₿ullish

Friday January 20, 2023 - Issue # 36

Happy Friday!

It’s funny how cycles in this market affect the way some might feel about Bitcoin relative to the rest of the other tokens, cryptos, coins…whatever you want to call them. In bull markets, people tend to forget that Bitcoin is the reason we have this market in the first place and ignore the characteristics that make it so special. This typically leads to Bitcoin underperforming the pack, and you see a lot of folks dismiss Bitcoin because it’s outdated, slow, bad for the environment, tough to build on, etc, etc… If my memory serves me correctly, “boomer coin” was a term that was thrown around quite a bit toward the end of the last run.

In bear markets, however, things change pretty quickly. The high-flying speculative crap gets crushed, firms that took on degenerate levels of risk blow up, frauds get exposed, and slowly folks start coming back around to the King. I am no saint in this regard. Even after 5+ years in this space with the majority of my bag in BTC, I’ve still found myself paying too much attention to the hype at times — fomo is a mofo.

I’ve found that it is always quite sobering to do a sort of rabbit hole refresh in times of need. Here are two great pieces I’ve read (more than once) as of late:

Finding Signal in a Noisy World - Jeff Booth

A look at the Lightning Network - Lyn Alden

There are good reasons why the market eventually finds its way back to Bitcoin. Here are a few:

Bitcoin has stood the test of time. To date, the Bitcoin network has experienced four significant market cycles, during which its value and user base have grown exponentially. These cycles, which alternated between periods of face-melting bull markets and devastating bear markets, took place in 2011, 2013, 2017, and 2021. Over the past ~13 years since its inception, Bitcoin has survived trying scenarios (ex. Mt. Gox, and the block size wars), constant attacks by governments (ex. country-wide bans), FUD (ex. ESG activism), and the like. Through it all, Bitcoin has remained fully decentralized and secure. Take that, tulips.

