You're not bullish enough

Friday May 24th, 2024 - Issue # 72

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Happy Friday! This week has been nothing short of revolutionary for the crypto industry. In fact, I will go as far as to say that it has been the most positive week in crypto history from a regulatory perspective. If you think you’re bullish, y’ain’t.

A New Dawn for Ethereum: Spot ETF Approved!

If you didn’t catch the 20% god candle ETH put in on Monday after what felt to most like decades of underperformance relative to BTC (ex. I don’t think I’ve mentioned Ethereum in a newsletter for 2 years?), the SEC made waves with its unexpected pivot and approved spot Ethereum ETFs yesterday. This is huge. As we’re all aware by now, spot ETFs provide a more straightforward and direct way for investors to gain exposure to Ethereum, as opposed to futures-based ETFs, which involve more complexities and risks. The potential approval signals a maturing market and could set a precedent for future crypto asset ETFs.

Why It's a Big Deal:

Approval of spot ETFs means more institutional investors, such as pension funds and endowments, can safely invest in Ethereum, driving up demand and prices. You might ask, why would an institution buy Ethereum over Bitcoin? I’m personally not a fan of a certain argument but when good news presents itself, the bullish narratives take hold and I see a world where ETH ETFs become the green option for crypto exposure. The energy-intensive nature of Bitcoin, which I feel to be an important feature of it, is also why others might not favour it or could face limitations in investing due to their ESG policies. Bleh.

If these ETFs are approved, we could see ETH run hot which could lead to a big run for the market in general. Just as I’ve written about Bitcoin having far less supply available than people might realize (lost coins, diamond hand OG holders), the same is true for ETH but in a different way. Here’s what you’re going to start to hear a lot of and may bear witness to in terms of price action: nearly 30% of all ETH is currently staked, meaning there’s a lot less available on the market than one might expect. Ethereum has about a third of Bitcoin's network value, with less than one-tenth of its daily issuance, and these upcoming approvals are catching the market by surprise. If the inflows are anything like those of Bitcoin ETFs, the coming months could be ones that you'll fondly recall as historic.

SAB-121

In another groundbreaking development, the crypto community scored a significant victory with the successful challenge of SAB-121. This rule, which previously required banks to hold reserves for crypto assets on their balance sheets as liabilities, has been overturned. This change will make it easier for banks to engage with crypto assets without the onerous capital requirements that previously stifled innovation and adoption. It's a win for the entire ecosystem, from small crypto startups to large financial institutions.

Why It's a Big Deal:

Bank Participation: Removing these restrictions allows banks to engage more freely with crypto, opening up new services and products for consumers.

Innovation Boost: With fewer regulatory hurdles, financial institutions can innovate faster, integrating blockchain technologies into their offerings.

Market Growth: Increased banking involvement will likely lead to greater liquidity and stability in the crypto markets, benefiting all participants.

