When the selling stops...

Friday July 12th, 2024 - Issue # 77

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Not that many have noticed (I’ll come back to this), but there has been a significant tug-o-war between sellers and buyers of Bitcoin over the past couple of weeks. The selling pressure, primarily driven by entities in Germany, has been relentless. While they were able to gain a ton of ground with their persistent, irresponsibly itchy trigger finger, they are nearly all out of ammo. If you were to have asked me last week, when the selling would stop, I would’ve told you that they’d be down to their last few thousand BTC in the next couple of weeks. However, with no regard for optimal selling strategies, they’ve absolutely flooded the market with precious coins — I guess that’s a strategy.

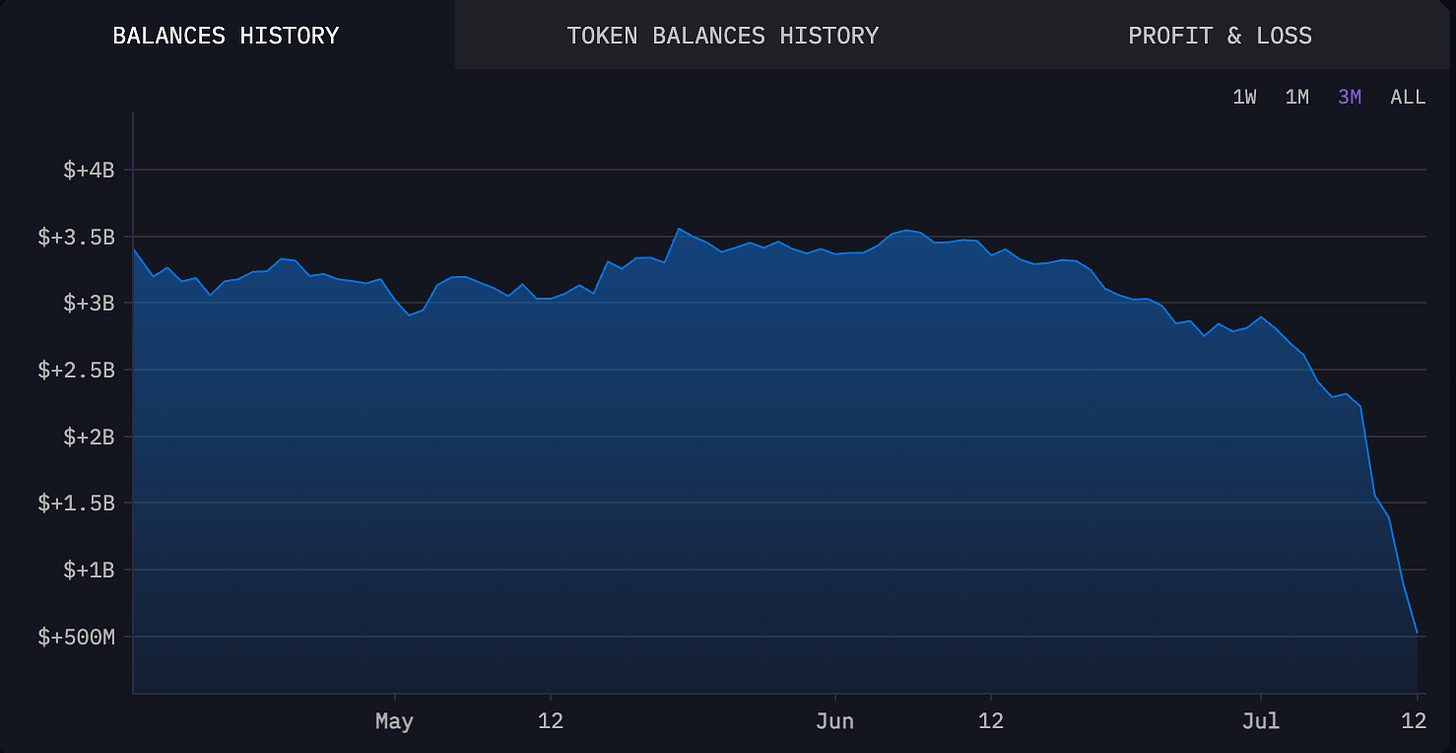

The charts below depict what will go down as of the biggest financial blunders of all time.

To understand why BTC is off 20%+ from the highs, you just have to look at that chart above. I’m actually very impressed BTC has held up as well as it has. I can’t remember a time where the market was so apathetic and at the same time we had a monstrous whale dumping so much coin that trading desks had to give back thousands of coins on a daily basis because they simply couldn’t sell hard enough within the day. Here we are, just shy of $60gs and ze Germans have only 6,000 BTC (~$350M) left.

