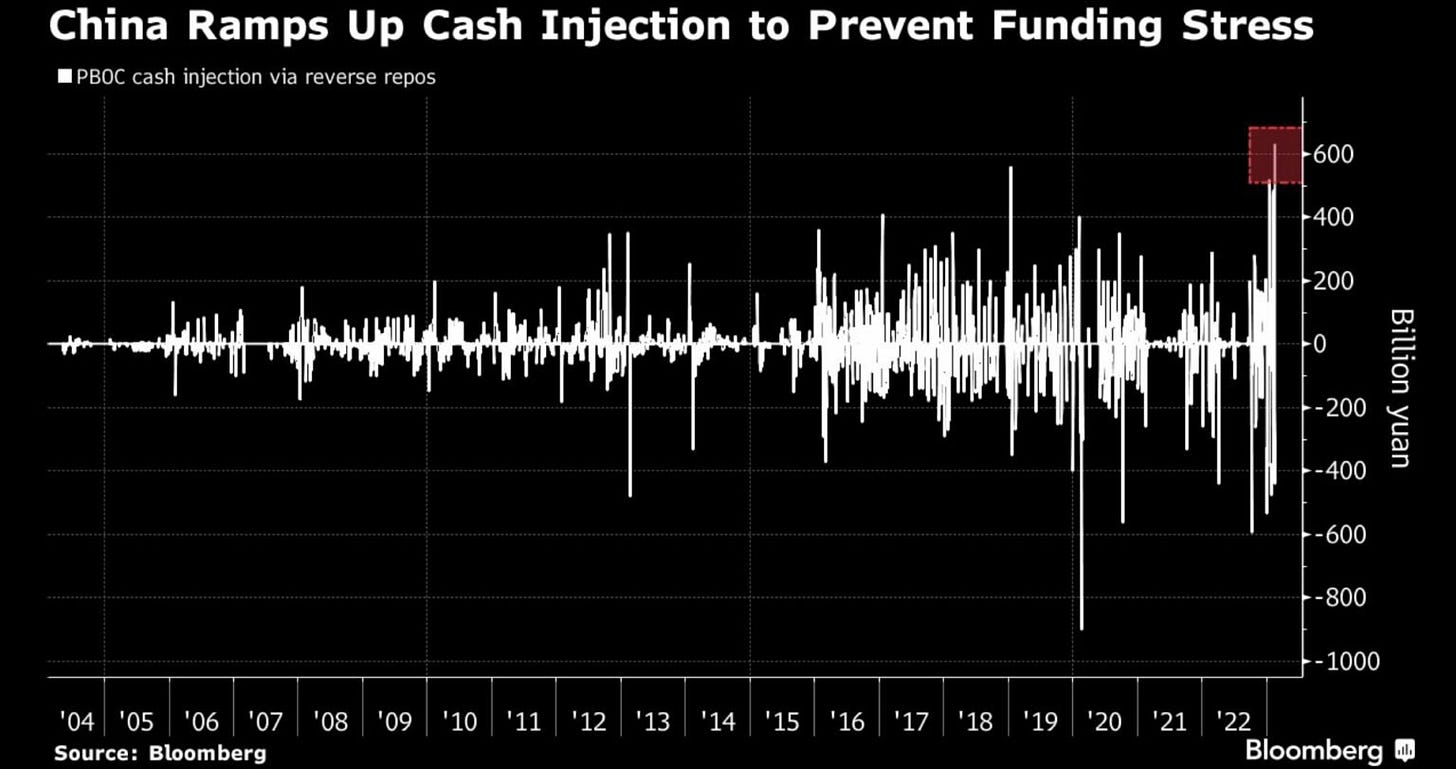

Reason to be bullish #2: People’s Bank of China (PBoC) is the world’s third-largest central bank, with assets of around $6 trillion, playing a key role in global liquidity. Having just reopened after a very long fight against Covid, the current monetary policy in China is opposite town compared to the West. Last Friday, for instance, $92bn USD (net) was injected to bring down borrowing rates and make cash easier to come by.

Although uncertain about the extent of the impact, the resurgence of Hong Kong as a cryptocurrency hub along with China's reopening is expected to be favorable for the market. The macro conditions are still fragile and the Fed seems pretty committed to taking rates higher and keeping them in and around these levels for longer than most of us would like. However, there are always asset classes that do well no matter the weather. When large markets like HK make it easier for their residents to access Bitcoin and other cryptos, we tend to notice that even minor developments can have a noticeable impact on the market.