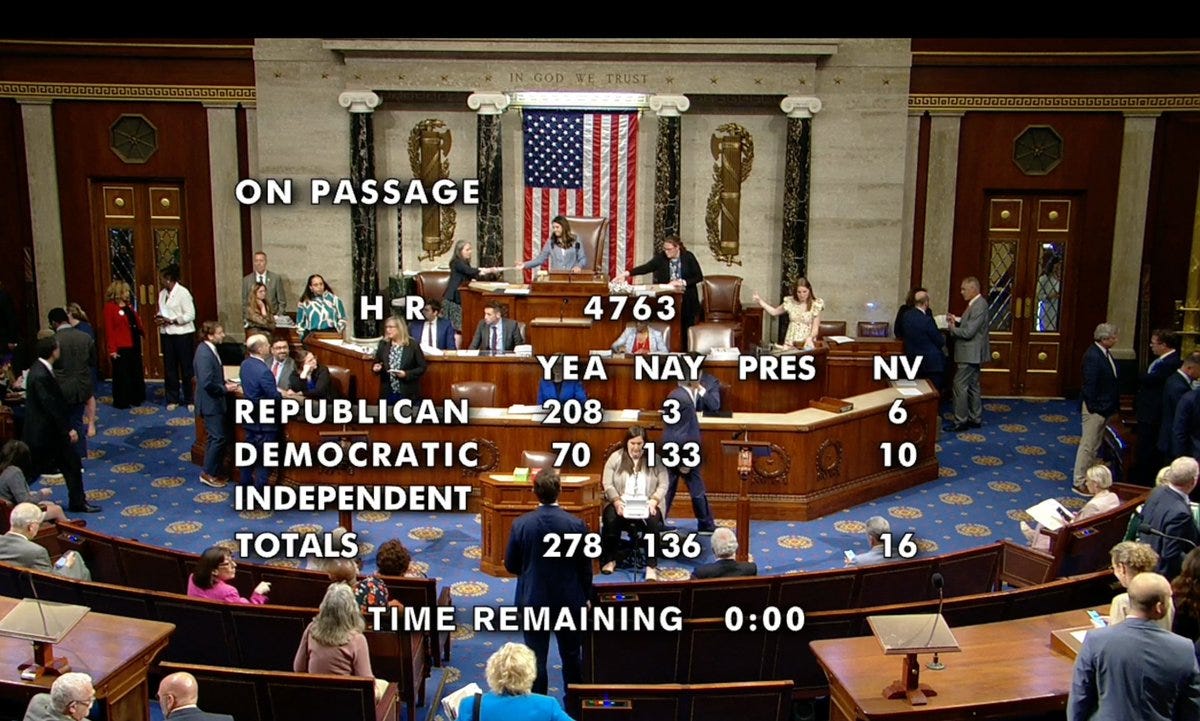

FIT21 Crypto Bill

Finally, the US House passed the FIT21 Crypto Bill, a landmark piece of legislation designed to clarify the regulatory landscape for digital assets. This bill delineates the roles of the CFTC and SEC, providing much-needed regulatory certainty. It’s a move that will foster innovation, protect consumers, and solidify the US as a leader in the global crypto economy. With clearer regulations, companies can innovate with confidence, knowing the rules of the game. This is expected to lead to a surge in crypto-related activities and investments.

TLDR: The CFTC and SEC have been battling for years over who has authority over crypto. Companies like Coinbase have argued with the SEC, stating that the digital assets they list are commodities, not securities. FIT21 clarifies this by defining digital assets: if a cryptocurrency is decentralized, it’s a commodity (CFTC); if it’s not decentralized, it’s a security (SEC). So, no matter how strongly you felt that ETH was a security, it’s not—this week, ETH has solidified itself as a digital commodity, just like BTC. This doesn't stop at ETH; there are likely dozens, if not hundreds, of digital assets that are "significantly decentralized" enough to be considered digital commodities and will no longer fall under the SEC’s jurisdiction, effectively sidelining Gary Gensler and the SEC.

Why It's a Big Deal:

Regulatory Certainty: Clearer rules mean companies know what to expect, reducing compliance costs and fostering a more stable and innovative business environment.

Consumer Protection: The bill includes measures to protect consumers from fraud and market manipulation, which could enhance public trust in crypto.

Global Leadership: By setting a clear regulatory framework, the US can reclaim its position as a global leader in fintech innovation, attracting talent and investment from around the world.