Another consistent pressure comes from Bitcoin miners. Each cycle, miners face a decision: stick around and compete for half the rewards, or shut down. There’s more to it though. To stay competitive, they need to upgrade to the latest hardware, a highly capital-intensive move. This necessity means miners are liquidating part of their BTC holdings to fund these upgrades. With the mining industry more competitive than ever, this cycle's sell-off is particularly pronounced.

When I think about it, this year has mostly been about the fight between unscrupulous and forced sellers and dedicated buyers.

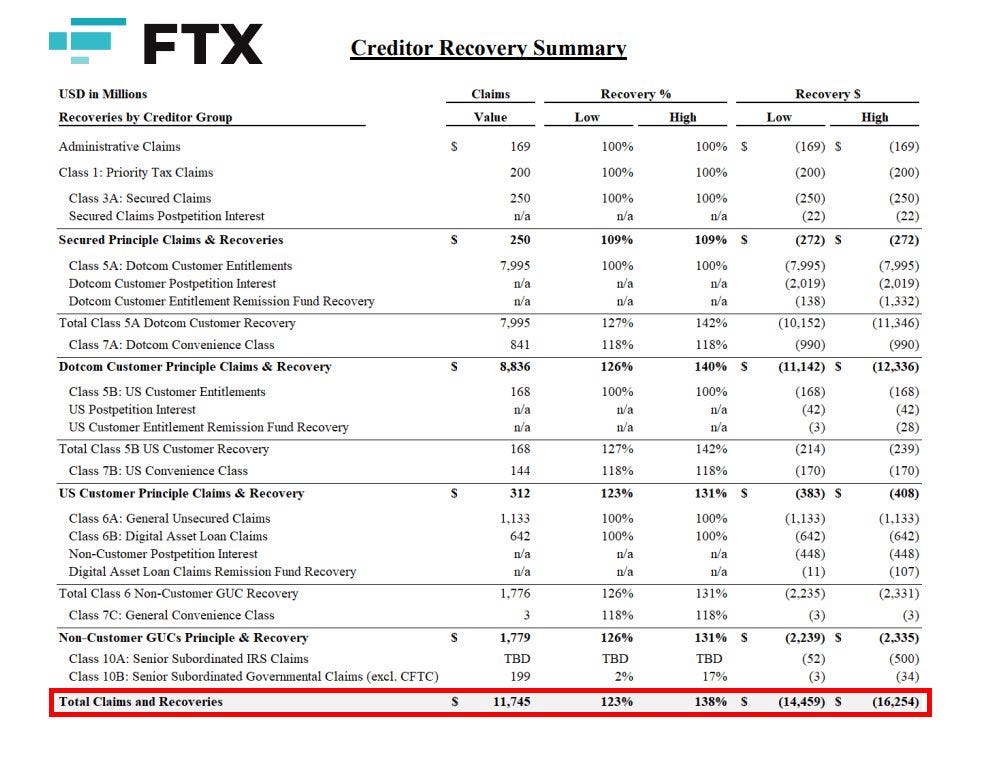

How do you think the FTX estate was able to recover USD $14-$16 billion for creditors? It’s something that not many people talk about. What is good news for creditors — albeit, not nearly as good as being paid in kind — has obviously been a tremendous weight on the market as FTX had to sell off it’s crypto. While BTC and ETH have held up pretty well — BTC ETF buyers and ETH ETF hopefuls — the alt market has been obliterated. The narrative of “low float, high FDV coins are cooked” has taken hold and market participants have been weary of coming back into tokens that VCs are dumping.

I’m going to take the other side here…firstly, we have to be careful when we describe market participants. Currently, the market to me just looks like folks on twitter with way too much time on their hands who were just recently rich, and who are now no longer rich, playing with each other in a toxic arena. Normal people (like you) are not paying much attention. Summer has always been a slower time anyway, and especially this cycle, which looks to be led by institutions, it only makes more sense as money managers and traders are mostly away from their desks enjoying their time off.

So who's on the other side of this legendary battle of tug-o-war?

U.S. Bitcoin ETFs are acquiring a lot of the Bitcoin that being sold in Germany — a significant real-time transfer of wealth between nations.

Back to FTX. As mentioned, it’s estimated that $14-16 billion will be paid back to creditors in the form of filthy U.S. denominated fiat sometime this year (hearing rumblings of Sept/Oct). I expect a lot of this capital will find its way back into the market which should make up for the selling the FTX estate did throughout the year.

I really like this chart.

It shows why you probably shouldn’t be selling 83 days after the Bitcoin halving…

Holy! I got through this one without mentioning Biden, Trump, Powell, or much politics and macro at all! Nice.

Have a great weekend.

Weekly podcast recommendations