USG ⬇️ BTC ⬆️

Friday October 3rd, 2025 - Issue # 116

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good morning,

I skipped last week (sales team golf outing at Glen Abbey, testing the course for our inaugural industry tournament on June 8, 2026…stay tuned 😎 — pic included for proof, and because my hat hair wasn’t so bad). But Q4 didn’t wait for me to get my swing back. Bitcoin ripped through $120K to open the quarter, right as the U.S. government officially shut down.

The timing couldn’t have been more poetic. While I was trying to figure out my slice, Washington was shutting off the lights. And as it turns out, UPtober was destined to tee off with fireworks.

Government shutdowns aren’t exactly rare. Since 1976, there have been 22 funding gaps and 10 full shutdowns, the longest running 35 days back in 2018–2019. Most of the time, markets shrugged. Workers got furloughed, parks closed, IOUs went out, and eventually Congress got it together. It was political theater more than an existential crisis.

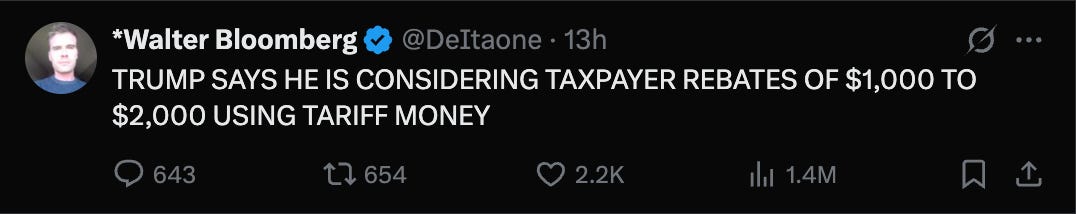

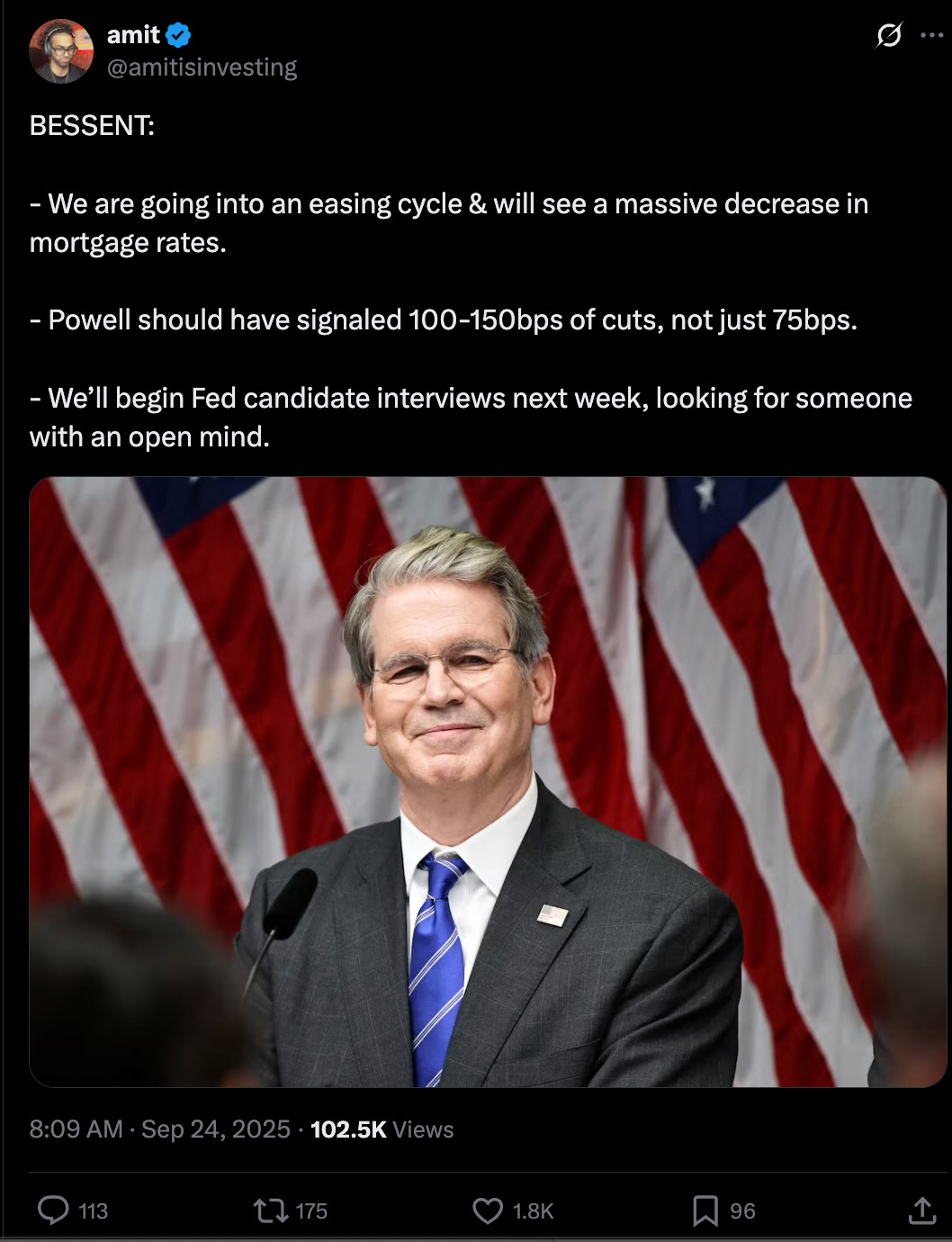

But this one feels different. Aside from the fact that literally everything is happening at once, US credibility is waning, and the left and right can’t see eye to eye on anything. Debt-to-GDP is already north of 120%. Interest expense now exceeds the defense budget. And instead of even pretending to debate fiscal restraint, the ideas being floated are things like $1K-$2K rebate checks (stimmys) funded by tariffs and promises that “we’ll grow our way out of debt.” In other words: the same broken playbook, only louder.

This is real and it shouldn’t be discounted.

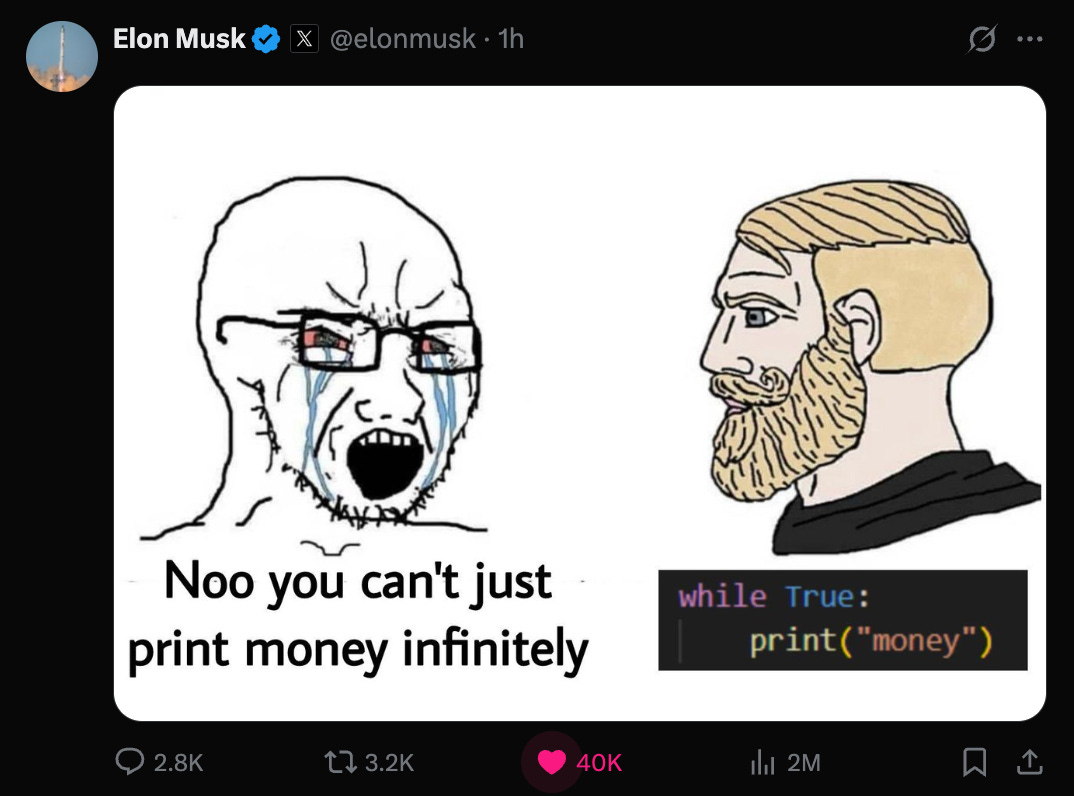

…& this might just be the best advertisement for BTC ever:

We’ve talked all year about how the US has chosen to inflate its way out of debt rather than confront austerity. So when you hear a bear droning on about “the recession around the corner” or how “markets are too expensive,” but they don’t have a coherent view on AI or debasement…run.