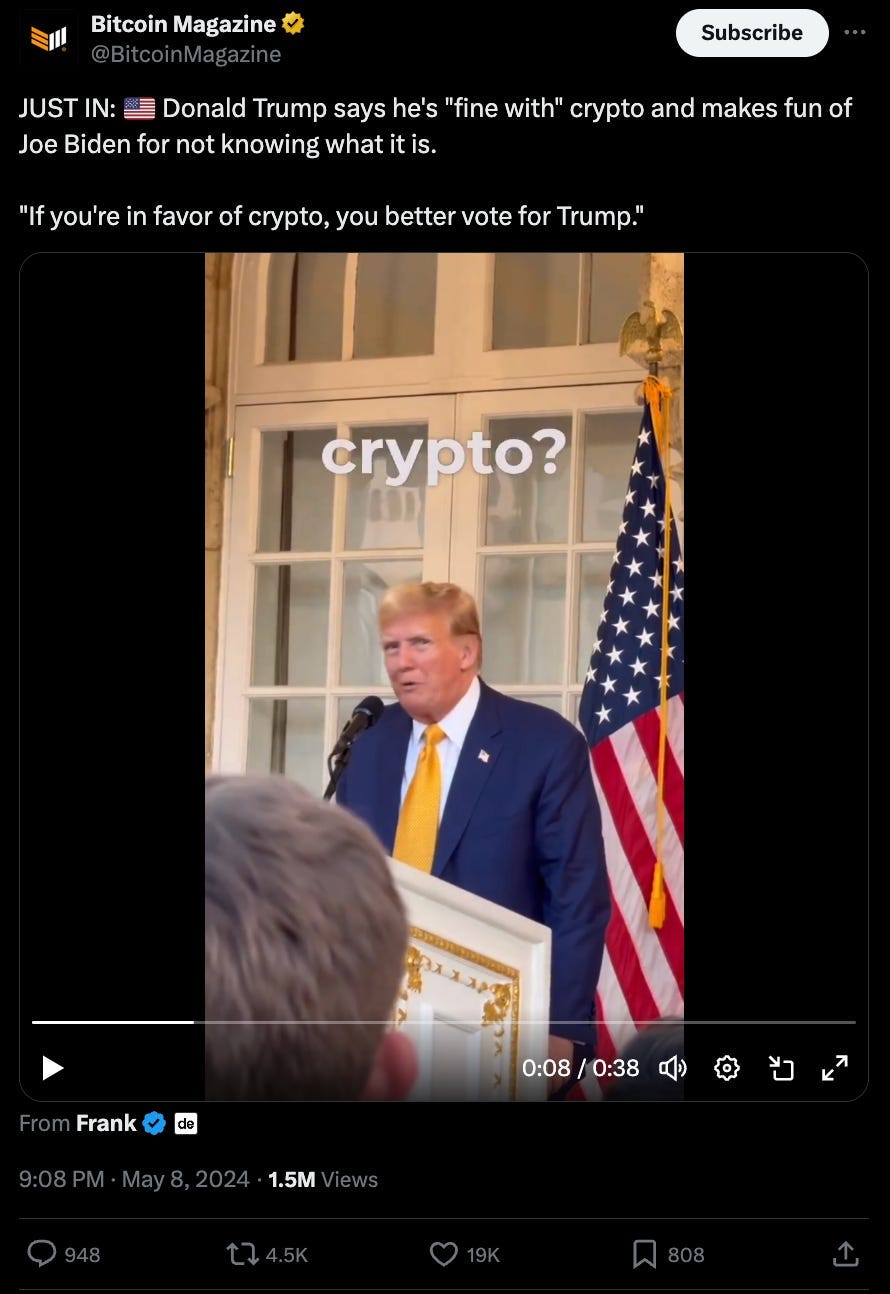

Election Year Dynamics and Presidential Support

As we head into an election year, these developments are even more significant. Regulatory clarity and institutional support could play a pivotal role in shaping the economic narrative. And let's not forget, President Trump has come out strongly in support of crypto. At a recent Mar-a-Lago event, he emphasized the importance of digital assets and even became the first major party candidate to accept crypto donations.

These developments aren't just headlines; they’re the foundation for the next phase of the crypto market evolution. Institutional adoption is about to skyrocket. Regulatory clarity will pave the way for more innovative products and services. And with the easing of restrictive banking regulations, we’re set to see an integration of crypto with traditional financial systems like never before.

If you’ve been on the fence or only dabbling in the crypto space, now might be the time to reconsider your position. The market is gearing up for what could be one of the most bullish phases we’ve ever seen.

Stay ahead of the curve and get ready for an exciting ride. Because, truly, you’re not bullish enough.

Weekly podcast recommendations