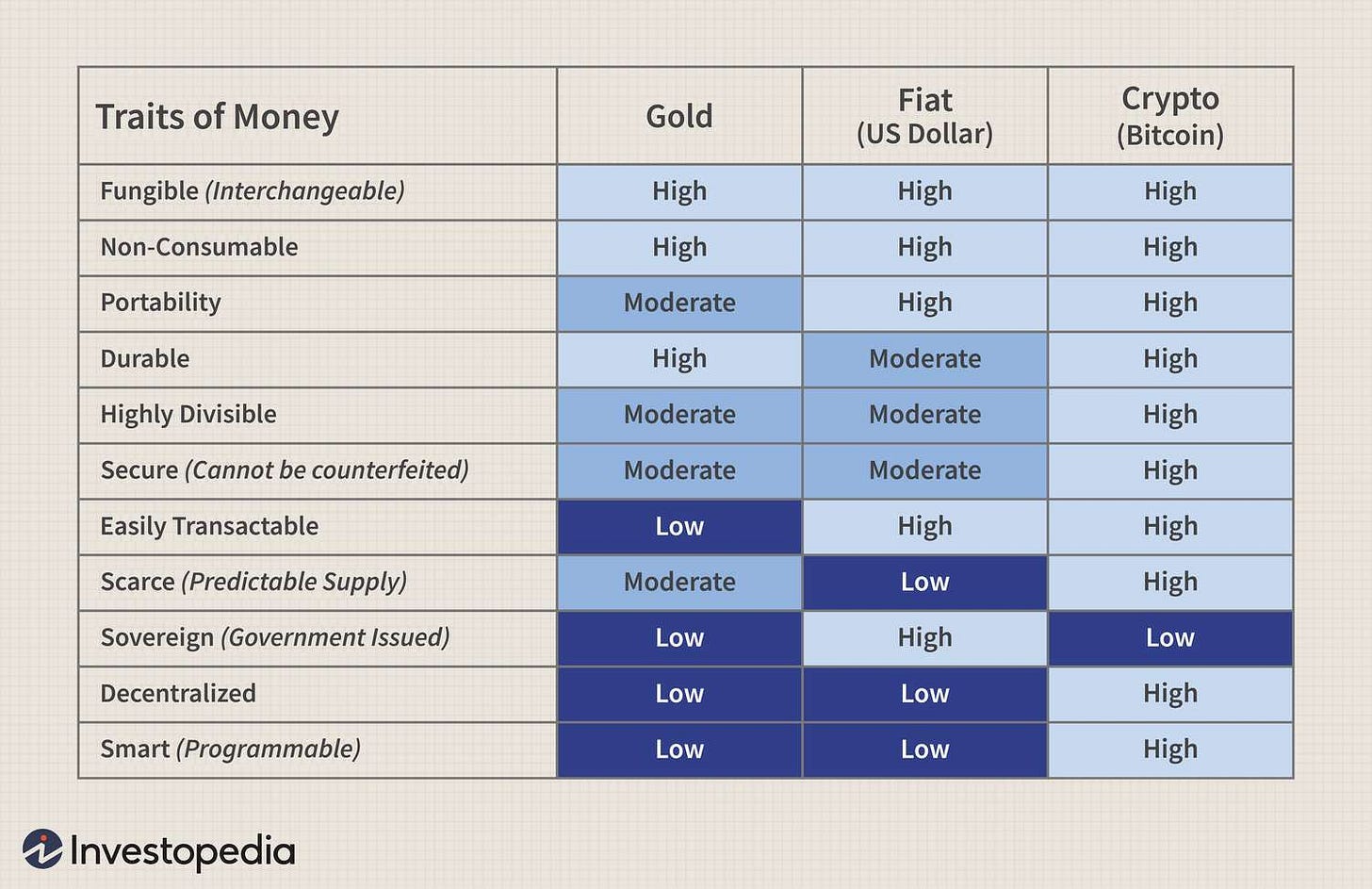

Bitcoin is the best form of money.

No other cryptocurrency is even trying to compete with Bitcoin on this fact.

Bitcoin can be seen as a reaction against the current global fiat monetary system, which is based on the idea that a currency's value is derived from the faith and credit of the government that issues it. Bitcoin is not susceptible to inflation and manipulation by central authorities.

“Digital gold” to which Bitcoin is commonly referred to, is a very strong narrative. Gold is a ~$10 trillion asset that has been regarded as the hardest form of money for millennia. In today's digital world, cash is represented by numbers on a screen and our wallets are now apps on our phones; it’s hard to envision a return to a gold standard.

Also, as the chart above illustrates, Bitcoin is a sovereign form of money. As the world becomes more divided and countries move away from cooperation, it makes sense that governments would not want to support the currency of perceived adversaries by increasing demand for it. Bitcoin operates independently of any central authority, making it a potentially attractive option for payments and settlements in a multi-polar world.

I suggest giving the article below a read if you want to dive deeper into all of the traits that suggest Bitcoin is the best form of money humans have ever had.

What is Money, Anyway? - Lyn Alden

Bitcoin is not a security. The US Securities and Exchange Commission (SEC) and other high-ranking regulatory bodies view bitcoin as a commodity rather than a security. This means that it is not subject to the same regulations as traditional securities, such as stocks and bonds. This level of clarity has helped Bitcoin to become an institutionally investable asset, unlike all other cryptocurrencies (some say ETH may fall into this category as well). The spotlight is on crypto right now for all the wrong reasons after an extremely loud 2020/2021 followed by a treacherous 2022, which was fraught with countless blow ups. Regulators are ramping up their efforts to reign in the crypto market and SEC Chair Gensler has made it abundantly clear that he believes most cryptos are securities and enforcement is around the corner. While investors sit on their hands waiting to see how this all shakes out, Bitcoin is sitting atop the market without concern.

The points I outlined above are just a few of the reasons why Bitcoin tends to fall back into favour once the market sobers up. So, I wouldn’t be surprised to see Bitcoin continue to stand out and garner most of the attention in crypto while the macro environment remains difficult.

Have a great weekend folks!

(Any views expressed are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)