Wake Me Up When September Ends

Friday September 6th, 2024 - Issue # 80

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

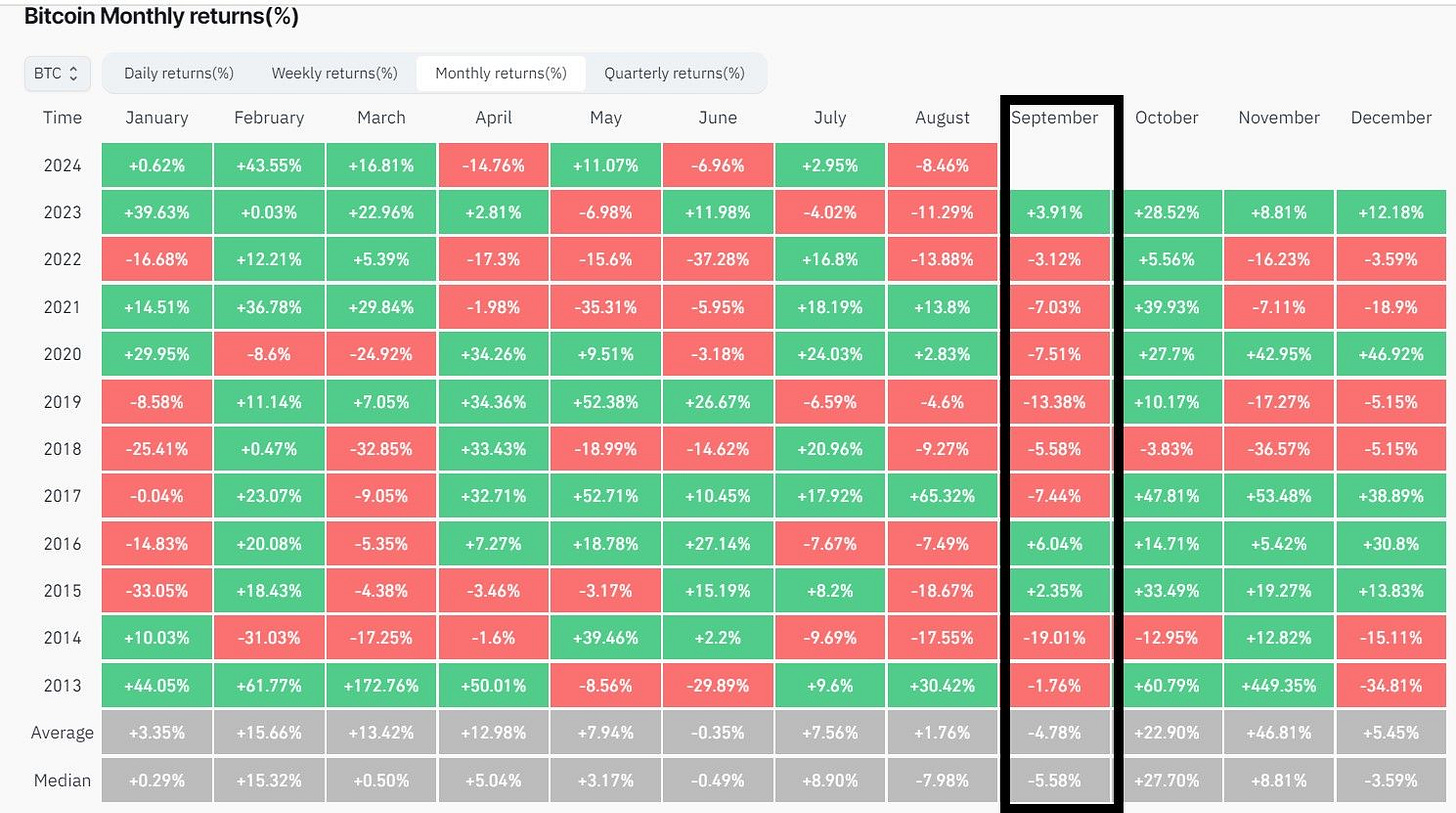

September, on average, has historically been the worst month for Bitcoin price.

We’ve kicked off the month down 6% which is just above average for September. Where we go from here is anyone’s guess, but the good thing is, we’re all long term investors right? Right???

It’s hard to deny that market sentiment on crypto Twitter is currently in the gutter — I can’t remember the last time it was this bad. People are genuinely losing hope, lots are on the sidelines waiting for something to happen, most aren’t even thinking about crypto right now.

What we’re seeing at the desk is that investors haven’t necessarily lost hope, but they are very much sidelined with large cash positions waiting for an opportunity to move in. I think it’s also interesting to note, we’re seeing a relatively new type of investor on the sidelines…sophisticated investors (UHNW, institutional) who have never allocated to Bitcoin but have been following it for years and are now ready to start building a position — again, after something happens. When I’ve noticed that the majority of folks I speak to are waiting for something to happen before they pull the trigger, 10/10 they usually end up buying at higher levels where they feel more confident that we’re back in easy mode. Obviously NFA, but I think if you have an idea of how much you want to allocate to this asset class, it’s best to dollar cost average (DCA) during these times.

Want some hope? Take a look at the chart above, and take a close look at the chart below. October Uptober and Q4 are just around the corner.

In every Bitcoin/crypto bull market, Q4 is where the real fun begins, and this cycle is shaping up no differently. We have plenty to look forward to next quarter: The Fed is expected to kick off its cutting cycle with the first rate cut in less than three weeks. Also, FTX creditors are likely to receive around $16 billion—a substantial chunk of which might flow right back into the market. Then there’s what might be the most important and polarized election in US history, especially critical for the crypto space.

How am I playing it? Regardless of who wins the election, Bitcoin’s trajectory does not change — it has already been institutionalized and both candidates are big spenders. However, things could get especially unpredictable if Kamala Harris wins. Altcoins should surge if Trump takes the victory as he’s promised to fire Gensler and usher in crypto-friendly regulations, but it’s definitely a gamble. I have consolidated most of my positions into Bitcoin until the election dust settles. If the Democrats somehow find a way to win, I’d expect they would ramp up their hostility towards crypto, therefore, altcoins even at these relatively depressed levels look expensive.

But hey, if there's going to be a nuclear war, it doesn’t really matter what your portfolio looks like, so you might as well be fully invested, right? Haha…

Weekly podcast recommendations