Be A Dumb Bull

Wednesday March 6th, 2024 - Issue # 65

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

An old bull and a young bull stand atop a hill, looking down at a field of cows. Excited and eager, the young bull says, "Let's run down there and mate with one of those cows!" The old bull, wise and experienced, responds calmly, "Let's walk down and mate with all of them."

I learned about this story from Round13 Digital Asset Fund’s CIO & Managing Partner, Satraj Bambra, who, back at the beginning of the year, wrote our team an inspiring email about how well situated we are and his plan for the remainder of the year. We can all learn a lesson from the story of the old bull and the young bull. It emphasizes the significance of patience, strategic diversification, and a steadfast long-term perspective in navigating the notorious volatility of this our chosen asset class. It advises against the allure of jumping from trade to trade, advocating instead for a methodical approach that includes educating oneself about market trends, leveraging historical insights, and spreading investments across various assets. This wisdom echoes the importance of resisting impulsive decisions driven by short-term market fluctuations, underscoring that the most substantial rewards often come to those who, like the old bull, adopt a measured, informed stance and hold firm to their convictions through the market's inevitable ups and downs.

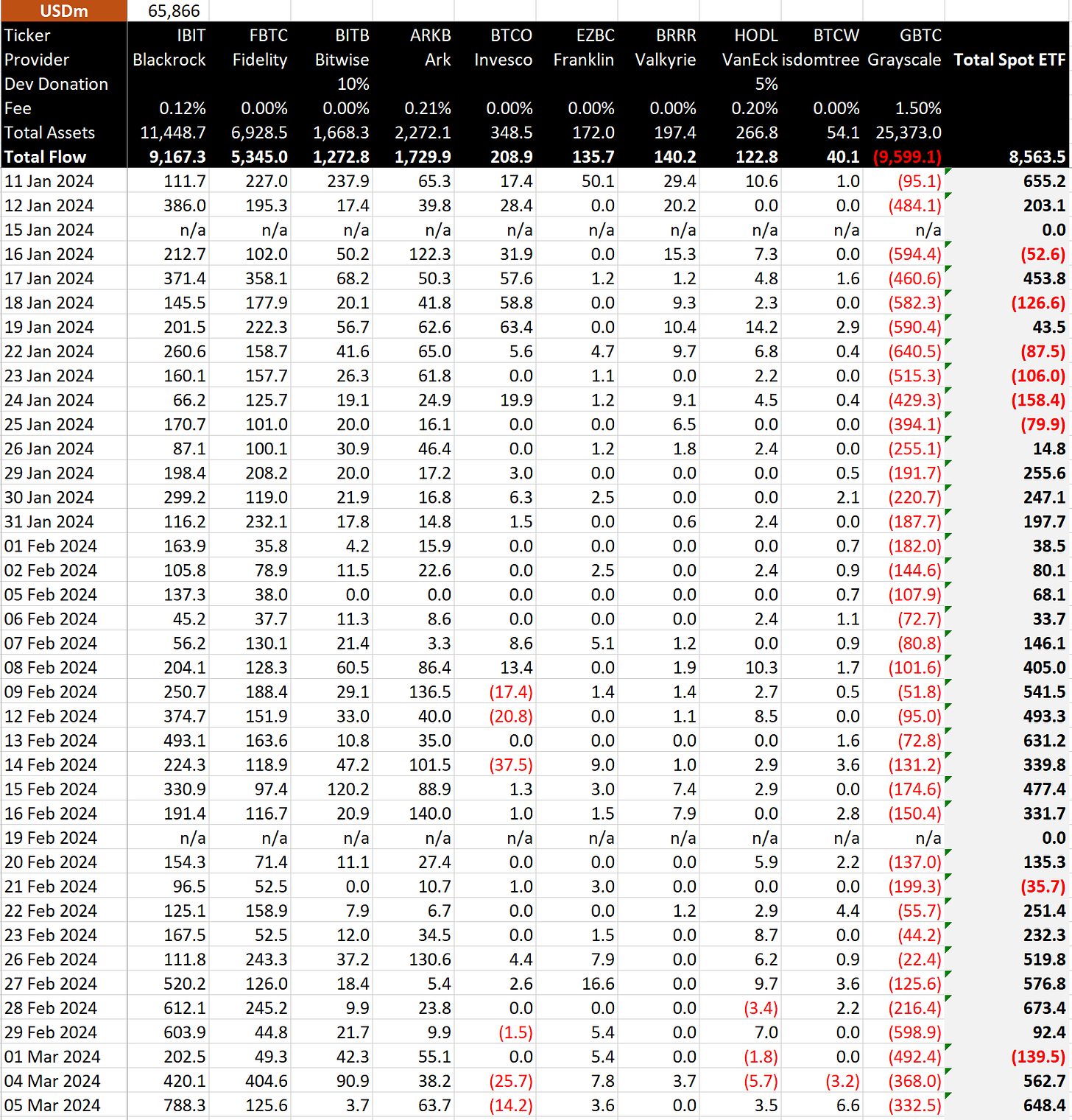

Before I kick this off, congrats everyone, on a new all time high! Despite what your normie friends and family are about to tell you — it has not been easy to hold through the bear market and to fight off selling your coins since we started running up last year up to now. But here we are, about to discover what the market really thinks the price should be. Hundreds of millions flowing into the ETFs daily with the halving just over a month away. Life is good and we're just getting started!

Speaking of inflows…while all the degens out there got liquidated on a whipsaw price action day after BTC breached $69k before falling sharply to $59k and change, BlackRock grew their Bitcoin holdings by more than 7% yesterday. $648m total net inflow for the day which is the largest inflow since inception. Blackrock with a record +$788.3 million day.