And let’s not forget, Trump isn’t just the President, he’s the self-proclaimed King of Debt. He told us straight to our faces almost a decade ago. Nothing about this should be surprising. They’re going to run it hot.

The other force that makes this cycle so strange — and so powerful — is the AI buildout. This isn’t pets.com. It’s the largest capex binge since WWII: land, power, chips, fabs, data centers, fiber, talent. You don’t pause a global arms race because CPI is 43 bps too high. That’s why the policy choice has already been made: run it hot, backstop the plumbing when it wheezes, and pray that productivity eventually outruns the debt service.

In that world, every shutdown, mini-stimulus, and “emergency” cut simply feeds the same loop: more nominal growth, more deficits, more financial repression…and more demand for scarce assets.

If you’re like me (a veteran round-tripper), you’re probably asking: how does this go bad? Blow-off tops don’t die of old age; they die when something critical stops clearing. In plain English: when the political will to print collides with a hard constraint. Here are a few ways that can happen:

The bond market revolts (we are here). Term premiums rise, auctions tail, foreign buyers step back. Treasury has to choose between much higher rates or explicit yield-curve control. Higher rates = liquidity tightens and risk cracks. YCC = dollar weakens and the debasement meme goes mainstream.

Inflation re-accelerates from a non-financial shock — a spike in energy or supply-side costs right into the AI buildout. Fiscal stays wide open. You get stagflation: “can’t cut, can’t hike.” That doesn’t kill the market, but it changes leadership. Hard assets, toll-like infra, and Bitcoin absorb the premium.

A credit event disaster — not regional banks this time — maybe REITs, shadow banks, or a sovereign in need of IMF-style help. Liquidity crunches hit everything…until the policy response overwhelms it. We saw it in 2023: BTC dumped, then ripped 40% when “no counterparty risk” actually meant something.

Fourth, political shock. A messy debt-ceiling standoff, shutdowns bleeding past expectations, or populist giveaways that accelerate deficits under patriotic slogans. Ironically, these “shocks” often end up bullish for the debasement trade because markets front-run the bailout.

The slow burn: USD hegemony erodes at the margin. More trade invoicing off-dollar, more BTC on sovereign balance sheets, more capital controls in fragile economies. Not exactly a collapse just the neighborhood changing around the dollar.

Which of these marks “the end”? Honestly, I don’t think any of them. Sure, we can get another bear market — but trying to trade Bitcoin in and out is near impossible. The best trade I’ve ever made is doing nothing. I’ve worn the round-tripper hat enough times to know: I’m not selling.

These shocks aren’t the end, they’re inflection points. If we do get a Q4 blow-off, it probably peaks when something breaks — a failed Treasury auction, an energy spike, a credit pocket blowing up. At that moment, policymakers just reach for the next lever — YCC, tariff checks, or some new easing gimmick.

For Bitcoin, the playbook is simple. In debasement, it stair-steps higher as institutions treat it like digital gold with torque. In liquidity crunches, it gets hit first then leads the rebound once the policy put kicks in. The only real headwind would be credible fiscal discipline, and clearly nobody in power has the stomach for that.

Or maybe it’s just the “end” for the dollar? I’m not so sure about that…not in a single headline anyway. Reserve currencies fade, they don’t fall and it’s all relative. The near-term risk isn’t a dollar collapse — it’s Washington quietly rigging the bond market to keep the lights on. Think capped yields, forced demand for Treasuries, and rates held below inflation. That’s how they defend the system. That’s not a bear case for bitcoin. That’s the case.

So yes, we can get a silly Q4 melt-up — shades of Q4 2017, when Bitcoin turned a normal quarter into the most insane 3 months of my career. If it happens, it likely ends on a funding or inflation constraint, followed by a messy shakeout…and then another round of creative policy to keep the lights on.

Have a nice weekend.