War — but not as we know it

Friday April 25th, 2025 - Issue # 103

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

War in the Middle East. War in Ukraine. A U.S.–China trade war. The war on AI, on inflation, on everything…

And then there’s the quietest, most important war of them all — the war to acquire as much freaking bitcoin as possible.

While everyone’s distracted by bombs, ballots, and bots, the smart money is stacking sats at a record pace. It started with Strategy (formerly MicroStrategy). Then Tether. Then Semler. Then Metaplanet. This week? SoftBank enters the chat. Who got Masa to take the orange pill?

SoftBank is joining forces with Tether, Bitfinex, and Cantor Fitzgerald to launch 21 Capital — a Bitcoin-native company seeded with over $3 billion in BTC and headed for the public markets via SPAC, according to the Financial Times. SoftBank alone is committing $900 million to buy Bitcoin at $85,000 — a massive reversal from Masayoshi Son’s ill-timed $200M BTC trade back in 2017 that ended in a $130M loss. But this time? There’s no easy exit. At the helm is none other than Jack Mallers, one of Bitcoin’s most diehard advocates — a move that gives the market confidence those 40,000+ BTC aren’t going anywhere. With Mallers in charge, this isn’t some short-term trade. It’s a mission. This is Son’s biggest bet yet — not just on Bitcoin, but on the future of hard money itself.

It seems like every week, a new public company announces Bitcoin on its balance sheet — and soon, it could be every day. We’re talking about hundreds, potentially thousands of cash-flowing, capital-raising public equities across every major market and index, buying BTC and holding it as treasury. Right now, they collectively hold over 700,000 BTC and I think that number could easily cross 1 million by year-end. However, if the price starts to run, it seems pretty clear to me that the market will reward this strategy with more liquidity, fueling an even more aggressive accumulation. We could be looking at millions of BTC held by corporates in short order. It’s not like we haven’t talked about this before…it just feels more real now than ever.

And just in case that wasn’t bullish enough, the Fed quietly dropped its crypto reporting requirements for banks this week. Yep — the same Fed that was cracking down on Bitcoin 12 months ago is now backpedaling hard. The winds are shifting.

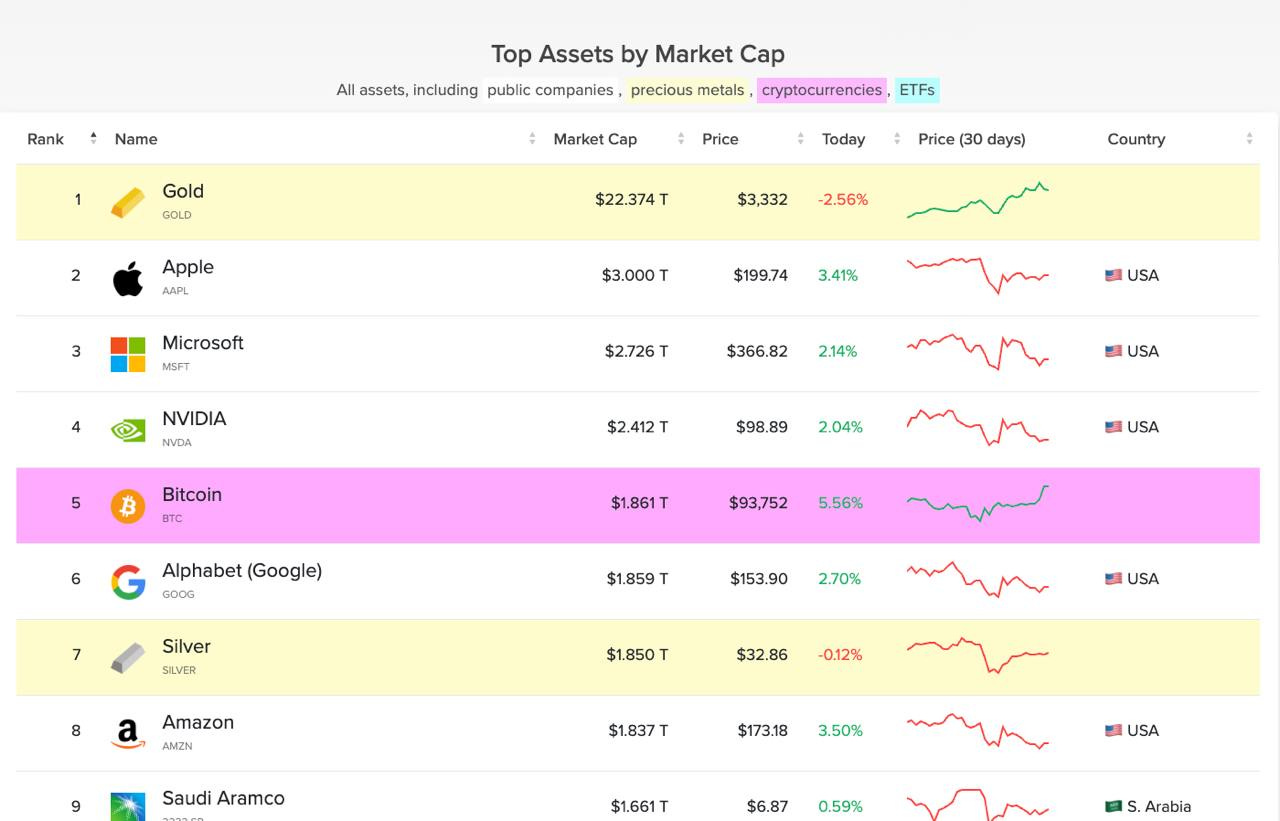

By the way, if you didn’t get to attend our Satstreet Q2 Market Outlook Call last week, it was well received and you can view it using the link above. At the time BTC was ~$83K. I’m not saying that we caused the run up but I think we covered something very important — the catch up trade to Gold. At the time — literally 8 days ago — BTC was the 9th most valuable asset in the world.

6 days later BTC made a big move to take the #5 spot ahead of Silver, Amazon, and Alphabet.

The catch up trade involves just two safe haven assets — Bitcoin and Gold. As you can see from the above chart, a sneeze is all that it will take from here for Bitcoin to get to the #2 spot. And from there, it’s nothing but blue skies and a lot of multiples to go until BTC does the inevitable and takes the lead.

I like that quote (click above to view the interview) "you can’t put $400 million of gold in your pocket.”

Meanwhile, ETF inflows are surging. Tuesday alone saw nearly $1 billion pour into U.S. spot Bitcoin ETFs — one of the biggest days ever. So far this week? Close to $2.7 billion in net inflows… and possibly $3B+ by the time markets close today.

Here’s an interesting X thread from Fidelity:

The constant buying pressure from corporates, ETFs, and sovereigns has me extremely bullish. Even if we get pullbacks with everything going on in the world, I think they’ll be shallow and short-lived.

Important side-bar:

We are just days away from arguably the most important election in Canadian history. Canadians are faced with two realistic options. No matter which side of the fence you normally sit, it is clear that Canada needs a change. You all know which way I’m voting. Have you voted yet?

Give this a click and listen to what Canada is destined to become in the eyes of Carney’s Liberals…you can find the extremely alarming report here. Warning, it’s a day-ruiner.

Have a great weekend!