Welcome to the Devaluation Station

Friday July 25th, 2025 - Issue # 111

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

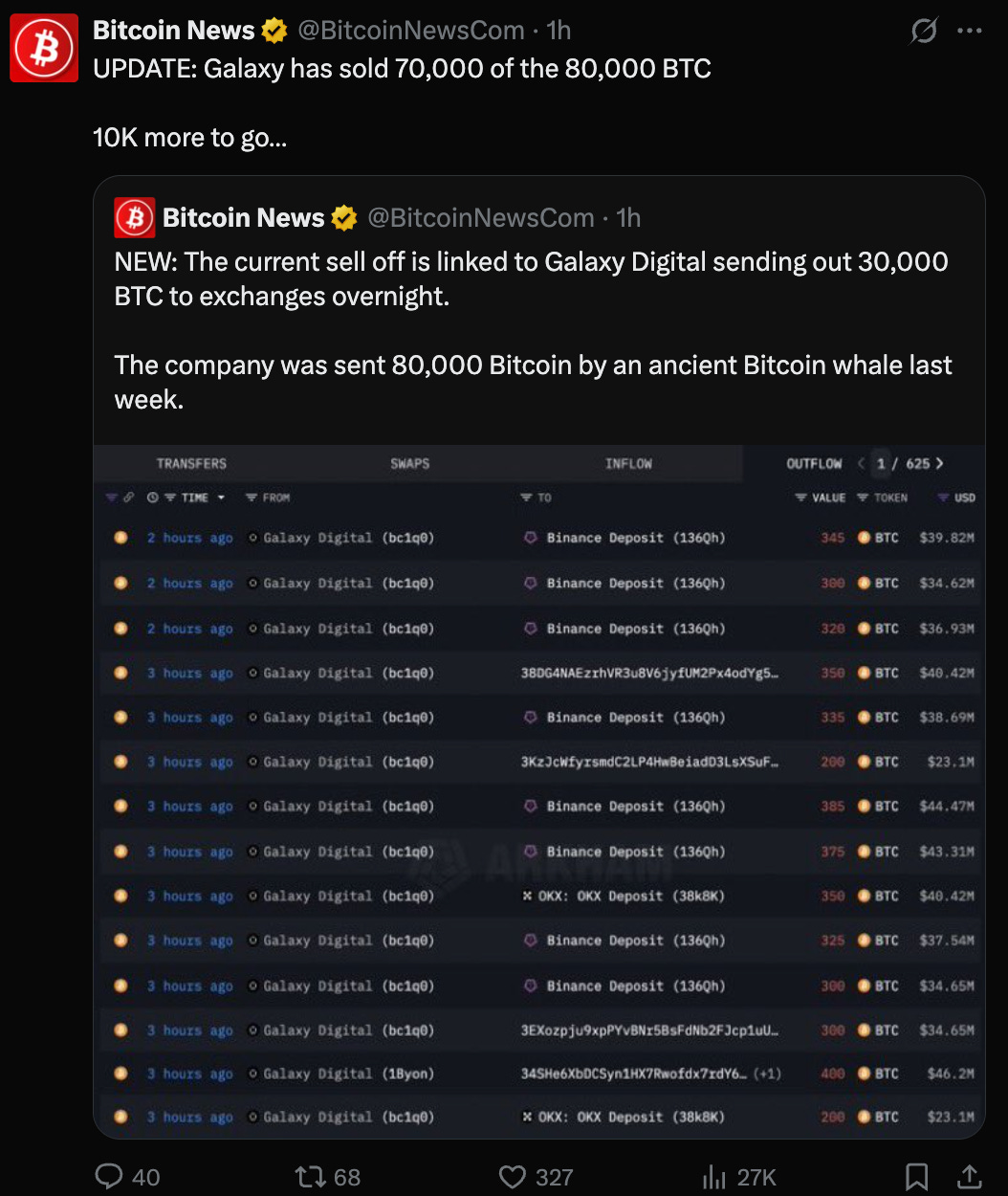

We have to quickly look at what just happened to explain this quick wick down to just under $115k BTC last night.

This really might be the last of the mega whales cashing out. What a trade, apparently they bought these 80,000 BTC back in 2011 for $54,000. It’s a good day to be a yacht broker. Moving on.

“How do I not fumble the bag this cycle?”

That’s the question I keep hearing - from friends, investors, even seasoned pros. They aren’t asking when bitcoin $150k, $200k, $400k (…) etc.. They’re asking what comes after. It’s blatantly obvious that the dollar is being actively devalued, so where do you store your wealth when you sell?

It’s a valid concern. Because here’s the truth: the real risk this cycle isn’t missing upside — it's rotating into something that's structurally bleeding out.

It wasn’t long ago we used to say, “only invest in Bitcoin what you’re willing to lose.” I think it’s time we flip that on its head: only invest in dollars what you’re willing to lose.

Let’s start with the facts. The U.S. Dollar Index (DXY) is down ~10% year-to-date, marking its worst start to a year since at least 1986. This isn’t a volatile correction. It’s a sustained drawdown, with barely any rallies on the way down. No meaningful rallies. No attempt at recovery. Just a glidepath lower.

