Under Pressure

Friday January 16th, 2026 - Issue # 124

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Woah, just realized this is my first post of the big ’26. Happy New Year to all of you. One of my many goals this year is to write more than I did last year so I guess that starts now. Coming to you live from El Salvador where I’ve been stationed and loving life since the beginning of the month. It truly is an incredible place.

Last week, we had the second annual Max & Stacy Golf Invitational which exceeded expectations.

While we didn’t come close to winning the golf tournament, Jon took down the poker tournament — Satstreet had 3/9 at the final table — couldn’t be more proud. And Jon took it down with the Doyle Brunson!

Alright, I don’t want to rub it in anymore as I know Toronto was hit with a massive snow storm yesterday so I won’t show you a picture of me writing this as I’m enjoying a coffee watching the sunrise on the beach 🤫

Okay, back to business.

Did you guys see Jerome Powell’s video message this week? I heard someone say it looked like a hostage video, which is both funny, and true. He had the subtle look of a man who knows every sentence is being dissected by politicians, markets, prosecutors, and millions of asset owners around the world. I have to admit I kind of feel bad for the guy. He’s under serious pressure.

And that pressure just got louder. Federal prosecutors have now opened a criminal investigation into Powell. Whether anything ultimately comes of it is almost beside the point. The most powerful central banker in the world is no longer untouchable. Institutional credibility is cracking, and when that happens, people start paying much closer attention to what they own versus what they’re being promised.

Check it out.

Powell’s getting hit from all sides as political pressure around monetary policy continues to build. There’s a growing push for easier financial conditions, especially as markets are ripping and the tech elite have sold US and China the AI promise land. They’re all in. They can see 5-6% + GDP through their rose coloured lenses. And all the while rising asset prices create a wealth effect, boost confidence, and make the economy feel healthier, regardless of what the underlying fundamentals say. It’s a self recursive loop and in today’s system, asset inflation has effectively become the new stimulus. Markets go up, people feel better. Markets stall, pressure builds. And the Federal Reserve sits right in the middle of it with very few levers to pull.

Adding fuel to the fire, CPI came in lower than expected on Tuesday. While economists will argue over the exact implications, the takeaway is simple: inflation isn’t accelerating the way policymakers feared. That gives central banks more room to justify easing financial conditions. Markets immediately read this as supportive for risk assets, and the response was predictable. Lower inflation plus political pressure to ease almost always points in one direction → moar moula.

So here we are. THE central banker under legal and political scrutiny. A growing narrative that financial conditions are “too tight.” Inflation data that makes easing easier to defend. And a market that has been trained for over a decade to expect support whenever things get uncomfortable. The outcome isn’t hard to predict. Liquidity will find its way back into the system. And when it does, it won’t flow evenly. It will flow into assets.

That’s the real dividing line in modern economics now. Not income. Not intelligence. Not effort. Ownership.

People who own scarce assets benefit when money gets cheaper. People who hold cash get diluted. This isn’t ideology, it’s math. Wages don’t keep up. Savings don’t keep up. But assets reprice. Stocks, real estate, commodities, businesses, and bitcoin all act as escape valves in a system that requires constant expansion to function. Cash has always been trash but it’s New Delhi style trash right now.

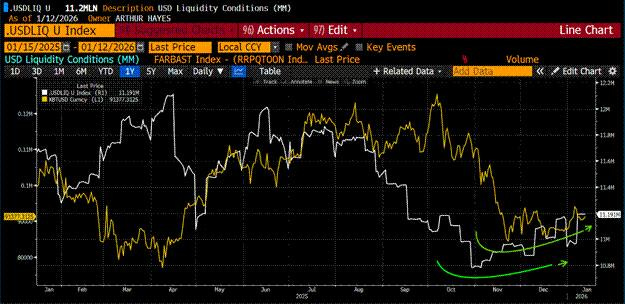

Stole this from Arthur Hayes recent essay.

“Bitcoin (gold) and dollar liquidity (white) bottomed around the same time. As dollar liquidity rapidly increases for the reasons described above, Bitcoin will follow. Forget about 2025 and Bitcoin’s underperformance; the liquidity didn’t support our crypto portfolios. But let’s not draw the wrong conclusions from Bitcoin’s 2025 underperformance. It was as it always is, a liquidity story.”

I mean this is exactly what bitcoin was built for.

Bitcoin wasn’t built for stable times. It wasn’t designed for calm, predictable monetary policy. It was built for a world where trust in institutions erodes, where money is politicized, where policy is reactive, and where the measuring stick keeps getting weaker. It was built for a system that has to print, has to stimulate, and has to inflate assets to keep the machine running.

When even the Fed Chair isn’t insulated from legal and political pressure, it becomes obvious that monetary policy isn’t purely technocratic anymore. It’s narrative-driven. It’s about optics, confidence, and keeping the system moving without breaking. And when stability becomes the priority, asset inflation becomes the tool.

Bitcoin doesn’t need trust in people. It doesn’t care who’s in office. It doesn’t depend on CPI prints, political pressure, or public confidence in central bankers. It runs on code, not credibility.

But owning bitcoin isn’t easy. And it’s not supposed to be.

If holding Bitcoin felt chill in any way, the opportunity would already be gone. Nobody struggles to hold BTC when it’s all green candles. The real test is in the drawdowns and the chop. The moments where price goes from $126k to $80k and your mind starts working against you. Especially if you’ve been around before, telling yourself in the midst of the bear that once BTC get’s back above ____ you’re done. After living through a few drawdowns the feeling pulls on your soul as soon as things start to get dicey.

Then you watch something like this ^ and you snap out of it, you buy more because “there’s blood in the streets.” Then it keeps going down and your fears start to compound. Then a scary narrative comes out and you become crippled with anxiety. Thinking about all the cool shi** you could’ve done or bought if you just didn’t get so greedy.

Lol sorry to put you through that. TGIF!

But seriously, that emotional difficulty is the filter. It shakes out the tourists, the over-levered, and the people who invested money they actually needed. The harder it feels to hold, the more upside is usually still ahead. Markets don’t hand out generational returns for free. They make you earn them.

Bitcoin isn’t a test of intelligence.

It’s a test of patience.

The people who survive the volatility are either the ones who sized their exposure properly and understood what they were buying, or forgot they had it. Bitcoin isn’t meant to be your emergency fund. It’s meant to be your long-term escape hatch. When you buy it with a 10+ year mindset with an amount of fiat that you don’t immediately need, the emotional experience changes completely. You stop caring about every dip. You stop obsessing over headlines. You let time do the heavy lifting.

Bitcoin wasn’t built for comfort.

It was built for chaos.

It was built for politicized money, eroding trust, asset inflation, and a system that survives by expanding. It was built for a world where the safest move isn’t trusting institutions to “get it right,” but owning something that doesn’t depend on them at all.

If it was easy, everyone would do it.

And if everyone did it, the opportunity wouldn’t exist.

Bitcoin was built for this.