I am currently more optimistic about Bitcoin than ever before. As someone who runs a trading desk and has been doing so for multiple cycles, I can tell you with confidence that our collective excitement is not wide spread and isn’t even close to the peak. I know the feeling — are we actually just so well positioned this early or do we have our head in the clouds and it’s time to start taking profits.

I think we’re very early. If it’s a baseball game, my guess is that we’re probably in the bottom of the second inning. These ETFs are rocket fuel and the rocket ship is in the "engine ignition and startup" phase.

That thing that I’ve been talking about for a long time is finally coming to fruition.

The biggest names on Wall Street will continue to file for Bitcoin ETF exposure in their in-house investment funds. As I’ve been shouting from the rooftops over the past many months, you're going to see a lot of this in coming months. After the close of trading yesterday, BlackRock filed with the SEC for its Strategic Income Opportunities Portfolio.

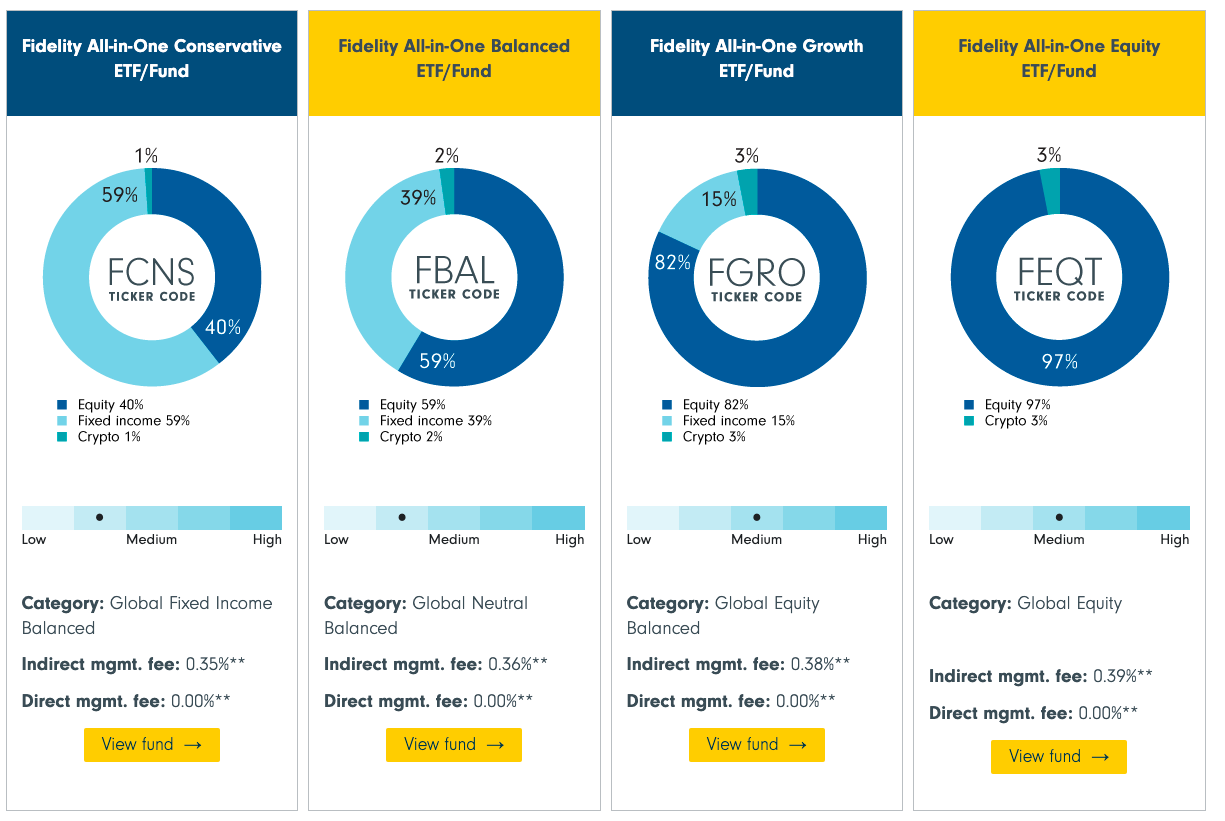

Oh, and here’s Fidelity Canada recommending a 1-3% crypto allocation in your portfolio. This will come to the US where Fidelity manages trillions of dollars.

These ETFs are suffocating all other bullish factuals that would be headlines if it weren’t for them. A couple of easy ones…

Microstrategy is aggressively purchasing more Bitcoin through leverage, making their stock one of the best performing.

Click to read the presser…MicroStrategy has announced the pricing of its offering of $700 million convertible senior notes (upsized from the previously announced $600 million). The notes will be unsecured, senior obligations of MicroStrategy, and will bear interest at a rate of 0.625% per annum.

Their main business is becoming secondary, setting a precedent that other CEOs are likely to follow.

Also, since November 2023, a mysterious wallet “Mr. 100” has been accumulating approximately 100 BTC daily, now holding over 50,000 BTC. It's speculated that a billionaire, possibly Jeff Bezos, is behind this. This trend may inspire other wealthy individuals.

There’s so much more to be bullish on but I kind of want to save it for when they start to come true. For example, most discretionary financial advisors are presently unable to invest in ETFs, but that will change soon, potentially unleashing significant capital.

Nation State adoption due to dedollarization, sovereign wealth funds allocating…etc, etc…

We have to be honest with ourselves — there are way less than 21 million bitcoin that will ever be in circulation. As I mentioned a couple of weeks ago in Supply Shock, we can safely assume 3-6 million coins have been lost or are unrecoverable. There’s also plenty of supply held up by OGs who firmly believe that the world will convert to a bitcoin standard at some point, thus, they will not be parting ways with their coins as “1 bitcoin = 1 bitcoin”.

Supply and demand folks. Be a dumb bull.