Zoom out, and the picture gets worse. Since Bitcoin’s inception, the dollar is down more than 100,000,000X against BTC. It’s not hyperbole. Bitcoin launched at $0.001 in 2009. That’s a compounded devaluation of 10.41% per month for 16 years straight. By any sane metric, we’re already in a hyperinflationary environment — we just don’t call it that because it’s happening slowly and measured against the wrong benchmarks. Slowly to us at least. If an alien who has been watching dynasties rise and fall over the past millennia saw BTC enter the equation in 2009, it would look like a financial hydrogen bomb hit the dollar.

I asked Grok to give me a historical USD/BTC price overview from 2009–2025 since I couldn’t find any charts that go back that far because of BTC’s irrelevance at the time.

We are fully in fiat ponzi territory now. The end game which a lot of us Bitcoiners have been talking about at family get togethers could very well be here. They’re telling us out loud and signing the appropriate bills — they’re going to spend a metric f-ton of money and go for the proverbial Hail Mary pass in an attempt to grow their way out of it. The miracle they’re praying for is AI. No, not the basketball player (am I the only one who thinks of him when I hear AI?) — Artificial Intelligence.

If you haven’t picked up on it by now, AI is all that really matters. Full stop. And if someone’s giving you financial advice without talking about AI? Run.

This week at the White House…

So, last week was “Crypto Week” and our industry got everything we could’ve hoped for. This week, the AI gigabrains in SF got their commitment that the USG is on their side and will do everything they can to make sure the US wins the race to general intelligence.

What does this all mean and why are both of these issues at the forefront of this administration?

First, we have to ask ourselves: why do AI and crypto go hand in hand?

It’s not just because AI agents might one day pay each other in crypto — though that could happen. It’s deeper than that. There are no recessions in an AI arms race. This isn’t a normal economic cycle — it’s a full-blown spending war between the US and China. And the US has one key advantage: it prints the world’s reserve currency.

This essay by Arthur Hayes is definitely thought provoking. It goes down a rabbit hole I wouldn’t dare to go down with you on these letters so I let him do the talking. Imagine this:

Economic Shift to Fascism and Credit Expansion

Hayes argues that under Donald Trump, the U.S. is transitioning to a "fascist economic system" characterized by government-guaranteed credit to critical industries like rare earths and semiconductors. This is exemplified by the MP Materials deal, where the U.S. Department of Defense guarantees profitability, encouraging bank lending and creating new credit out of thin air. This policy, Hayes termed "QE 4 Poor People," is designed to boost wartime production but inevitably leads to inflation.BTC as the Beneficiary

The inflation resulting from this credit expansion makes fixed-supply assets like Bitcoin highly attractive. Hayes predicts a significant rise in the crypto market cap, driven by favorable regulations (ex. 401(k) plans investing in crypto) and the possible elimination of capital gains taxes on crypto. He estimates that if the crypto market cap reaches $100 trillion by 2028, $9 trillion could flow into stablecoins, which in turn finance U.S. government debt through Treasury bill purchases.Broader Implications — this part I find fascinating

The essay connects economic policy to social and political outcomes, noting that a booming crypto market could politically benefit the ruling party by making a broader demographic feel wealthier (because it’s the younger demographic that owns crypto and the older demographic is already rich and can participate anyway so they don’t really care about that asset ballooning — win win).

The dollar may be weakening, but in a race this existential, it's still the US's most powerful weapon. The truth is, the AI race matters more than defending the dollar. And that’s exactly why monetary policy has become a sideshow. The printers aren’t going to stop — not when the future’s on the line.

Update on the Fed…

This week, high-profile voices — from Mohamed El-Erian to Senator Cynthia Lummis — are openly calling for Fed Chair Jerome Powell to resign. Surprising to me but El-Erian chimed in this week and said Powell should step down to preserve the Fed’s credibility and operational independence. Lummis went further, saying he's "fatally wounding" the Fed’s role altogether.

We’re now at the point where Powell's presence is viewed as an obstacle to easier financial conditions — and his resignation is being positioned as a market stabilizer. That’s not normal. That’s regime change talk.

Click into these clips below…said it last week and I’ll say it again, I feel bad for the guy, but this is pretty funny.

Enter Ray Dalio. His latest note lays out the macro battlefield pretty clearly:

“Trump wants to devalue the dollar to reduce the real burden of U.S. debt. Powell wants to defend the dollar to preserve the Fed’s credibility. That tension mirrors historical episodes like the Reagan-Volcker era. But today, Powell lacks both the mandate and political capital to win that fight.”

Dalio points to a set of critical indicators:

U.S. equities are up 14% YTD

The dollar is down 5% vs. fiat currencies, down 27% vs. gold, and down 45% vs. Bitcoin

Credit spreads are tight (1% over Treasuries)

Real rates are still positive (~2%)

Money supply has grown faster than output every year since 2008

His conclusion? The U.S. will defend the dollar only once inflation gets completely out of hand like it did in the 1970s. Until then, the path of least resistance is more debt, more easing, more devaluation.

Which brings us back to the original question: how not to fumble the bag this cycle?

Here’s the uncomfortable answer: You may already be fumbling if you’re holding fiat.

Because if your exit plan from Bitcoin is “cash,” and that cash is structurally bleeding 10% per month relative to what you just sold...then you didn’t take profits. You traded into a melting ice cube.

We’re not just seeing price action anymore — we’re seeing a regime shift.

This is the devaluation cycle. And you don’t want to be on the wrong side of it.

This week, Trump posted this clip that’s always worth revisiting (clickable).

Have a nice weekend!